After Italy, USA, Brazil and Germany, Canada is the next market to be analyzed in Fiat Group’s World blog. It is Fiat-Chrysler’s 4th largest market by volume and is not far from the leaders in terms of market share. Canadian car market could be considered one of the developed world’s most stable ones, and this has allowed it to offset other important markets, such as Italy. In 2012 it had the best result since 2004. Though it could be considered a small US car market, Canada has some differences in terms of offer and segmentation. Small and mid size cars are more popular in Canada, but large pickups have also a bigger share. It means that big sedans and SUVs don’t have the same importance they do in USA. This particular fact allows Fiat-Chrysler to have a very important position over there. Actually the position of the group is much better than in USA and last year they sold more cars than GM. Canada ranks 3 in the list of Fiat-Chrysler’s share in all markets, after Italy and Brazil. It does very good in some segments and is the absolute leader in MPV one. It is also the place of production for some important products of the group.

After Italy, USA, Brazil and Germany, Canada is the next market to be analyzed in Fiat Group’s World blog. It is Fiat-Chrysler’s 4th largest market by volume and is not far from the leaders in terms of market share. Canadian car market could be considered one of the developed world’s most stable ones, and this has allowed it to offset other important markets, such as Italy. In 2012 it had the best result since 2004. Though it could be considered a small US car market, Canada has some differences in terms of offer and segmentation. Small and mid size cars are more popular in Canada, but large pickups have also a bigger share. It means that big sedans and SUVs don’t have the same importance they do in USA. This particular fact allows Fiat-Chrysler to have a very important position over there. Actually the position of the group is much better than in USA and last year they sold more cars than GM. Canada ranks 3 in the list of Fiat-Chrysler’s share in all markets, after Italy and Brazil. It does very good in some segments and is the absolute leader in MPV one. It is also the place of production for some important products of the group.

Canada

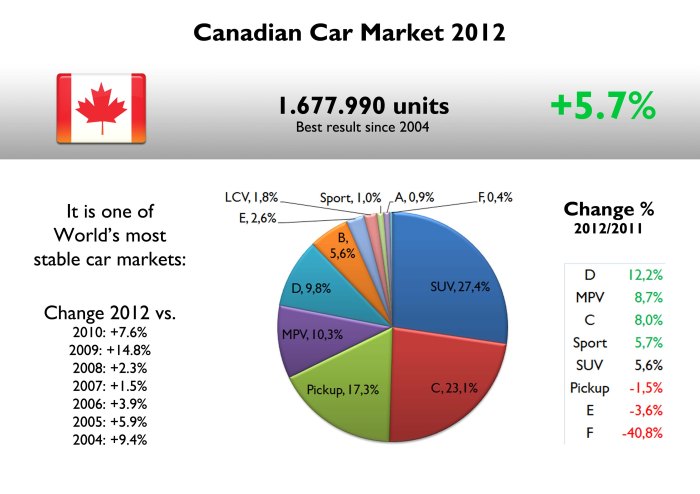

Last year the market was up almost 6%, which is not bad compared to European markets, but is worse than US performance and other developed markets such as Australia or Japan. Considering their population, Canada is one step ahead of USA with 47.8 new cars/1000 inhabitants vs. 46.1. Therefore, Canada is perhaps the first country in the world with more new cars sold per 1000 inhabitants in 2012. In terms of segmentation, the market is a mix of Europe and USA: big pickups are also the best-sellers, but small and mid size passenger cars have more relevance than larger sedans. That’s why city cars like the Fiat 500 or compact cars like the Mazda 3 are easy to see in Canadians roads. Anyway, the offer in Canada is almost the same of USA. What changes is the composition of the market.

Since 2004, Canadian car market has moved between 1.4 and 1.6 million units/year. By segments, it is a mix of USA and Europe: SUV and Pickups, but compact cars are also popular there. Source: FGW Data Basis, Good Car Bad Car

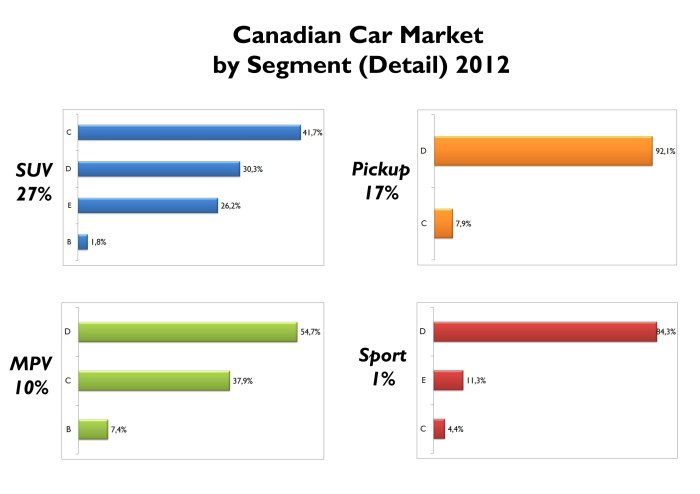

SUVs count for 27% of Canadian total sales. From them, 42% correspond to compact SUVs, while full size ones count for 26% of SUV total. That’s the only difference compared to US market, because in Pickup, MPV and Sport segments, the proportion is very similar. Source: FGW Data Basis

The composition by groups is interesting too. Last year the Detroit 3 occupied the podium, but contrary to what happens in USA, GM occupied the third position. Hyundai is ahead of Toyota, and VW Group is ahead of Nissan. At the end, Canadian tiny growth did not come from American groups, but from Japanese, VW and Koreans. They all gained market share thanks to fresh products more adapted to Canadian consumers.

47% of total sales correspond to Detroit 3. The share among all auto groups is quite equally distributed and there isn’t a clear leader. Source: Good Car Bad Car

Fiat-Chrysler

The group has a very important position in Canada. Thanks to its leadership in MPV segment and the success of some of its SUVs and the Ram, Fiat-Chrysler continues to increase its market share. In 2012 its share was bigger than Chrysler’s plans, in which they intend to have 14% of the market by the year 2014. The success is explained by higher quality standards and more products. Regarding the composition by brands, sales are very well-distributed and even Fiat has some relevance with its 500. However Dodge lost market share, gained by Chrysler brand and Fiat. Anyway the range of products fits very well with Canadian customer profile.

Fiat-Chrysler’s share was among the best in the world, just behind Italy and Brazil, and ahead of USA. It is not the case for growth result, which is not as good as what happened in USA. Dodge counts for 40% of sales (in USA it counts for 32%) and was the main reason of the tiny growth of the group. Jeep did not grow but is still a reference in SUV segment. Very good for Chrysler brand with only 3 products. Source: Good Car Bad Car

Compared to rivals, the group’s brands are very well positioned. Dodge and Ram together are behind Ford and Toyota, but ahead of the big Chevrolet. Their sales were unified in order to make a better comparison with Chevrolet and Ford, that offer a wide range of products. Nevertheless, they did not have the best performance, and Toyota brand surpassed it thanks to a spectacular growth. Contrary to what happens in USA, Jeep is not the best-selling SUV brand. GMC sells much more even though its sales are down 7%. Buick could be considered the direct rival for Chrysler as they are both family sedans brands that can’t be positioned as mainstream brands or premium. And finally Fiat’s rivals, Mini and Smart, had also big jumps but not as big as Fiat, which is the absolute leader of the tiny A-Segment.

Dodge and Ram could not stop the massive jump of Toyota. Notice that they both sold almost 3 times more than VW. Jeep sells 10 times more than Land Rover, which plays as a foreign brand and with more expensive products. Small cars had an interesting growth last year and all brands belonging to A and B segment had progressions. Anyway, Fiat is now the best-selling small car brand, ahead of Mini and Smart, which sell their cars from a long time ago. Source: Good Car Bad Car

Even though Canadian market is more open to smaller cars, the group’s sales composition by segment indicates that it is highly concentrated in big cars: SUV, Pickup and MPV. They all count for almost 82% of total sales, which is a lot. Those 3 segments count for 55% of all Canadian car market. Besides, most of Fiat-Chrysler offer is composed by large SUVs, MPVs and Pickups. This mix works better in USA but not that good in Canada, where compact cars are also very popular. The position of the group in this segment is quite bad: 7% of its sales correspond to C-Segment, and it only owns 4.6% of it. The new Dart is called to improve these numbers and allow Fiat-Chrysler to have more relevance in lower segments. It is not the case for MPV, Pickup and A-segment, where the group is very well positioned with high shares within the segments. If Fiat-Chrysler manages to boost Dart sales and introduce the next compacts from Chrysler brand, then it could become easily the best-selling group in Canada with more than 15% market share.

35% of Fiat-Chrysler sales in Canada correspond to MPV. In that segment, the group’s owns almost the half of it thanks to the great success of Dodge Grand Caravan. The 500 is also the leader of its segment. In the opposite side there is the poor position in C-Segment (only 4.6%). Considering the demand, Canada could be a market where a B-Segment Fiat or Alfa Romeo could work. Source: FGW Data Basis

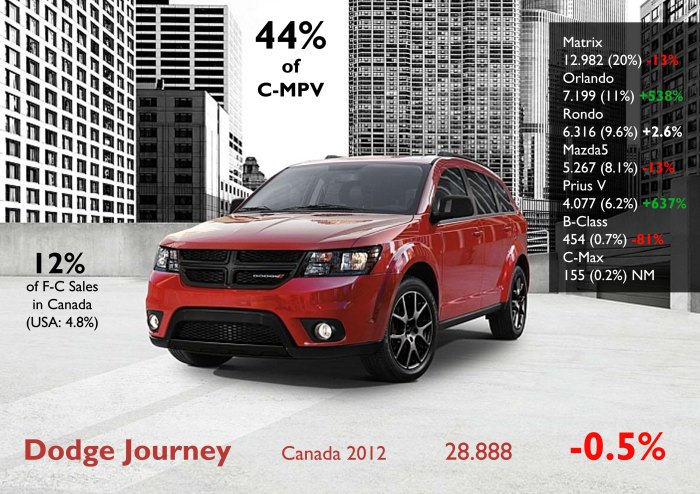

2 out of 3 minivans sold in Canada by Fiat-Chrysler correspond to large ones: Grand Caravan and Town & Country. The position of the group in C-MPV is extremely good, catching 59% of the segment thanks to the Journey. Canadians prefer mid and full size SUV from Jeep. Thanks to the Wrangler, Nitro and Liberty, the group owns 14% of D-SUV. The Patriot and Compass are not key players in C-SUV segment. Their successor should rise this small share. Source: FGW Data Basis

The origin of the cars sold in Canada is also an interesting thing. Canadian and Mexican products have more share than what they have in USA. That’s how a bit more than half of Fiat-Chrysler cars sold in Canada last year came from the States, and 28% were made locally. Models produced in Canada: Dodge Grand Caravan/Chrysler Town & Country/Ram Cargo Van, Chrysler 300, Dodge Charger, and Dodge Challenger.

All models production increased last year. Only the Routan, the minivan made for VW, dropped. All these minivans, which at the end are all the same car, count for 59% of Chrysler production in Canada. Thanks to Domenico Di Cintio from Autoitalian for the information.

Models

The Ram Pickup is the best-selling model of the group and counts for 28% of total sales. In Canada it is a very popular model and occupies place number 2 after the invincible Ford F-150. The gap between the Ram and its rivals is lower in Canada. After it, then comes the rock star of the group in Canada: the Grand Caravan is the absolute leader of the MPV segment and occupied place number 4 of best-selling cars in that country. Its success is as big as the fail of its twin brother, the Chrysler Town & Country. Canada is probably the market that confirms what Marchionne wants to do with these two models in the future: to differentiate them more to sell more. Last year was not the best for this minivan but it still reigns without any clear threat. Another clear winner is the Journey, which had interesting numbers no matter its age. This car, made in Mexico, could be considered the 500 for Chrysler Group. Where ever it is introduced it has interesting results.

A Ram diesel should boost this model’s sales in Canada in 2013. As it happened in USA, it did better than GM pickups but worse than the F-150. Source: FGW Data Basis, Good Car Bad Car

The VW Routan is made by Chrysler in Canada using the Grand Caravan base. Its sales are a complete disaster. Interesting to see how that brand does not always matter when buying a car. Source: FGW Data Basis, Good Car Bad Car

The Journey has 44% of sales of the segment. No matter its age it continues to achieve nice results. Source: FGW Data Basis, Good Car Bad Car

But if the Ram, Grand Caravan and Journey were Fiat-Chrysler best-selling models, the Wrangler, 200, 300 and 500 were the best performers. They had amazing years thanks to their updates or more options. It is not the case for the Grand Cherokee, which increased its registrations only 1%. The facelift presented in Detroit and introduced in Q1 in Canada should revert that slow growth and boost its sales registrations. The remaining products had all falls in 2012 (except for the Avenger with a tiny positive growth). Some of them just said good-bye, such as the Dodge Nitro or Caliber, and some of them just because they are old and no competitive anymore: Jeep Compass/Patriot, Durango or Challenger. In conclusion, Fiat-Chrysler range is still strong in Canada thanks to specific products that may have problems in short time if they are not replaced by all-new cars. The Journey and Grand Caravan will not be able to increase their sales if a new successor does not arrive shortly. In the case of the Ram, this pickup will face difficult times due to the arrival of new Silverado/Sierra, and a diesel version should arrive as soon as possible. Jeep counts on the updated Grand Cherokee that will certainly succeed, and the Wrangler. But it needs more fresh products for lower segments. Chrysler did very good but that performance is not for sure in 2013 as the 200 and 300 are nice products but old. Fiat needs the 500L to enlarge its success and maybe boost 500 sales as they slowed down in the last months of 2012.

The 500 is now Fiat-Chrysler 7th best-seller car and is ahead of other important products such as Chrysler 300 and Dodge Avenger. In 2012, 26% of its sales corresponded to the cabrio version. Poor performance in C-Segment with the 200 (that a record year) and the Dart. The Grand Cherokee was surpassed by Ford Explorer. Source: FGW Data Basis, Good Car Bad Car

My Forecast 2013

Canadian car market may continue to grow in 2013, according to what most car makers believe. About 1.73 million cars could be sold in 2013, up 3%. Those numbers correspond to a stable bu mature market that could have a good year but without any spectacular growth. Fiat and Chrysler could be selling around 251.000 cars, up 2.8%, to 14.5% market share, which is a bit more than what the group’s forecast. This result is based on the growth of Ram Pickup (the diesel version should boost its registrations), the Grand Cherokee, the Dart (10.000 units should be sold this year), and the introduction of 500L (2.500 units). The D-SUV from Jeep should also arrive and I believe around 6.000 units should be sold in 2013. In the opposite side, sales of Grand Caravan, Journey, 200, Patriot, Compass, 300, Town & Country, and Durango, should decrease in this year.

Il Ram 1500 Ecodiesel sarà disponibile negli Stati Uniti a partire da luglio, quindi dal mese successivo anche in Canada. Mentre invece il Volkswagen Routan non è più prodotto da luglio 2012 nello stabilimento di Windsor, Ontario. Infatti ora Volkswagen sta negoziando con Chrysler Group per la futura produzione del minivan. Infine la 500L sarà disponibile a partire da luglio negli Stati Uniti e quindi dal mese successivo in Canada.

Buon lavoro e grazie ancora per la citazione

LikeLike

Usual very good analysys.

Only one remark: Dodge Caravan is an E segment MPV and Journey is a D segment CUV.

LikeLike

Thank you DeWitte.

I divide MPV into 3 segments: B, C and D. D-MPV are all those full size minivans. Regarding the Journey, as I can’t open so many segments, I believe it is a product closer to a minivan concept but is not as big as a Grand Caravan/Town & Country. That’s why I place it in C-MPV as a mid size minivan. At the end it is a subjective matter.

LikeLike

Hi Juan,

I think Turkey is also a important market for Fiat.

They introduced the Freemont right now new there. The Linea is since Years a selfrunner.

LikeLike

Yes SlumLord. Turkey is another key market for Fiat. The analysis will come soon. The problem is that there is no full information about that market. I’m working on it

LikeLike

Pingback: FCA Canada 2014: Sales Results Insights | Fiat Group's World