FCA needs a plan B and it is quite urgent. The failed merger with Renault leaves both automakers weaker than before the negotiations started two weeks ago. The problems with the French government exposed them to the fears of investors that don’t see a bright future without a partnership.

Renault is perhaps suffering the most. In one hand the facts demonstrated once again the power that the French government has within its management. In the other, the problems with Nissan are now bigger due to the lack of trust that both automakers showed during the process.

In the case of Fiat Chrysler, the withdrawal of the proposal meant another failed attempt to find the perfect match. Their main motivation was to secure the future, save costs and keep profits as the costs of electrification and CO2 fines in Europe are due to hit its financial results badly.

What’s next?

I don’t think everything is over between FCA and Renault. The match proved to be quite convenient for both and even for its investors, who rapidly approved the idea by increasing the shares value of both companies. As I said in my previous article, this marriage would create the world’s largest SUV maker.

The withdrawal could be part of the game by putting more pressure on Renault. Actually, the current situation of Renault Chairman Jean-Dominique Senard is quite complicated as he is now dealing with two fronts: the weaken alliance with Nissan, and the complex relations with the government.

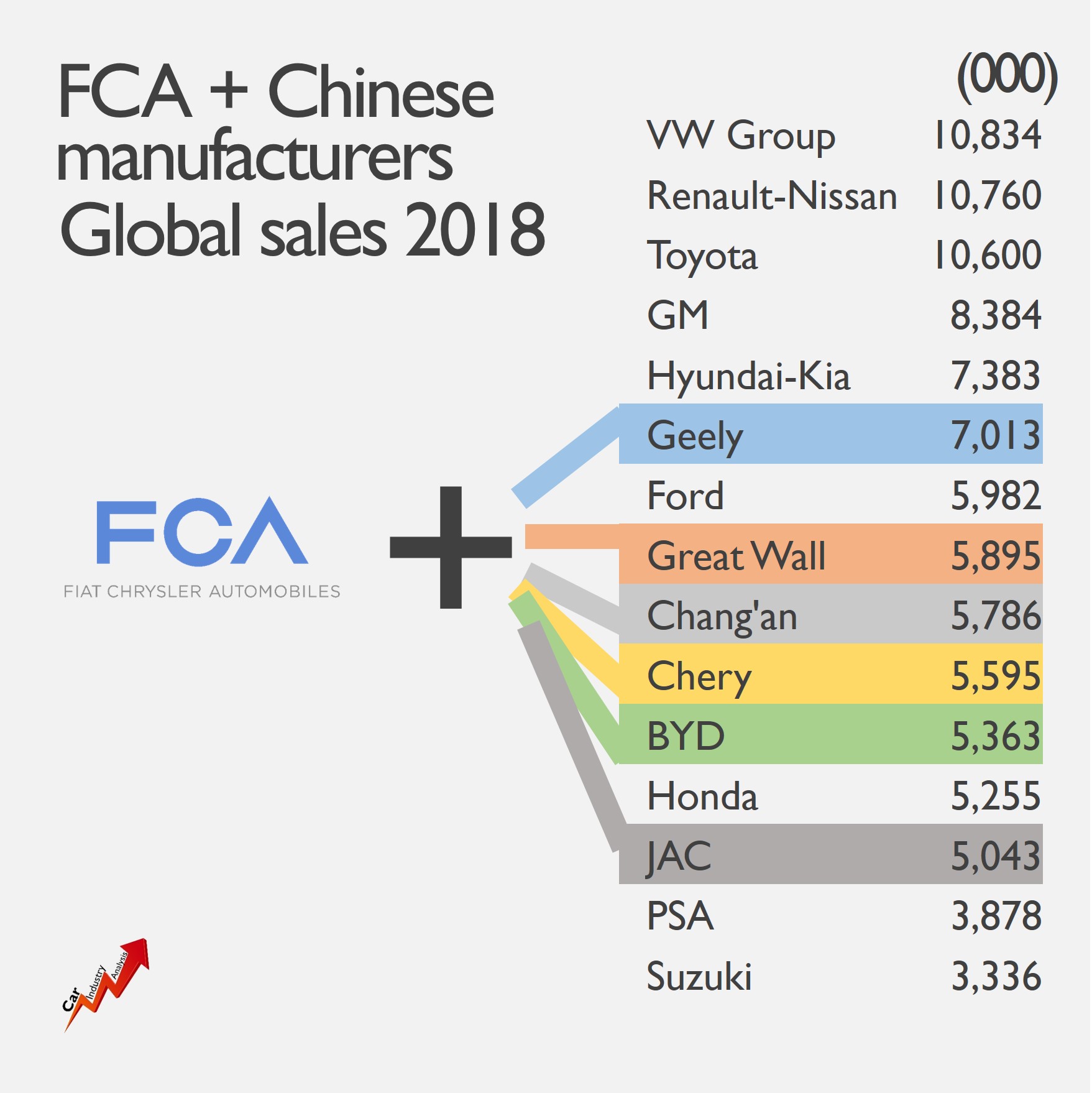

FCA’s plan B is to look even further in both terms, time and space. While the French decide what to do, Manley and his guys should start looking for partners in China. Nissan is the natural candidate to merge with Renault after 20 years of collaboration. In the same way, China should be the plan B for FCA considering its weak position in this market.

China is the answer

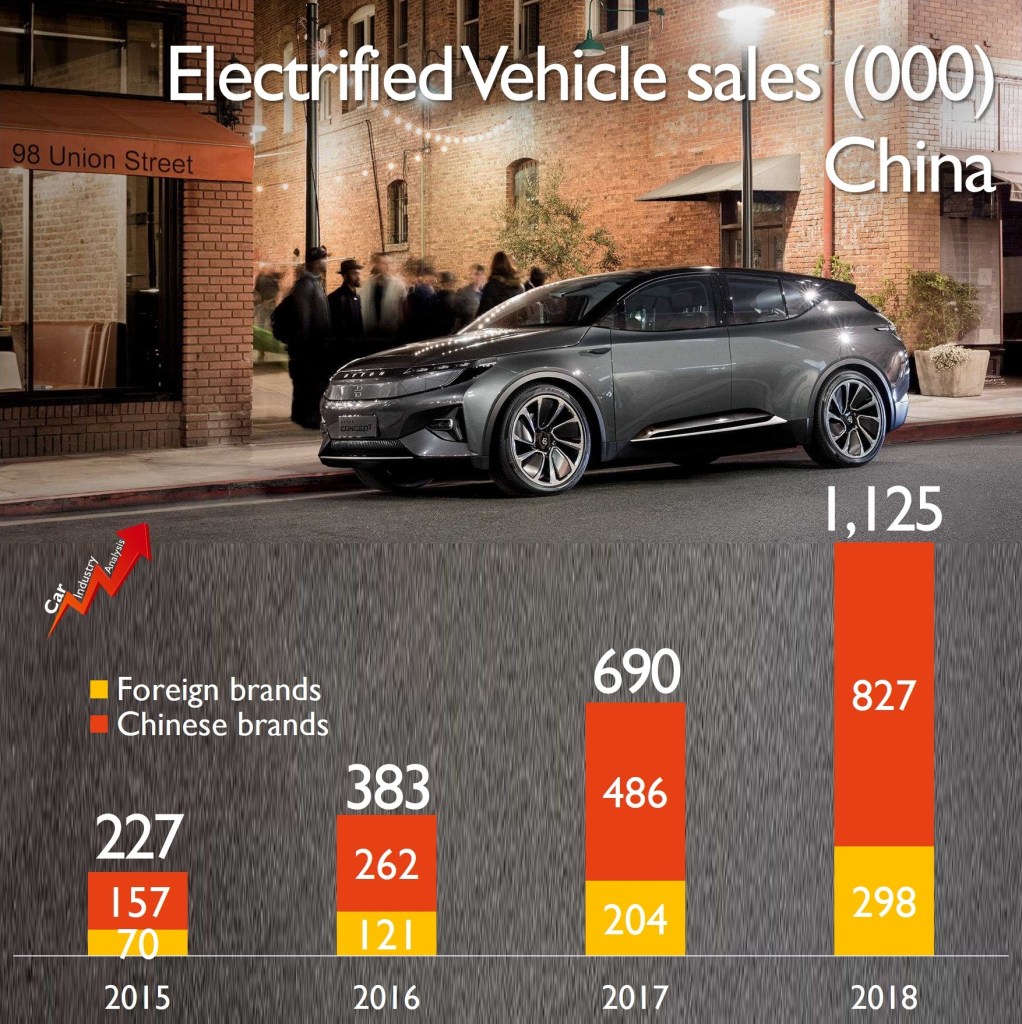

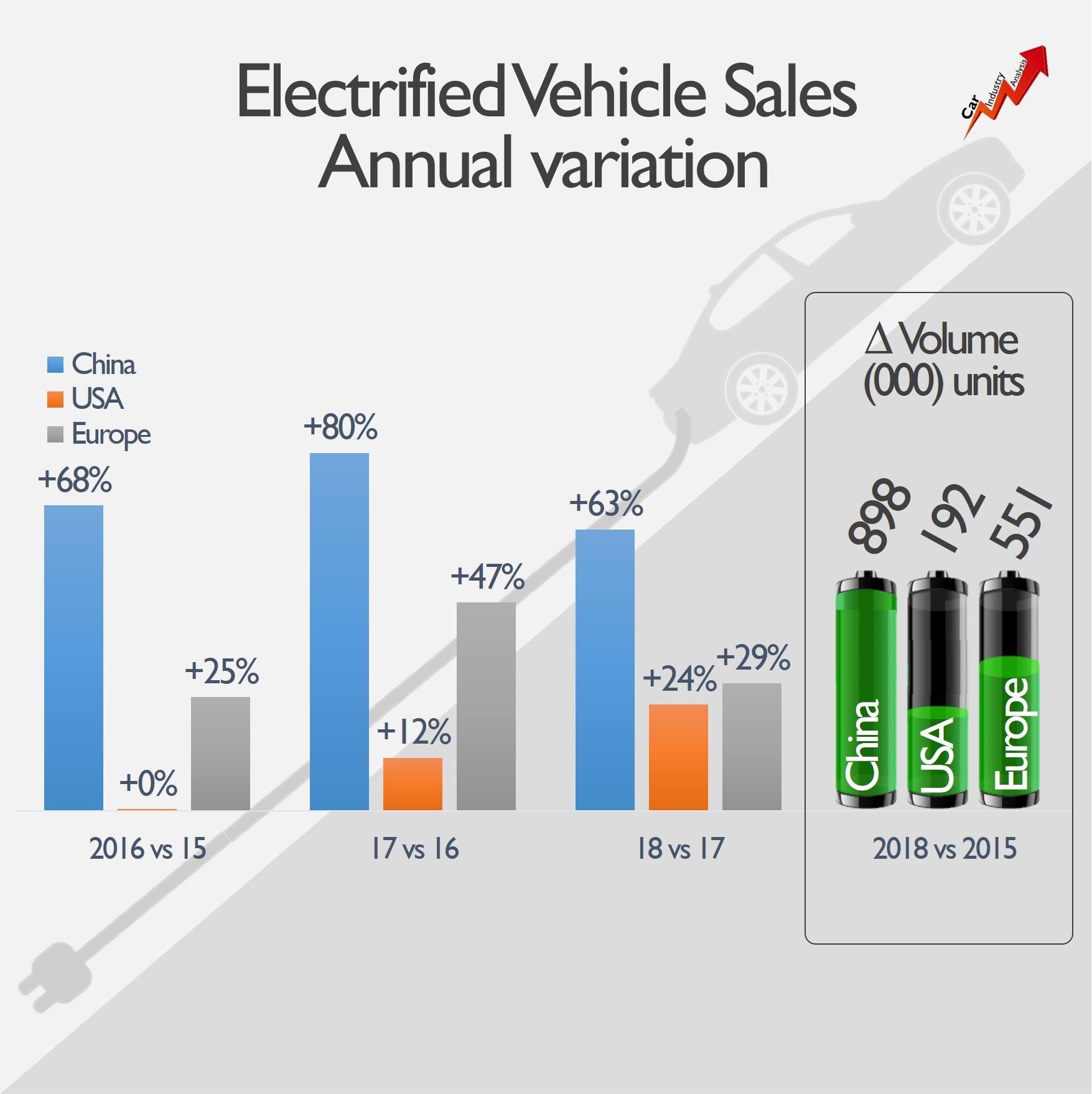

More than PSA, Renault or other Western automaker, FCA needs to take part of the Chinese wave. Vehicle sales stopped growing (down by 13% through May 2019), but the country is slowing becoming the world’s leader in terms of electrification technologies. The EVs are an essential part of the future of the economy of China.

The EVs are going to be the longed passport of the Chinese cars, which have been waiting for years to conquer the global markets. So far, China has focused its production to satisfy the domestic demand, and the very few attempts to export its cars have failed (with the exception of some South American markets, Russia and South East Asia).

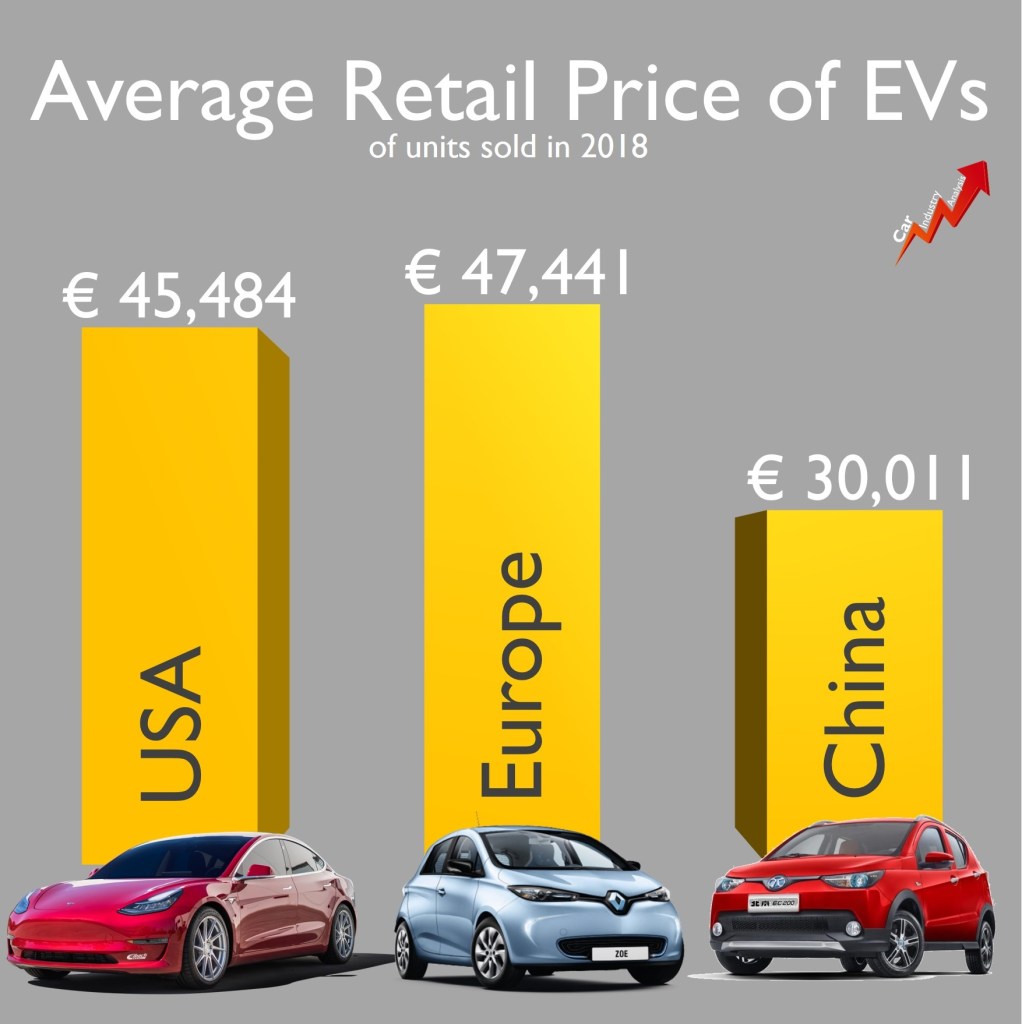

They can’t simply be competitive enough in Europe and USA because of many reasons. Quality is one of them; but also the lack of heritage, awareness and the bad reputation Chinese products have in the Western world. Even if their cars have evolved quite fast and now feature beautiful shapes and quality interiors, they don’t offer anything new or different from their rivals in Europe, USA and Japan.

Therefore by getting a competitive advantage in terms of electrification, China is winning its ticket to global markets. Unlike it happens with the ICE, the electrification is a race of equals between China and the Western world. Actually, China has an advantage: its giant local market and the government’s commitment.

As long as they bring to the market an efficient, modern, safe, good quality and affordable electric vehicle, they will be ready to expand their presence overseas. However, they will continue to struggle due to the lack of awareness among consumers in those markets. FCA could be the solution.

FCA: the enabler

A merger between FCA and a big Chinese automaker would be beneficial for both parties. The big potential of the Chinese EVs would be reinforced by the strong presence of FCA in North America and Europe. China needs a partner in the Western world in order to enable its success with its EVs. FCA could be their enabler.

Who to marry? Geely, Chery, Chang’An, BYD, JAC or Great Wall could be among the candidates to establish collaboration with FCA. The Italian-American maker would win direct access to China by playing as a local, while the Chinese could use FCA’s network to sell their cars in Europe and USA. At the same time, FCA would benefit from the Chinese EV know-how and incentives allowing it to reduce the current big gap with its peers.

China?! Are you stark raving mad?!?! That’s by far the absolute worst outcome. The vehicles will turn into low quality crap, because that’s the only kind of “quality” the Chinese know how to build, European and American plants will be closed down and lots of jobs will be lost. And from a geopolitical point of view it would be a disaster – trust me, we don’t want to empower the Chinese any more than we already have, and at the very least Donald Trump seems to have realized this.

I can only conclude that you don’t have FCA’s best interests at heart when you propose such a despicable “solution”. Are you on the payroll of the Chinese government?

LikeLike

Wow, that is a tad over board, FCA may be strong in the States, average in Europe and okay in South America, but its vehicles are under scrutiny in Europe as far as fuel consumption but very weak on the EV front as it is buying Tesla sales in Europe to reach their fuel consumption limits. They have to look further afield and I agree with the Renault link up but if that does not work where too then? I do not like Chinese products either but if you are sitting with a massive issue going forward you have to find the best solution and maybe Chinese is that or maybe even a Japanese one. Fortunately we do not have to take that decision so lets see what FCA Management team take

LikeLike

From a future security point of view then, merging with Chinese is best option as they have the capital, while FXA have the engineering know how. Only concern is the Trump possible trade wars with China.

LikeLike