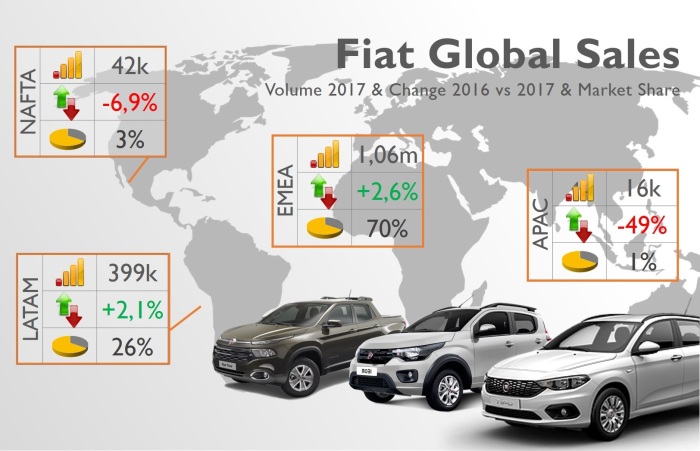

Fiat may not be attractive and not even profitable, but it is the biggest brand in terms of sales volume. My own figures indicate that 1,52 million units were sold/delivered/registered last year. That’s 1,1% higher than the total seen in 2016. One in three cars sold by FCA globally is a Fiat. Therefore it is very valid the discussion about how this brand can become a problem in case of a merge or acquisition negotiation. Fiat represents a big part of the volume, but is not attractive and it is not expected to be profitable.

Fiat may not be attractive and not even profitable, but it is the biggest brand in terms of sales volume. My own figures indicate that 1,52 million units were sold/delivered/registered last year. That’s 1,1% higher than the total seen in 2016. One in three cars sold by FCA globally is a Fiat. Therefore it is very valid the discussion about how this brand can become a problem in case of a merge or acquisition negotiation. Fiat represents a big part of the volume, but is not attractive and it is not expected to be profitable.

EMEA is a key region for Fiat, as 70% of its global sales took place there. Volume grew by 2,7% thanks mostly to the very well received Fiat Tipo/Egea, which outsold the popular Fiat 500 (Abarth figures not included) and became the second best-selling Fiat in the region. Besides Italy, Fiat is also popular in Turkey, its second largest market in the region and one of the drivers of growth last year (+13%). Poland, Portugal, Belgium, Switzerland, Lithuania and Greece also contributed to more volume sold. In the opposite side there were Morocco, UK, Denmark and Czech Republic where Fiat had challenging times.

EMEA is a key region for Fiat, as 70% of its global sales took place there. Volume grew by 2,7% thanks mostly to the very well received Fiat Tipo/Egea, which outsold the popular Fiat 500 (Abarth figures not included) and became the second best-selling Fiat in the region. Besides Italy, Fiat is also popular in Turkey, its second largest market in the region and one of the drivers of growth last year (+13%). Poland, Portugal, Belgium, Switzerland, Lithuania and Greece also contributed to more volume sold. In the opposite side there were Morocco, UK, Denmark and Czech Republic where Fiat had challenging times.

Despite the growth in this region, the situation of Fiat is becoming dramatic. It doesn’t have a big range of products with only one SUV, and most of them are getting aged. The problem is that it seems that nothing new will arrive this year, and the current range will have to deal with more challenging times in Europe for at least 18 more months. If it wants to grow, Fiat EMEA needs at least more SUVs and an all-new Fiat 500.

Despite the growth in this region, the situation of Fiat is becoming dramatic. It doesn’t have a big range of products with only one SUV, and most of them are getting aged. The problem is that it seems that nothing new will arrive this year, and the current range will have to deal with more challenging times in Europe for at least 18 more months. If it wants to grow, Fiat EMEA needs at least more SUVs and an all-new Fiat 500.

Outside EMEA, Fiat is only visible in Brazil and Argentina, or what they call LATAM. Based on data for the four largest markets for the brand in Latin America – Brazil, Argentina, Chile and Uruguay – the results are also positive, with volume growing by 2,1% to 399.100 units. Brazilian good results during the last months of the year were not enough to offset the drops recorded before. Argentina saved the day as total volume grew by 28% following big increases posted by the new Fiat Mobi and Toro.

Outside EMEA, Fiat is only visible in Brazil and Argentina, or what they call LATAM. Based on data for the four largest markets for the brand in Latin America – Brazil, Argentina, Chile and Uruguay – the results are also positive, with volume growing by 2,1% to 399.100 units. Brazilian good results during the last months of the year were not enough to offset the drops recorded before. Argentina saved the day as total volume grew by 28% following big increases posted by the new Fiat Mobi and Toro.

Too bad in APAC and NAFTA, where Fiat is slowly disappearing from the rankings as a consequence of not having competitive products for the majority of these markets. Combined sales in 8 markets in Asia-Pacific posted a 49,3% decline from 30.900 units in 2016 to 15.600 vehicles in 2017. The main cause of this dramatic change was the bad situation of the brand in China and India, the world’s first and 5th largest car markets. The locally made Ottimo and Viaggio in China, and Punto and Linea in India are a complete flop that ruined the image of Fiat brand over there. China, India and Australia demand SUVs, and more competitive products.

Too bad in APAC and NAFTA, where Fiat is slowly disappearing from the rankings as a consequence of not having competitive products for the majority of these markets. Combined sales in 8 markets in Asia-Pacific posted a 49,3% decline from 30.900 units in 2016 to 15.600 vehicles in 2017. The main cause of this dramatic change was the bad situation of the brand in China and India, the world’s first and 5th largest car markets. The locally made Ottimo and Viaggio in China, and Punto and Linea in India are a complete flop that ruined the image of Fiat brand over there. China, India and Australia demand SUVs, and more competitive products.

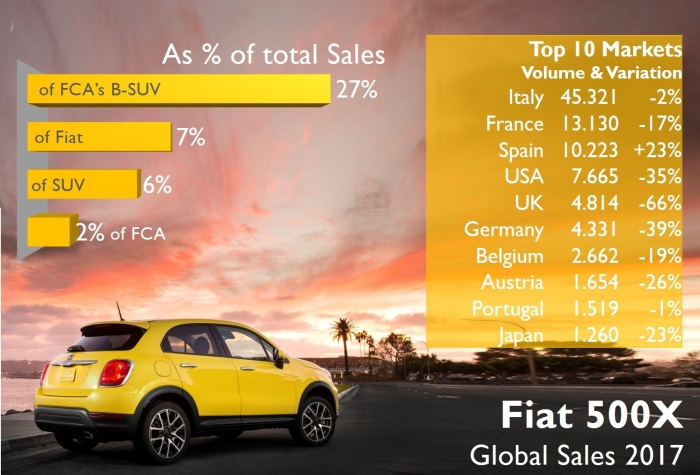

The situation in North America is also quite disappointing. The Fiat 500 family doesn’t stop losing ground in USA, where sales for 2017 were the second lowest since 2011, when the brand was reintroduced. The iconic 500 hasn’t been updated and the 500L and 500X are too small to be considered the big versions of the tiny 500. The arrival of the 124 Spider didn’t solve the problem, and as long as Fiat doesn’t update its current line up and doesn’t add a bigger SUV, it will continue to lose ground.

The situation in North America is also quite disappointing. The Fiat 500 family doesn’t stop losing ground in USA, where sales for 2017 were the second lowest since 2011, when the brand was reintroduced. The iconic 500 hasn’t been updated and the 500L and 500X are too small to be considered the big versions of the tiny 500. The arrival of the 124 Spider didn’t solve the problem, and as long as Fiat doesn’t update its current line up and doesn’t add a bigger SUV, it will continue to lose ground.

The Tipo/Egea was Fiat’s protagonist in 2017. Thanks to this model the brand was able to offset the losses recorded by the Panda, Ducato, 500X and 500L. The Turkish-made Fiat is an example of how the brand can grab a decent piece of the market with a competitive car in terms of price and look. The Tipo sits at the bottom of the compact segment due to its price, and features a modern design proving that Fiat can succeed with cheap and attractive cars. The other winners came from Brazil with the new Mobi more than doubling its sales, and the Toro up by 45%.

The Tipo/Egea was Fiat’s protagonist in 2017. Thanks to this model the brand was able to offset the losses recorded by the Panda, Ducato, 500X and 500L. The Turkish-made Fiat is an example of how the brand can grab a decent piece of the market with a competitive car in terms of price and look. The Tipo sits at the bottom of the compact segment due to its price, and features a modern design proving that Fiat can succeed with cheap and attractive cars. The other winners came from Brazil with the new Mobi more than doubling its sales, and the Toro up by 45%.

Source: FGW database, Automotive News Europe, Bestsellingcarsblog.com, Carsitaly.net, KBA, SMMT, UNRAE, ANIACAM, CCFA, FENABRAVE, Autoblog Argentina, JATO Dynamics, Autoblog Uruguay, Motor.com.co, Goodcarbadcar.net

I’d love to know the source of the fact that Fiat is not profitable. I think that is just a rumour, indeed the brand is not making lots of money (and that is for sure) but I believe it is not anymore in negative territories as you state here. Remember that Europe is profitable for the second year in a row, and Latam was too. In any case, the economic situation of the brand is not as dramatic as you depict it. And in Brasil, Argentina, Turkey things are getting well and it was repositioned as a quality massa market producer instead of budget car assembler. True, Europe needs more products soon but I believe that starting next year many will come (new Punto first and foremost). They scheduled to present it late this year, though it is still unofficial

LikeLike

Even so, FCA in EMEA posted a profit margin above 3%.

Without investing in new products for Fiat, it’s impossible for the brand to return to profitability.

It’s disheartening to see how mismanaged Fiat has become. It has everything to be a success in India and Japan for example, where small cars reign supreme. Fiat is a master in making small cars yet it fails to break into these markets.

And it needs new product in Europe. The longevity of the 500 is surreal. It needs a compact SUV, a 7-seat SUV a replacement to the Punto and so much more. I’m certain Fiat could become a success again.

In North America they really need to introduce the cost-effective Fiats. Fiat failed to be associated with a chic image there (americans equate size with luxury). So embrace the cheap brand image and launch the new Punto, a new Panda and maybe even the Tipo in the US.

LikeLike

https://blogs.cfainstitute.org/investor/2016/03/07/sergio-marchionne-has-seen-the-auto-industrys-future-hes-not-interested/

LikeLike

Non vedo avverarsi nessuna di queste previsioni…. e tra meno di un anno Marchionne si ritira. Inoltre la sua scelta di puntare tutto su SUV e trucks, considerata azzardata al tempo, oggi è già diventata una mossa strategica seguita da tutti gli altri. Le Cassandre che scrivono sti articoli non si vergognano mai che la realtà li smentisca sistematicamente?

LikeLike

It is a good summary for FIAT for 2017, but I do not understand one thing. You wrote:

“Volume grew by 2,7% thanks mostly to the very well received Fiat Tipo/Egea, which outsold the popular Fiat 500 (Abarth figures not included) and became the second best-selling Fiat in the region.2

As I see in EMEA region in 2017 FIAT 500 was the best seller, than came Panda on the second place. Tipo family got the third place. So how could Tipo outsell Fiat 500? Okay, you wrote that Abarth figures not included, but there is a diagram from you (FIAT EMEA products 2017 Global Sales by model (k)). On that diagram 215k Fiat 500s were sold, then 195k Panda. Tipo/Egea had only 177k sold units.

LikeLike

Fiat Brazil need the Tipo (hatchback, sedan and SW) to replace the Bravo, Linea and Weekend, at least the 500X and a Toro-based SUV.

Fiat India should introduce the Mobi, Argo and Cronos instead of the old Punto and Linea.

Fiat China is dead, they should rebrand the Viaggio/Ottimo as Chrysler 100, resurrect the Chrysler 200, produce them locally and maybe import them to Mexico at least just as Chevrolet do with the Aveo and Cavalier.

Fiat USA should rebrand the 124 as a Dodge Demon, 500X as a Chrysler, kill the 500L and keep only the 500.

In Europe Fiat need to bring the Argo to replace the Punto and a Compass and Grand Commander- dervided SUV’s to replace the Freemont.

LikeLike

Felipe,

It seems Marchionne does not agree with you when you said Fiat needs new cars… it seems he wants to create a “new Lancia”… Lancia has one car – Y, fiat will be almost like that… the 500 family…

Maybe you can elaborate on this thought in your next article…

LikeLike

Pingback: Stelvio & Giulia boost Alfa Romeo global sales in 2017. But for how long? | Fiat Group's World

In a the dynamic world of auto industry, a single company cannot be profitable without having a product that is taking the lead in a certain segment against other companies. Without introducing models that are up to the taste of consumers, profitability is not feasible. Relying on retro design may work for countries like Italy where there is a history for that design in the memory of people. Fiat 500 was a success. It is now aging, and expending it to 500X and 500L was not successful. In north America, Fiat is denying the consumers some of its best models like the Argo, Cronos, and the Tipo. Fiat should learn from Renault, they managed to introduce beautiful SUV models using Nissan power terrains while the exterior is truely French and they are expending in markets new to French cars. Look at Chinese cars, they study the world markets and try to introduce vehicles that satisfy the needs of people. Fiat needs to think like Koreans and Chinese and with their long experience, they can dominate the market again like in the 70th (the era of Fiat 128, 124, 125 and 124 Sport).

LikeLike

we need in united states the tipo hatchback please….and plus if the interior change little more…..more stylish

LikeLike