The difficulties facing the automotive industry started long before the outbreak of Covid-19. Last year the global economic landscape was negatively impacted by several factors around the world, complicating operations for manufacturers. Data published by 28 of the most important car makers* indicated that they saw less profit in 2019, with their operating profits falling by 11% to €86.4 billion**.

The results are even more significant when comparing the profit decrease with the growth in revenue. As a whole, the automotive industry recorded a combined revenue of €1.87 trillion, up by 1% from the year before. The volatility and continuous pressures in the industry, meant counter efforts to protect sales and profit were unsuccessful, such as efforts to produce more expensive vehicles.

China as the source

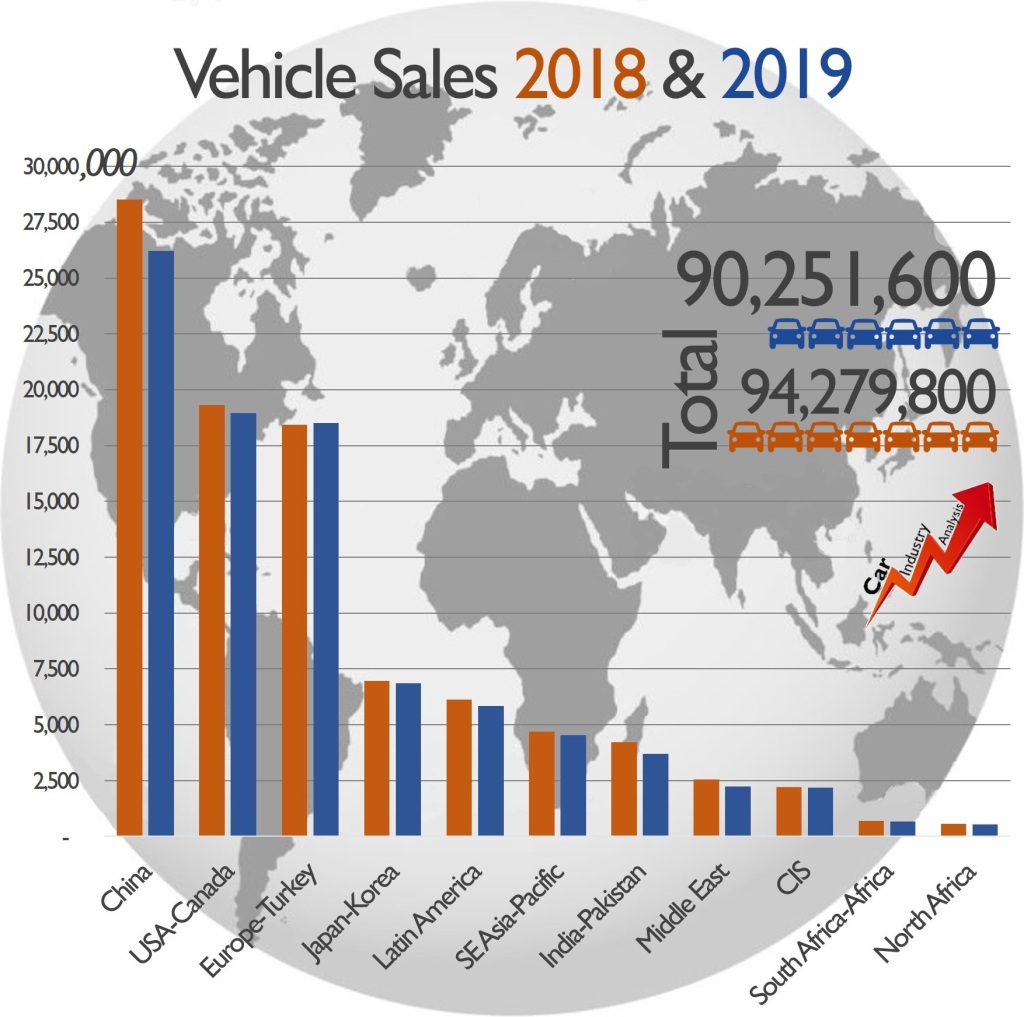

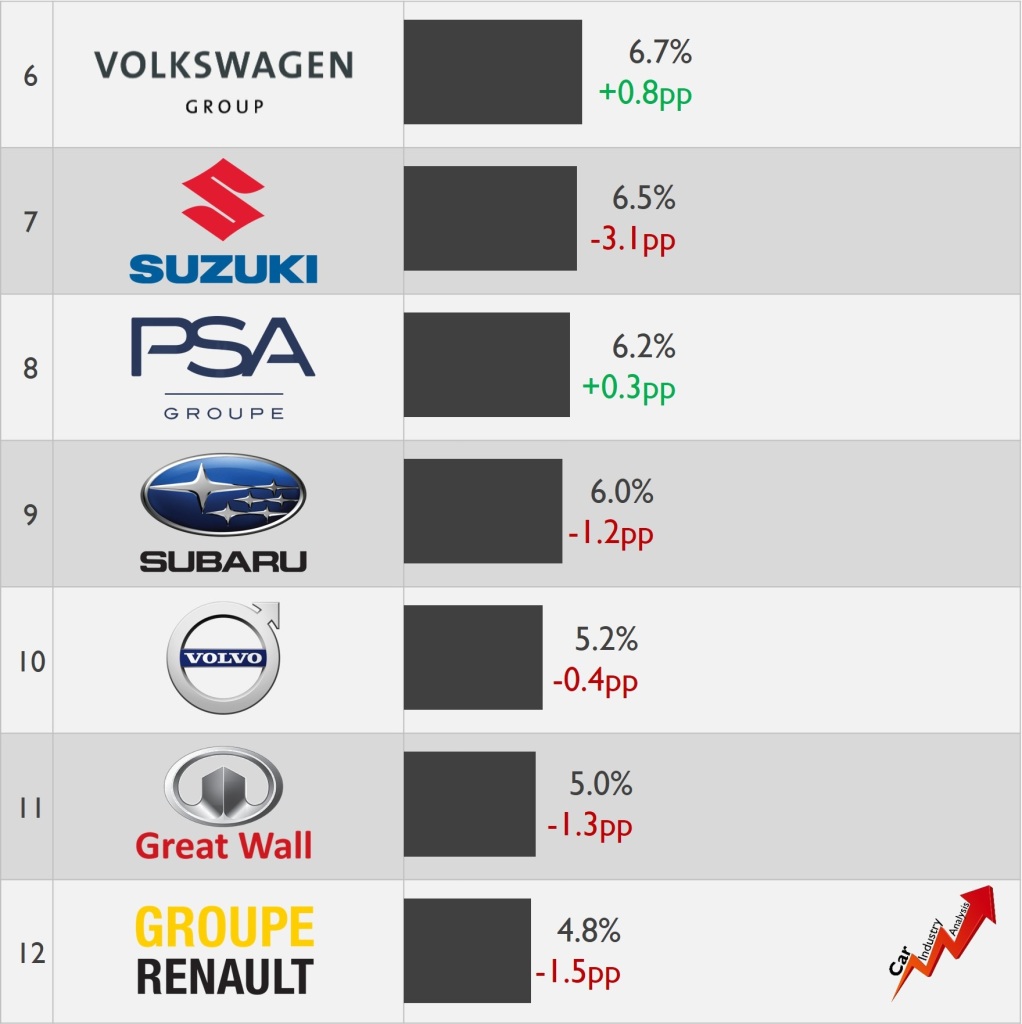

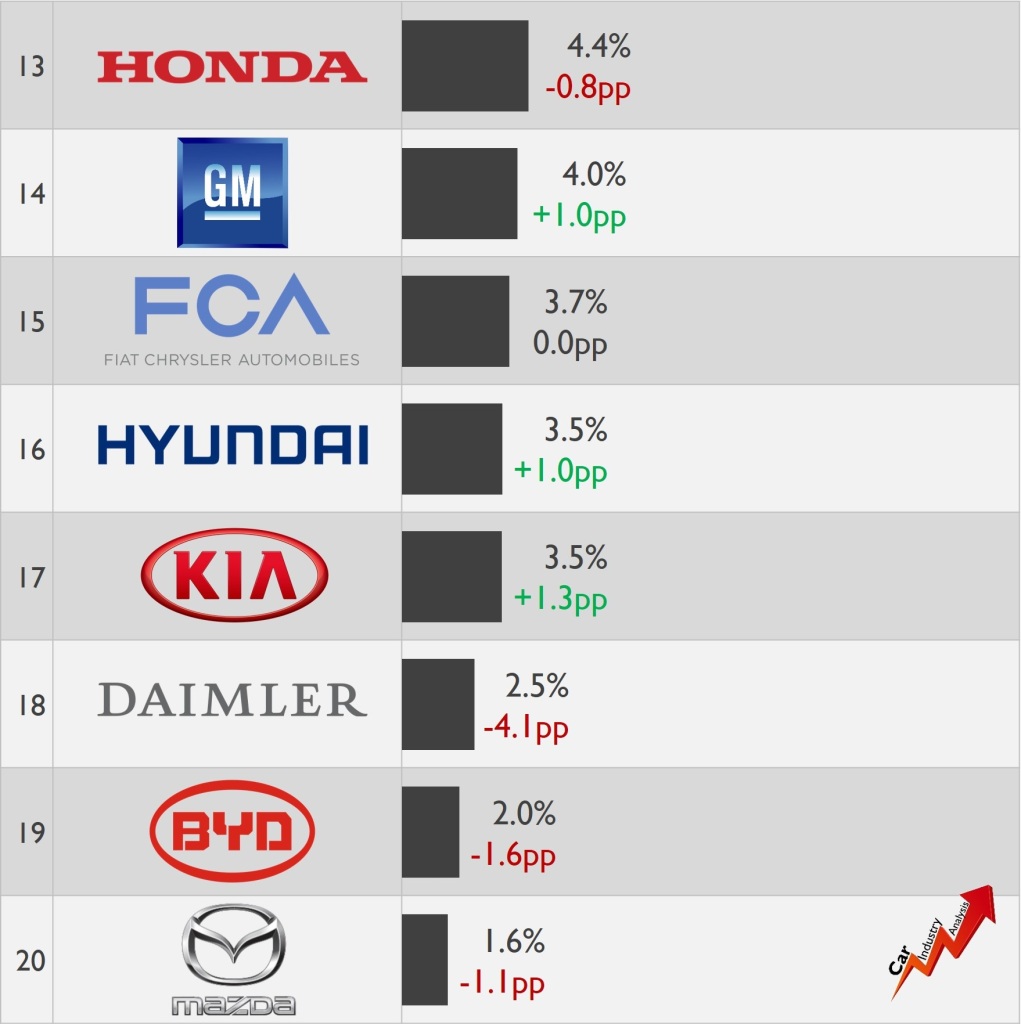

The consequences of greater revenue and reduced profits is evident within the operating margin, which fell from 5.2% in 2018 to 4.6% last year. The deteriorating financial results initially arose from converging issues in China, USA and Europe.

Firstly, China were affected by a series of policies and measures implemented to encourage consumer spending in the vehicle market, pressure on the economy, the early implementation of “China VI” standard, and a significant decrease in new energy vehicles subsidies.

As China represents 29% of global vehicle sales, it is a key market for big players like Volkswagen Group, Honda, GM, Daimler and BMW Group. Any changes or downturns in the Chinese economy is likely to have a global impact.

The USA and Europe also showed signs of stagnation following many years of continual growth. Unlike China, the European and American car markets are mature ones, so this level of fluctuation can be considered within the normal range.

However, the increasing regulatory pressures in Europe, and the uncertainty generated by the US-China trade war, made conditions difficult for manufacturers. These two markets combined accounted for 42% of global sales in 2019. In addition to these markets, players in India, Iran (PSA and Renault), Argentina and Turkey, also faced uncertain periods. A total of 5.1 million vehicles were sold in those 4 markets, down by 21% from the year before.

Volkswagen is the biggest by revenue, Toyota by profits

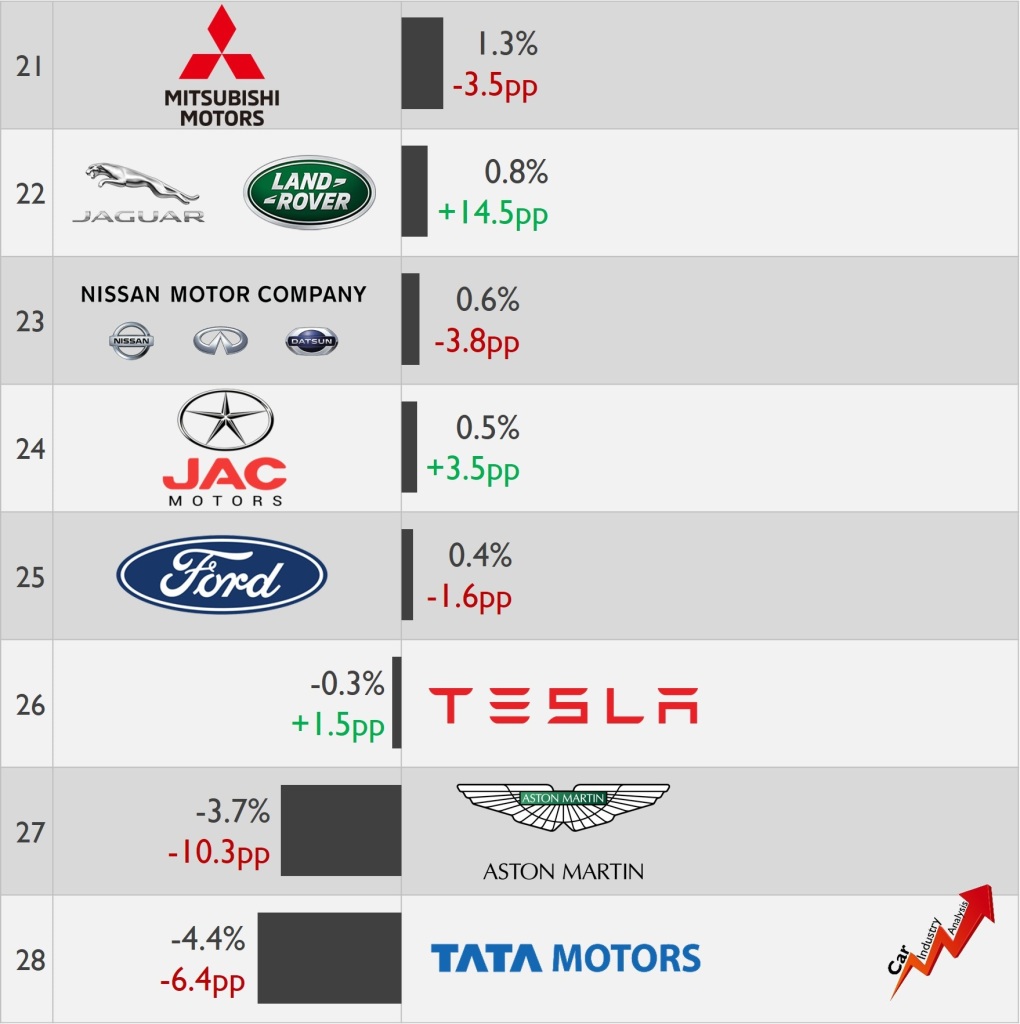

Volkswagen Group became the world’s biggest car maker not only by unit sales but also by revenue. The German manufacturer reported €252.6 billion in revenue, compared to €250.8 billion posted by Toyota. In both cases, their revenue increased compared to 2018 and this was caused by higher deliveries, a better price mix and higher levels of income from non-automotive activities. However, in terms of performance there were only two OEMs to post double-digit growth: Ferrari and Tesla.

In terms of profit, Toyota led the ranking by operating profits with €21.2 billion – however this is an increase of only 1%. This means that they had an operational profit of €1,976 per unit sold, ahead of Volkswagen and all of its Japanese rivals (with the exception of Isuzu). This period of volatility is not having a negative impact on Toyota, compared to its peers. The performance can be explained by the hybrid models in its lineup.

Ferrari is a money maker while Tesla is still losing money

With 10,131 cars sold last year, Ferrari continued to dominate the profitability ranking. After setting a record result of sales figures, the Italian car maker recorded a 23.2% operational margin, with each unit worth more than €86,000. Their quick adoption of new technologies, ability to adapt to changes in the market and their impressive marketing department, allowed Ferrari to successfully navigate the tough period. Impressively, they achieved these strong results without the contribution of SUVs. Would the inclusion of SUVs boost their profits even further?

Tesla remains an outlier, running on a different business model to many of its competitors. The introduction of the Tesla Model 3 helped the brand to expand its global presence and increase unit sales. However, as it is a cheaper car than the other Tesla models, revenue did not grow to similar levels. Tesla is still in an expansion phase, burning money in order to grow the business. This explains its 2019 operational loss of €61.6 million, at loss of €346.4 million in 2018. This means they have lost €168 for each car sold.

What’s next?

We forecast that the industry won’t see green figures this year. The global pandemic is causing more trouble than expected and many OEMs will struggle to end the year with cash in their pockets. If the scenario was complex in 2019, this year is catastrophic. In addition to this, car makers operating in Europe face incoming penalties for excess of emissions.

The question become, will the manufacturers survive alone, or will governments intervene and play a more relevant role?

*Aston Martin Lagonda, BMW Group, BYD Company, Daimler, FCA, Ferrari, Ford, Geely Auto, GM, Great Wall Motors, Honda, Hyundai, Isuzu, JAC Motors, JLR, Kia, Mazda, Mitsubishi, Nissan, PSA, Renault, Subaru, Suzuki, Tata Motors, Tesla, Toyota, Volvo and VW Group. The report excludes the Chinese companies that also produce vehicles for foreign brands. ** Exchange rate EUR – other currencies on 31/12/2019

Source: manufacturers

Very great job, well done. Thank you.

LikeLike

Gracias Javier

LikeLike

VERY HELPFUL ARTICLE, THANK YOU!

Just a small question, how did you calculated the number 86,369 operating profit per car? or where could i found the number which disclose by Ferrari?

LikeLike

It is the result of dividing total operating profits by total units sold/delivered

LikeLike

Pingback: L’incroyable rentabilité de Ferrari en un tableau - Tounesna News

Pingback: L’incroyable rentabilité de Ferrari en un tableau - InfoUtiles

Pingback: L’incroyable rentabilité de Ferrari en un tableau - World Top Buzz

Pingback: L'incroyable rentabilité de Ferrari en un tableau - 24H News

Pingback: Global car maker profits dipped 11% in 2019 | Cars News

Pingback: Global car maker profits dipped 11% in 2019 - The Garage Seaham

Pingback: Ferrari Made A $94,000 Profit On Each Car It Sold In 2019: Study – vehicle twenty19

Pingback: Ferrari Made A $94,000 Profit On Each Car It Sold In 2019: Study | Livingo Group

Pingback: Toyota would have to sell 44 cars to make the same amount Ferrari makes from one car - Singapore Car Reviews, News, Tips and Tricks

Pingback: Ferrari Made A $94,000 Profit On Each Car It Sold In 2019: Study – Car News Media Today

Pingback: LO REVELARON - ¿ Cuanto ganó Ferrari por cada auto que vendió en el 2019 ? - Gossip Vehiculos

Pingback: The Automotive Market Has Gone into the Deep Freeze Except for Ferrari (NYSE:RACE) the Sector's Aristocrat - Live Trading News

Pingback: 自動車市場はセクターの貴族であるフェラーリ(NYSE:RACE)を除いて、Deep Freezeに入りました | Let`s Start Investing

Pingback: 自動車28ブランドの利益率公開!フェラーリは1台売って1023万円の利益。日産が同じ額を稼ぐには926台を売らなくてはならない・・・ - Life in the FAST LANE.

Pingback: Ferrari obtuvo una ganancia de $ 94,000 en cada automóvil que vendió en 2019: estudio | Heaven32

Pingback: Ferrari Hizo Un 94.000 Dólares De Beneficio En Cada Uno De Los Autos Que Se Venden En 2019: Estudio - Public Carros

Interesting.

LikeLike

Pingback: ¿Cuánto dinero gana Ferrari con la venta de cada auto? | Dineroclub.net - Medio Digital Internacional

Pingback: Ferrari a realizat un profit mediu uriaș în 2019 | 24Auto

Pingback: Ferrari lucrou 90 mil euros por carro em 2019 | Auto Drive

Pingback: Marcas mais rentáveis do mundo: Ferrari domina tabela

Pingback: Few but profitable. Ferrari is unbeatable in profit | NetNewsPike

Pingback: Poucos mas rentáveis. Ferrari é imbatível no lucro – Confidence News

Pingback: Sales of Ferraris and other luxury vehicles exceed expectations due to global car sales plummeting - Technology Shout

Pingback: Ferrari sales and other Luxury Cars beat Estimates as Global Car sales plummet

Pingback: Ferrari sales and other Luxury Cars beat Estimates as Global Car sales plummet - Get all the latest update on Bollywood, Automobile , Cricket, Technology and Travel etc.

Pingback: Sales of Ferraris and other luxury vehicles exceed expectations due to global car sales plummeting - Technology Shout

Pingback: Ferrari sales and other Luxury Cars beat Estimates as Global Car sales plummet – LUXENGER

Pingback: GM And Nikola: A Fine Deal For GM - Talk Right

Pingback: ¿Cuánto dinero gana Ferrari con la venta de cada auto? | Dineroclub.net

Pingback: L'incroyable rentabilité de Ferrari en un tableau - Auto moto : magazine auto et moto

Pingback: Ultimate Guide To An Effective Business Strategy - Super Scaling

Pingback: În 2019, Ferrari a avut un câştig de peste 86000 de euro per maşină vândută! Şi asta neavând un SUV

Pingback: L'incroyable rentabilité de Ferrari en un tableau

Passive income

Artificial Intelligence and technology are powerful tools that hold limitless opportunities and possibilities. Finley Asia’s simple-to-connect hardware changes the way you look at wealth building.

LikeLike

We provide single-window solutions, like Bulk sms, VoIP, call center solutions, and manpower enlistment services. We are here to empower businesses to communicate effectively and efficiently, while also fostering talent and providing opportunities for the growth and development of individuals.

https://www.blissfulemergingtechnologies.com/

LikeLike

Satin labels are relatively durable and can withstand washing, making them suitable for clothing and textile applications.

https://rudraprints.com/

LikeLike

Ensure compliance with regulations and obtain consent from recipients before sending Bulk SMS messages.

https://brainmaptechnologies.com/

LikeLike