Last year was wonderful for Chrysler Group in America. For the first time in 5 years, the group’s market share surpassed the 11% barrier market share. It means that Chrysler’s share is higher than the year before the financial crisis started. However, it is still far from a decade ago when it reached 13.1%. Anyway Chrysler USA is perhaps the division of the group with better results in 2012 and allowed Fiat-Chrysler to increase its global sales. It was possible thanks to 2 facts: Americans are buying cars again. And Chrysler is making use of that, by offering better cars (in terms of quality) through excellent marketing/ad campaigns. One of the first things that Marchionne and his team did when Fiat bought 20% of Chrysler was to focus on quality. 4 years later the results are clear: consumer likes Chrysler products because it is a quality car. Nevertheless there are many things to do yet. But the important thing is that the first step (quality products) is almost accomplished and it will be a good base for next step (to increase market share). In this post I will analyse total market’s results and the position of Chrysler Group, which must use its enormous success to keep it and offset Fiat problems in Europe.

Last year was wonderful for Chrysler Group in America. For the first time in 5 years, the group’s market share surpassed the 11% barrier market share. It means that Chrysler’s share is higher than the year before the financial crisis started. However, it is still far from a decade ago when it reached 13.1%. Anyway Chrysler USA is perhaps the division of the group with better results in 2012 and allowed Fiat-Chrysler to increase its global sales. It was possible thanks to 2 facts: Americans are buying cars again. And Chrysler is making use of that, by offering better cars (in terms of quality) through excellent marketing/ad campaigns. One of the first things that Marchionne and his team did when Fiat bought 20% of Chrysler was to focus on quality. 4 years later the results are clear: consumer likes Chrysler products because it is a quality car. Nevertheless there are many things to do yet. But the important thing is that the first step (quality products) is almost accomplished and it will be a good base for next step (to increase market share). In this post I will analyse total market’s results and the position of Chrysler Group, which must use its enormous success to keep it and offset Fiat problems in Europe.

USA

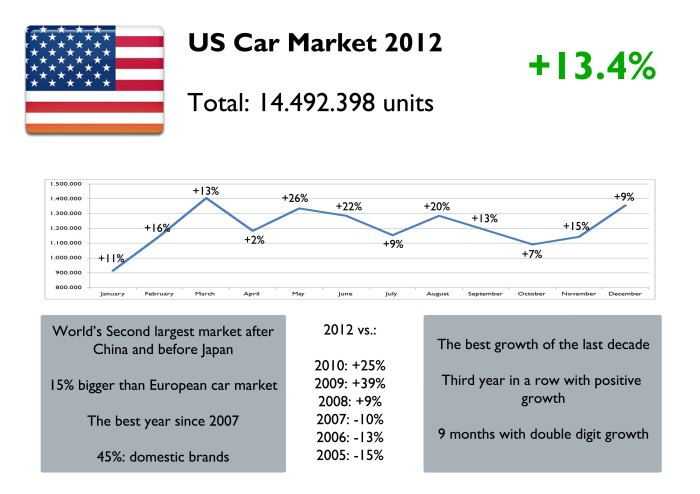

Last year’s growth was the best since the moment when annually car sales began to fall back in 2006. One year before Americans bought 17 million cars but since then, that record has not been achieved again. Sales dropped to a minimum of 10.4 million in 2009, which took GM and Chrysler into bankruptcy. 3 years later the situation is different: though American economy has not fully recovered yet, car industry heads to pre-crisis levels and the best is still to come. That is how 14.5 million units were sold last year, up a not bad 13%, the best growth of the last 10 years. The number is better if compared to 2009: up a massive 39%. But is down 15% compared to decade’s best year, 2005. It means that the market is half of the way of reaching previous record. That’s not bad at all as the growth is going slow but safe, along with healthy indicators that show that this trend will continue in 2013. Last year’s result allowed the USA to occupy place #2 in terms of growth among developed car markets, after Japan and before Australia and the UK. And of course it occupied the pole position when considering growth in terms of units. Nonetheless it is still far away from China’s total, which continues to grow.

Source: Good Car Bad Car

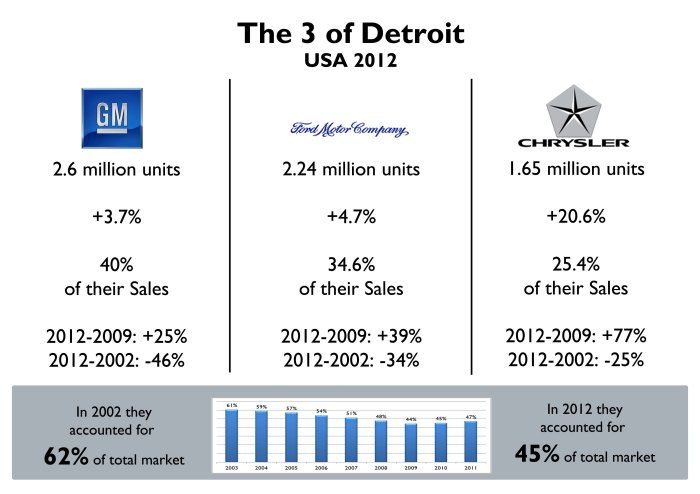

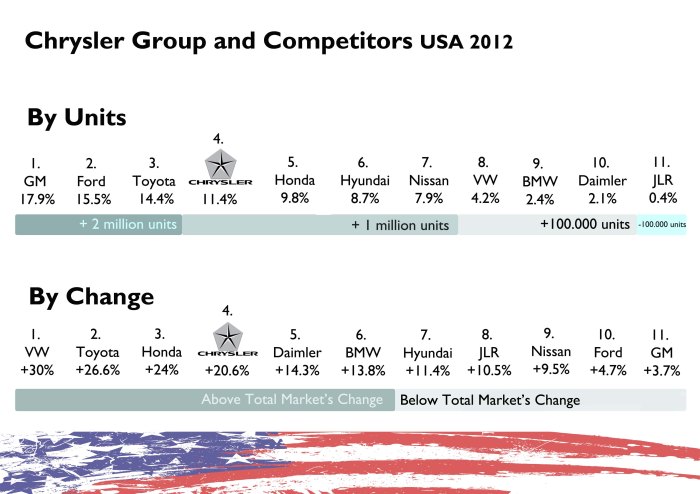

Contrary to what happens in Europe, in USA all groups had positive changes. The 3 of Detroit did better than a year earlier, but only Chrysler performed better than total market. Actually GM and Ford had the lowest positive growth rates among all car makers by group. They occupied pole and second position but they lost a big market share that was gained by the following in the ranking. GM lost 1.7 points, while Ford lost 1.3. Those points were mainly gained by Toyota, Chrysler and Honda groups. That makes of Chrysler the only American group to increase its share and it is now closer to its eternal rivals from Detroit. Ten years ago GM sold 2.6 million more cars than Chrysler, while Ford was 1.2 million ahead. Last year the difference between them is shorter: GM sold 940.000 more cars and Ford is ahead by 590.000 units. It means that they all have lost market share in the last 10 years, but GM and Ford did worse than Chrysler. In fact, due to their fall, the 3 of Detroit came from selling 61% of total cars in America by the year 2003, to sell 45% in 2012. This fall did not begin with financial crisis years but is something that happens progressively since a decade ago. Competitors first coming from Asia, and now from Europe, have gained more market share. Last year for example the best performer in terms of growth was VW Group, up 30%, which is certainly a lot. It was followed by Honda and Toyota, which had big growths due to the fact that 2011 was a bad year for them because of problems with Japan’s earthquake and Thailand’s floods.

Chrysler is still the smallest of the 3 from Detroit, but it is the one with lowest fall in the last decade and the best positive growth in the last year. Nonetheless they all have lost share in overall market due to Asian competitors. Source: Good Car Bad Car

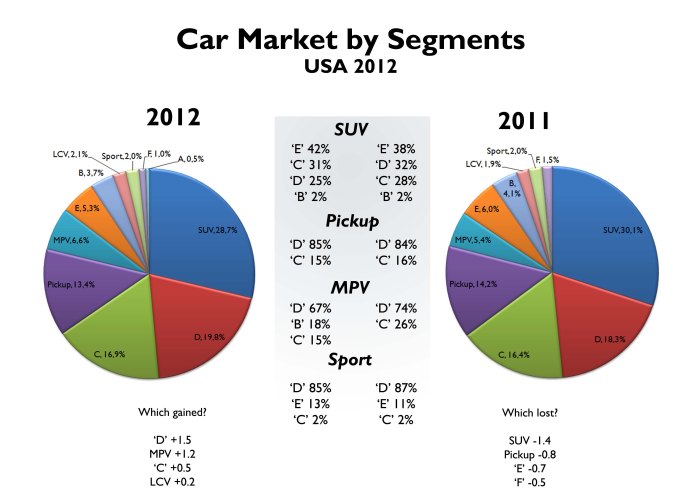

Americans still prefer SUVs but their share decreased favoring MPV segment. It is more or less the opposite of what happened in Italy in 2012. However, part of the growth of MPVs is explained by the change on segmentation parameters year on year. Small and city cars have never been popular in USA. That’s why American buyers and specialized press refer to A, B and B-MPV cars as small cars making part of the same segment. And that’s also the reason why in 2011 they were all classified in a unique segment, the ‘B’ one. However, due to the fact that they have become popular, for 2012 analysis I separated them as it happens in Europe and the rest of the world: A, B and B-MPV segments. Taking into account the new segmentation, is important to mention the big sales growth this kind of cars had in 2012. Their share rose 1.3 points compared to 2011, which is the second best growth after ‘D’ segment (+1.5 points). In the other side SUV lost market share mainly because of less growth coming from mid-size ‘D-SUVs’ as larger ones keep being the most popular ones. The share coming from citycars is still tiny: only 0.5% of the cars sold in USA last year correspond to ‘A’ segment, which is even less than ‘F’ segment. The pickup segment, which is very popular over there, lost 0.8 points. Last year results show that Americans are getting into mid-size sedans (‘D’ segment) and minivans.

In general the market’s composition has changed a lot year on year. MPV and mid-size cars are now more popular. Segmentation based on FGW parameters. Source: Good Car Bad Car

Fiat-Chrysler

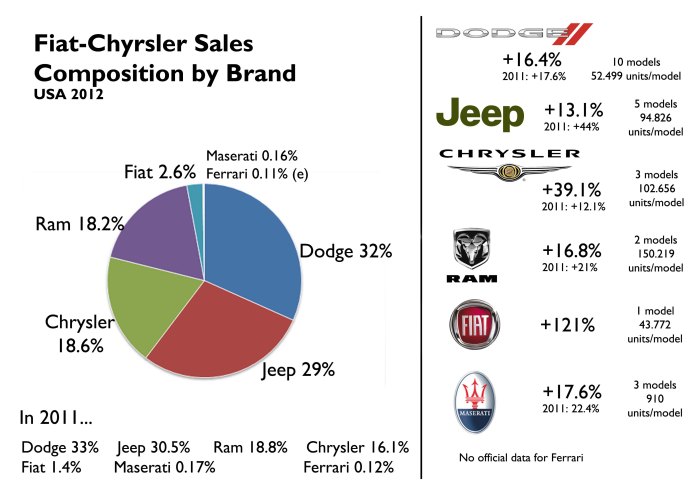

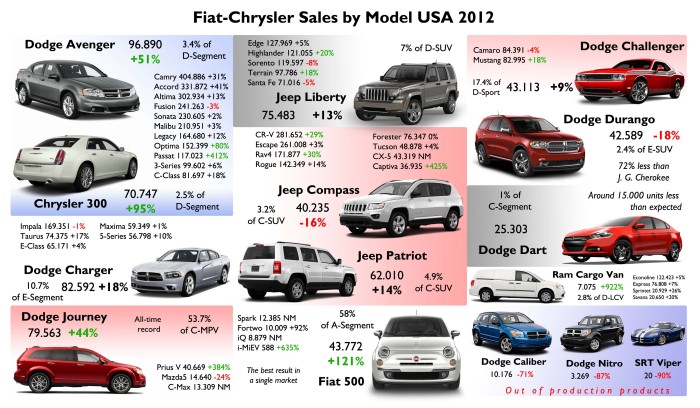

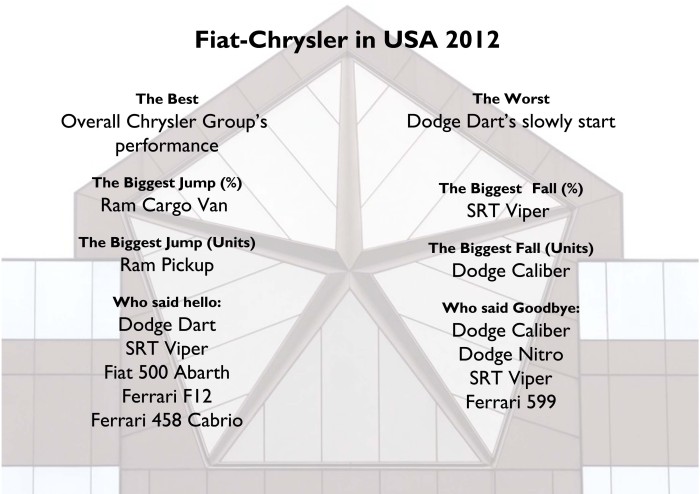

The group did very well in 2012. Chrysler Group brands plus Fiat, Maserati and Ferrari (e) sold 1.656.317 cars, up 20.6%. It was by far the best result of the group in the whole world, followed by Brazil and Italy. And in terms of growth it was also really good. To rise sales more than 20% in a millionaire market is an awesome result. It is more than double the result in Western Europe and 4 times more than what the group sold in Italy. However Italian market share is almost 3 times bigger than American share. Chrysler is big but it occupies place #4 in the ranking by groups and is closely followed by big Japanese and Koreans. It means that its position in the market is more complicated as it does not rely on unconditional buyers just as the ones Fiat has in Italy or Brazil. Besides Chrysler is not the only local manufacturer. The group’s market share jumped from 10.75% in 2011 to 11.43% last year, but it is still far from 2005 result, in which Chrysler Group had 13.6% of the market. Fiat wants Chrysler to take its market share up to 13% in 2014, and from what happened last year and the good perspectives of car industry, it won’t be hard to achieve that goal. Anyway, they must hurry up and launch new models because most of the big gain in 2012 was possible without the help of any all-new car, but this trend will not continue forever. Fiat and Chrysler must work to introduce the new Jeep SUVs, the compacts for Chrysler, better sedans for Dodge and the come back of Alfa Romeo.

Chrysler did very good but wasn’t the best. VW and Japanese brands did much better. In 2013 this situation may happen again, specially in the case of VW. Source: Good Car Bad Car

The group manages to include 2 of its brands in the top 10. Once again Dodge and Jeep ranked 8th and 9th as the best-selling car brands in USA. In the top 10 there was only one change: VW brand is now in 10th position beating GMC. Actually VW brand was the best performer in the top 10, while Chevrolet registrations were up only 4.3%. Dodge’s growth was higher than total market’s, but lower than Chrysler Group’s. The same happened to Jeep’s performance, a bit lower than Dodge’s as its registrations fell in the last 3 months of the year. The new Grand Cherokee and the coming all-new Liberty should help the brand to stop falling and not let VW to overtake it in 2013. Chrysler brand ranked 13 in the list and had the group’s best result in terms of units. Without the help of new models, this brand got over Mercedes, BMW, Mazda and even Ram. Considering the number of models offered and its total sales, Chrysler brand USA could be the best performer brand (in terms of units/model) of the group in the whole world (of course considering Ram as part of Dodge brand). Ram sold a bit more than 300.000 units surpassing Mercedes by 5.000 cars sold. If Ram and Dodge are considered a single brand (as it happens sometimes), then that brand would occupy place #6. But among Chrysler’s brands, Fiat got the pole position in terms of growth. It is quite normal that a new brand has big growth rates at the beginning of its commercial life. That’s the case of Fiat, up a massive 121%, which is by far the best performance of any other brand in USA in 2012. But Fiat’s performance was not only a matter of year-on-year comparison. By selling more than 43.000 units of its 500, USA became the largest single market for this model, and at the same time, the brand reached Marchionne’s initial target of 50.000 units per year just in NAFTA market (USA, Canada and Mexico). Time and big work demonstrated that Marchionne was right. Fiat results are also great from historical point of view: 2 years ago the only remaining memory of Fiat among American buyers was the bad quality of its products. Last year the small Fiat 500 got the attention of 43.772 buyers, or only 1.339 units below its main rival in that market, the Mini Cooper.

Chrysler brand and Fiat had the best performances of the group. Jeep slowed down but is still doing good. Source: Good Car Bad Car

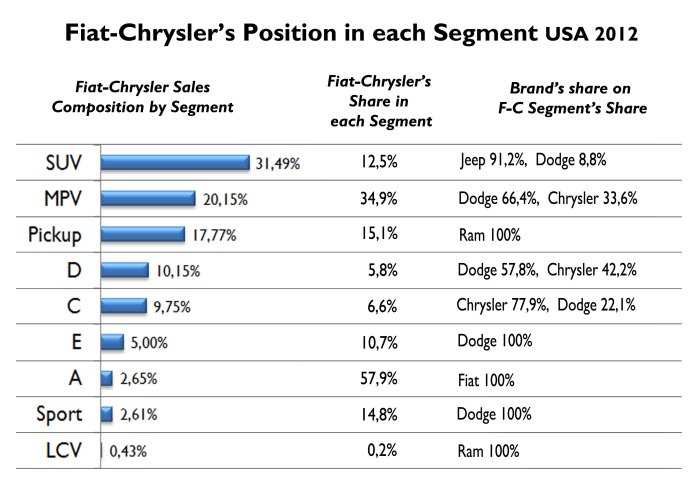

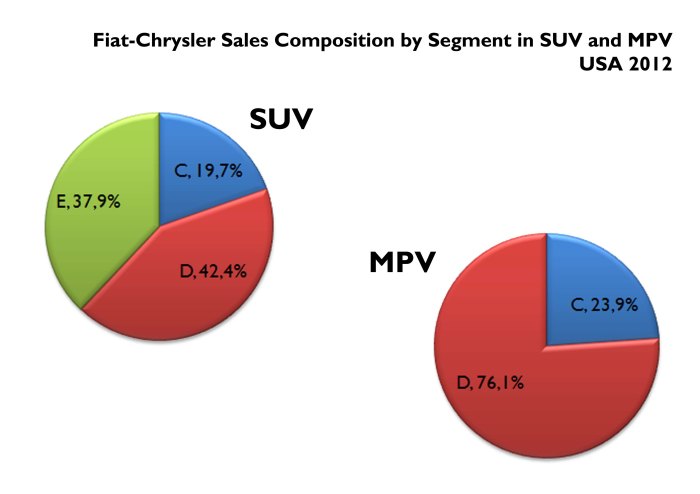

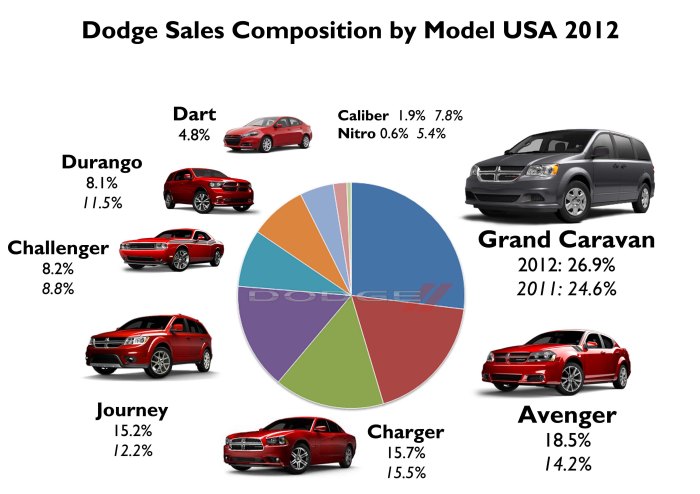

The group sold 455.000 regular passenger cars, 520.000 SUVs and 333.000 MPVs. It means that SUVs count 31.5% of the total, followed by passenger cars, MPVs and Pickups. Among SUVs, those mid-size ones count 42%, followed big size with 38% of the share, and finally the compact SUVs with 20% of the share. In car passengers, D and C segments count 72% of the total, while ‘E’ segment share doubles ‘A’ segment. All these results show that Chrysler’s position in USA is the opposite of Fiat in Europe. Just as it happens with total market, 77% of the group’s sales correspond to big cars (in general). Compared to 2011 figures, big cars share decreased 1 point (maybe the success of the 500 helped to increase the small and compact car’s share). This segmentation analysis don’t include Maserati and Ferrari products. The analysis brand/segment shows that 66% of the MPVs sold by the group last year had the Dodge logo. Most of all SUVs sold were Jeeps, while in the regular passenger cars, 47% of them had Dodge logo, 43% Chrysler logo and 10% of them were Fiat 500. Fiat rules in Chrysler’s ‘A’ segment, Chrysler rules in ‘C’ one and Dodge rules in ‘D’ and ‘E’ segments.

This chart shows first the group sales’ composition by segment (1st column). Then it shows Fiat-Chrysler’s share in each segment (2nd column). Finally there is the composition by brands for each segment. Notice how strong the group is in MPV segment and most of the sales come from Dodge brand. In the other side the group’s position in ‘D’ segment is very small. Complete dominance in ‘A’ segment thanks to the 500. Source: FGW Data Basis

SUV and MPV are Chrysler’s best-selling segments. In this chart, there is the composition of them by size. Source: FGW Data Basis

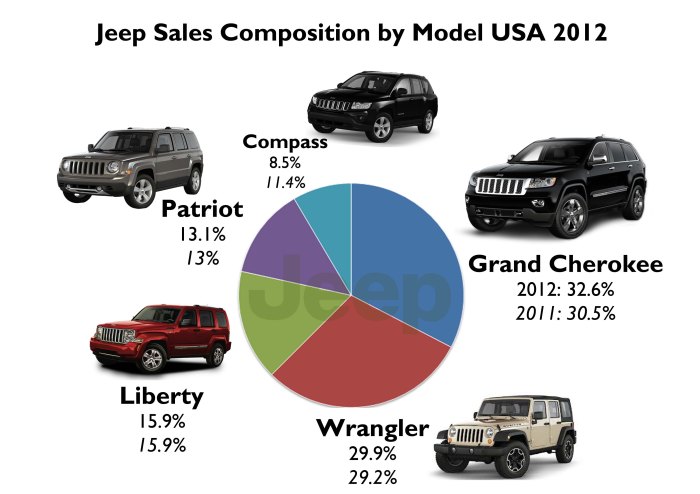

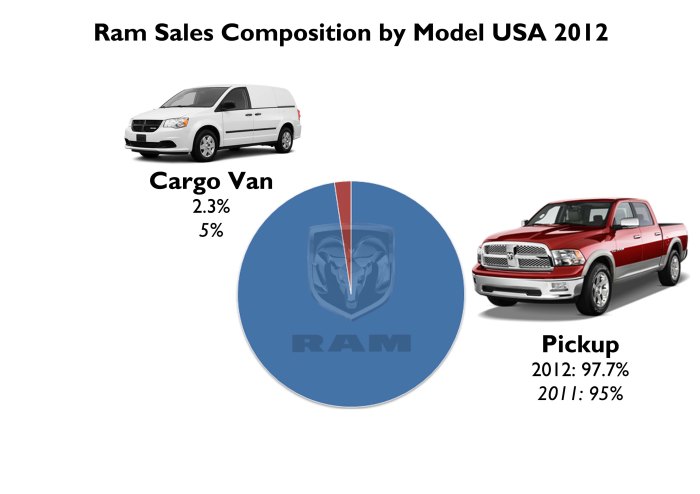

And how is the position of the group regarding the total for each segment? for example, the group is the absolute leader in ‘A’ segment thanks to the 500, which ranked first among its competitors (Smart, Spark), with 58% of it. No presence in ‘B’ segment, while only 6.6% of ‘C’ segment correspond to Chrysler products. The share in ‘D’ segment is even lower (5.8%), and in ‘E’ segment Chrysler Group has 11% of the market. The group sold 12.5% of all SUVs sold last year: 8% of ‘C-SUV’, 21% of ‘D-SUV’, and 11% of ‘E-SUV’. But the segment where Chrysler group is better positioned is MPV. Thanks to their successful Caravan/Town & Country and Journey, the group owns 35% of total segment distributed like this: a massive 54% in ‘C-MPV’ and 40% in ‘D-MPV’. Those are good numbers for a segment that is growing. Finally in Pickup segment, thanks to the successful of the Ram, the group’s share is 15%.

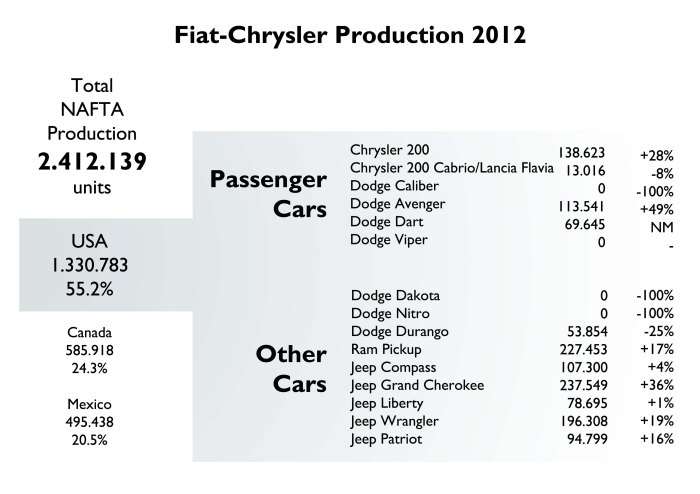

This figure shows Chrysler’s main problem nowadays: its plants are running more than 100% of their capacity. The opposite to what happens in Europe. Many thanks to Domenico from AutoItalian website for this information.

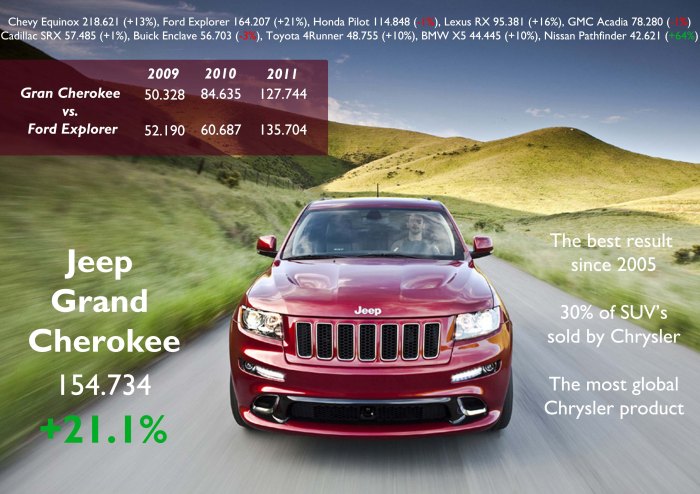

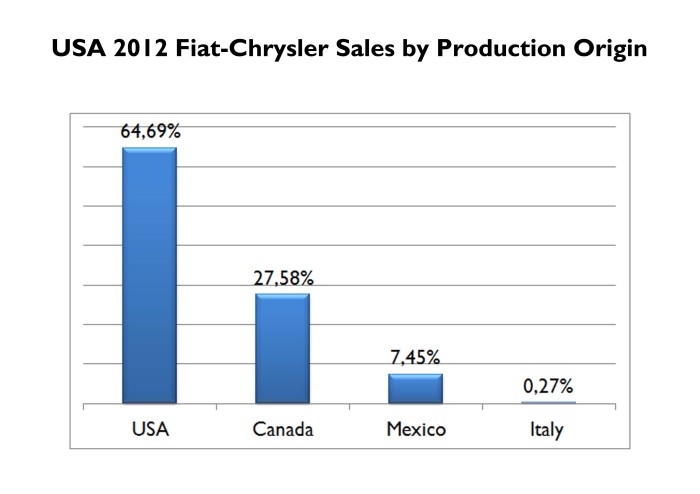

SUVs and big cars are mostly produced in USA, while those smaller ones come from Mexico. Canadian production share on Chrysler’s sales is 28% which correspond to ‘D’ and ‘E’ segments. Thanks to Domenico from AutoItalian site, I got access to Chrysler’s production data. The group produced 2.4 million cars last year in USA, Canada and Mexico, up 21%. From that amount, 27% correspond to regular passenger cars, and the big part to SUV, MPV and pickups. In the case of USA, Chrysler produced 1.3 million cars over there, more than half. Unlike it happens with demand, the most produced vehicle by Chrysler in USA is not the Ram Pickup, but the Grand Cherokee, counting 18% of the total. It is explained by the fact that the Grand Cherokee is a global product, while the success of the Ram is exclusively for USA and Canada. The Avenger production had the biggest jump.

Models

In USA the distribution of sales among models is more balanced than in Italy. From 21 models available in the USA last year, 10 of them count 79% of total sales which means that 48% of Chrysler offer count for 80% of the demand. It is a good thing because the group is not completely dependent on few models or segments. The Ram was again Chrysler’s best-selling model with almost 300.000 units sold, and it was the Fiat-Chrysler’s best result for a single model in a single market. The Ram is even more popular than the Uno in Brazil. However, the Ram is still far from the good years when almost 450.000 units were sold. Compared to its rivals from GM and Ford, the Ram had the best growth as the F-150 kept the pole position in the market but its growth was lower than total market’s, while Chevrolet increased its Silverado’s sales by only 0.8%. Chrysler sold 20% more of its Ram Pickup, which is about two times the F-150’s growth. It allowed Ram to increase its share among the top 3 by 2 points. In 2011, the Ram counted 19.66% of the 3 pickup’s sales. One year later the Ram counted 21.62%. Its rise meant Chevy Silverado’s fall and a bit growth of Ford F-150. Nevertheless, the F-150 continues to dominate with a big margin and even bigger than 10 years ago.

A big jump for the Avenger and Journey, while the Nitro and Caliber just said goodbye in 2012. The Durango keeps falling no matter it is a relatively new product based on the successful Grand Cherokee. Source: FGW Data Basis

The Grand Cherokee is still the best-selling product of Jeep. The Compass is about to say goodbye. Source: FGW Data Basis

It is expected a new product in Ram range. It will be a rebadge Fiat Professional product. Source: FGW Data Basis

The Jeep Grand Cherokee occupied second place in Chrysler’s ranking. It did quite well and as the Ram, it had the best performance of the top 3, but it could had done a better job if it wasn’t because of the poor results it had in the last 2 months of the year. This model counted 9.4% of Chrysler’s sales just as one year before. It is perhaps Chrysler’s most important product nowadays as is the most international one with important results abroad. Actually it is the only of its segment (among Detroit car makers) to be exported successfully, as the Chevy Equinox and Ford Explorer are considered more local products. One more Jeep follows the ranking: the Wrangler is another key product for Chrysler. It doesn’t have a direct rival but it is one of those cars that age doesn’t have a big impact on its sales, just as it happens with the Fiat 500. The Wrangler is up 16% without any clear explanation as the car has not received any deep facelift in the last years. However its quality has improved a lot and Jeep offered several limited editions through out the year. It was closely followed (only 200 units behind) by the always popular Dodge Grand Caravan. This model, along with its twin from Chrysler, the Town & Country, is the car that allows Chrysler to rule in one single segment. In fact, if they were both considered a single model, then it would be the second best-selling product of the group and would be ranked #10 in all-models table. Both models did a great job with better growth rates than total group’s and its competitors.

Of all Fiat-Chrysler models available in all markets, the Ram in USA got the best result in terms of units sold. Notice that it has got back its share among the 3 of Detroit and now is closer to Chevy Silverado. Source: Good Car Bad Car

2012 results for Jeep Grand Cherokee. Its recent facelift should help it to stop falling in the ranking as it happened in the last 3 months of 2012. Source: Good Car Bad Car

Even though it is an old product, the Wrangler continues to success. Source: Good Car Bad Car, FGW Data Basis

USA 2012 results for Dodge Grand Caravan. It sold 27% more than its twin brother, the Town & Country. The both count for 40% of D-MPV segment. Source: Good Car Bad Car, FGW Data Basis

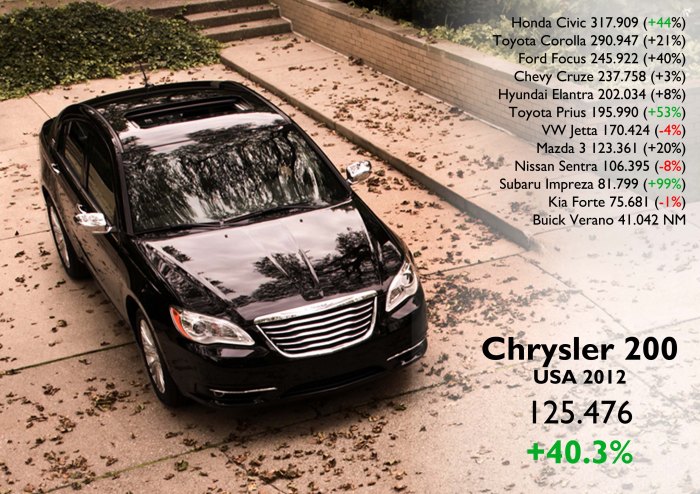

The Chrysler 200 had the best result since 2002. However it is still far away from its rivals. It got only 5.1% of C-Segment. Source: Good Car Bad Car, FGW Data Basis

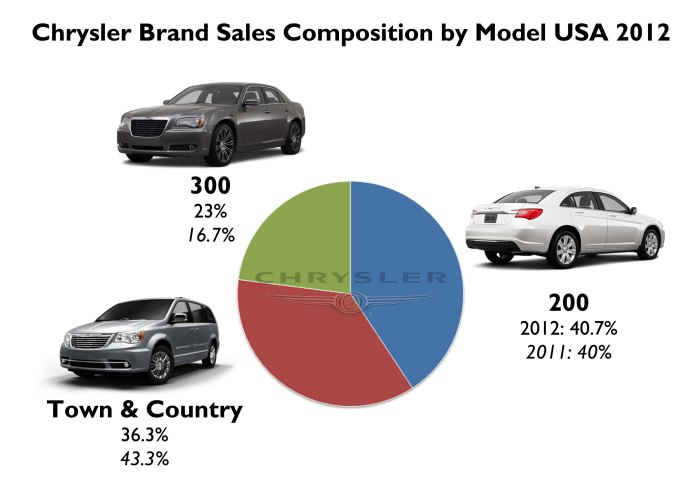

The fifth best-selling model from Chrysler Group is the Chrysler 200. This is the example that proves that a good Ad campaign can have bigger impact on sales than the product itself. The 200 is an old product that had deep facelift in 2011 and since then is promoted aggressively beginning with the ‘Imported from Detroit’ campaign. That’s how the second life of the Sebring had a wonderful sales growth of 44%. It is still far from its modern rivals of ‘C’ segment, but it is expected Chrysler to boost its sales with the introduction of the new generation this year. The Town & Country sold 112.000 units, up 18% and play a good role in MPV segment because the result shows that it is not stealing sales of its twin brother from Dodge (something that happens in Canada, where the Caravan sells 13 times more than the T&C). It was the last model to cross the 100.000 units/year barrier. Then comes the sedans from Dodge, and the excellent performance of the Journey, with all-time record numbers. Special mention for the Chrysler 300, which doubled its sales thanks to the same Ad campaign mentioned above, as it is also an old product. Unfortunately the same car did not work at all in Europe, aka Lancia Thema, selling about 2.000 units, Italy included. But the 300, as its smaller brother, is very far from the big competitors of the segment and a new generation isn’t still in official plans.

Good for the Journey and the 500, which impressed with their results and market share. Bad for the Avenger/300 and Compass/Patriot, which no matter they had positive growth, they are still far away from the leaders of their segments. Source: FGW Data Basis, Good Car Bad Car

By origin, 65% of Chrysler cars sold in USA were produced locally. It is a good result and this year should be even larger that proportion as the locally built Dodge Dart will count more sales. Canadian product counted 27%, while Mexico counted only 7%. Notice that only 0.3% of the cars sold by the group in America come from Europe: the Ferraris and Maseratis. This is shocking, as Marchionne wants to increase Italian production to sell it mainly in USA. That jump will be a hard task and Italy must prove it can be competitive enough to export to the American market, where Italian made cars are exclusively associated to high performance sporty cars. That’s good in the way Italian product has a good image among American buyers, but at the same time it is a big challenge for the coming Alfa Romeos, as they must prove that they are as good as their cousins from Ferrari and Maserati.

Just as it happens in Italy around 2/3 of Chrysler cars sold in USA are built locally. Italian made cars share should rise in the coming years according to Marchionne’s plans. Source: FGW Data Basis

Models and Segments

The best position of the group is in the tiny A-Segment. Thanks to the Fiat 500, the share in this segment is 58%. In C-Segment the domination is not that big: 6.6%. The Dart and coming compact Chryslers should help to rise this shy result. For the important D-Segment (the largest single segment in America), Chrysler Group’s share is only 5.8%, 10 times lower than the presence in A-Segment. The problem here is that current products are old and can’t reach the big numbers of popular cars such as the Toyota Camry, Honda Accord or Ford Fusion. In E-Segment the Dodge Charger is better positioned and controls 10.7% of it. For the SUV segment, the group’s position is not bad: 8% in C-SUV, 20.6% in D-SUV, and 11.3% in E-SUV. It means that Chrysler group owns 12.5% of all SUV segment, down 0.5 points compared to 2011. With MPV segment, Chrysler is by far the absolute leader with 35% of share, composed as follows: 53.7% share in C-MPV segment, and 40% in D-MPV. No presence in B-MPV so far (but the Fiat 500L will change that).

Forecast

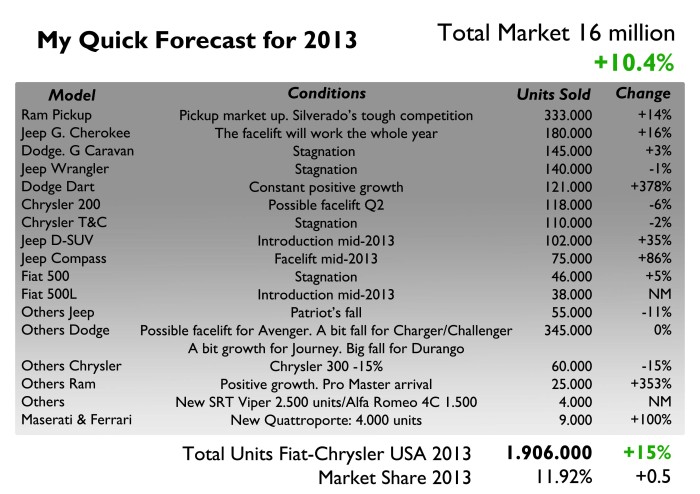

American consumers will continue to buy new cars and in 2013 total market may reach 16 million units, up 10% and is 500.000 units higher than Fiat-Chrysler’s forecast. Then, total market would grow but not as good as in 2012 partly because of two main reasons: in the last quarter of last year, monthly sales showed that even if December and November had bigger increases compared to the same months of 2011, their share in whole year’s result was smaller (in the case of October and December). In other words, the growth has began to stabilize. A second reason for not better increase in overall sales, is the fact that American economy is still in its recovery path and recently it is going slower than expected. In latest Chrysler’s plans, they want to reach a 13% market share by the year 2014. So, according to their plans, the group should increase its share up to 12% in 2013. It means 1.9 million cars sold, up 15.7%, and once again a bigger gain than overall market. Personally I think increasing sales that much is a bit exaggerated. Chrysler Group will continue to have positive growth rates in 2013 in USA but not as good as it was in 2012. Therefore I believe they will grow just above the market: 12%-13% (1.85 to 1.87 million cars). The reason for not better growth is explained by the fact that the only all-new model to hit the full year in 2013 is the Dart, while the expected new Chryslers or Jeep would arrive by the end of first semester, at last. Only the new Jeep Grand Cherokee will help.

Forecast made upon Chrysler product plan for 2013 and current economic situation in USA. It is expected the market to continue growing and Chrysler to do it even better in order to get 12% of the market, just 1 point above 2014 target. It is expected the Dart to take off starting from 7 thousand units in January up to 12.000 in December. Other successful products will be the renovated Jeep Compass and the new D-SUV from Jeep. But more sales volume will come from the success of the updated Jeep Grand Cherokee. Other products like the 200, Minivans, the Wrangler, Charger and Journey are expected to maintain their 2012 results. The Durango will fall dramatically (-30%), while the Patriot, 300 and the Challenger will also lose market share. Maserati may sell 4.000 units of its new flagship and the Ghibli will not arrive till late 2013. Finally, Alfa Romeo will return with its 4C, from which it is expected to sell around 1.500 units.

Brazil 2012 Full Year Results Analysis coming soon

Click here to see USA December 2012 results

Click here to see USA November 2012 results

Click here to see USA October 2012 results

Click here to see USA September 2012 results

what a great analysis!!

LikeLike

Grazie mille Dario!

LikeLike

Woow, nice to read a lot about this company and strategy

Thanks Juan

LikeLike

It’s my pleasure to share my passion with you all. Unfortunatelly I don’t have enough time to write more often. Keep reading

LikeLike

Complimenti Juan. Saluti

LikeLike

Grazie Corrado. Tra poco arriva l’analisi per il Brasile

LikeLike

Pingback: Fiat and Suzuki: a new opportunity for a partnership | Fiat Group's World

Juan Felipe, excellent analysis. In 2012 there are many more SUV competitors in the US market fighting for share and cost competition is fierce especially from the Asians (Koreans). Growing market share during this time is really impressive. CJD quality is vastly improved over 6 years ago. New life for 88 year old Chrysler (Dodge will be a 100 year old brand in 2014).

LikeLike

Yes. SUV segment is getting enlarged with so many offer. Koreans are doing very good with interesting products. Dodge should celebrate its first 100 years with an excellent new product. Keep reading!

LikeLike

Pingback: Canada 2012 Full Year Analysis | Fiat Group's World

Pingback: Dodge Dart and Fiat Viaggio. A flop? | Fiat Group's World

I am a bit late, but: un’analisi eccellente! Zdenko dalla Croazia, 2014

LikeLike

Thanks! greetings from Turin

LikeLike

Pingback: FCA USA 2013: Sales results Insights | Fiat Group's World

Pingback: FCA USA 2013: Sales results Insights (UPDATED) | Fiat Group's World

Pingback: FCA USA 2014: Sales Results Insights | Fiat Group's World

Hello mmate nice post

LikeLike