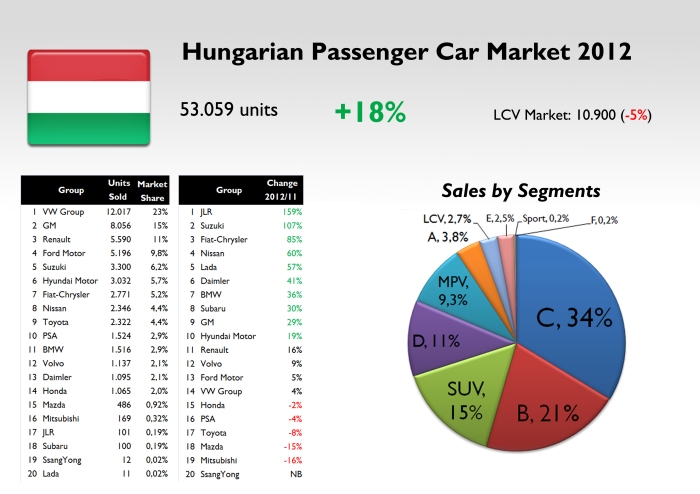

After a quick visit to the beautiful city of Budapest I’m going to share with you the highlights of this small car market where Fiat-Chrysler isn’t as small as anyone could think. In 2012 Hungarian market sold 53.000 units, up a healthy 18%. It is indeed a small market but is quite interesting as the composition by groups is some how different from the rest of Europe. VW Group dominates with the usual 23%, and the following top sellers are the usual from Western Europe except for PSA, which is replaced by Suzuki, a local producer. German premiums don’t make part of the top 10, and Toyota and Nissan look weaker than in Western Europe. In this ranking, Fiat-Chrysler occupies the usual 7th position but it was one of the best performers, increasing its registrations a massive 85%. The group holds 5,2% market share, which is better than the share in European major markets. Hungary is the home for the production of the Suzuki Swift, SX4/Fiat Sedici, some Audis (the new A3 Sedan for example), the Mercedes CLA, and some GM and Ford products.

After a quick visit to the beautiful city of Budapest I’m going to share with you the highlights of this small car market where Fiat-Chrysler isn’t as small as anyone could think. In 2012 Hungarian market sold 53.000 units, up a healthy 18%. It is indeed a small market but is quite interesting as the composition by groups is some how different from the rest of Europe. VW Group dominates with the usual 23%, and the following top sellers are the usual from Western Europe except for PSA, which is replaced by Suzuki, a local producer. German premiums don’t make part of the top 10, and Toyota and Nissan look weaker than in Western Europe. In this ranking, Fiat-Chrysler occupies the usual 7th position but it was one of the best performers, increasing its registrations a massive 85%. The group holds 5,2% market share, which is better than the share in European major markets. Hungary is the home for the production of the Suzuki Swift, SX4/Fiat Sedici, some Audis (the new A3 Sedan for example), the Mercedes CLA, and some GM and Ford products.

PC sales jumped 18% in contrast to what happened in the rest of Europe. The good economic momentum of the Hungarian economy allowed this result. Fiat-Chrysler occupied a decent position and was the third best performer compared to 2011 figures. Source: see at the bottom of this article

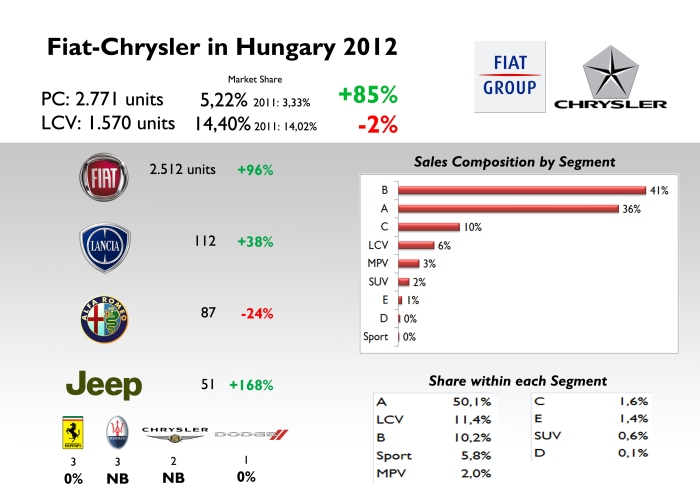

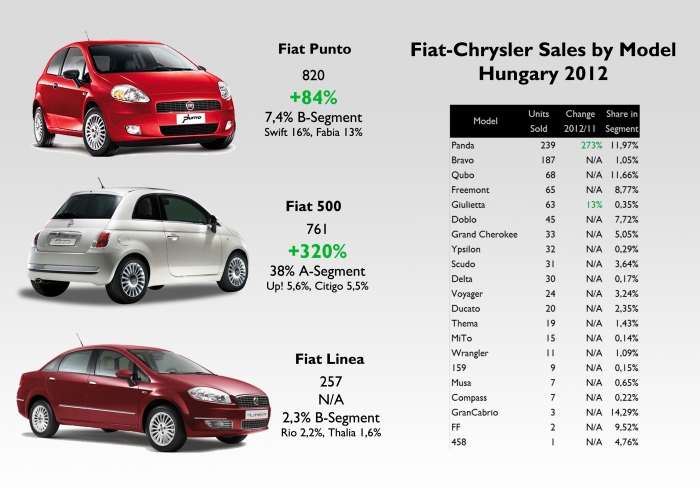

One out of 3 new cars sold last year corresponded to C-Segment. Hungarians love the Skoda Octavia, Ford Focus and many others. Then comes the B-Segment with 21% share, and SUV counting for 15,5%. City cars are not popular at all. Fiat-Chrysler sold 2.771 passenger cars and 1.570 LCV. It means that the group got a decent 5,2% market share in the PC market, and a wonderful 14,4% in LCV (one of the best, after Italy and Turkey). It jumped from place #9 in 2011 to #7 last year outselling Toyota and PSA. The good thing is that Fiat-Chrysler had the second highest growth rate among major groups. This was possible thanks to the great performance of Fiat brand that doubled its sales year-on-year. Lancia and Jeep had also a big jump but their contribution is very low: 4% and 1,8% of the group’s sales. Actually in 2012 Lancia outsold Alfa Romeo (-23%), thanks to the good mix of the Ypsilon, Delta and Voyager. Curiously the 500 isn’t Fiat’s top seller. It occupies second position, behind the Punto, while the Panda is in fourth position, after the Linea. One interesting fact that I personally confirmed after visiting Budapest in June, is the good position of the Bravo in that market. In 2012 it was the group’s 5th best-selling model and you can see it quite often in Budapest’s streets. The good market share doesn’t correspond to the way the group manages this market, as it doesn’t sell directly but through importers. Or maybe it is the reason for this good results; who knows.

Strong growth for all the brands except for Alfa Romeo. Generally speaking, the group has a good position in Passenger Car market, and an excellent share in LCV market. Hungary is one of the few European markets where the group sells more B-Segment cars than city cars. Source: see at the bottom of this article

The Punto sales include the Grande Punto (91% of total) and the Punto 2012. Good share within segments for the Punto, 500, Panda, Qubo, and Freemont. Source: see at the bottom of this post

Click here to see the Hungary PC sales 2012 by model and the Hungary LCV Sales 2012 by model

Source: Datahouse Kft. Many thanks to Róbert Gábor, commercial director

Great review, however i don’t see sales stats for the Fiat Sedici. Even though they are built by Suzuki, shouldn’t they be included in Fiat-Chrysler’s sales report?

LikeLike

Eventhough the Sedici is built in Hungary, it is not part of Fiat’s offer over there. Maybe because it is the homeland of its twin brother, the Suzuki SX4

LikeLike

Fiat LCV market share is really good in Hungary but it’s not 3-rd place in Europe after Italy and Turkey. In Poland Fiat LCV is a leader with 25% market share.

Also nice to see good position of Fiat Bravo in Hungary. Same here in Poland, Bravo is much more popular than in Western Europe (1,5% share in C segment).

LikeLike