Fiat Uno is Brazil’s second best-selling car. Photo by netcarshow.com

September 2012 was a good and bad month for car registrations in Brazil and Argentina. Fiat Automoveis in Brazil was up 15.5% in a market down 5.2%. Meanwhile in Argentina things are not that good, as Fiat was down a massive 44.3%, much more than total market’s, down 24%. With a big market share in both markets, Fiat Auto depends a lot on them as European sales plunge and there is no solution yet. It is why it was so shocking not to see any all-new model in Sao Paulo last week, which is the most important car show in the region. Brazil and Argentina make part of MERCOSUR, one of world’s largest union trades, and their industry is more or less the same, sharing a lot of models and production lines.

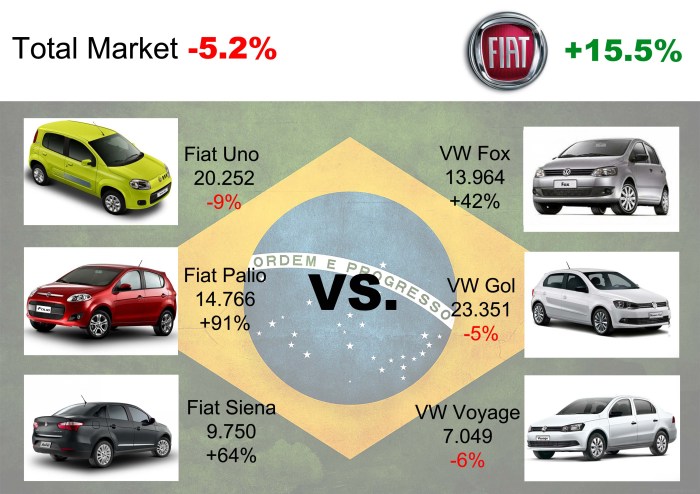

September 2012 Brazil, Fiat’s top 3 best-selling models against its main rivals from VW. Source: bestsellingcarsblog.com, carsitaly.net

Fiat sold 54.800 passenger cars in Brazil last month, less than previous month (in which Fiat plus all its LCV brands sold a record of 100.000 cars). However, due to a tiny fall of the whole market, Fiat increased its market share and had its best so far, 25.57%. The reason for this is the great performance of new Palio, up 91%, which after one year of its official launch, seems to finally take off, no matter the difficult times it will face in the next months with the arrival of the updated VW Gol and new Hyundai HB20 and Chevrolet Onix, all presented in Sao Paulo. The new Siena did also great, up 64%, and it was the best-selling small sedan during that month, beating Chevrolet Corsa Sedan and VW Voyage. The popular Uno stays back, down 9%, as its main competitor, the VW Fox, grows 42%. It all seems that the Uno reached its top of its commercial life, while the Palio and Siena still have a bit way to grow. What’s missing is the arrival of new generation Strada, still strong but soon will get old.

Argentina’s car sales September 2012. Notice that new Fiat Palio is the only model from ‘B-Segment’ to increase its sales figures. Very bad for the Uno, Punto and Fiorino. The coming facelifted Punto and new Doblo will help to boost Fiat registrations. Source: bestsellingcarsblog.com, Autoblog Español

In Argentina Fiat brand sold a bit more than 5 thousand cars and contrary to what happened in Brazil, it got its worst market share so far this year, 7.97%. September was the fourth consecutive month of sales decrease for the company, in a market that shows signals of depletion. The boom the car industry had last year seems to finish this year as some economic problems affect buyers decision. Only the new Palio has good performance, up 16%. The Siena is down an alarming 56%, waiting for the new generation to come in the next weeks. The bad performance of the Siena (historically Argentina’s best-seller Fiat) plus the Uno down 57%, can explain the reason of the fall of the brand. These falls are explained by lower general demand but also because of some problems of stock as customs in the border with Brazil had some bureaucratic problems. Nevertheless Fiat has just presented the new Siena (starting at $17.300) and from some weeks ago it offers the Bravo, imported directly from Italy, starting at $29.900 US dollars. It is also working on more launches, with the new Punto, coming from Brazil, or the Idea. Even the Doblo, the passenger LCV made in Turkey, is part of the new cars Fiat will present soon, as this kind of vehicles is some how popular and Fiat has an important market share.

The Grand Siena was already presented in Argentina. It will be positioned between the regular Siena, locally produced, and the Linea. Photo by Carsale