The most important motor show in Latin America is getting ready to host two important launches. The São Paulo Motor Show will take place from October 16th till the 26th in Brazil’s largest city and is where Fiat, who plays as the country’s largest car maker, will present the all-new Jeep Renegade and an updated version of the Fiat Uno. The Jeep is going to be built in Pernambuco, the new plant to be ready in early 2015, and is expected to hit the market in 2015-Q1. FCA has big expectations with this small SUV as it will mean the official debut of Fiat in the SUV segment in Latin America, following the positive trend of this kind of cars during the last years. The Renegade will be positioned in the upper part of the B-SUV segment, just as in Europe, so it will be able to steal sales from the high versions of the regular B-SUV (aka Ford EcoSport, Renault Duster) and the lower versions of the C-SUV (aka Hyundai Tucson, ix35, Honda CR-V). In the other hand there will be the new Fiat Uno, which will be the first refresh after its presentation in 2010. The current Uno is Fiat’s main problem at the moment as its sales plunge since 2012.

The most important motor show in Latin America is getting ready to host two important launches. The São Paulo Motor Show will take place from October 16th till the 26th in Brazil’s largest city and is where Fiat, who plays as the country’s largest car maker, will present the all-new Jeep Renegade and an updated version of the Fiat Uno. The Jeep is going to be built in Pernambuco, the new plant to be ready in early 2015, and is expected to hit the market in 2015-Q1. FCA has big expectations with this small SUV as it will mean the official debut of Fiat in the SUV segment in Latin America, following the positive trend of this kind of cars during the last years. The Renegade will be positioned in the upper part of the B-SUV segment, just as in Europe, so it will be able to steal sales from the high versions of the regular B-SUV (aka Ford EcoSport, Renault Duster) and the lower versions of the C-SUV (aka Hyundai Tucson, ix35, Honda CR-V). In the other hand there will be the new Fiat Uno, which will be the first refresh after its presentation in 2010. The current Uno is Fiat’s main problem at the moment as its sales plunge since 2012.

SUV Segment in Brazil

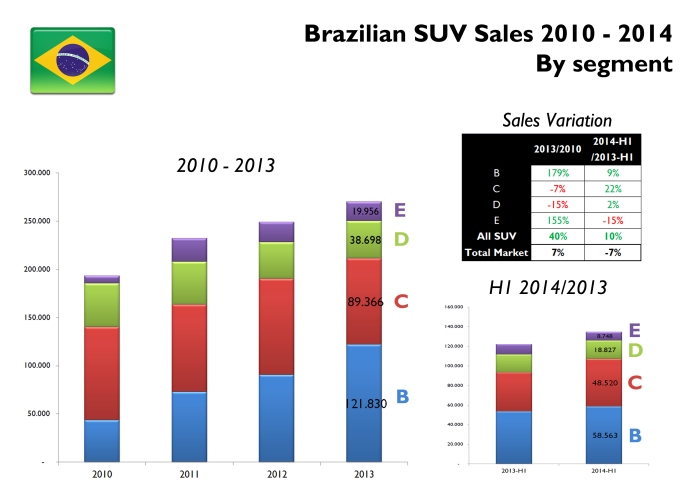

SUV demand has been growing since 2010 and this year it is up 10% despite the overall market’s fall since 2012. In 2010 SUV segment counted for 5,8% of total market. In 2011 and 2012 it had 6,8% share followed by 2013’s share of 7,5%. In the first half of this year the SUV segment rose its share up to 8,5%. Source: Fenabrave

Brazilian SUV sales have experienced continuous positive growth since 2011 despite the fact that overall market fall since 2012. In 2010 the whole SUV segment counted for 5,8% of total market, far away from the B and A segments. The demand has grown in a slowly but solid basis every year to reach 8,5% share in 2014-H1. Certainly Brazilians are more fascinated by more aggressive and robust cars even though many of them are still considered small cars. In fact, most of the SUV sales growth is explained by the arrival of small-SUV, or B-SUV, with the debut of the Ford EcoSport in 2003 and later followers such as the Renault Duster and the Chevrolet Tracker. They are the solution for those looking for B-cars but taller and with more capabilities. Therefore the B-SUV segment sales jumped from 44.000 units in 2010 to 122.000 units in 2013, and till June 2014 sales soared 9% to 59.000 units while overall markets fell 7%. These kind of SUVs counted for 43% of 2014-H1 total SUV sales, but they weren’t the best performers: C-SUV registrations rose 22% to 48.520 units. Considering this context Jeep and Fiat are doing good by launching the locally-built Renegade. Even if they are a bit late compared to the competitors (however VW isn’t there either), FCA plans to sell around 80.000 units in 2015, counting for 19% of total SUV market. By the year 2018, the Renegade and other models will sell 180.000 units in a SUV market of 620.000 vehicles.

In the last 3 years SUV sales have risen 40% against a timid 7% of the industry. Growth has been possible thanks to more B-SUV offer. In the first 6 months of this year the demand continues to grow with the exception of large SUV, which are severely affected by the lack of extension of the incentives (IPI). Source: Fenabrave

52% of FCA sales volume increase in Latin America in 2018 will come from Jeep brand. The company plans to sell 200.000 Jeeps in the region by 2018, of which 180.000 will stay in Brazil, where the locally-built Renegade will play an important role in the growing B-SUV segment. To achieve that the brand will open new dealers all over the country. Source: FCA Investor day LATAM presentation.

A-Segment in Brazil

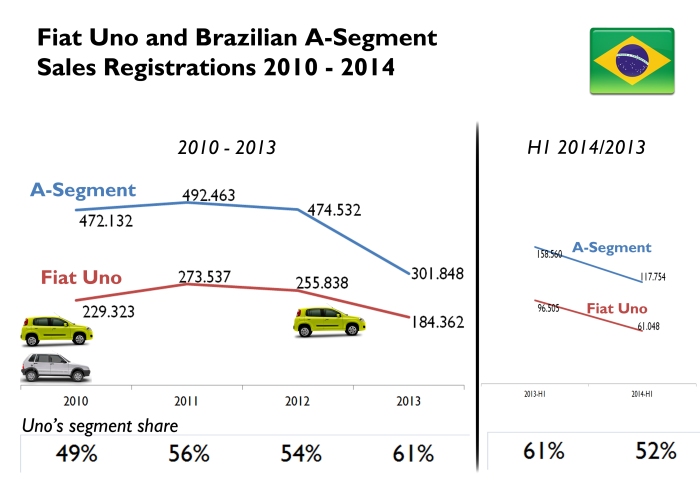

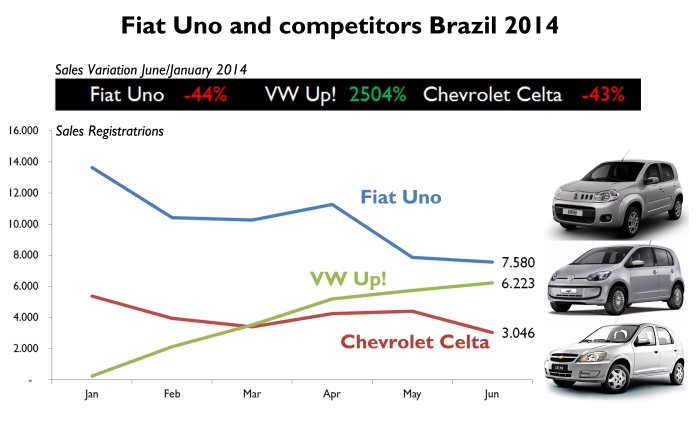

Is the opposite case. City-car sales have been the second most important after the giant B-Segment. Fiat plays an important role thanks to its Uno, first boosted by the old Mille and now left alone. In 2010 when the current Uno was launched, Fiat controlled 49% of A-Segment, which totalled 472.000 units. One year later both, the Uno and A-Segment, reached their record numbers and Fiat had 57% share. Since then, even if Fiat still controls more than 50% of the segment, the Uno demand has fallen dramatically. Due to safety regulations, the production of old Uno, called Mille, had to be switched off so Fiat’s range in A-Segment came from 3 models (Uno, Mille and 500) to just 2. Then came the success of the Palio Fire (the old Palio) which is explained by very low prices, that cannibalized with the Uno. But it wasn’t an exclusive problem of the Uno. Its main competitor, the Chevrolet Celta has seen its sales plunged as well, from 156.000 units in 2010 to 75.000 in 2013. This year the situation is even worse for the Uno as VW started selling the locally-built Up!, the first direct competitor from the German brand. In the first semester of 2014, VW has placed 23.000 Up! getting very close to the Celta and almost 3 times less than the Uno. This segment is crucial for Fiat and that’s why the company is moving on to shake it with the Uno facelift (to be presented in Sao Paulo) and a smaller all-new car that should be produced in Pernambuco and is expected to be revealed in the second half of 2015.

Even if volume sales fall since 2012, the Uno has been able to rise its share in the segment even. Nevertheless during the last 6 months, the small Fiat has suffered because of the lack of production of the old Mille and the arrival of the VW Up!. Its sales have fallen 37% in the first half of 2014, while the segment’s fall is more moderated: 26%. Source: Fenabrave

The Uno demand has collapsed this year due to the absence of the Mille and the arrival of the VW Up!. If Fiat doesn’t launch an updated version soon, the Up! will outsell the Uno in the coming months. Source: Fenabrave

Click here to see Brazil’s car market segmentation

Meanwhile in Paris…

Fiat brand gets ready for the world premiere of the 500X. The auto show will open its doors on October 4th but is expected that Fiat will reveal some official pictures some days before. This model is another important product for the expansion of FCA in Latin America and North America. It will be the major and probably the only launch of the group in Paris.

Don’t they have the new Fiat Punto Evo there. Why do they consist in building the Uno. Is it the smaller price than the Punto?

LikeLike

Yes, the Brazilian Uno is like the European Panda. It is not part of B-Segment as it used to be in Europe in the 80’s.

LikeLike

We have (Brazil) the second generation of Punto, which is older than European version.

Uno is a lot cheaper than Punto, so it is Palio (two versions), one is the cheapest car in Brazil…

LikeLike

Good job Juan. Your blog have many interesting news.

LikeLike

Thanks Staien!

LikeLike

Pingback: The good, the bad and the ugly of FCA results in 2014 | Fiat Group's World