The latest moves and news of the industry indicate that FCA and Tesla might be closer than what they think. Both companies face issues that could be the beginning of further collaboration between them. Moreover, the situation of global markets is pushing the two companies to take decisions that were unthinkable some months ago.

With trade tensions escalating, and the cooling of growth in key markets, both the traditional car makers and the latest entries, are more vulnerable than ever. Without growth and more obstacles to sell a car, it is almost impossible to achieve the ambitious goals set by all automakers. And it is the best scenario for mergers and alliances.

FCA and Tesla need each other

Within this context, it is important to remember the recent moves that have taken place in the industry. Beijing Auto is looking to acquire 5% Daimler stake; Chery gets ready to hit the Indian market thanks to a joint venture with Tata Motors; and Ford announced it is ready to invest $500 million in electric vehicle startup Rivian.

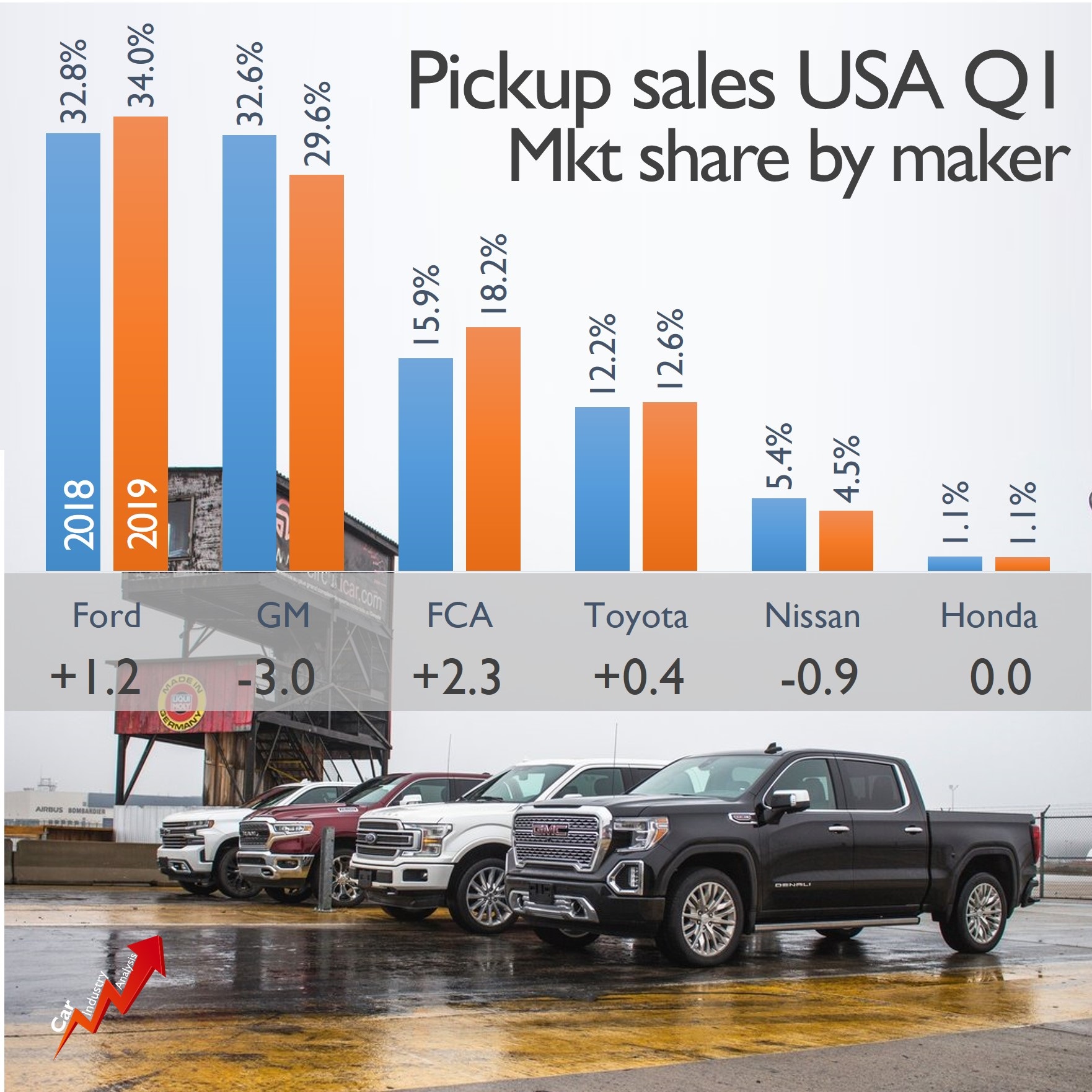

The latter move is maybe the most important among all. Even if it is not an acquisition, Ford is willing to cooperate with a small but very promising company like Rivian. The only motivation of Ford is to lead the electrification race in the most lucrative segments in North America. Unlike Detroit’s big 3 and Tesla, Rivian has already an electric pickup in its range.

Tesla is not a startup and according to Elon Musk, it is years ahead of the traditional automakers. This year it is expected to sell around 300,000-400,000 cars globally with only 3 models available in its lineup. As the brand gets ready for more volume following the arrival of the Model Y in 2020, and the start production at its new Gigafactory in Shanghai, Tesla will need more resources to go ahead.

Meanwhile, FCA has already started to flirt with Tesla thanks to the agreement they reach concerning the CO2 credits for Europe. The Italian-American manufacturer is due to pay 1.8 billion euros in the next three years to buy regulatory credits and reduce the average CO2 emissions in Europe.

The dark spots of Tesla

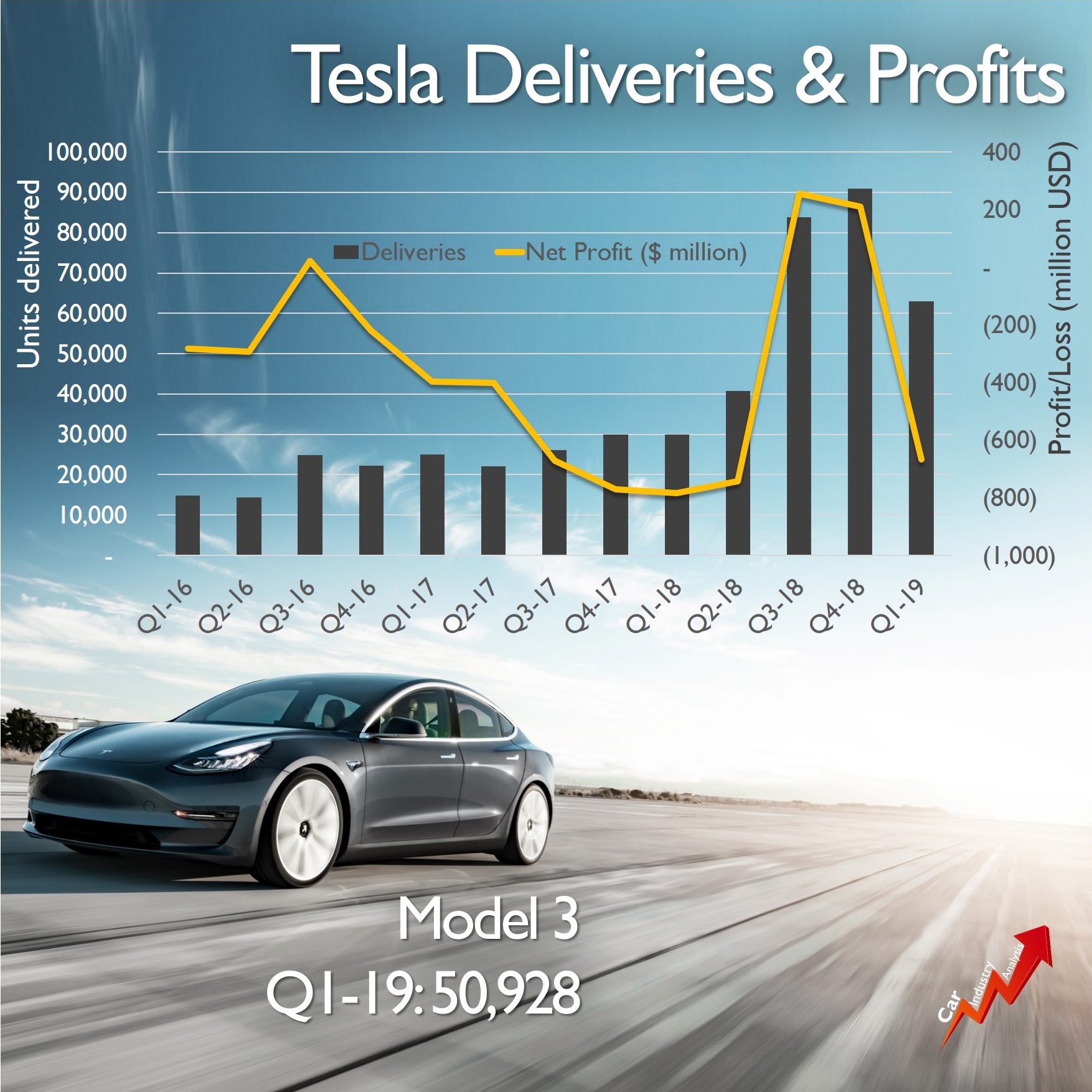

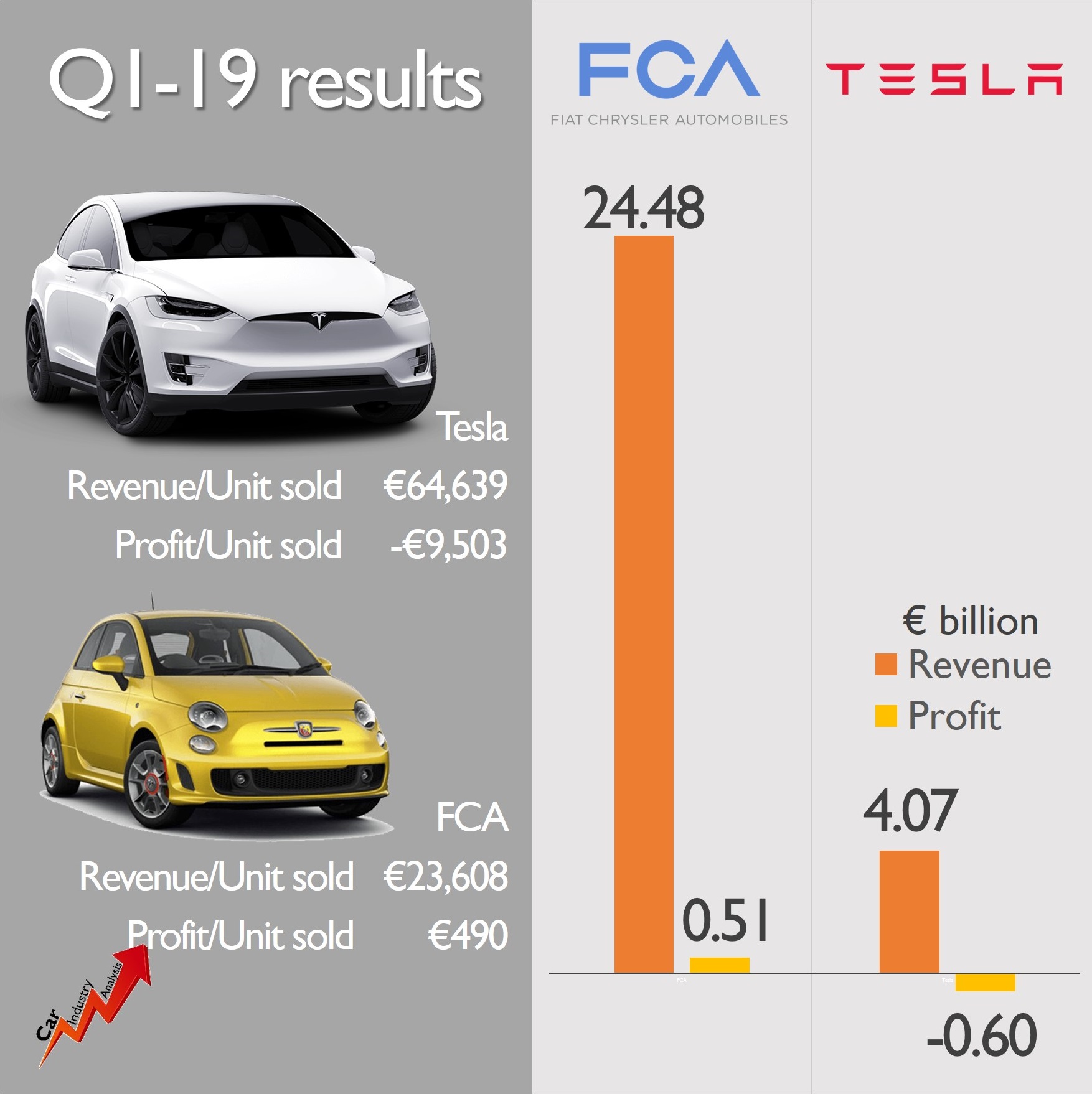

Not everything is perfect in Tesla. During the first quarter of this year, the company lost 600 million euros following lower deliveries of its cars (U.S. federal tax credit was halved starting in Jan 1st) and issues with logistics. Despite the negative result, Tesla was the best performer among all car makers in terms of net profit margin variation, as it lost 704 million euros in Q1-18.

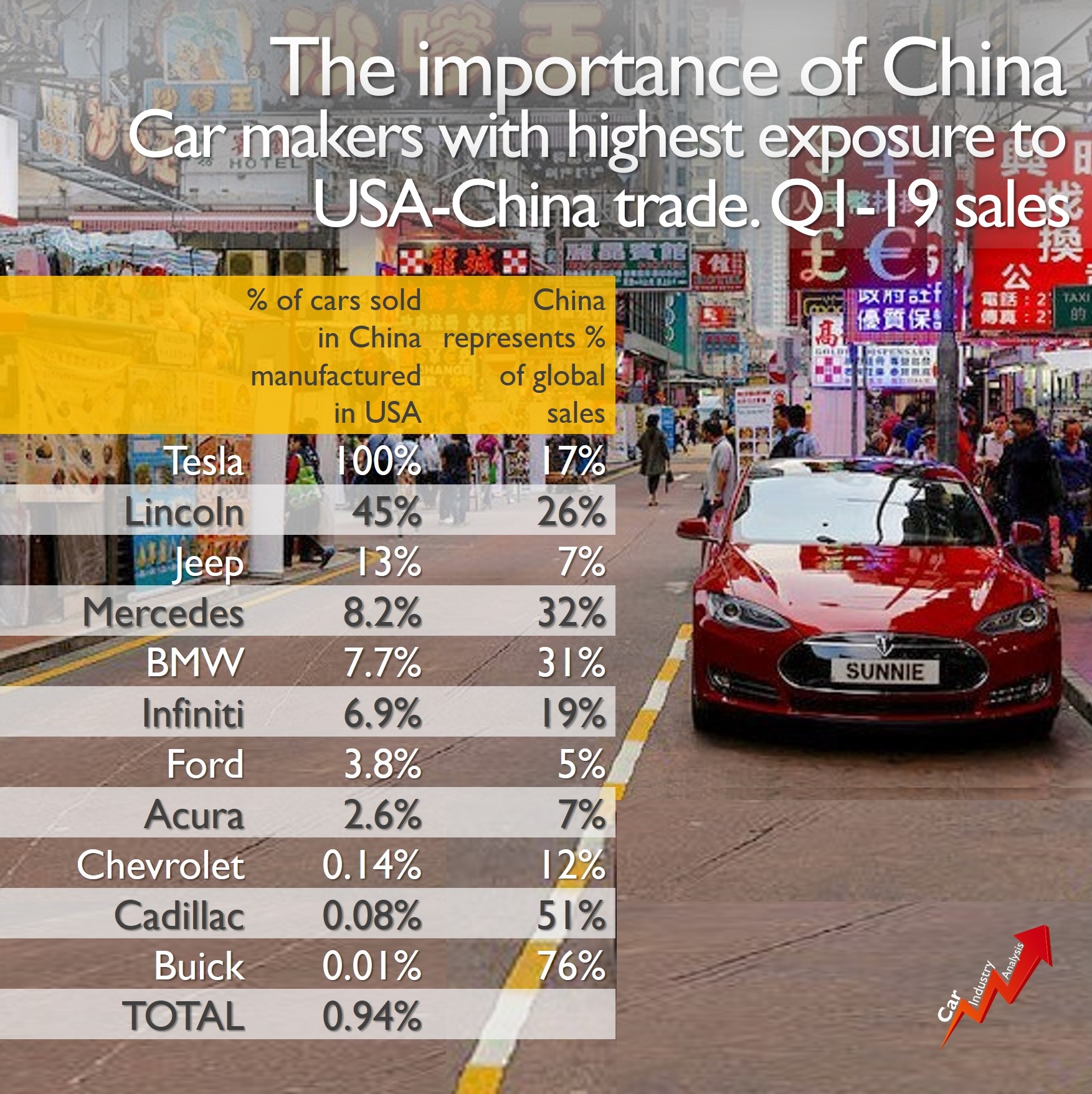

The brand’s main challenge is to keep being competitive in a more complex trade situation. Tesla is by far the maker with the highest U.S. import rate among all car makers selling cars in China. Therefore, it is extremely exposed to any change on the trade conditions between the two markets.

This would not be a problem if the Gigafactory (see picture) that Tesla is building in Shanghai was fully ramped up to produce cars. In the best of the cases, according to Musk, this plant will produce 3,000 vehicles by the end of this year. But the plans indicate that the construction will take one and half years from now.

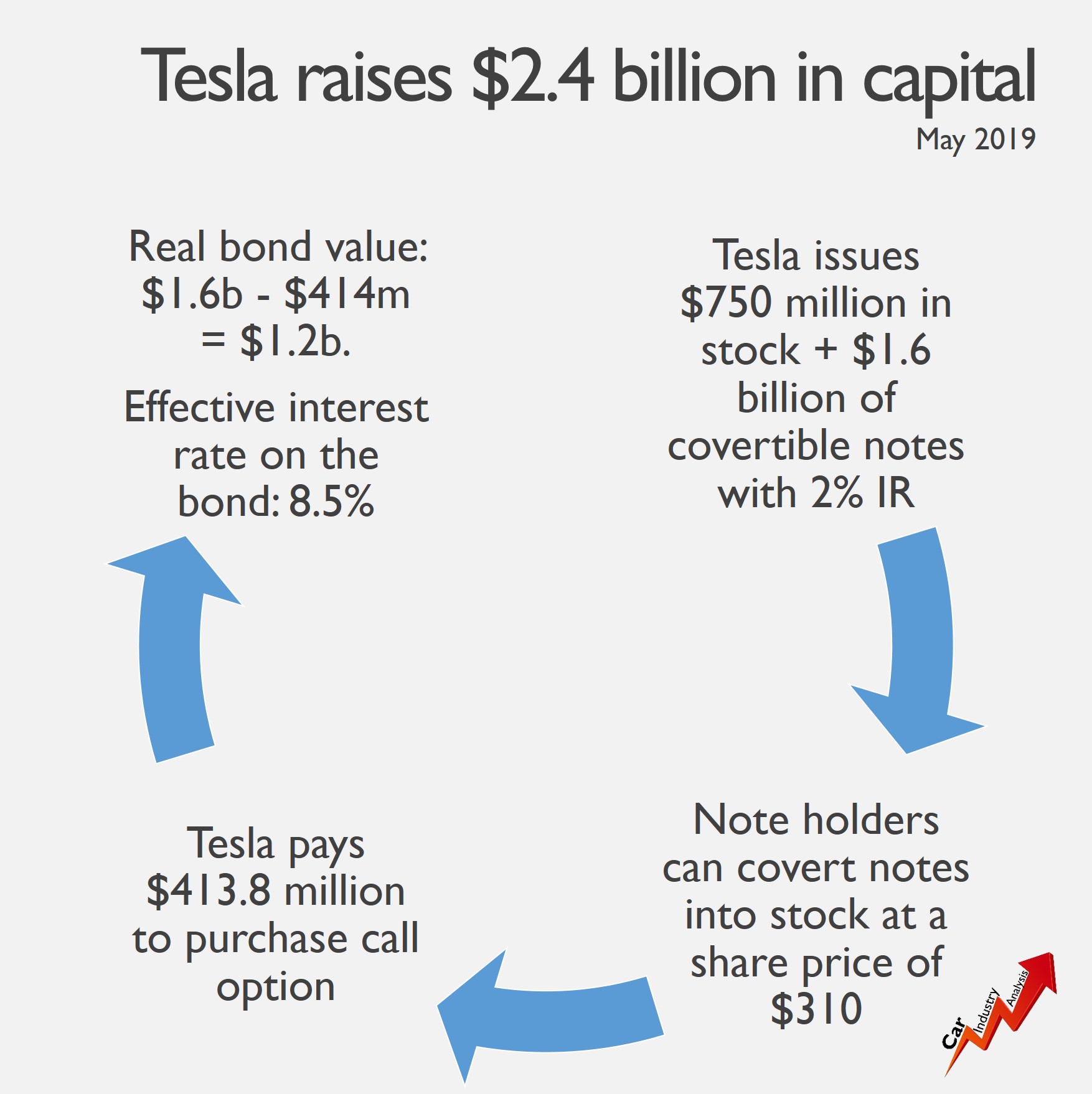

In addition, Tesla has other fronts to deal with too. The most dramatic is the high financial costs of its latest bond issues. The latest figures show that it is paying one of the highest effective interest rate on debt among the companies within the same industry, with headquarter located in same country and with closest market capitalization (see figure).

FCA has something that Tesla doesn’t

Despite all the difficulties that FCA is dealing with nowadays, the company is still attractive enough. In one hand, it has 20.3 billion euros in cash*. Unlike Tesla, the guys of Fiat Chrysler earned 508 million euros in Q1 2019, although the margin fell dramatically from 3.7% in Q1-18 to 2.1% in Q1-19. Tesla might have more growth potential than FCA, but the latter sits on a more comfortable financial situation.

The situation is also more interesting from the point of view of brands/products. FCA has at least 4 brands that have a very good appeal and can become real big game changers once they are electrified. In one hand there is Ram, which plays in the most profitable segment in North America and has already the truck knowhow that Tesla doesn’t have. Rivian has a pickup, Tesla doesn’t.

There is also Jeep, whose SUVs are globally known and are produced in six different locations around the world. Wouldn’t like Tesla to access to this strong brand to develop its own crossovers? Maserati is the other Crown jewels that could attract Tesla. The former has the prestige, and heritage to be the perfect match for the creation of an electric luxury supercar, and the best way of competing against Porsche.

However, FCA’s top advantage is that it can finance its electrification plans with sales of ICE cars. Tesla needs to finance its own expansion by selling cars that are still not profitable. But why would Tesla merge or cooperate more with a dinosaur like any of the current ICE makers? they are old, big and move slowly as the bureaucracy prevails in most of the decisions. FCA’s latest agreement on paying Tesla for its credits indicate that the interest has been in one direction (from ICE maker to EV maker). This could turn around and FCA should be ready.

*Total available liquidity by the end of Q1-19: cash, credit lines

Source: FGW database, Electrek.co, gurufocus.com, valuewalk.com