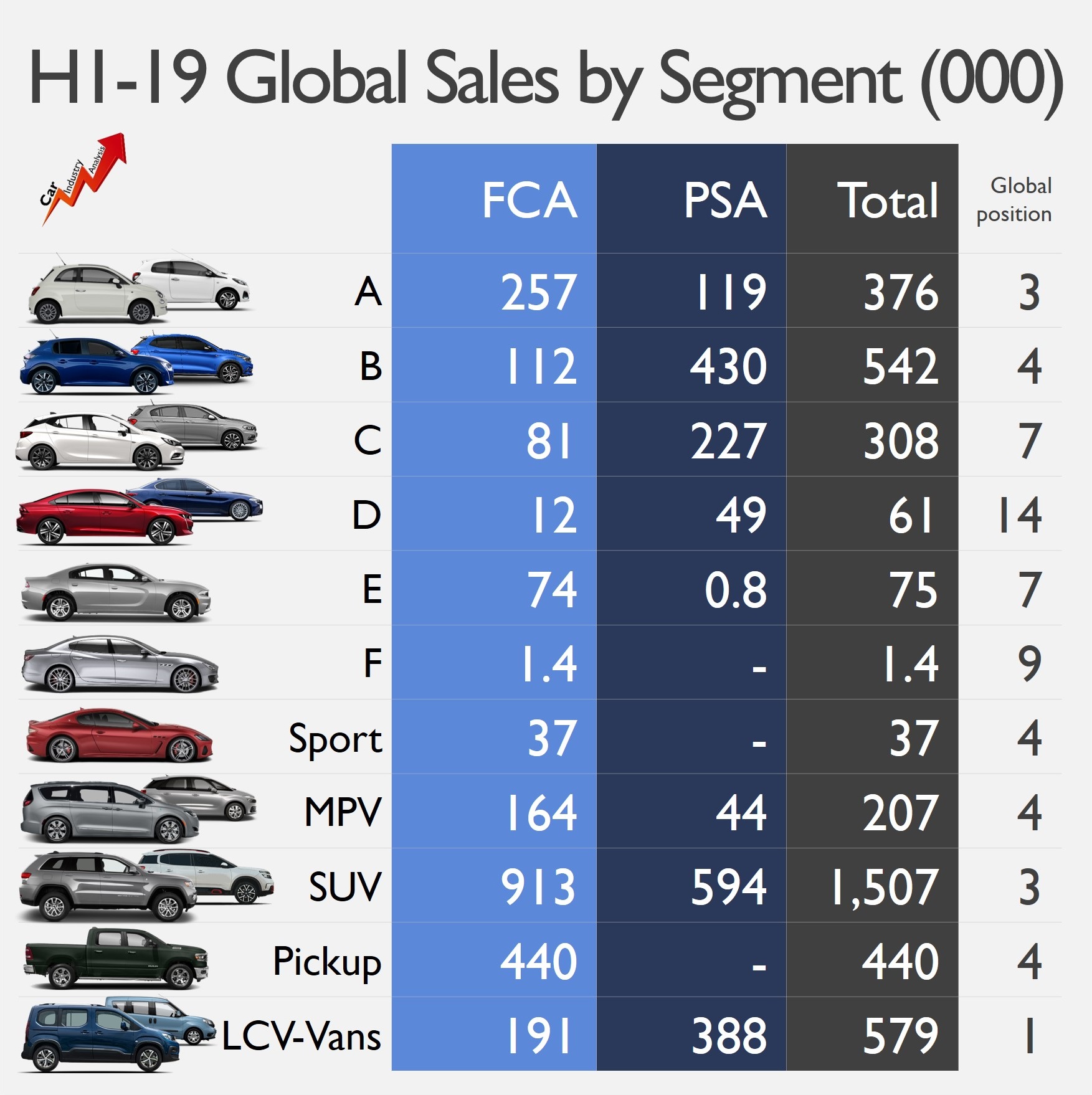

The FCA’s intention to marry another car maker is a never-ending story. This time it is the turn for PSA and it worked. Both groups combined create not only the world’s fourth largest car maker (if Renault and Nissan are counted as a unique group), but they become Europe’s top-selling SUV and LCV/Vans auto group. These vehicles are the most profitable segments nowadays.

After the withdrawal of FCA’s proposal to Renault in June, the Italian-American company decided to try again in France but with its closest competitor: PSA. In general terms, the deal is quite similar in both conditions and impact. However, the deteriorating conditions of global markets, and the missed opportunity with Renault, are two big reasons that boosted the marriage.

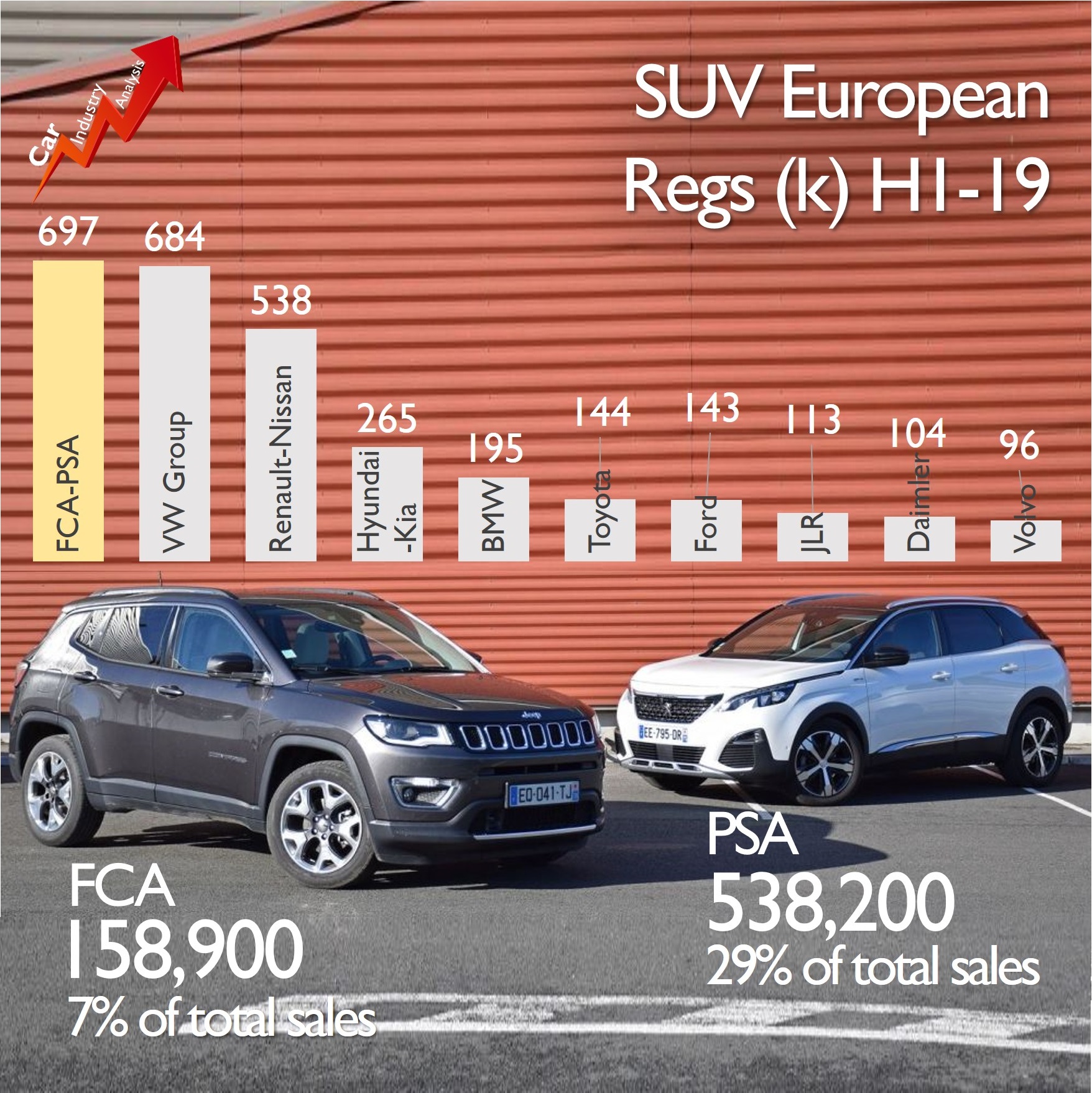

The top-selling SUV and LCV maker in Europe

As PSA does not have any alliance with other company and is also facing very difficult times, FCA is be the best candidate in order to better face the coming tougher regulations in Europe. Together they will become the largest car maker in Europe, and the most important, they will have a dominant position in the continent’s main driver of growth.

The deteriorating conditions of global markets, and the missed opportunity with Renault, are two big reasons that boosted the merger

SUVs are not only selling well but they are the main source of profits in a time when the financial statements are being hit by tougher regulations. Their combined operations would allowed them to control 22% of this segment, outselling VW Group, which currently has 21.6% market share. This is a very important aspect of this merger, as it is the only segment that continues to grow. Besides, it is quite significant to outsell the German group after its aggressive SUV offensive.

The SUV leadership will be even more noticeable in the B-SUV subsegment. FCA and PSA sold 382,000 units in the first half in Europe, whereas Renault-Nissan followed with 297,800 units. The new merger’s market share will be 31% of the SUV subsegment that currently grows faster.

They will have an even more comfortable position in the LCV/Vans segment. These vehicles were the fourth largest European segment by sales in H1 2019 with 1.37 million units, or 14% of total market. Unlike the B and C segments (2nd and 3rd largest segments) that posted sales declines, the LCV/Vans demand increased by 1% in the first half, which is quite nothing but much better than 4% decline of overall market.

In total, FCA and PSA together sold 502,100 units of these vehicles in H1 2019, counting for 37% of total. That is more than double the sales posted by Renault-Nissan, the second one in the ranking.

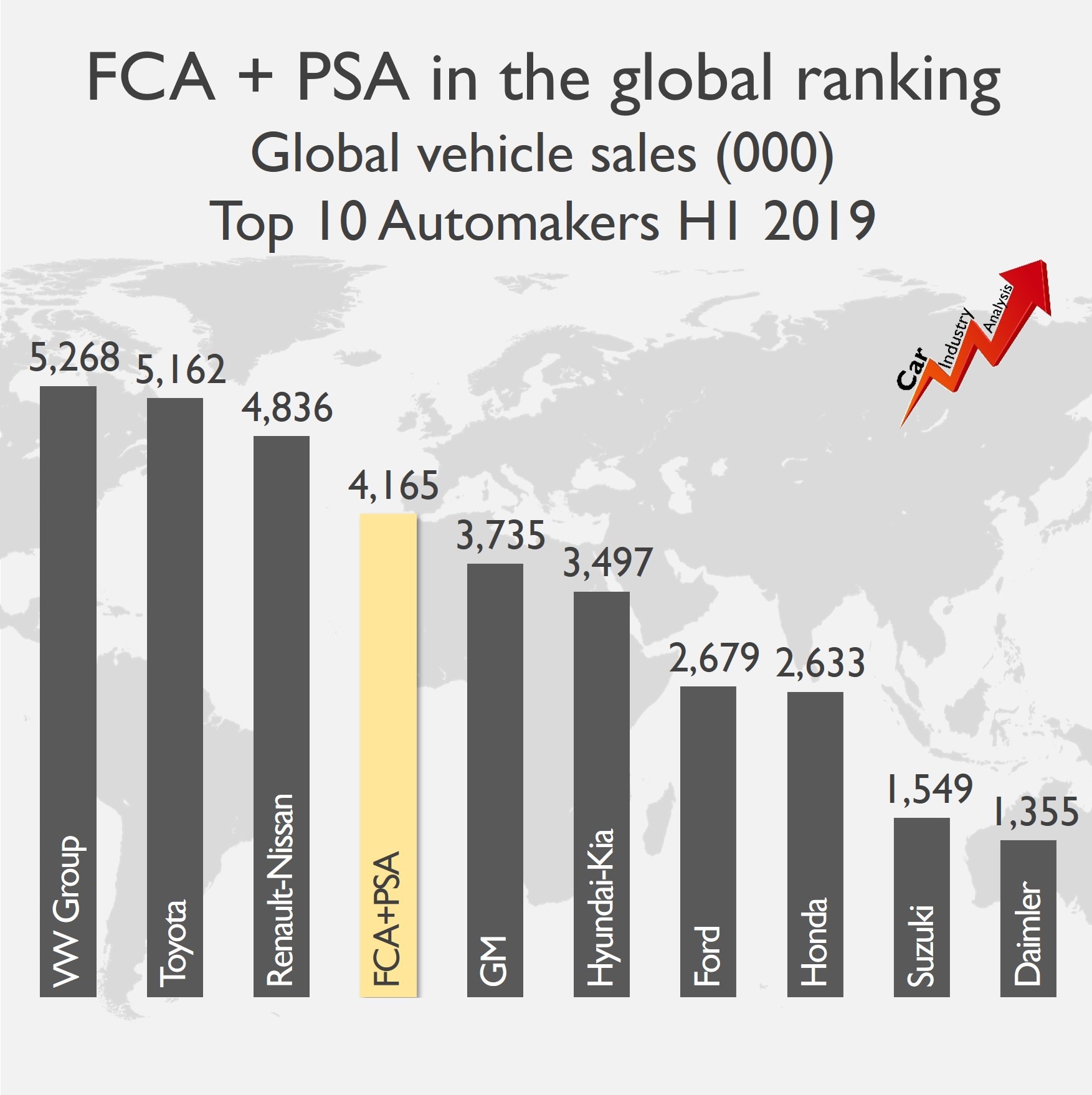

Getting close to the world’s top 3

Despite its dominant position in key segments in Europe and Latin America (FCA+PSA also lead the LCV/Vans segment and is the second SUV seller behind Renault-Nissan), the agreement is not enough to reach the current sales levels of the world’s top 3 automakers. FCA and PSA combined sold 4.16 million vehicles in H1 2019. That is 680,000 units less than the total sold by Renault-Nissan. Still, it is significant to be ahead of General Motors by 430,000 units.

The main reason for the missing volume is the little presence of both companies in Asian markets. If FCA’s problems in this continent are quite known by the industry, PSA is not in a very different situation. The French manufacturer, partially owned by Dongfeng, struggles to keep alive in China, where its sales dropped by 53% in H1 2019. They sold 77,700 units or 11,000 more than FCA. For comparison reasons, VW Group sold 2 million vehicles.

The merger will only boost the operations in Europe and Latin America, two markets that count for 28% of global vehicle sales.

In addition to this, PSA is not adding strength to the presence in USA-Canada, where it does not sell its cars. The merger will only boost the operations in Europe and Latin America, two markets that count for 28% of global vehicle sales.

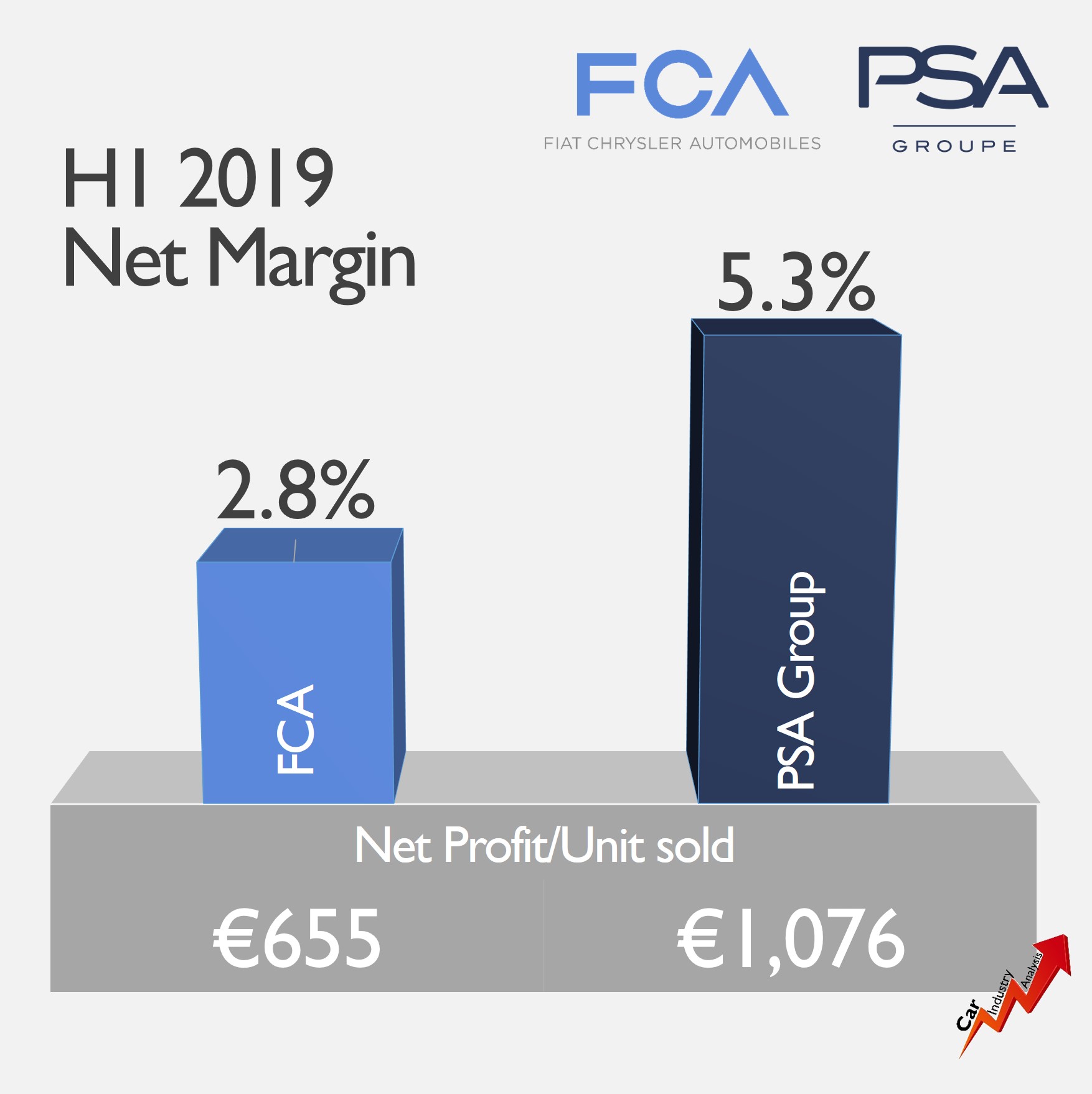

The benefits

PSA gains access to North America and FCA gets some oxygen in its troubled European business. However, it is not clear what role will play PSA brands in the FCA lineup in USA, considering the fact that two of the four Chrysler group brands struggle to survive, and Fiat and Alfa Romeo can’t find their place. Americans don’t like European cars, unless they are premium.

In the other side of the Atlantic, the situation is better for FCA. Its sales fall very fast due to the lack of new cars and the aging lineup. On the other hand, PSA has been updating its models with very positive results so far. FCA could then make use of the new 208/Corsa to re-enter the B-Segment and improve its presence in the C-Segment thanks to the 308/Astra. The B and C segments count for 36% of the passenger car European registrations through September.

No progress in the electrification race

The marriage is not improving the poor conditions of both groups in the EV world. According to JATO, the electrified vehicles counted for 0.2% of PSA and 1.4% of FCA global sales through September respectively. The small percentages confirm that they lag behind the Chinese and Japanese leaders.

This could change thanks to the contribution of the Chinese side of the story. Dongfeng has a 15% stake on PSA shares, and as local player it can benefit from the Chinese EV incentives packages to develop new electrified cars.

Source: FGW database, Bestsellingcarsblog, JATO, ACEA, Goodcarbadcar.net, own research.

After merger can FCA bring FIAT brand back to life in Asian market?

LikeLike

Question: how many brands will survive after this merger? And will there be brands that”s going to be killed?

LikeLike

Great article as always Felipe. I have a question if I can. Donfeng is represented as a “part of psa” party in the board. I mean that the 2 Dongfeng’s members in the board are accounted by the press as PSA. Which is of course correct , but istinctively suggests a pourpouse identity into the 3 PSA members (Peugeot, Dongfeng and the French State) that simply has no clear reason to be there. That is not, by nature, a UNIFIED FRONT. So, I guess that 1)Alliances in the board could fluctuate a lot depending on the the theme on the table. 2) after the 3 yars period lock up, everything is possible and Exor will be in a predominant position. What is you take on this? Thanks.

LikeLike

Pingback: Stellantis sold 6.2 million vehicles in 2020, dropping two positions in the top 10 global ranking | Fiat Group World