The auto industry is certainly one of the big casualties of COVID-19. The outbreak started to hit the economy in China by the end of January, and soon spread in Europe in early March. By the end of March, more than half of the world population was under lockdown. As a consequence, sales of vehicles fell by 21% in Q1 with the effects on revenue and profits.

414 billion euro in revenue

Revenue of the 27* most important OEMs totaled 413.6 billion euro, down by 8%. The drop was lower than the unit sales decrease indicating that the automakers increased prices or reduced incentives, rebates, in order to protect revenues.

In fact, the average retail price of the vehicles sold in Q1 increased by 16% to 25,713 euro. This is a huge increase that did not help to offset the uncertainty generated by the coronavirus crisis. PSA posted the highest price increase possibly because of the repositioning of Peugeot and Opel brands in Europe.

In contrast, Tesla was one of the five OEMs to see a reduction in the average retail price of its cars. The highest contribution of Tesla Model 3 with cheaper versions explains this reduction. Higher sales of more affordable Ferrari’s and Aston Martin’s also contributed to their lower average prices.

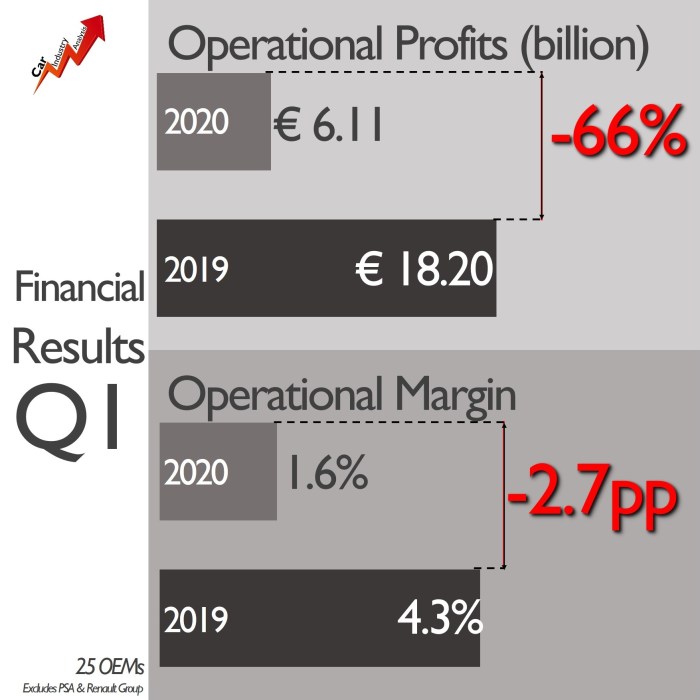

Profits down by 66%

The massive drop in profits confirms how difficult the situation is for the majority of OEMs. In Q1 2020, the 25 companies* reported operational profits of 6.1 billion euro, or one third of the profits recorded in Q1 2019, when they saw 18.2 billion euro.

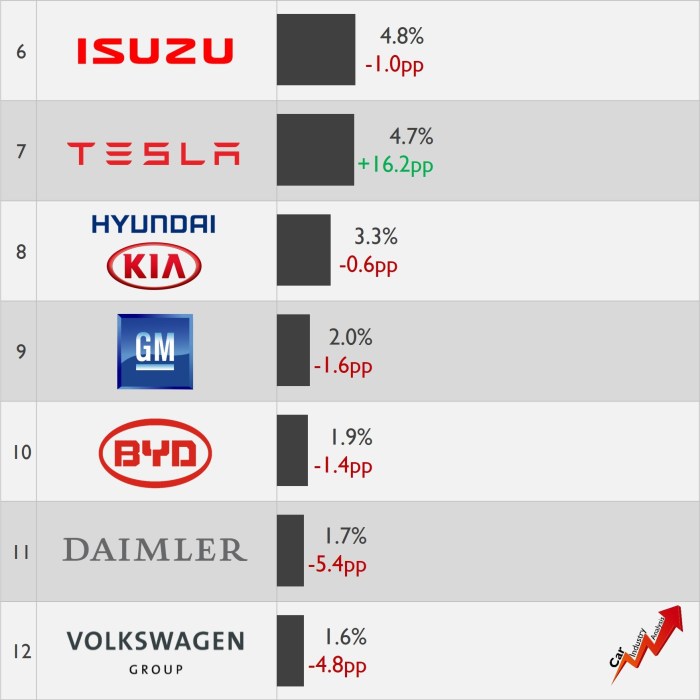

As most of them halted production, they could not absorb the fixed and operational costs, so they lost some millions. It was the case of Ford, Nissan, JLR,Tata, Great Wall, Aston Martin, McLaren, JAC and Honda. Other 12 OEMs recorded double-digit drops in their profits, while only BMW, Subaru and Hyundai increased them.

Tesla was the star during the quarter, as it turned its loses of 466 million euro in Q1-19 to profits of 257 million euro. Elon Musk’s efforts are finally paying off, with Tesla becoming one of the top 10 most profitable OEMs during the quarter.

What’s behind this outstanding result? the success of Tesla Model 3 explains most of it. In Q1 2019, the Model 3 was starting to climb in the US ranking, while it was just a new entry in Europe and China. Sales of the midsize sedan increased by 34% in Q1 helping Tesla to offset the drops posted by Model S and Model X, and most important, to finally use the full capacity of its plant in California.

At the same time, more than a problem, the pandemic became an opportunity for Tesla to expand its presence and sell more cars. Demand of green cars have accelerated due to the association of the virus presence to environmental issues. The higher interest of consumers on EVs has been accompanied by a wider offer and better battery ranges. The Model 3 was there when it was needed.

However, as Tesla grows fast it is clear that it is slowly turning into another giant OEM with its strengths and weaknesses. I mean, one of the main strengths of Tesla so far is its ability to change and to adapt to new trends. It is a small company so it is easier to be flexible. But as it grows bigger, it needs more plants (they just built one in China, and two more are coming in Berlin and Texas), more staff and more suppliers. These changes will impact the high speed it moves and will affect its flexibility.

It is just the beginning

These results are just the beginning of a long crisis that will hit the industry hard. Both European and US markets are set to post double-digit drops by the end of this year, while China will barely grow. Latin America, South East Asia, India and the Middle East will also face tough times.

The situation is so dramatic that some brands will disappear or reduced to few models. Other groups will be absorbed by the ones who have more cash (Tesla?), and some others will be forced to set alliances or collaboration agreements with their rivals.

Only the companies that have focused more on EVs are likely to suffer the least. This includes not only Tesla but especially many Chinese companies that will finally find their way to expand globally. In the meantime, the autonomous driving cars and other coming technologies are likely to find funds from other sources.

Source: manufacturers

*PSA and Renault Group only report revenue information; Volvo, Geely did not release Q1 results by the time this article was written

**Exchange EUR – other currencies 31/03/2019 and 31/03/2020

Pingback: May 2020: post-pandemic recovery under way | Fiat Group World