After some days waiting for official data now is possible to have a close analysis to Fiat-Chrysler sales figures in the main markets and most important models. The overall result could be considered more or less good though the troubled European market may change that at the end of the year. The whole group has sold around 1.8 million cars* in the first six months of 2012, up 5.7%, which is not considered bad in current conditions, especially taking into account that Italy counts for 13% of total sales and is a market that dropped 20%. It all means that the small growth in units sold is due to the great success most of Chrysler Group models are having in the US and Canada. Brazil would not be included in the list of good results as Fiat brand slow down its growth following the total market (-0.3%). The analysis by models shows two different worlds: Europe with terrible results for old products, and USA for good results for most of all the models, no matter the fact they are mostly old models.

After some days waiting for official data now is possible to have a close analysis to Fiat-Chrysler sales figures in the main markets and most important models. The overall result could be considered more or less good though the troubled European market may change that at the end of the year. The whole group has sold around 1.8 million cars* in the first six months of 2012, up 5.7%, which is not considered bad in current conditions, especially taking into account that Italy counts for 13% of total sales and is a market that dropped 20%. It all means that the small growth in units sold is due to the great success most of Chrysler Group models are having in the US and Canada. Brazil would not be included in the list of good results as Fiat brand slow down its growth following the total market (-0.3%). The analysis by models shows two different worlds: Europe with terrible results for old products, and USA for good results for most of all the models, no matter the fact they are mostly old models.

ITALY

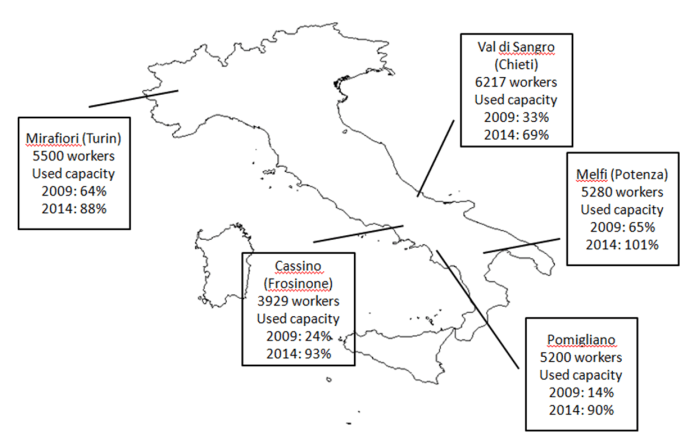

Italy is Fiat’s main problem nowadays. The dependence of the group is evident and therefore total sales and practically all models are having very bad results. What used to be Fiat’s best selling car now occupies a second place and is severely affecting the whole company. The Punto, which counts for almost 23% of the group sales and drops 32%, much more than the market, and than its rivals. The ‘restyling’ gotten at the beginning of the year has not had any effect because consumers of B-Segment seem to prefer the new generation of Toyota Yaris (a fall of just 5.5%) or the new Peugeot 208 (4200 units). Then comes the Fiat 500 that falls even more due perhaps to the fact that is now facing its 5th year on the market without any significant change (see analysis of Fiat 500-Panda vs. VW Up! for June 2012). These two models count for 76% of main models fall. But in terms of percentage fall, the winner is the C-Compact Bravo with a spectacular fall of 47%, or 6.063 units less. This car is not old at all but the positioning given by the brand has not been the best allowing the VW Golf to keep its pole position among C-Segment cars. Nevertheless the german compact begins to suffer the consequences of its old age which can be seen by the good result gotten by the Giulietta (the best selling compact in April, May and June), which ‘only’ falls 18%, but is an alarm sign to Alfa as it is the only competitive product and is just 2 years old. Other really bad performers are Alfa MiTo, which just sold 16% more than Mini and 20% more than Audi A1, and Lancia Delta, down 36%. In a market that falled 20%, the Panda, Ypsilon and Freemont did quite well. The new generation Panda helped this popular model to maintain its sales figures and allowed it to become the country’s best selling car by far. Same situation for the Ypsilon, very popular in Turin. Fiat as a brand falled as much as the market, while Lancia did better only falling 11% and Alfa Romeo dropped 31%.

Total sales of B segment main models in Italy. The latest launches had the best performance, while those with more years in the market dropped their sales. Source: http://www.bestsellingcarsblog.net

Thanks to new Panda, Ypsilon and somehow the Giulietta and Freemont, Fiat Group has been able to rise its market share in Italy. The evolution of each model is compared to the performance of each segment according to UNRAE. Source: http://www.bestsellingcarsblog.net and http://www.unrae.it

USA

As usual, American sales figures are just amazing. The total market has returned to pre crisis numbers but Chrysler Group is doing much better, eventhough the new entry model, Dodge Dart, is available from late June. The Ram grew 24%, much more than its rivals, thanks to the good results got by the luxury versions. If rumors are confirmed, a diesel version would have a positive impact for the rest of the year. But in terms of the largest impact on the total growth on sales, the Chrysler 200 is certainly the main character, because it represented 16% of total growth, or 37.000 more cars. The deep facelift that received the Chrysler Sebring has made consumers to come back to Chrysler in the C-Segment. Besides the good Ad campaign regarding its American origin has given it more awareness among consumers. With less sales figures but equal interesting results, the Chrysler 300 took off, up an amazing 200% (anyway it is still far away from its rivals, most of them already renewed). As most of models had great performances (thanks to better economic situation), only those having bad results deserved a close analysis: the old couple Compass/Patriot did not well during the period. The Compass falled 1%, while the Patriot grew 12%, below total market. It is clear that these models are old enough and competition gets really hard with all new models, but it is weird that the Compass and not the Patriot falled when the only the first one had an interesting restyling. Another fact to consider is that minivans don’t count in Chrysler’s sales as much as they did one year ago, and now Jeep Grand Cherokee and Wrangler occupied the second and third place of best selling Chrysler models. The group, included Fiat sales numbers, grew up two times more than total markets allowing it to increase its market share up to 11.5%. By brands only Dodge/Ram had stable growth, while Chrysler had an amazing growth of 75%, Jeep up 28% and the Fiat 500, up 319% to 20.706 cars, more than the whole year 2011.

The Fiat 500 had the best performance compared to H1 2011. Anyway most models did better than the whole market. It is weird what happened to Dodge Durango which has been on sale for less than 2 years, shares platform and components with the successful Jeep Grand Cherokee. Source: http://www.goodcarbadcar.net

The figure shows the total units sold during the first half and then the change in terms of percentage and units. After that there is the contribution of each model to total growth in terms of units. Chrysler models are the ones which contributed the most for the total growth. Source: http://www.goodcarbadcar.net

EUROPE

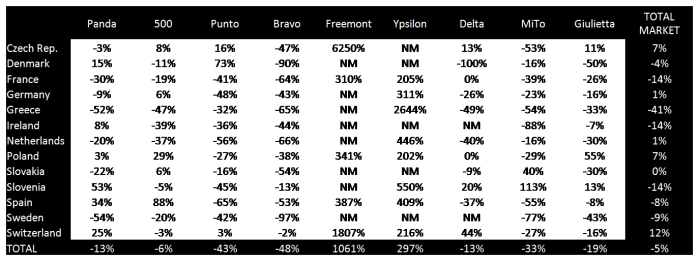

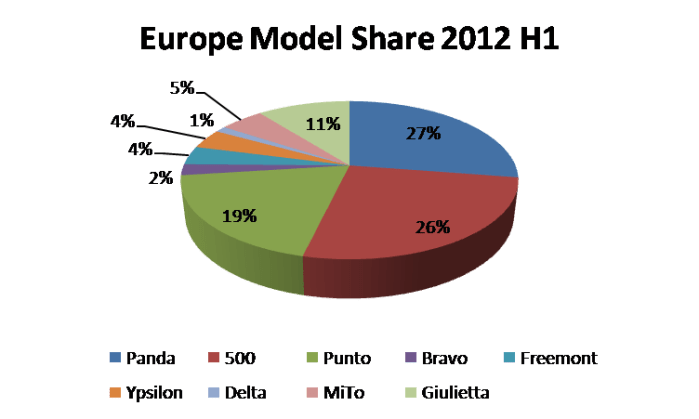

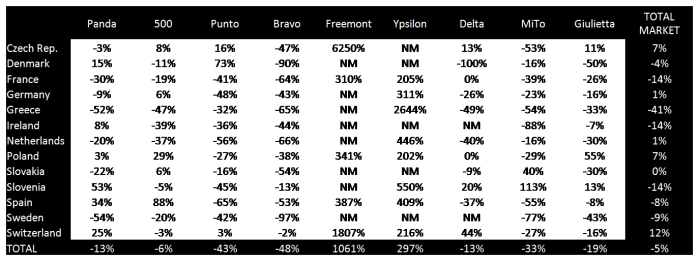

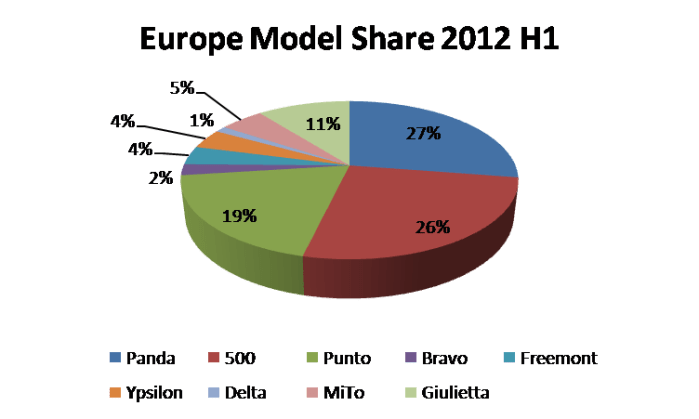

Outside Italy the situation is really bad. Without taking into account UK and Austria figures (only Czech Rep., Denmark, France, Germany, Greece, Ireland, Netherlands, Poland, Slovakia, Slovenia, Spain, Sweden and Switzerland), the main models of the group sold 115.275 units, down 17.5%, a bit less than what happened in Italy. Of course not all the markets had the same performance as the largest ones had the deepest fall: France down 25%, and Germany down 13%, compared to a total fall in France of 14% while Germany grew 0.7% (part of that growth due to self-sales). But the top 9 models had the worst fall in Greece, a market that dropped 41% in the first half. Spain, other troubled market, surprisingly was good for these models, which grew up 4%, or 500 more units. Once again the Fiat Bravo got the worst figures falling in all markets as a response to Fiat’s decision of reducing the range and options. Germany has been the largest market for the Punto after Italy, but this year the model has fallen 48% over there, even more than the fall seen in Greece, but less than the horrible result in Spain and the Netherlands. Certainly the model is not anymore popular. The Panda had good and bad results but in general the car continues to be popular, though its total result was severely affected by the deep fall in France, where the market is going bad. As in Italy Lancia goes better thanks to the Ypsilon, which had excellent numbers in terms of growth but still low numbers in terms of units delivered. One year ago the old model barely sold one thousand units but with the arrival of the new 5 door generation the Lancia sold 4 times more, and is especially popular in Greece where it has become one of top 20. Alfa Romeo does not do good at all with its 2 models falling in the ranking, especially the MiTo, which never had good results. In terms of the dependence of the models on the Italian market the situation changes a lot according to the car. Without any doubt the Fiat 500 is the most international model of the group as only 34% of its sales are done in Italy. Surprisingly the Alfa MiTo is the next model to have less sales share in Italy, as 52% of them are done outside Italy. It is certainly interesting to see the result of the MiTo taking into account that the Giulietta is more popular. The Lancias continue to be popular only in Italy and it seems the new generation Ypsilon will depend on Italian market no matter the fact is built in Poland.

This figure shows the Export ratio of Fiat Group’s main models in Europe. The Fiat 500 is the one less dependant on Italian market thanks to great sales in the UK, France and Germany. On the other hand there is the Lancia Ypsilon, whose new generation has not been able to change its strong dependance on Italy. Europe includes: CZ, DK, F, D, GR, IR, NL, PL, SK, SL, E, S, Switzerland and the UK. Source: www.bestsellingcarsblog.net

Sales growth of each model in each market for the first half of 2012. Good results for the Ypsilon, Freemont and 500. To bad for the Punto, Bravo and MiTo. Source: http://www.bestsellingcarsblog.net

One year ago the Punto was Fiat’s best selling car outside Italy (28% of total sales). In 2012 H1 the fall of its sales allowed the Panda, 500 and Ypsilon to have better share among Fiat models. Source: http://www.bestsellingcarsblog.net

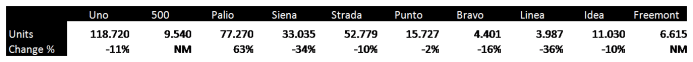

BRAZIL

In Brazil the analysis gets larger as more models are really popular over there. The market is stable with a tiny fall of 0.3% and is expected more sales in the second half thanks to some incentives given by the government. In this context Fiat continues to be the leader and keeps its market share above 22% thanks to one single model, the new Palio. Its registrations have risen 63% and is now the third bestselling car of that country, but it is still far behind from the king of the market, the VW Gol. Although year-to-date numbers are still low, the arrival of the new Siena, aka Grand Siena, has made of this model another great performer and the results will be seen at the end of the year. The Uno, in its second year, falls 11% partly because of the arrival of the new Palio, which could be catching some of its sales (Palio is B-Segment and Uno is A-Segment, but they are close in size and prices), and also because of the success the facelifted VW Fox is having (up 19%), also from A-Segment. But the worse comes from C-Segment: the Linea falls 36% and it seems it will continue like that until a deep facelift arrives. The Bravo stopped its fall in the last month thanks to new engines and features. Good for the Punto (-2%) which got its first deep facelift in July/12, and the Freemont, with 1 thousand units sold per month, not bad considering its high price. The small 500 is doing also good allowing the Toluca plant to keep working. For the second semester things will get hard for Fiat with the arrival of the facelift of VW Gol/Voyage and the all new Hyundai HB20, exclusively designed for Brazilian market.

CANADA & ARGENTINA

The situation in Canada is not as spectacular as in USA. Chrysler group (included Fiat 500 figures), had the same growth of total market, but it is much more than its competitors from Ford and GM. Actually the group has the second place and sells more than GM, but is now facing the threat of a strong Toyota in fourth place and growing much more. Fiat sold 4.920 cars, up 92% and it seems the small 500 has reached its maximum. The Ram (up 16%) and Grand Caravan (down 6%) are among top 5 best selling cars of that country. In Argentina where total market continues its instability, Fiat is doing good with the new Siena, up 10%, the Uno, up 11%, and the Strada, up a massive 74%, or 2105 units more. Bad for the Palio (the new generation just began local production some weeks ago), the Punto (the restyling will arrive by the end of the year). The small 500 sold almost 2.000 units.

*Fiat, Lancia, Alfa Romeo, Chrysler, Jeep and Dodge.

Source: www.carsitaly.net, www.bestsellingcarsblog.net, http://www.goodcarbadcar.net

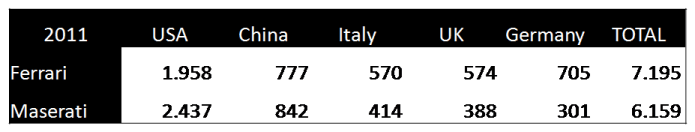

The tittle may be shocking, but it explains what is going on in the troubled Italy with expensive cars. According to Bloomberg news the situation with luxury cars is becoming dramatic in Italy because of the financial crisis and governments measures. It is not only a matter of new car sales figures, which are down an incredible 20%, but is also about the impossibility of having the Ferraris, Maserati, Porsche or Lambos in a country where new taxes appear every day and the fight against tax evaders has become an official duty. That’s why many Italians are exporting their super cars in order to avoid tax payments or the persecution of police. According to the article, the number of secondhand high performance cars exported from Italy was up 177% in the first 5 months of 2012, when 13.633 cars were taken out of the country. Italian authorities began a raid against all tax evaders going to exclusive places where all the millionaires go with their supercars. By doing it they could know who was really declaring the right income and therefore paying enough taxes. And as expected, Italian police has found several people enjoying their ‘toys’ and having the ‘dolce vita’ without paying the right amount of taxes. It is certainly a pity in a country known by its supercars in its wonderful roads.

The tittle may be shocking, but it explains what is going on in the troubled Italy with expensive cars. According to Bloomberg news the situation with luxury cars is becoming dramatic in Italy because of the financial crisis and governments measures. It is not only a matter of new car sales figures, which are down an incredible 20%, but is also about the impossibility of having the Ferraris, Maserati, Porsche or Lambos in a country where new taxes appear every day and the fight against tax evaders has become an official duty. That’s why many Italians are exporting their super cars in order to avoid tax payments or the persecution of police. According to the article, the number of secondhand high performance cars exported from Italy was up 177% in the first 5 months of 2012, when 13.633 cars were taken out of the country. Italian authorities began a raid against all tax evaders going to exclusive places where all the millionaires go with their supercars. By doing it they could know who was really declaring the right income and therefore paying enough taxes. And as expected, Italian police has found several people enjoying their ‘toys’ and having the ‘dolce vita’ without paying the right amount of taxes. It is certainly a pity in a country known by its supercars in its wonderful roads.