Germany is Fiat’s second largest market in Europe in terms of volume. In 2012 Fiat-Chrysler sold 91.818 cars, down 7.8%. It is not a bad number till one realizes that Germany is Europe’s largest car market: Fiat-Chrysler’s share is only 2.98%, down 0.16 basis points. And that’s not good at all to have such a tiny quota in a market that is not suffering the European debt crisis as much as other countries. Yes, Germany is a difficult market as VW is the absolute king over there, while the premium brands, playing as locals, continue to increase their presence in lower segments. The problem is that Fiat’s sales are extremely concentrated in few models, leaving other brands of the group with marginal sales. It may not be part of Fiat-Chrysler strategic markets, but Germany should be considered when planning new products for Europe.

Germany is Fiat’s second largest market in Europe in terms of volume. In 2012 Fiat-Chrysler sold 91.818 cars, down 7.8%. It is not a bad number till one realizes that Germany is Europe’s largest car market: Fiat-Chrysler’s share is only 2.98%, down 0.16 basis points. And that’s not good at all to have such a tiny quota in a market that is not suffering the European debt crisis as much as other countries. Yes, Germany is a difficult market as VW is the absolute king over there, while the premium brands, playing as locals, continue to increase their presence in lower segments. The problem is that Fiat’s sales are extremely concentrated in few models, leaving other brands of the group with marginal sales. It may not be part of Fiat-Chrysler strategic markets, but Germany should be considered when planning new products for Europe.

Germany

Contrary to what happened in Italy, France and Spain, car sales in Germany dropped only 3%. The fall was mainly explained by December’s result, -16.4%, which affected the tiny cumulative growth the German market had till November. That’s how 3.08 million cars were sold, allowing Germany to occupy place #1 in Europe and #5 in the world. Of course VW made not only to rank first but to gained market share: in 2012 the whole group got 38.1% of share, or 1.17 million cars sold (Fiat Group’s share in Italy is 30%, and PSA and Renault’s is 48% in France). Situation gets tougher for foreign brands if it is considered the fact that VW is not the only local player: German premium brands (BMW and Mercedes) got 19.3% of share, while Ford and Opel caught 13.6% of the market. It means that local players count for 71% of the market. Only those foreign brands offering good quality products with interesting design proposals have an important place in the remaining 29% of the market. Another thing to take into account is the strong share corporate purchases have in total market. Unfortunately I could not get any precise data, but the ranking published by my friend Matt Gasnier in his blog, shows that some popular models, such as the Golf are not really that popular among common buyers. The top 40 private best-selling cars, count for 40% of their total sales. It means that less than half of their total sales correspond to regular purchases, and corporate (companies and rent agencies) count for more than half. I just wonder how much of the corporate purchases come from VW itself.

Despite its fall, Germany continues to be Europe’s largest car market. However it is expected Russia to overtake it in the next years. Notice that local brands (VW, Mercedes, Audi, BMW, Opel, Ford and Porsche) count for a big part of the market, contrary to what happens in the other major European markets. Source: KBA Statistik, www.carsitaly.net, www.bestsellingcarsblog.com

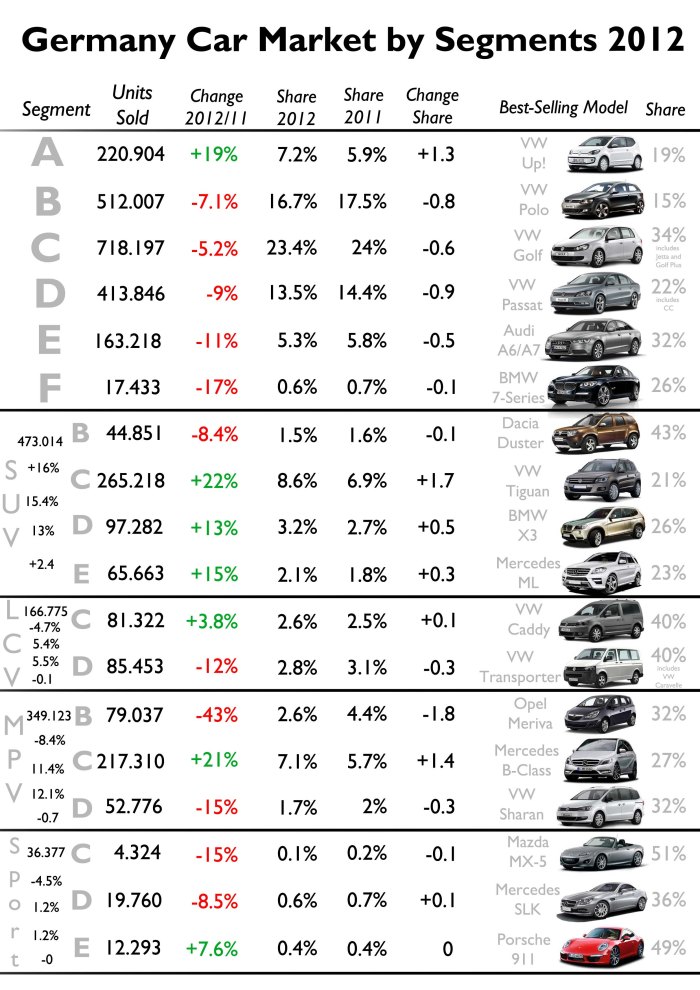

The composition of German car market by segments show interesting facts. First of all the market is pretty balanced among segments, which indicates a good economic situation among buyers. In fact the segment with the higher share, the C-Segment, counts for 23% of the market, not far from second place, the B-Segment, with 17% of share. SUVs and MPVs do also have interesting numbers placed at third and fifth place. So, when it is about selling a car, most of all car body types find their client in Germany. If total market fell 3%, not all segments did: SUVs increased their sales by 16%, while city car sales (mainly explained by the arrival of the VW Up!) raised 19%. The segments that forced total market to fall were ‘B’, down 7%, ‘C’ -5%, and ‘D’, down 9%. In other words, Germans moved to small passenger cars, and mid/big size SUV in 2012, as some of them did not wait for the new VW Golf, down 7%, and were not attracted by the Opel Astra/Ford Focus, down 23% and 22%.

VW is the leader in most of the segments. The Duster and MX-5 are the only foreigners to rank first in their segments. Notice that small SUVs and MPVs decreased their registrations in favor of larger ones. C-SUV is the segment to rise the most its share, while B-MPV is the one with the highest fall. Source: FGW Data Basis, KBA Statistik

Fiat-Chrysler

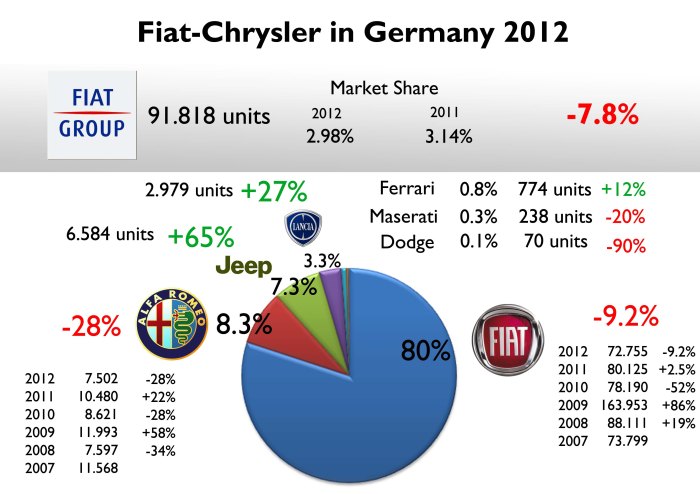

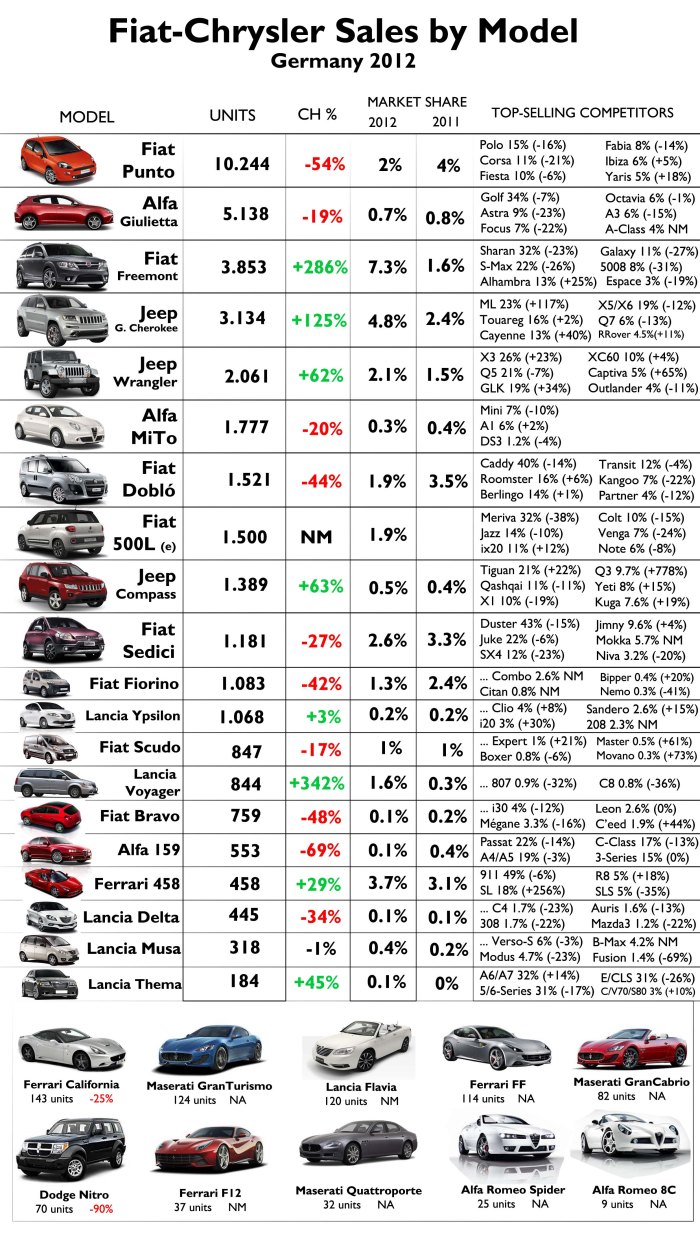

Fiat and Chrysler lost market share in Germany during 2012. Guilty: Fiat brand and Alfa Romeo. Fiat brand counted for 80% of total sales, and it fell 9%, due to the Punto mainly. But Alfa Romeo did much worse: it is down 28%, and the reasons are evident. In the other side there are Jeep and Lancia, both with excellent results, but still marginal. Jeep registrations grew 65% and now counts for 7% of Fiat-Chrysler sales. Lancia did also very good with +27%, but only 3.3% of quota in the group. Considering what happened to segments, the group 1) made use of the growth in mid and large SUVs with Jeep brand, 2) did not do anything with the expansion of A-Segment, and 3) lost share in B and C segments. Another explanation comes from brand composition and new launches: Fiat brand counted for 80% of total sales and last year it only introduced 1 all-new model.

The group lost market share in 2012 but its sales are more or less in the same level of the last years. It could be said that total sales are stable in Germany, except for Alfa Romeo. Source: KBA Statistik, www.carsitaly.net

Compared to its rivals, the group clearly stays behind. The group occupies place #9 in a list of 20 auto makers, between PSA and Toyota. In terms of change it ranks 6th of the top 10 ahead of Ford and behind Renault. Compared to big Europeans, Fiat did better than PSA, Ford and Opel, and worse than Renault and VW. But they are not the only players in this case. As usual, Hyundai Motor Co., got the best performance in the top 10 and now is the best-selling foreign group in Germany (if Ford and Opel are considered locals). Hyundai is up a massive 21%, rising its quota from 4.06% in 2011 to 5.05% in 2012. It sold more units than Renault or PSA, and was along with VW, the unique groups in top 10 to have positive growth. VW group gained what GM and Ford lost, while Daimler and Hyundai gained what BMW, PSA, Renault and Fiat lost. Toyota didn’t do that bad and it is now closer to Fiat result. In 2013 it could overtake it thanks to fresh products.

Fiat-Chrysler’s position is some how in the middle of all car makers. It lost less market share than all its main competitors from France and Germany (except for VW). Source: www.bestsellingcarsblog.com

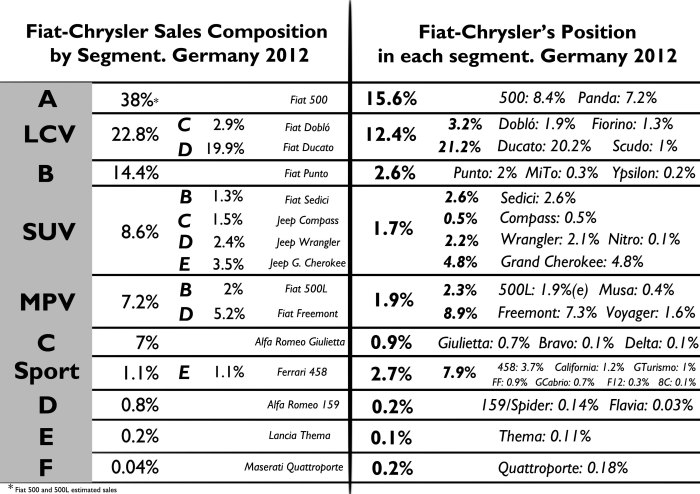

In terms of segmentation, 40% of the group’s sales correspond to the Panda and 500, the A-Segment, followed by LCV, and B-Segment. The SUVs from Jeep are more popular than the minivans offered by the group, and the presence in Germany’s largest segment, the ‘C’, is really low: 7%. It is simple: the 500 did a good job no matter the introduction of the Up!, but it was not enough to leave an old Punto fighting against its German, French and Japanese rivals, or to leave an excellent Giulietta to gain presence in the land of the Golf. The Grand Cherokee is the leader among SUVs, while MPV information is not completely right as German sales figures do not separate 500 and 500L results. The group’s best position is in A-Segment, where it owns 16% of the segment. Then comes the LCV where the group sold 12% of the total. Surprisingly the group is stronger in Sport segment than in B-Segment: 2.7% vs. 2.6%. Jeep as a brand did very good in terms of growth, but its presence in SUV segment is still far from becoming an important player: 1.7%.

This figure shows Fiat-Chrysler’s sales composition by segment and the position of the group in each segment. For better understanding, 22.8% of the group’s sales correspond to LCV vehicles: 2.9% to C-LCV and 19.9% to D-LCV. The Doblo was the best-selling C-LCV, and the Ducato was the best-selling D-LCV. Then, in the second column, Fiat-Chrysler has 12.4% of total LCV sales in Germany: 3.2% in C-LCV (1.9% Doblo and 1.3% Fiorino), and 21.2% in D-LCV (20.2% Ducato and 1% Scudo). Notice that Fiat-Chrysler’s sales in Germany are highly concentrated in small passenger and large LCV cars. Regarding the position of the group in each segment, the Ducato is the best positioned model with 20.2% of share in its segment. The 500 and Panda are also well positioned, aswell as the Freemont and Grand Cherokee. Too bad for the C, D, E and F Segments. The group has more market share in Sport segment than in B-Segment. Source: FGW Data Basis

Models

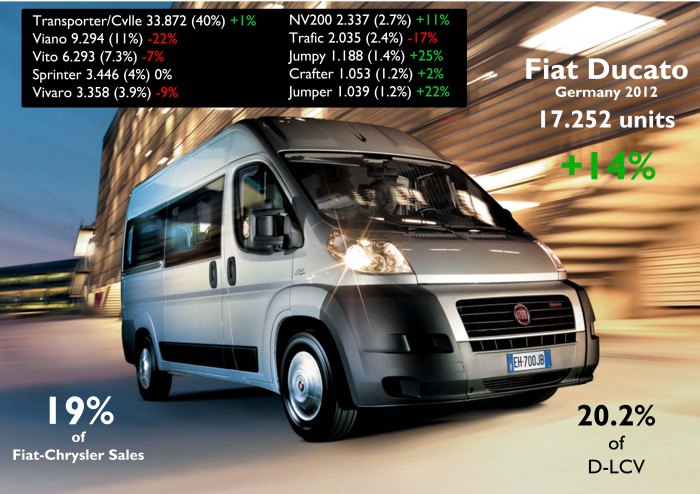

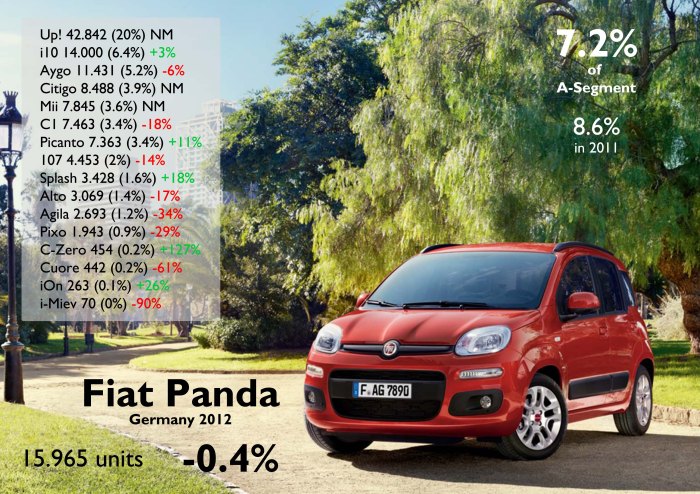

The 500 did its best but it was not enough to compensate the fall of its bigger brothers and cousins. German official data says that 20.018 units were sold last year, up 18%, not bad. However this total includes the 500L numbers, on sale since September. It is my belief that the new minivan could had sold around 1.500 units, based on its performance in France and total sales for its immediate rival, the new Ford B-Max. Then Fiat 500’s sales would be around 18.500 units, which is also good compared to 17.000 units sold in 2011. The result is even better if it is considered the fact that VW is doing great with its Up! in its local market and the 500 is a 5 year 0ld boy. In 2013 things will get a bit more complicated as the Opel Adam, a direct rival of the 500, will try to catch some part of the segment. The success of the 500 is followed by another positive result: the Ducato is Fiat’s second best-selling car in Germany with more than 17.000 units delivered, up 14%. It has become a referent in the segment, only surpassed by VW Crafter. Contrary to what most people believed, the arrival of the Up! had a stronger impact on the new Panda than in the mature 500. The Panda is down a tiny 0.4%, which is not bad but shows that overseas this car is not as invincible as it is in Italy. The 500, Ducato and Panda count for 57% of the group’s sales.

The 500 was the only of its segment (3 door A-Segment) to increase its registrations during 2012. All other competitors fell following the arrival of Up/Mii/Citigo. They caught some 500’s market share. Germany was the third largest market for the 500 in Europe. Source: FGW Data Basis, www.bestsellingcarsblog.com

As the 500, the Ducato did very good in its segment and sells much more units that its twin brothers from Peugeot and Citroen. Source: FGW Data Basis, www.bestsellingcarsblog.com

As it happened in Italy, the new Panda allowed the nameplate to remain stable in 2012. Hyundai i10 is getting close. Source: FGW Data Basis, www.bestsellingcarsblog.com

The worst result that made Fiat-Chrysler to lose market share and decrease its registrations in Germany, comes from Fiat Punto’s extreme fall. If it wasn’t because of it, the group’s results would had been positive. The Punto is down a shocking 54% or 12.000 units. Italy is not the only market to stop buying the Punto. German B-Segment is down 7% and Fiat makes it worse with an old Punto and no clear successor yet. Other bad performers are the Giulietta, MiTo, Doblo, Delta and Bravo. In the opposite side there are the Freemont, Grand Cherokee, Wrangler, Compass and Voyager.

American products had a wonderful performance but they are still very unknown. The worst position of the group is in C-Segment with very bad numbers for the Bravo/Delta. Source: FGW Data Basis, www.bestsellingcarsblog.com

Forecast 2013

According to German Federation of Motor Trades, total market should reach 2.9 million units this year, down 6.5%. I think the German car market will fall a bit more, and no more than 2.8-2.85 million cars will be sold in 2013. Official forecasts were made when German car market had tiny falls in the last months of 2012, but did not count December when sales fell 16%, just as France. This doesn’t mean that Germany will have the same bad numbers of Italy or France. But things will not be good in Germany in 2013. Fiat-Chrysler is going to feel it aswell. My forecast indicates that they would sell around 81.000 units by the end of this year, down 11%. That number is based on some sort of stability coming from the top sellers and very bad results coming from the Punto, Giulietta, Sedici, Ypsilon, Bravo and Delta. The 500L could reach around 6.000 units reaching the Punto’s sales, while all Jeeps will continue to grow. Maserati will rise its registrations thanks to the new Quattroporte.

Fiat-Chrysler certainly has its work cut out in this market. The Freemont is a real winner. Amazing to see that 25 Alfa Spider sold in 2012!

I am wondering how Fiat can claw up some market share with such strong rivals. They probably will need to double their dealer network when the new products start rolling out. No doubt Sergio Marchionne will have Opel and PSA options at the back of his mind one the Chrysler merger is complete.

LikeLike

If VW plays as local imagine how tough this market is

LikeLike

Pingback: Canada 2012 Full Year Analysis | Fiat Group's World

Pingback: FCA Germany 2014: Sales Results Insights | Fiat Group's World