It was a good third quarter for FCA. Beyond Sergio Marchionne’s usual optimistic outlook, the financial situation of the Italian-American car maker is stable and going in the right direction. That is the first conclusion based on the full Q3 financial results published this week. Basically, the company is earning more money by selling the same quantity of cars. That’s good news for investors as FCA is becoming more efficient with its current structure.

It was a good third quarter for FCA. Beyond Sergio Marchionne’s usual optimistic outlook, the financial situation of the Italian-American car maker is stable and going in the right direction. That is the first conclusion based on the full Q3 financial results published this week. Basically, the company is earning more money by selling the same quantity of cars. That’s good news for investors as FCA is becoming more efficient with its current structure.

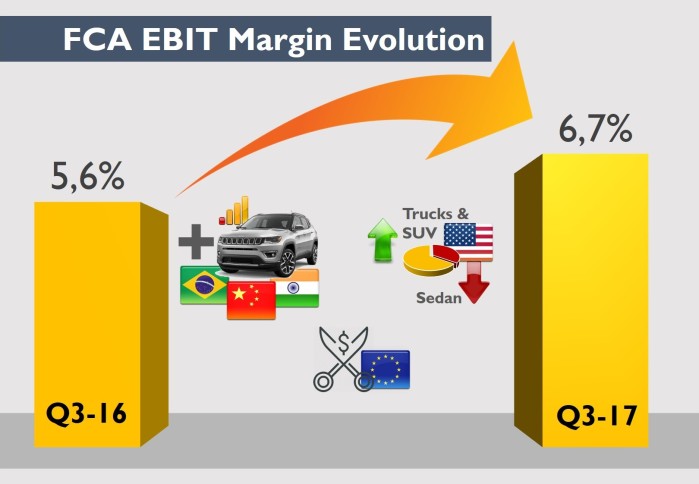

The good news is that FCA is becoming more efficient thanks to the Volume & Product mix in two key regions: Latin America and Asia Pacific. Most of the EBIT margin improvement came from higher volumes and prices in LATAM, and the insurance recoveries from the Tianjin port explosions that happened two years before. In other words, the company improved its margin thanks to more Jeeps sold in Brazil, but also thanks to fewer sales to fleets in USA, which had a negative impact on the deliveries but a good one on the margin.

With the latest results it is even more clear the management strategy of focusing on the most profitable segments. This means production of big trucks and SUVs in USA, and more Jeeps in Brazil, India, China and Europe. Contrary to what happens in NAFTA region, the European margin’s growth is slowing down. Two major forces contributed to this result: the shipments fell due to the drop in the UK, and the company increased the incentives in major markets. The financial results didn’t say that current sales levels for Alfa Romeo Giulia and Stelvio are still far from the company’s target.

With the latest results it is even more clear the management strategy of focusing on the most profitable segments. This means production of big trucks and SUVs in USA, and more Jeeps in Brazil, India, China and Europe. Contrary to what happens in NAFTA region, the European margin’s growth is slowing down. Two major forces contributed to this result: the shipments fell due to the drop in the UK, and the company increased the incentives in major markets. The financial results didn’t say that current sales levels for Alfa Romeo Giulia and Stelvio are still far from the company’s target.

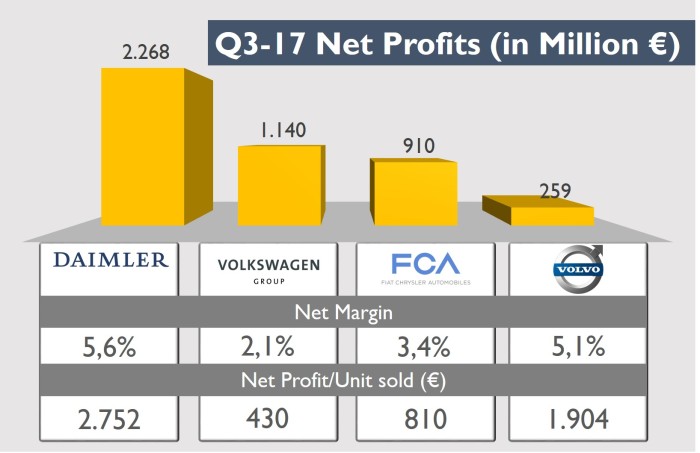

Based on these highlights, the company reported net profits of €910 million, up by 50% compared to the same quarter of last year. That’s a very good result which contributed to improve the net margin to 3,4% from 2,3% in Q3 2016. As revenues for the quarter fell by 1,6%, the improvement on the margin is only explained by a more efficient cost structure that tells a lot on how Marchionne is managing the company in order to make it more attractive for a potential buyer. I think FCA will be sold to another big car maker before 2020.

Based on these highlights, the company reported net profits of €910 million, up by 50% compared to the same quarter of last year. That’s a very good result which contributed to improve the net margin to 3,4% from 2,3% in Q3 2016. As revenues for the quarter fell by 1,6%, the improvement on the margin is only explained by a more efficient cost structure that tells a lot on how Marchionne is managing the company in order to make it more attractive for a potential buyer. I think FCA will be sold to another big car maker before 2020.

There was another interesting fact from the Q3 results published by the European car makers this week. Volkswagen Group sold 2.4 more cars than FCA during that period, but its net profits were 1.3 higher. In other words, the net profit per unit sold was €430 for VW Group and €810 for FCA. Of course the German’s results are explained by the additional provisions in connection with the diesel issue with special items of €2,6 billion which had been recognized for this in the third quarter. Interestingly, though, FCA made more money by unit sold than the big Volkswagen.

While VW Group sells more cars, and is expected to increase growth with the arrival of its SUV offensive, and earns fewer money, other car makers in Europe are doing much better. Volvo Cars confirms its positive trend during Q3, with net profits up by 89% to €259 million. The Swedish maker earned €1.904/car sold thanks to a better product mix that includes the executive S90/V90 and higher volumes for the XC60. Daimler had to deal with warranty increasing expenses, which affected its good performance, with net profits falling by 17% to €2.268 million. However, it it has one of the highest profit/car sold among all car makers: €2.752.

Agnellis are staying in car business.

This constant selling story is not only annoying. Now it became so boring.

LikeLike

Sure as Fuq is. I love FCA,especially Alfa Maserati and Ferrari plus RAM

LikeLike

Why o why this constant talk about selling?

They are making profits so i don’t understand why they would need to sell, who gains?

Much smaller car companies make profit and are happy so what is Marchionne afraid of?

LikeLike

It’s true, the revenue is slightly down compared to last year, but the major reason therefor has nothing to do with Marchionne improving the cost structur by cutting research effort/new model development: It’s symple the result of Dollar to Euro exchange rate dropping by 7% compared to last year.

EXOR investment group (in controll FCA) CEO John Elkann made it clear to the italian press, that he (the Agnelli family) will remain in the busness, they was never a plan to abandon mass car production. FCA as a group will remsain intact, Marchionne will spun off Magneti Marelli as a own company to extract money they can use lower FCA’s the debt, to extract hidden value for share holder, like they did with Ferrari. The value of both the FCA and Ferrari share today is way higher than the value of FCA incorporing Ferrari befor!

This is not a well thought article, sorry to say, you are jumping on conclusion that makes no sens to me! It seems i’m not the only one to think this way.

LikeLike

Thanks for your comments Michele. Revenue’s performance has nothing to do with cost improvement. If you referred to profits, then exchange rates is certainly one of the reasons, but not the only one. The group is definitely selling cars with higher value, and this is more evident in Brazil, China and more recently in India. A car company selling less than 5 million units per year will be sooner or later bought by a bigger one. That’s how it works nowadays.

LikeLike

That’s not quite true. Honda and BMW has been selling less than that for years and still independent . The key is improving the quality and brand image . That’s the real downfall of FCA

LikeLike