It’s becoming frequent to hear bad news coming from Europe. Every month European car sales are released with terrible results that seem not to hit rock bottom. This year about 12.5 million cars will be sold, which is by far one of the worst results in the last 15 years. All of this mess is known by everybody and makes no sense to keep talking about it. Nevertheless when looking at car sales figures of 5 years ago, it is clear that not only the market has dropped dramatically but also its composition. The change can be seen in every road in Europe and if the trend is not stopped, several car makers will have even more problems in the future.

It’s becoming frequent to hear bad news coming from Europe. Every month European car sales are released with terrible results that seem not to hit rock bottom. This year about 12.5 million cars will be sold, which is by far one of the worst results in the last 15 years. All of this mess is known by everybody and makes no sense to keep talking about it. Nevertheless when looking at car sales figures of 5 years ago, it is clear that not only the market has dropped dramatically but also its composition. The change can be seen in every road in Europe and if the trend is not stopped, several car makers will have even more problems in the future.

European Union + EFTA countries car sales for 2007. Notice the big importance Italy had in European market. Big numbers for Spain, Greece and Portugal. Among car makers notice the short distance there was between Opel, Ford, Renault, Peugeot and Fiat, and VW. Audi was occupied 11th place in the ranking. Hyundai and Kia got a combined market share of 3.5%. Fiat brand almost sold 1 million cars while Alfa and Lancia sold more than 265.000 units combined. Souce: ACEA

In 2007, just 5 years ago, almost 16 million cars were sold in the European Union plus EFTA countries (Iceland, Norway, Switzerland and Liechtenstein). By that time American financial crisis was about to start while Europe had fun with interesting macroeconomic indicators and a ‘healthy’ government management. Europe could say that it could support auto industry with incentives as most of all car makers operating over there had full efficiency and use of their plants. Contrary to what would happen later, by the end of 2007 Germany was one of the few car markets to fall in registrations, while Italy and France led the growth. In other words, European car market was a completely different story 5 years ago. In terms of composition (by brands), VW was of course number one with an important market share, followed by mainstream brands from France, Germany and Italy. The strong growth of almost all car makers was also triggered by good demand coming from Eastern Europe (EU new members). The new economies allowed western companies to invest and develop more business over there. But the subsequent events proved that economy is a continuous cycle and is strongly affected by public affairs.

This figure shows the dramatic change premium and mainstream brands have had. Audi is perhaps the brand to grow more fast than any other. Peugeot, Renault, Ford, Opel, Citroen and Fiat are dealing not only with VW brand competition but also with premium brands. The brands that lost more market share are Opel (-1.7), Toyota (-1.5) and Fiat (-1.4). In the other side, VW gained 2.7, Audi 1.6, and Nissan 1.5 (thanks to Qashqai sales). Source: ACEA

When looking at 2012 results the first word that comes to mind is ‘dramatic’. The fact that by the end of this year about 3.2 million cars won’t be sold is a shocking reality that tells the bad situation that many European car makers face. No matter what the reasons are, Europeans don’t buy car as much as they did and the worse is that it will continue to be like that for the years to come. This may not be the typical crisis in which economy collapses for some years and then it strongly grows again. Besides the current problems with governments’ debt and unemployment among young people, Europe may be coming thru a new trend in which cars don’t occupy the same place anymore. The sharing car program or alternative transport means are good examples of the change. So, by the year 2016 when all analysts expect Europe to grow again, car market will be a completely different one, also because of its composition. If 5 years ago VW Group was the absolute leader, nowadays the big growth of this German player may be unstoppable for the coming years. Meanwhile the other Europeans struggle to survive and the market gets even smaller for them. The problem for PSA, Ford, Renault, Opel and Fiat is not only VW but premium brands. Audi, BMW and Mercedes became the new stars of the show due to their enormous growth and the fact that they enlarged their range of products. In the past they used to sell big sedans while mainstream brands were in charge of smaller segments. Times have changed and now Audi and BMW are strong in ‘C’ segment with their A3 and 1-Series, while Mercedes gets ready with its awesome A-Class. The same happened to Volvo and Lexus. And for smaller segments Audi introduced its successful A1. They all presented their small SUV and minivans, and soon Europeans will be able to buy the ‘C’ segments sedans such as next Audi A3 sedan, Mercedes CLA and BMW 2-Series.

In just 5 years the market collapsed and now 3.14 million fewer cars are sold. Fiat is one of the most affected as all of its major brands fell more than the market (only Ferrari and Maserati gained market share). Excellent performance of Hyundai-Kia (together they sold 6.000 units less than Fiat-Alfa-Lancia combined in YTD Nov 2012). The only VW brand to perform bad was Seat. If the trend continues Skoda may overcome Fiat brand in the next years. Source: ACEA

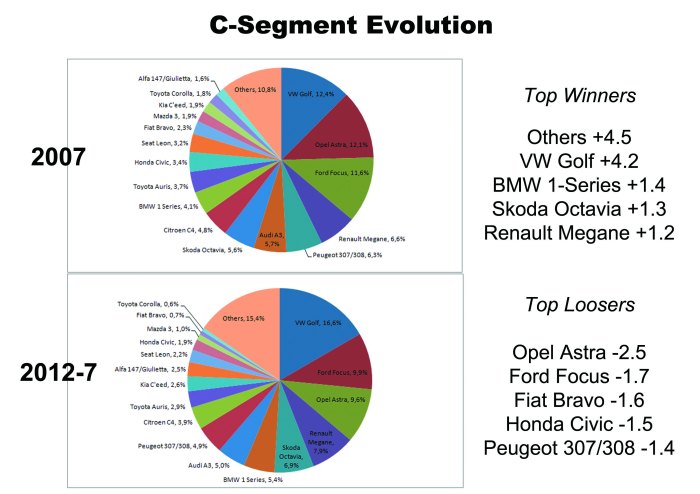

Companies like Peugeot, Citroen, Opel, Renault, Ford and Fiat not only struggle to overcome current crisis but they also figure out how to stop the market share gained by the 3 German premiums. The battle is specially tough in ‘C’ segment, for passenger and SUV. The new premium compact cars gain market share as their traditional rivals don’t catch the attention of buyers as before. It seems that more and more consumers prefer the entry-level versions of an Audi A3 or BMW 1-Series than full level versions of a Focus, Megane or Astra. Of course Fiat is one the most affected brands with this change, as its portfolio gets smaller, its position in ‘C’ segment is now marginal and its premium brands run out of fresh products. Besides it has two big problems: as a brand and as a group, Fiat strongly depends on a single market and in terms of product, it depends a lot on smaller segments without any big presence in larger segments (sedans and SUV). It is why if market share is analyzed Fiat group brands lost an important piece of market share due to the rise of premium brands and Koreans. Europe may not be the same market it used to be and its perspectives may be not as good as wanted, but Fiat should accelerate its plans with Alfa Romeo. It has a great potential to catch some market share of the new rising premium small cars and SUV.

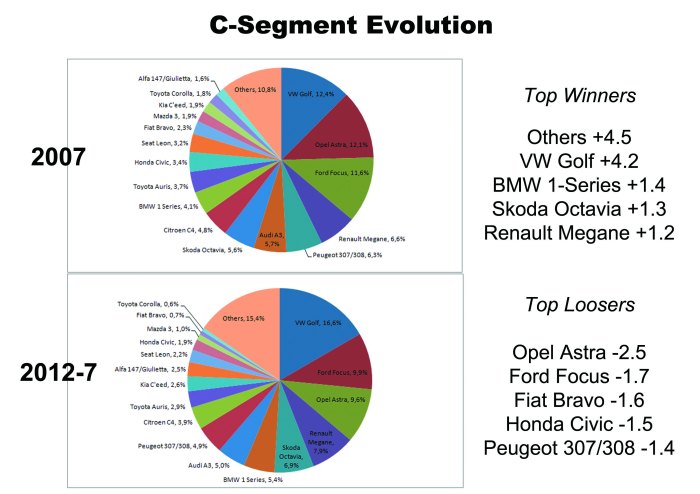

Market share for C-Segment cars in Europe for 2007 and 2012 July YTD. Big changes in the composition of C-Segment. The Golf increases its distance. Others include the success of Hyundai i30. Fiat Bravo’s fall is bigger than the rise of Alfa Giulietta. Source: bestsellingcarsblog.net, carsitaly.net