Jeep is the only truly global brand of FCA with presence in all of the regions where the group operates. Unlike Fiat brand which is only popular in Brazil and Europe, the American SUV brand has been gaining market share during the last years thanks to the localization of production in key markets. In 2009, when Jeep was one of the brands of the bankrupted Chrysler Group, its global sales totalled around 350.000 units. Last year Jeep sold 1,4 million units. The rapid growth is the consequence of the SUV boom that spread everywhere.

Jeep is the only truly global brand of FCA with presence in all of the regions where the group operates. Unlike Fiat brand which is only popular in Brazil and Europe, the American SUV brand has been gaining market share during the last years thanks to the localization of production in key markets. In 2009, when Jeep was one of the brands of the bankrupted Chrysler Group, its global sales totalled around 350.000 units. Last year Jeep sold 1,4 million units. The rapid growth is the consequence of the SUV boom that spread everywhere.

It is not the only global brand of FCA. It is also the one with the highest growth potential and value for eventual buyers. To be a SUV maker in a world that’s only interested on SUVs makes you really attractive. This is evident when looking at Jeep sales figures right after it hits a market: Europe, Brazil, China and more recently India can confirm this healthy trend for FCA. But last year things didn’t go as good as in the previous years, turning on the alarms for what is considered the source of growth and profits for FCA.

It is not the only global brand of FCA. It is also the one with the highest growth potential and value for eventual buyers. To be a SUV maker in a world that’s only interested on SUVs makes you really attractive. This is evident when looking at Jeep sales figures right after it hits a market: Europe, Brazil, China and more recently India can confirm this healthy trend for FCA. But last year things didn’t go as good as in the previous years, turning on the alarms for what is considered the source of growth and profits for FCA.

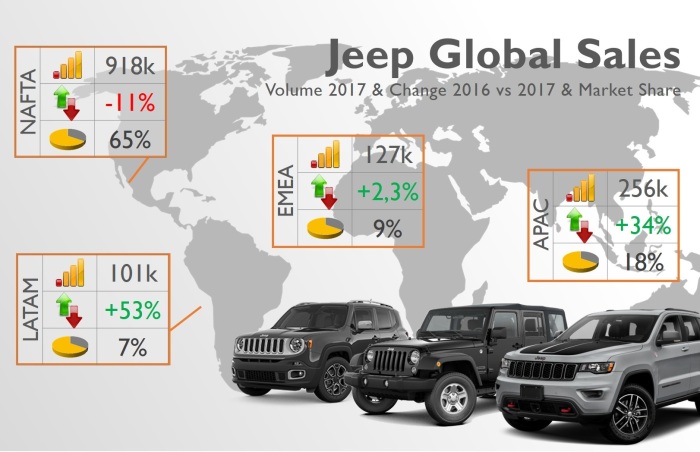

For the first time since 2009, global sales of Jeep posted a drop. Last year its volume fell by 0,7% to 1,4 million units, after posting a record of 1,41 million in 2016. While the brand registered records in Asia, Latin America and Europe, the volume tumbled in North America, its largest market. As FCA continues with the planned lower fleet volumes, primarily for Jeep, overall sales showed a negative change. In fact the US fleet mix for all brands of FCA fell from 24% in 2016 to 19% last year.

For the first time since 2009, global sales of Jeep posted a drop. Last year its volume fell by 0,7% to 1,4 million units, after posting a record of 1,41 million in 2016. While the brand registered records in Asia, Latin America and Europe, the volume tumbled in North America, its largest market. As FCA continues with the planned lower fleet volumes, primarily for Jeep, overall sales showed a negative change. In fact the US fleet mix for all brands of FCA fell from 24% in 2016 to 19% last year.

But the reduced fleet mix doesn’t explain all. The model changeover for the Compass, the drop of the Patriot and the double-digit sales fall posted by the Cherokee explain the other part of Jeep’s negative results. Jeep sales in NAFTA fell from 1,03 million units in 2016 to 918.000 in 2017 (down by 11,9%). The drop could be considered “normal” in a market that fell by 1,5% last year, but it wasn’t when considering the segment where Jeep plays. Total SUV sales in North America grew by 6,2% to 8,2 million units, which was definitely a lower growth than in the previous years, but still a positive one.

But the reduced fleet mix doesn’t explain all. The model changeover for the Compass, the drop of the Patriot and the double-digit sales fall posted by the Cherokee explain the other part of Jeep’s negative results. Jeep sales in NAFTA fell from 1,03 million units in 2016 to 918.000 in 2017 (down by 11,9%). The drop could be considered “normal” in a market that fell by 1,5% last year, but it wasn’t when considering the segment where Jeep plays. Total SUV sales in North America grew by 6,2% to 8,2 million units, which was definitely a lower growth than in the previous years, but still a positive one.

Jeep lost market share in one the world’s largest SUV market because of lack of models. Currently the brand has only 5 different nameplates in its range, which is in my opinion a small number for a brand that had a target of selling 1,9 million units in 2018. USA and Canada SUV segment has still room for more nameplates, especially above the Grand Cherokee, which is not considered a full-size SUV there. Jeep should make use of the increasing demand now and not when the segment’s growth starts to slowdown.

Jeep lost market share in one the world’s largest SUV market because of lack of models. Currently the brand has only 5 different nameplates in its range, which is in my opinion a small number for a brand that had a target of selling 1,9 million units in 2018. USA and Canada SUV segment has still room for more nameplates, especially above the Grand Cherokee, which is not considered a full-size SUV there. Jeep should make use of the increasing demand now and not when the segment’s growth starts to slowdown.

The other problem is related to the timing and restylings. FCA hasn’t been particularly good at planning and when the industry standard is about 6/7 years for the life cycle of a car, FCA extends it to 8 or 9 years. This may save money but at the end the company loses market share to more modern cars from its rivals. Restylings are also part of the “wise” move from FCA. The updated Cherokee revealed in Detroit this month should have arrived last year in order to prevent the accelerated sales drop. The all-new Compass hit the markets 6 years after the restyling of the first generation.

The other problem is related to the timing and restylings. FCA hasn’t been particularly good at planning and when the industry standard is about 6/7 years for the life cycle of a car, FCA extends it to 8 or 9 years. This may save money but at the end the company loses market share to more modern cars from its rivals. Restylings are also part of the “wise” move from FCA. The updated Cherokee revealed in Detroit this month should have arrived last year in order to prevent the accelerated sales drop. The all-new Compass hit the markets 6 years after the restyling of the first generation.

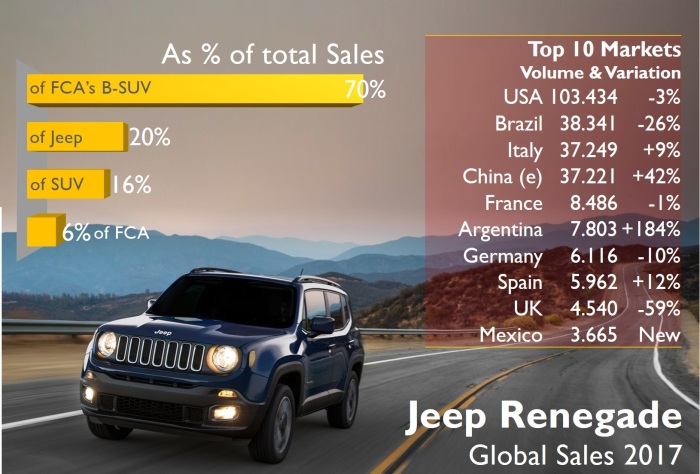

The “lousy job” in Europe based on Marchionne’s words is also explained by this lack of planning. While total SUV registrations grew by a massive 20%, Jeep had to settle for little, with volume growing at 3,1%. The brand’s market share fell from 2,7% in 2016 to 2,4% in 2017. They are simply not making use of the booming sales that are driving growth in Europe because the brand has only concentrated its effort in one model, the Renegade. It hit the market in 2013 and helped the brand to achieve a decent market share in Europe. But nothing else was launched until the arrival of the Jeep Compass last year. This means that Jeep wasn’t able to keep the initial growth posted by the Renegade.

The “lousy job” in Europe based on Marchionne’s words is also explained by this lack of planning. While total SUV registrations grew by a massive 20%, Jeep had to settle for little, with volume growing at 3,1%. The brand’s market share fell from 2,7% in 2016 to 2,4% in 2017. They are simply not making use of the booming sales that are driving growth in Europe because the brand has only concentrated its effort in one model, the Renegade. It hit the market in 2013 and helped the brand to achieve a decent market share in Europe. But nothing else was launched until the arrival of the Jeep Compass last year. This means that Jeep wasn’t able to keep the initial growth posted by the Renegade.

The Grand Wagoneer and Scrambler are supposed to be revealed by the end of this year and they are supposed to keep the good pace started with the updated Cherokee and all-new Wrangler. But the launches confirm that no big target will be achieved as long as the new cars are delayed or simply don’t arrive in time. Five models and no consistency in the timings of the product launches won’t help to make use of the SUV boom.

The Grand Wagoneer and Scrambler are supposed to be revealed by the end of this year and they are supposed to keep the good pace started with the updated Cherokee and all-new Wrangler. But the launches confirm that no big target will be achieved as long as the new cars are delayed or simply don’t arrive in time. Five models and no consistency in the timings of the product launches won’t help to make use of the SUV boom.

Source: Automotive News Europe, Bestsellingcarsblog.com, Carsitaly.net, KBA, SMMT, UNRAE, ANIACAM, CCFA, FENABRAVE, Autoblog Argentina, JATO Dynamics, Autoblog Uruguay, Motor.com.co, Goodcarbadcar.net

FCA couldn’t even exist without Jeep.

Thankfully this will be the last year of Marchionne as ceo of the group and maybe he will be replaced with someone who knows something about cars and their relavite market, other than stocks.

LikeLike

Marchionne “perfect” management team should read this..

LikeLike

They are actually planning smaller than Reneged Jeep (Ford ecosport dimension) for Europe and Asia. Which may help them gain the market share.

https://auto.ndtv.com/news/jeep-close-to-making-a-final-decision-on-new-subcompact-suv-1805552

LikeLike

After replacing Marchionne by someone who actually knows how to do product planning, I expect FCA to vastly improve their line-up in all regions.

It’s easy to notice that the focus of Marchionne management was ALWAYS the financial targets.

LikeLike

I am sorry but you guys have no idea of economics and how a company is run . Everybody wants new models , if it was so easy like it’s easy to talk about I can guarantee you Marchionne would’ve made 10 new models if each brand not just Jeep

LikeLike

I do not frankly agree with these comments, and only partly with the analysis. First and foremost, Marchionne is concentrated in making debt-free FCA, which is (was) the only cash negative automaker in the world. If you do not know that, it is your problem and not Marchionne’s. Of course, it is all too easy suggesting a correct product pipeline comfortably seated in your armchair… with no knowledge of the actual finances and economic means of the Group. As to the analysis, it only tangentially mentions that Jeep suffered in terms of sale because they wanted it to suffer: the management intentionally dropped fleet sales, to increase profitability (which doubled, maybe you should have said that too…. you did in a previous post of yours, which means that you are aware of that). Anyway all this will come to an end. From the second semester of 2018 with a new Wrangler, a refreshed Cherokee, the new Compass (which is selling very well wherever they launched it) and the refreshened Renegade Jeep won’t have big problems. And they will also be able to keep the level of profitability they reached, which ultimately is what matters if you want to run a healthy company. Your suggestions would have burnt more cash, lower the margins and is narrowly-minded oriented on the short terms. Marchionne has a broader view, and the guy knows perfectly what he does. Time will tell us who is right and who is not.

LikeLike

I get your point, and I think improving profitability is one the priorities. But it wasn’t me to say “lousy job” when talking about Jeep commercial performance in Europe. It was Marchionne who said that.

LikeLike

I guess he was discontent with the Cherokee results, which is actually the only car not really brilliant in the line-up. I do not think its result will substantially change with the fresh version, unfortunately, but it is the only weak product I see. In 2019 the bigger Jeep will also come and honestly I see a bright future for the brand.

LikeLike

We all agree with you in “financial terms”.Marchionne is a genious!

But, in what respects “product”… “cars”… more could and should have been done… even though both aspects are obviously related.

LikeLike

Lets see how will Jeep commercial performance evolve in Europe this year with the new Compass.

LikeLike

We are talking about jeep which is the most complete brand of FCA`s portfolio… if we were talking about the others…

And we should always compare to the best… see the new X4, shown only 4 years after the launch of the “old” one… in my opinion, a clear attack to Stelvio.

We could nevertheless praise the new Yuntu for China, which is a good step for that specific, and important, market.

LikeLike

FCA conference call 01/25/18 – Adam Jonas, Morgan Stanley, addresses Sergio: “We hadn’t seen anything like you. You took $2 billion, roughly, and you’ve turned it into around $72 billion, and more important than that, there are many hundreds of thousands of families across many nations that are better off because of you and your team.” In 2004, he picked up a broken company without size or strategy on the verge of being absorbed by GM and built a group able to stand on its own. Jeep is the jewel of the crown and literally has kept going the show for a while. The analysis is flawed.

LikeLike

Pingback: Stelvio & Giulia boost Alfa Romeo global sales in 2017. But for how long? | Fiat Group's World

Pingback: Will Jeep be able to double its sales by 2022? | Fiat Group's World