The pandemic, the lack of fresh products and structural problems in China hit the global sales of Stellantis in 2020 hard, up to the point that the new group dropped two positions in the sales global ranking by OEMs. It is certainly not a good start for this Italian-American-French automaker that has now more challenges than when they announced their marriage in late 2019.

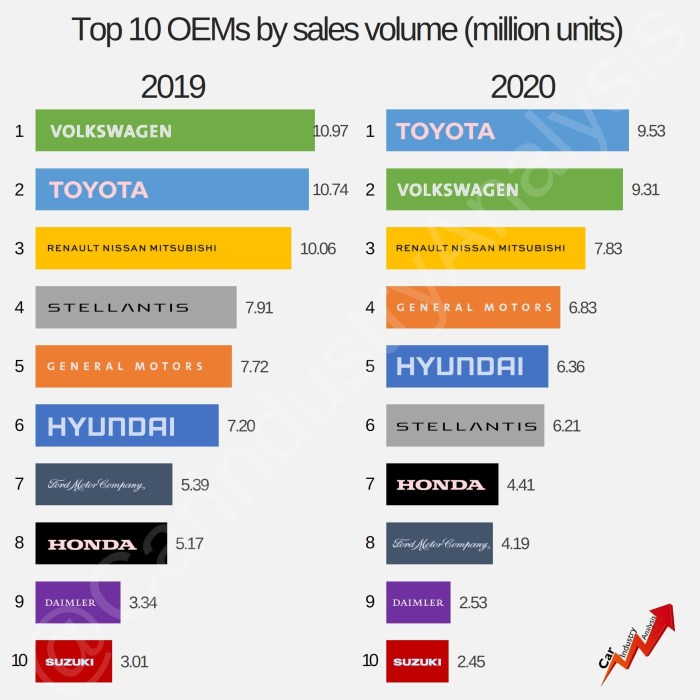

Combined sales of FCA and PSA totaled 6,206,000 units in 2020, down by 22% compared to 2019 figures. When the two companies announced their decision to merge, they became the world’s 4th largest automaker by sales volume. It was only outsold by Volkswagen Group, Toyota and Renault-Nissan-Mitsubishi alliance. With 7,907,000 vehicles sold in 2019, FCA-PSA (which was not called Stellantis by then), was bigger than GM and Hyundai-Kia. One year later, these two outperformed Stellantis.

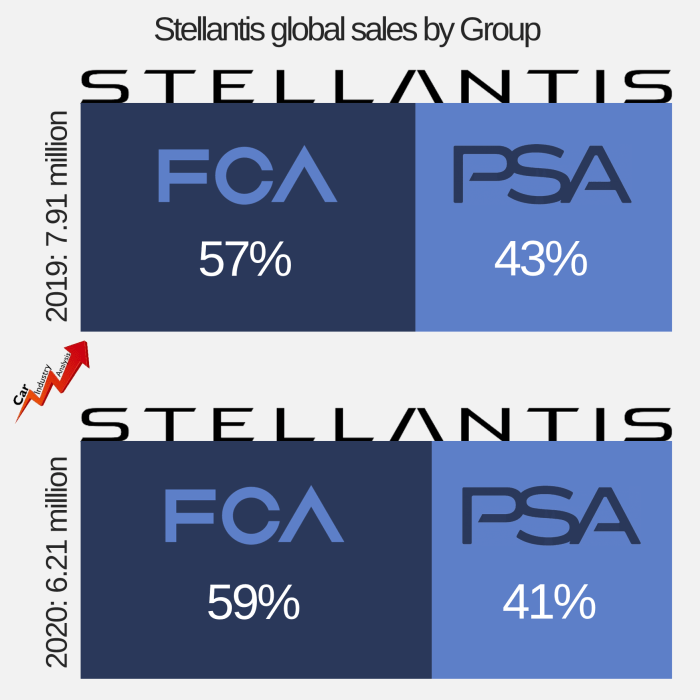

FCA counts for 59% of Stellantis’ sales in 2020

Contrary to the general belief, most of the drop posted by Stellantis in 2020 was driven by PSA and not FCA. The French side recorded a 27% drop to 2.52 million cars, or 41% of the new group’s total in 2020. In 2019, they counted for 43% of the volume of the group. In contrast, FCA’s volume fell by 18% to 3.68 million units.

In fact, FCA’s performance was in line with industry average (-14%), and more similar to some of its peers in the global top 10. The strong presence in North America helped to offset the big drops in Brazil and Europe. It was not the case for PSA, whose sales in Europe make up 85% of its global. Despite its efforts, the cars of PSA continue to lack the global appeal.

In any case, both parts of the new group face the same challenge: to sell competitive cars in China and increase the presence in Asian markets. It is impossible to become a real rival to VW, Toyota and Renault-Nissan without a strong presence there. Stellantis only sold 111,300 vehicles in China in 2020, or 0.4% of total market.

Jeep, the top-selling brand of Stellantis

The results by brands put Jeep as the top-selling brand of the group with 1.23 million units in 2020. The SUV brand posted a decline of 17% in its global sales not only because of the pandemic effect, but also because of the lack of new products. The last time Jeep launched a new vehicle was in H1 2019 (Gladiator). They waited too long to update the Compass and introduce the all-new Grand Cherokee, and still don’t have an A-SUV for India and South America.

Jeep was followed by Fiat brand (includes Abarth and Fiat Professional). The brand from Turin sold 1.15 million vehicles in 2020, down by 15%, following a 16% decline in Europe-Turkey (where it sold 65% of its vehicles) and a 13% drop in Latin America. Fiat has already disappeared from the Indian, Chinese markets, and is endangered in USA. Its main problem persists: a reduced lineup in Europe and lack of SUVs for both Europe and Brazil.

Peugeot sales shrunk to just 1.12 million units losing one position to Fiat. Volume fell by 22% as a consequence of the flop in China (-55%) and 24% decline in Europe. Peugeot has done quite well with its SUVs during the last years, but has lost ground in the compact segments in both Europe and China. Hopefully, the upcoming all-new Peugeot 308 will revert this negative trend and be the base for more appealing sedans in China.

Chrysler contained the drop and Dodge plummets

The rest of the brands all posted double-digit drops too. However, they did not all suffer in the same way. Chrysler for example, which has been falling since 2016 has contained the drop to “just” -11%, the lowest fall among all brands. Fortunately, the Chrysler Pacifica continued to lead the declining MPV segment in USA. Ram also recorded a small drop of 12% to 743,600 units.

DS was the best-performer among the premium pole of the group (DS + Alfa Romeo + Maserati). With 46,900 units, its volume fell by 16% compared to 30% and 37% drops posted by Alfa Romeo and Maserati respectively. Last year, DS outsold Lancia, whose Ypsilon sold 43,100 units, down by 27%. These four brands did not sell more than 170,000 cars last year; Jaguar-Land Rover, Volvo, Lexus all sold more than 400,000 units each.

Citroen was a dark spot too. The brand was affected by more competition in the B-SUV and C-SUV segments and the aged lineup in China. If Tavares doesn’t work fast on Citroen, it can become another headache like Fiat, Alfa Romeo and Chrysler. Opel/Vauxhall is in a different situation. Since Tavares took control of it, the strategy has focused on profitability at the expense of sales, so we’re finally seeing a profitable Opel but less popular than under the GM rule. Will Tavares apply the same formula for Fiat, Chrysler and Dodge?

Dodge got the worst of the crisis. Its sales fell by 38% to just 312,400 units, the lowest result since the 80’s. The brand announced the end of production of the Dodge Journey, Dodge Caravan, leaving only three products available. If nothing changes, Dodge will follow the fate of Chrysler.

Source: FGW database, national car sales offices

Fiat n.º 2 !?! Almost without any new cars…

Stellantis…bring the new Punto(!) and many more…

LikeLike

Does Fiat sales includes LCV as well?

LikeLike

YES

LikeLike

Pingback: Classifica mondiale vendite Gruppi auto 2020: Stellantis scivola al sesto posto -

Everything to the right of Opel/Vauxhall on the graph is in a dismal situation (Fiat is also in bad shape but it still sells in higher numbers so let’s leave it alone on this). It will require lots of cost/platform sharing and investments to save these brands. If I were Tavares, I would pair the weaker ones that somehow match and count them if not as one, at least as one when it comes to most of the development costs.

Make Dodges use Alfa platforms and manufacture Alfas in North America. Get PSA platforms for Chrysler and make it the “civilian car” brand of the group in NA, it needs sedans and crossovers to survive. Possible to make smaller alfas in NA with this scheme as well. Also the new 308 is a good base for an Alfa hatchback in Europe; god they need whatever they can get, look at those numbers. Of all their “premium” brands, I think it is the one more likely to have image, history, and status that can back up a worldwide presence in the upper market. But they have to have the models. And PHEVs/EVs.

Make Lancia what Vauxhall is for Opel, an image-only local brand (which it already is); unlike Chrysler’s, DS’s cars have more or less the same size and brand image as Lancia, as some sort of “luxury stylish urban” car. Long gone are the glory days of performance and rally cars for them, new performance models such as Deltas or Stratos are mostly enthusiast delusions nowadays. A DS-3 with an Italian redesign would probably sell well in Italy. The original DS3 sold well, they should work on the new 500e’s platform and make a new small hatchback for the wealthy urbanites going electric, brand-wise it makes more sense to spend more than 25k euros on a DS than on a Fiat.

Honestly no idea on what to do with Maserati. I knew it sold in small numbers, but 26-17 THOUSAND units make me wonder how it still is going. The Taycan sold more than the entire brand worldwide.

And for God’s sake, they need to get their shit together in Asia as a whole asap.

LikeLike

Pingback: Classifica mondiale vendite Gruppi auto 2020: Stellantis scivola al sesto posto - info24.news