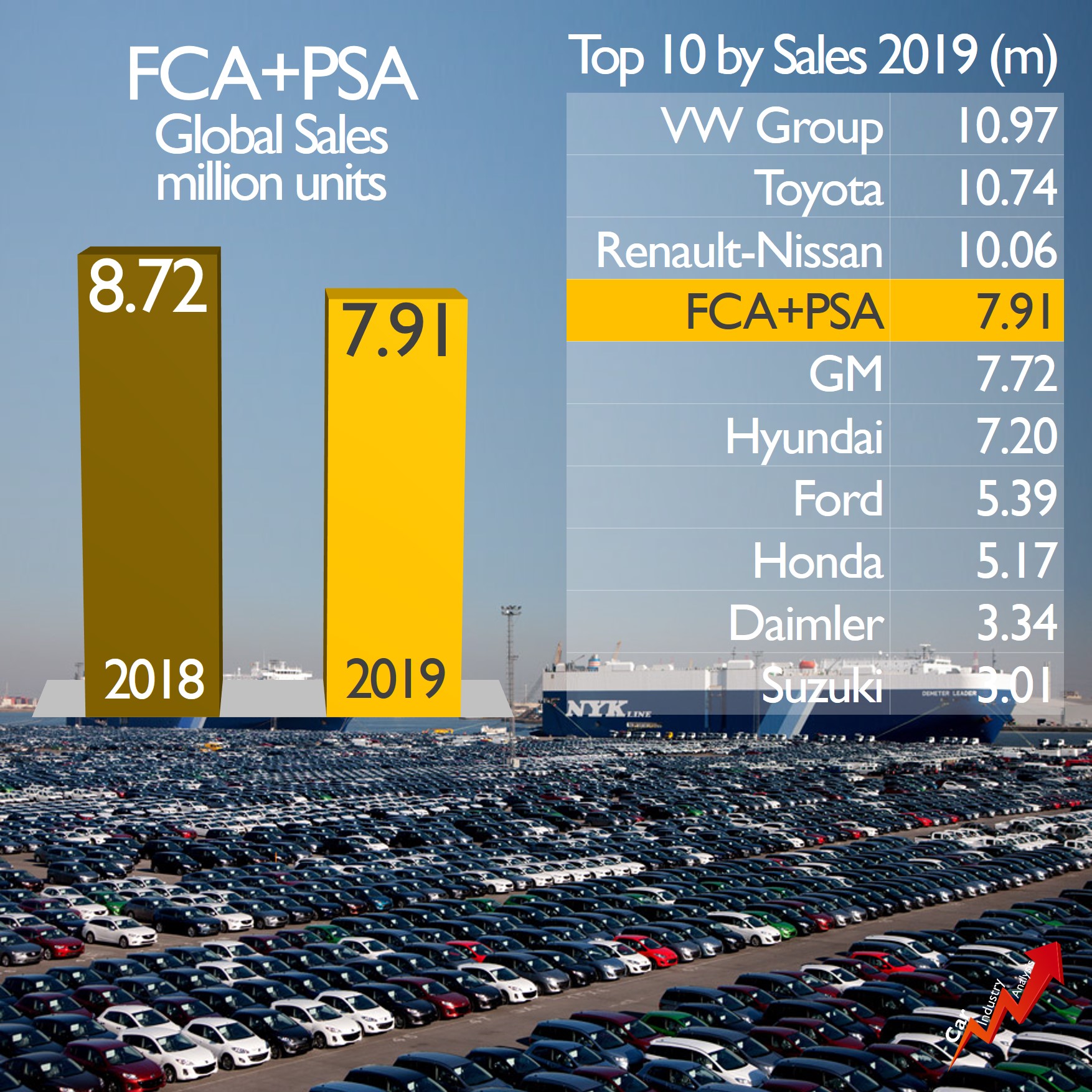

The engagement was announced in October 2019, but the marriage won’t occur before the end of this year. This is the situation of the FCA-PSA merger that will create the world’s fourth largest car maker behind Toyota, Volkswagen, and Renault-Nissan. The announcement preceded what was to become the most serious crisis of the auto industry since World War II.

The scenario today is awfully different from what we saw in October last year. Global vehicle sales fell by 26% in Q1 2020 to 17.4 million units, and April preliminary data indicates a drop of 40% Year-on-Year. This massive contraction did not even take place during the dark months of the financial crisis in 2008-2009. And as the industry is still uncertain about how long this outbreak will last, the players in the industry must prepare quickly for the worst.

The merger makes more sense now than 6 months ago

Following rumors about how the merger could be at risk from virus fallout, both companies confirmed their commitment to it. Despite the difficulties that the COVID-19 outbreak are creating, the merger makes more sense than ever before. These are times to remain solid, guarantee cash flows, and reduce costs. Only a merger can do that.

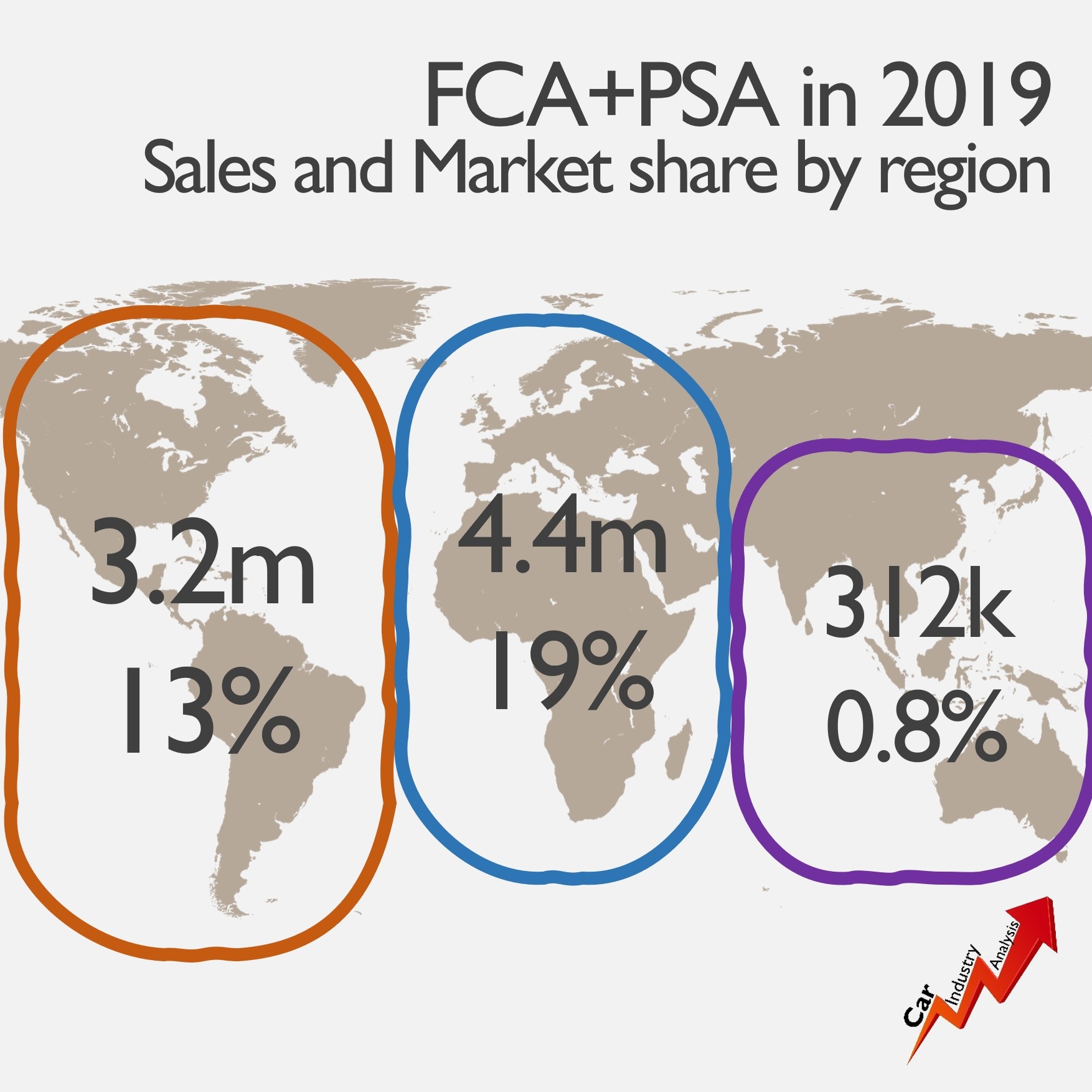

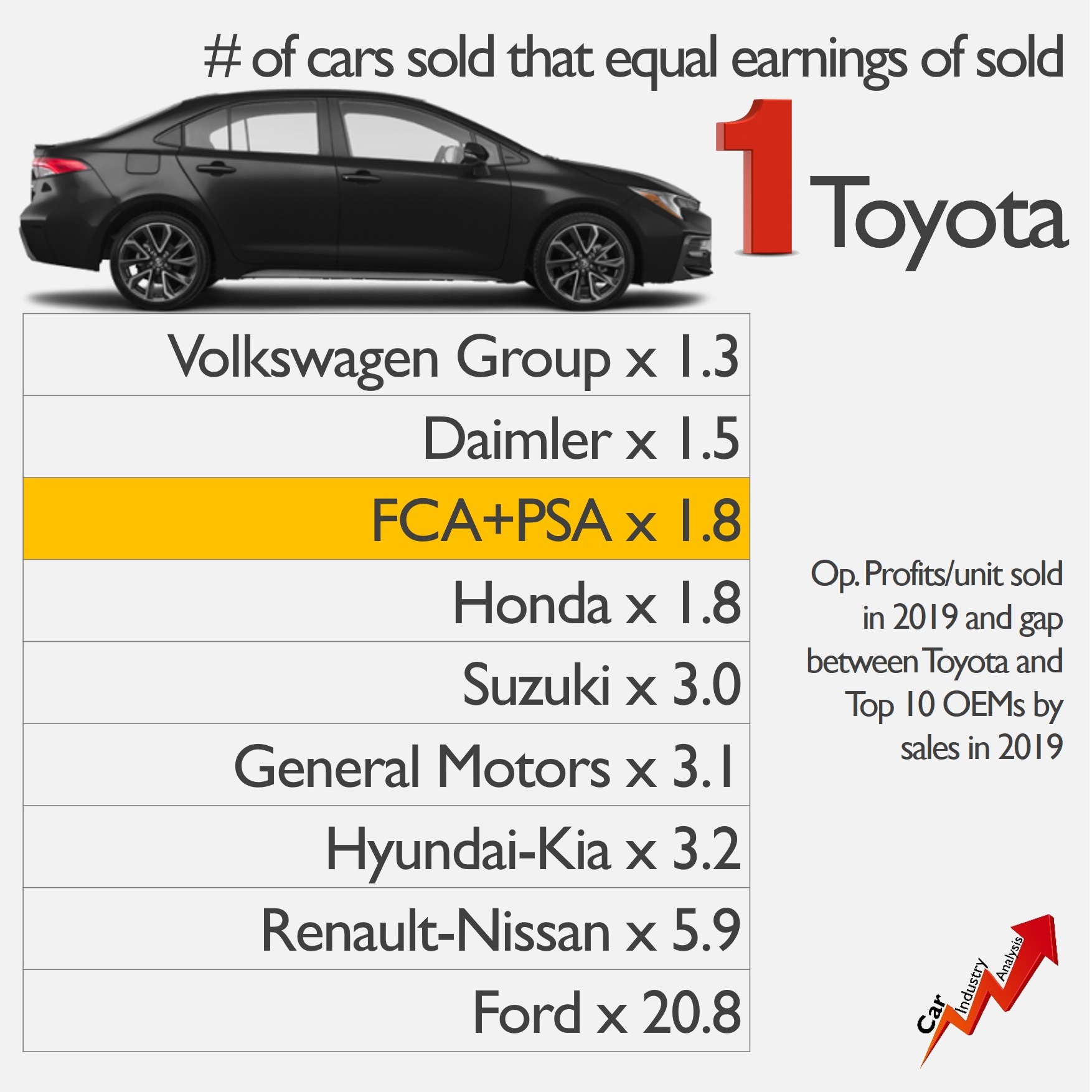

Last year the combined operations of FCA and PSA totaled €183 billion in revenue and €8.7 billion in operating profits. The amounts put FCA-PSA in the third position behind Volkswagen and Toyota and ahead of Renault-Nissan. However, it was the fourth in terms of volume, with 7.9 million vehicles. Thanks to its strong presence in Europe, North and South America, the new group can better face the new threats derived from the pandemic.

At the same time its little exposure to China, can become an advantage in the coming months, when a big economic war is expected to occur between that country and the West. During these times, the merger will have to deal with a more active role from the Italian and French governments, but at the same time, they will likely benefit from their support.

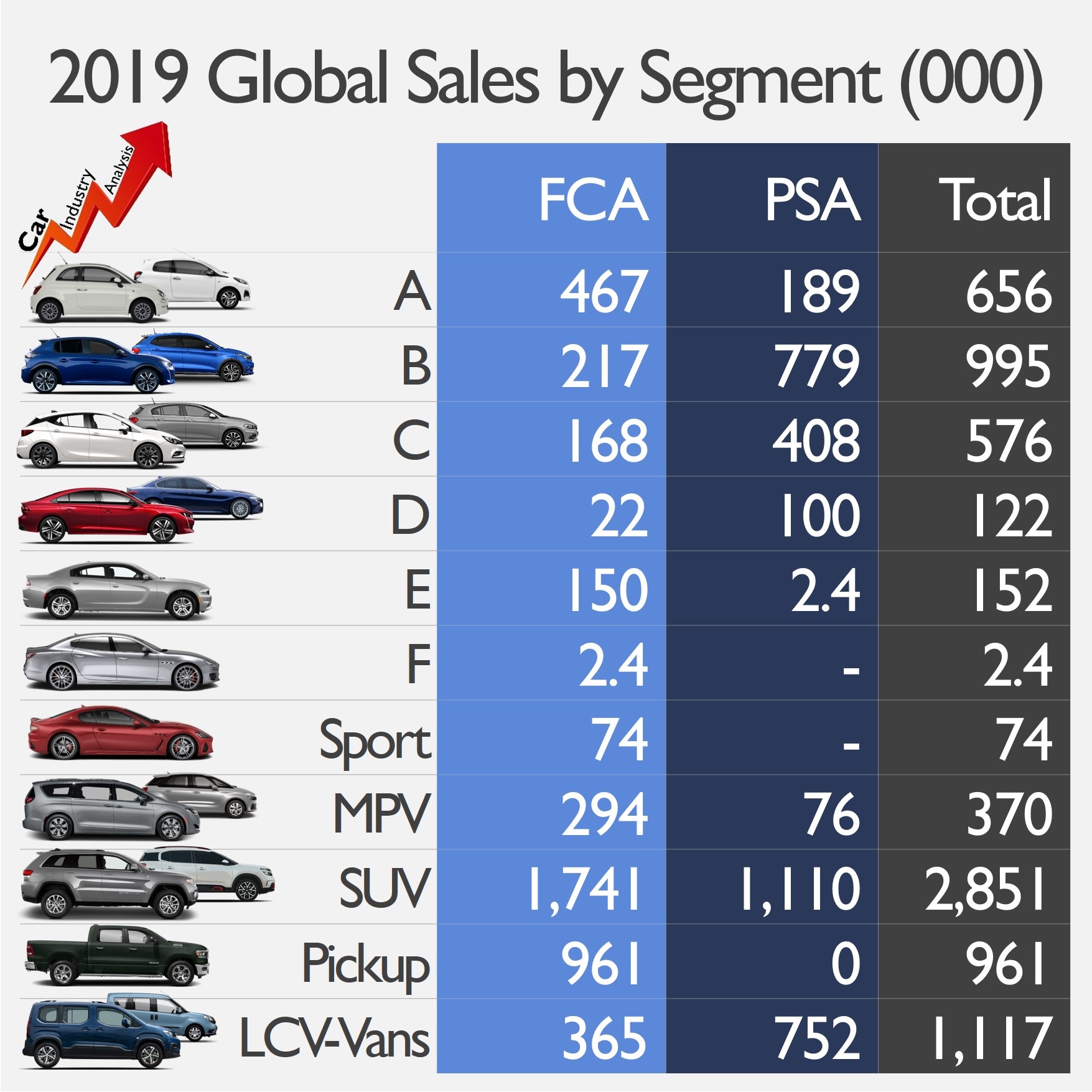

PSA’s knowhow in the EV market can also help FCA to take off in the only segment that is not shrinking yet. On the other hand, the strong presence of FCA in America’s popular pickup segment can also be a relief. If the preliminary studies are confirmed, there should be a boom in the demand of small cars a response to fears of using public transport. If this is true, both companies can also benefit as they are known for their city-cars and subcompacts.

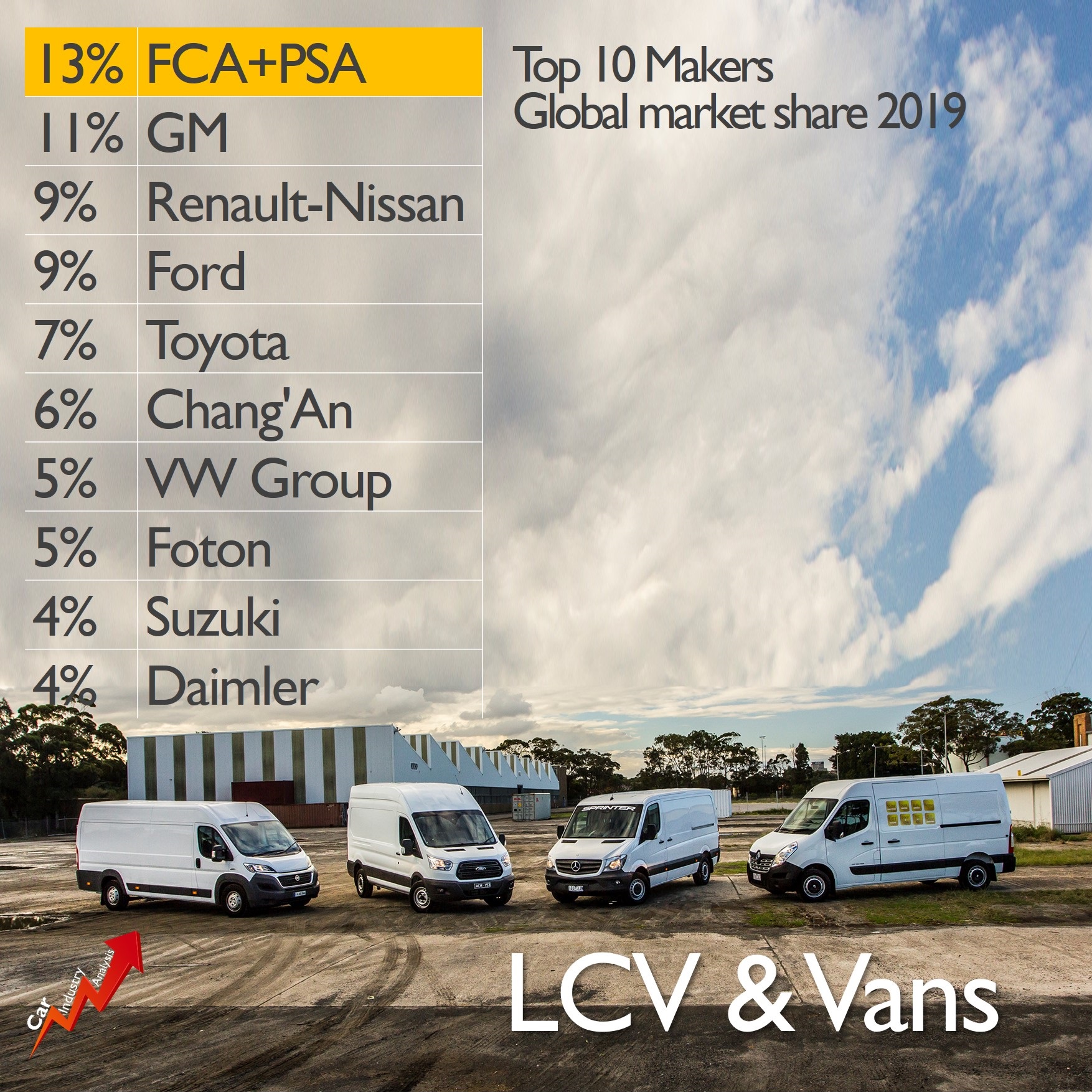

FCA+PSA: the world’ largest LCV seller

One of the most important outcomes of the merger is that the merger will create the world’s top LCV seller. According to my own data coming from several sources, FCA and PSA together sold 1.12 million LCV and Vans in 2019, making up 12.6% of global sales. This total put the merger in the first place ahead of General Motors with 975,000 units and Renault-Nissan with 820,000.

More than sales volume, the importance of this result is related to profits. The light commercial vehicles and their passenger cars derived versions (Vans) are usually cheaper to produce, do not have to respect strong safety and emissions regulations, and leave higher margin. The profitability becomes even more important when sales drop. However, if the economy falls into recession, the trade and freight (the ones moved by the LCV and Vans) are likely to suffer.

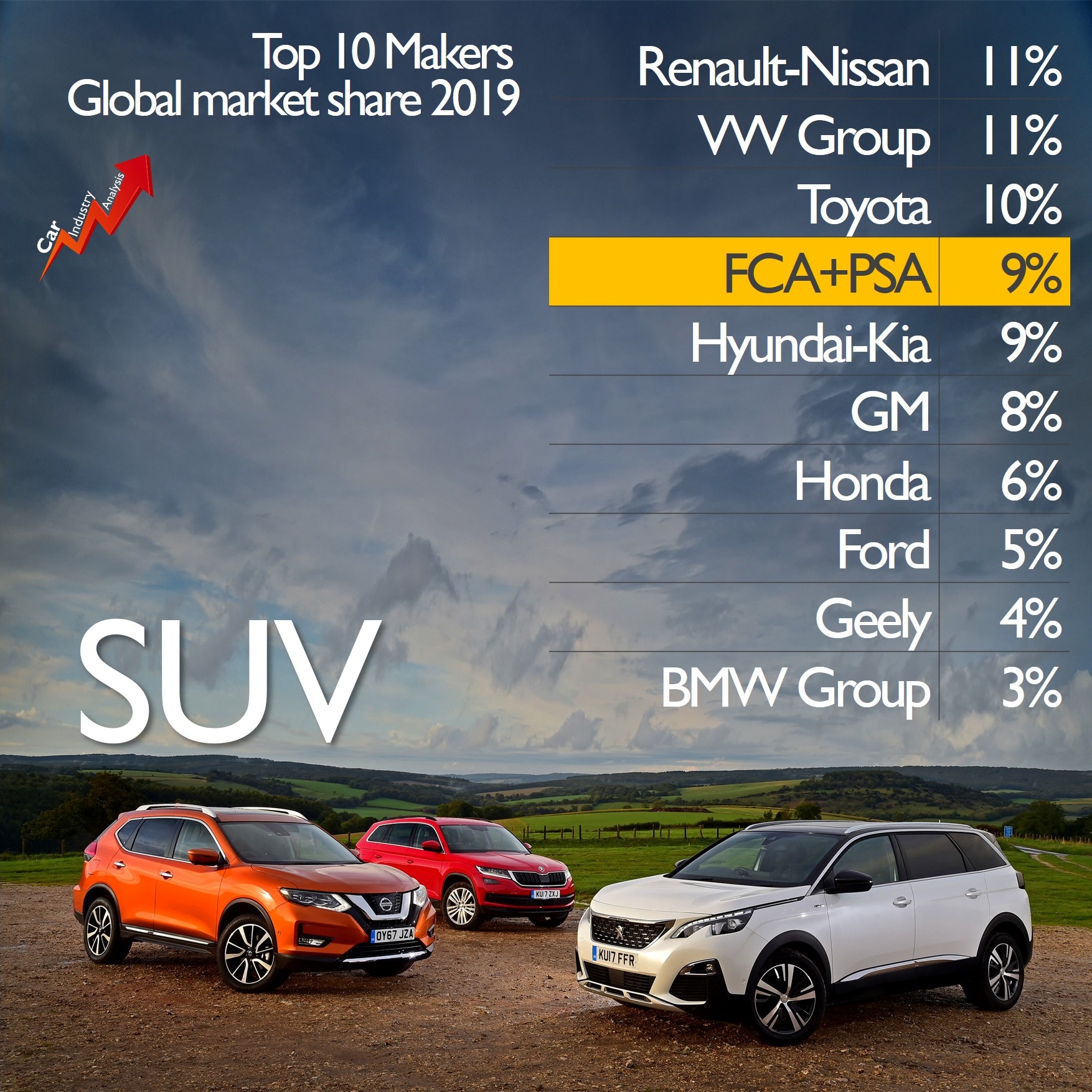

The merger will also have a key position in the SUV segment, the only driver of growth during the last 3 years. In 2019 the SUVs from Peugeot, Citroen, Opel, Jeep, Dodge and Fiat found 2.85 million customers, to become the fourth largest. However, they lost traction compared to 2018 results, when they were the world’s second SUV seller only behind Renault-Nissan. While Fiat, Jeep and Dodge sold fewer SUVs in 2019, other groups like Volkswagen and Toyota recorded strong growth. Jeep needs to be reactivated if they really want this merger to work properly.

Go to my Instagram Profile to see all segments: Car Industry Analysis

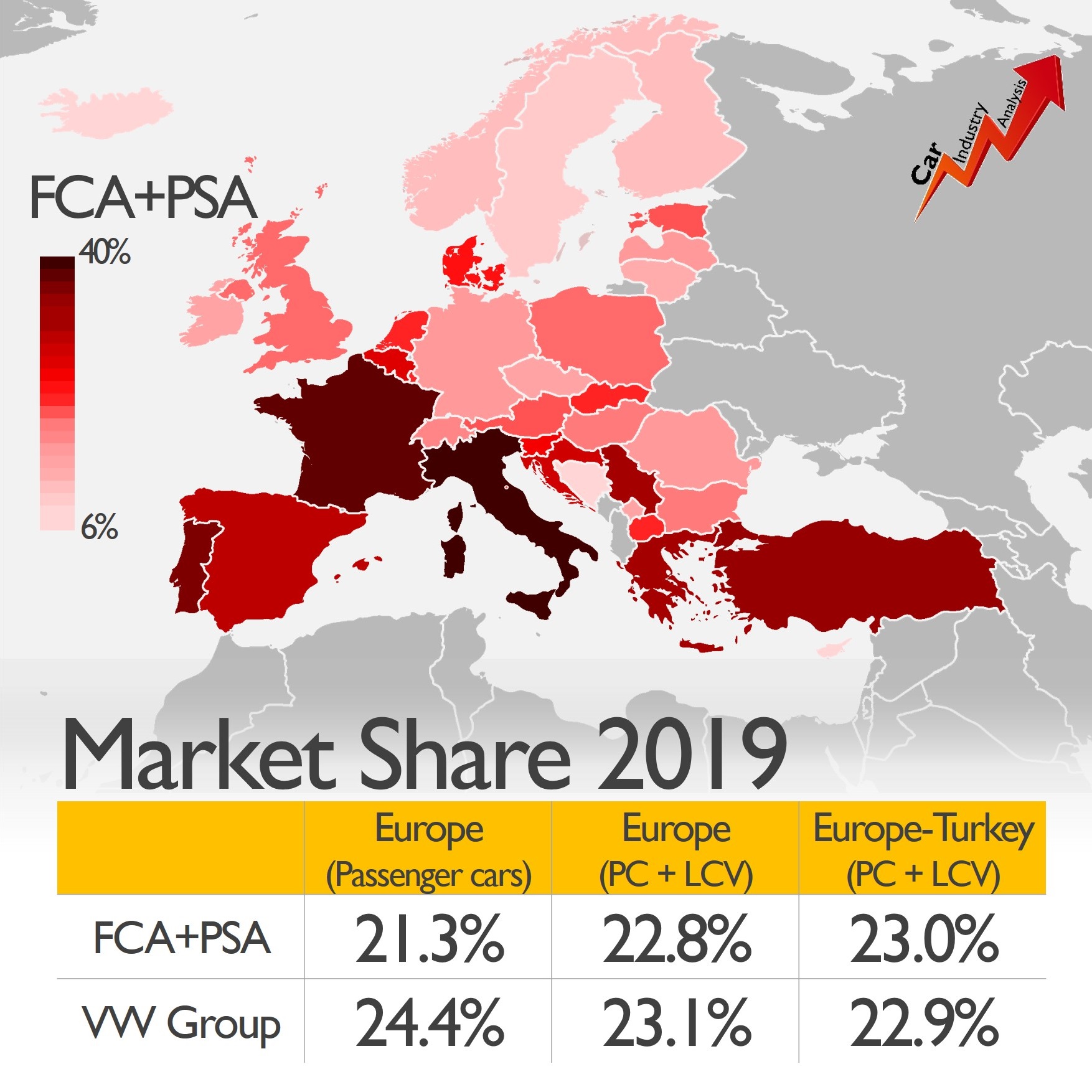

Biggest in Europe

As of 2019, the combined operations of these two companies resulted in Europe’s largest automaker by sales. The data for 37 markets that include 27 EU countries, 3 EFTA nations, Turkey, 4 Balkan nations and two micro States, indicate that FCA+PSA sold 4,249,500 vehicles. The volume fell by 2.4% year-on-year, and allowing Volkswagen Group to get close, as its volume increased by 2.6% to 4,238,300 units.

In addition to France and Italy, they were particularly strong in Spain, Belgium, Turkey, Portugal, Greece, and Serbia.

Strong in the Americas, but very weak in Asia

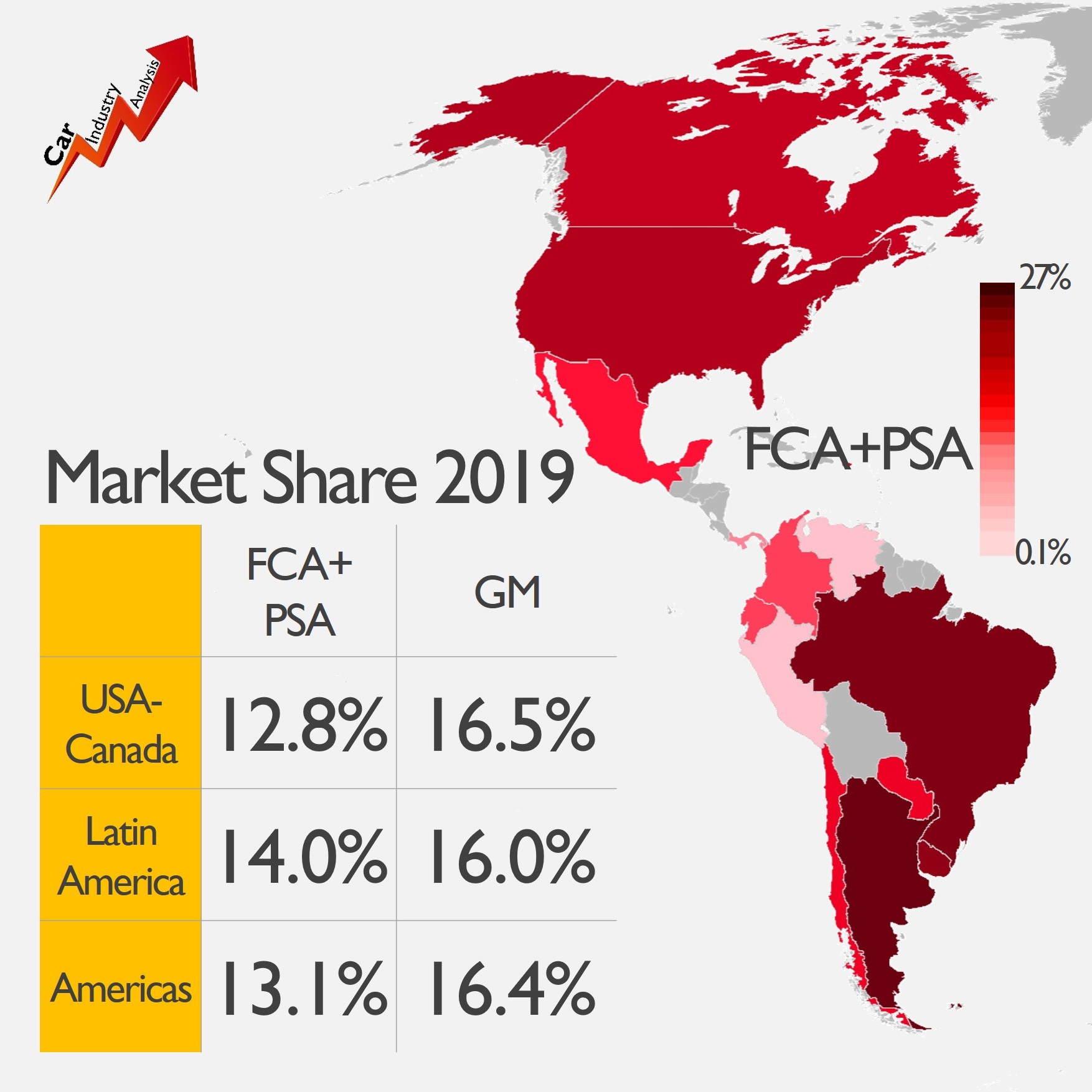

Thanks to the good position of FCA in North America, and the good combined results in South America, the merger was the second largest maker in that region in 2019. This is a key element to consider here, because in addition to its dominant position in Europe, the world’s third largest vehicle market, they occupy the second position in the Americas, the world’s second largest market.

In total, FCA and PSA together was the biggest car maker in Europe and the Americas combined. This is not negligible, considering that these markets represent almost half of sales of global total. The problem is that outside these regions, the presence of the merger is marginal. For instance, their market share in all Asia and Oceania was 0.8%, or the 25th largest carmaker.

Life after COVID-19

The big question is whether both groups will resist or not the outbreak and the coming months of recession. The COVID-19 crisis has confirmed the importance of having a solid financial position, a good strategy for mobility, and a consistent product plan. Months before this crisis started, both groups were already feeling the impact of stagnated sales in some of their key markets.

Moreover, the coming CO2 targets in Europe and the electrification race need solid financial results. Fortunately, PSA has already done a good job with its EVs, while FCA signed a deal with Tesla that will allow to reduce the average emissions and the consequent fines. Nevertheless, they still need to go faster to equal their bigger competitors.

In the mid-term, the COVID-19 outbreak is likely to impact the status-quo of the production plants. The market was already saturated in terms of production capacity in markets like Europe. The crisis will only accelerate the closure of those plants that do not make competitive products. Furthermore, the lower demand will force many OEMs to reduce their presence in countries where they cannot make money (GM started to do it two years ago).

Once all these difficult decisions are taken, the global car industry is going to have a second life. This crisis is an opportunity for the industry to compact and become more competitive, flexible, and faster to changes. And to join forces with another player is due to be an advantage.

Source: Own research, OICA, national vehicle associations, estimations, Autonews, PSA, FCA