Fiat is in trouble, big trouble. It is not only a matter of its home market, Italy, or the delay in plans for new products. The problems with its factories and Fabbrica Italia are just some more to the latest one. What used to be the main strength of the group is now being hit hard by Europe’s largest car maker. VW is having great results with its trio Up!/Mii/Citigo and it means that Fiat is feeling the success of the Slovaks with less sales figures for its couple 500/Panda. Last month is the best example as sales figures for the Italian couple drop while the VW trio seems not to feel the crisis. As I have done it during the last months, the analysis takes into account the sales figures for Fiat 500 and Panda vs. the trio together, Up!, Mii and Citigo, as they are the same car. The analysis includes the countries where there is data available every month: the largest markets, Germany, France, Italy and Spain (except the UK) plus Netherlands, Ireland, Sweden, Denmark, Poland, Czech Republic, Slovakia, Slovenia, Austria, Switzerland, Romania and Greece. 16 countries that can tell a lot about sales trend of these small cars. Due to lack of data important markets as the UK, Belgium and Portugal are out of the monthly analysis. Nevertheless even though the UK is not included (is the second largest market for the 500 in Europe), the results for August indicate that Fiat should be worrying a lot.

Fiat is in trouble, big trouble. It is not only a matter of its home market, Italy, or the delay in plans for new products. The problems with its factories and Fabbrica Italia are just some more to the latest one. What used to be the main strength of the group is now being hit hard by Europe’s largest car maker. VW is having great results with its trio Up!/Mii/Citigo and it means that Fiat is feeling the success of the Slovaks with less sales figures for its couple 500/Panda. Last month is the best example as sales figures for the Italian couple drop while the VW trio seems not to feel the crisis. As I have done it during the last months, the analysis takes into account the sales figures for Fiat 500 and Panda vs. the trio together, Up!, Mii and Citigo, as they are the same car. The analysis includes the countries where there is data available every month: the largest markets, Germany, France, Italy and Spain (except the UK) plus Netherlands, Ireland, Sweden, Denmark, Poland, Czech Republic, Slovakia, Slovenia, Austria, Switzerland, Romania and Greece. 16 countries that can tell a lot about sales trend of these small cars. Due to lack of data important markets as the UK, Belgium and Portugal are out of the monthly analysis. Nevertheless even though the UK is not included (is the second largest market for the 500 in Europe), the results for August indicate that Fiat should be worrying a lot.

Though Fiat invested 800 million euros in the plant of Pomigliano for the production of the new Panda, the small car continues to lead the ‘A-Segment’ but far away from initial forecast. Photo by: Automobilismo.it

In August 2012 the trio sold 12.041 cars*, which means more than double of Fiat 500’s registrations and almost 4.000 units above the Fiat Panda, the historical leader. This trend was evident in July when the Up!/Mii/Citigo was just 51 units behind the Panda. But last month sales figures dropped for the Italian couple while the Slovak trio did not experience it that way. Compared to July figures, the 500 was the most affected one, down a massive 40%. Then comes the Panda, down 37% and finally the trio from VW Group, down only 9%. The results are really bad for Fiat specially if it is considered the fact that both models represent more than half of the brand sales in Europe and now the Punto is becoming a rare model to see in the top best-selling cars outside Italy. It is also even more complicated taking into account that the Panda is an all new model with no more than 10 months old, and the investment required for it was around 800 million euros. At this point is when Marchionne says that there is not enough market for new models, specially if that market is being conquered by VW in all segments. In the other hand there are some people who say that there is no such cataclysm and August bad results for the small couple are just punctual. Some how that position is right.

The new versions of the 500 may be helping but after 5 years in the market the small Fiat should be thinking of a successor

Last month’s results can be explained from several points of view. First of all August has been always a month of small numbers all over Europe as people go out for vacations. Second, European car market is certainly passing thru perhaps the most difficult times in decades. And third, Italian market is becoming one of the worst in terms of sales fall. Just in August the market was down 20%, which is the biggest fall among big European markets. For example, in August/11 almost 1.800 Fiat 500 were sold in Italy, and one year later 1.700 were sold (down only 4%) so at the end the bad result for the 500 could be explained as a ‘seasonable’ thing, more than really bad results. The same situation for the Panda and Italy: one year ago 4.532 units were sold against 5.011 last month. Of course, if those numbers are compared to July ones, the conclusion would be completely different. What happens in Italy every August does not happen that much in other European markets. Germany for example saw its total car sales to fall 5%, year-on-year, but at the end the total number is not far from previous months. So it is important to consider what happens in main markets for the models analyzed. As the 500 and specially the Panda depends a lot on Italian market, their total sales figures for Europe will be strongly affected by the Italian result. In the other hand the Up! depends a lot on German market (42%) but that market does not collapse in August.

This figure shows the main 3 markets for each model. The left number indicates the market share of that market on model’s total sales. The right number indicates the market share of the model in that market. It means Italy represents 31% of Fiat 500 sales in Europe, while that model has 3% of Italian market sales. Fiat Panda sales figures include the second generation numbers. VW Up! sales figures include Skoda Citigo and Seat Mii numbers. Source: bestsellingcarsblog.net

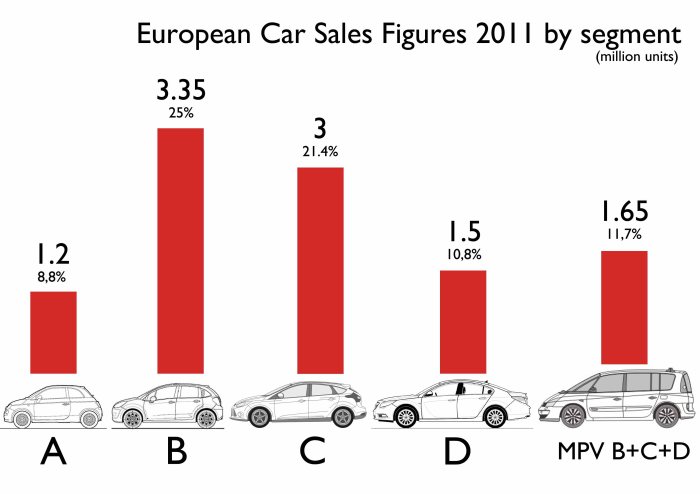

But if Italy and Germany are not considered, certainly VW is winning the match. The trio sold more than 2.000 units in small markets as Denmark or Netherlands, while they sold some more in France, Romania, Austria, Slovakia, Slovenia, Sweden and Switzerland. Fiat did well in Germany and the Netherlands with the 500, while the Panda did not do bad in Austria and Denmark. French sales figures for the Italian couple are really bad and it contributes to less numbers, as traditionally France has been an important market for both models. The good markets for ‘A-segment’ cars are now being conquered by VW. It means Denmark and the Netherlands, where this kind of cars is very popular (because of high taxes to all cars). Other important markets (in terms of units sold and not in terms of ‘A-Segment’ market share) such as Spain and France, Fiat still dominates the battle. Year-to-date numbers show that the Slovak trio surpasses for the very first time the Fiat 500 with 2.300 units. If the three models were considered as a unique model, the 500 would not be anymore the second best-selling ‘A-segment’ car in Europe. The Panda is still the best-selling small car but initial forecast and the capacity of Pomigliano plant are far away from current results.

*Not included Mii and Citigo Italian sales numbers