Brazilian car market continues to be the place of good news for Fiat. Last month the brand got its best market share so far this year with 26.17%. It is also the highest share since April 2009. This great result was possible thanks to a big growth in Fiat’s registrations much more than industrywide gain. Fiat was up a massive 45% (the second best performance of this year) while Brazilian car market was up 23%. Compared to October 2011 Fiat sold 20.313 more passenger cars, most of them because of more registrations of the couple Palio-Siena. After the historical record in August for both, Brazilian market and Fiat itself, partly inflated by the fact that IPI reductions could be cut, a big fall was evident in September. Since then, with two extensions of IPI and political measures looking to facilitate credit to buyers, the market is back in October with almost 327.000 units. IPI, for Imposto sobre Produtos Industrializados, is a Brazilian basic tax applied to industrial products produced in or outside Brazil. In the case of Brazilian products, the IPI is calculated based on the sales price, while in the case of imports, it is on sales price plus shipping costs and import duty. Dilma Roussef government places auto industry as one of the most important for future economic development. It is why they decided to reduce this tax as an incentive for the industry and when it all seemed the reduction was going to be cut at the end of August, the government decided to keep the reduction until December 31st. It allows Brazilians to buy cheaper cars, most of them locally produced as there is one ‘Super IPI’ with a higher tax that applies to imported cars. For example, a locally produced Gol with 1.0 liter will pay 0% of IPI until the end of this year, while an imported Picanto with the same engine has to pay 30% of IPI.

Brazilian car market continues to be the place of good news for Fiat. Last month the brand got its best market share so far this year with 26.17%. It is also the highest share since April 2009. This great result was possible thanks to a big growth in Fiat’s registrations much more than industrywide gain. Fiat was up a massive 45% (the second best performance of this year) while Brazilian car market was up 23%. Compared to October 2011 Fiat sold 20.313 more passenger cars, most of them because of more registrations of the couple Palio-Siena. After the historical record in August for both, Brazilian market and Fiat itself, partly inflated by the fact that IPI reductions could be cut, a big fall was evident in September. Since then, with two extensions of IPI and political measures looking to facilitate credit to buyers, the market is back in October with almost 327.000 units. IPI, for Imposto sobre Produtos Industrializados, is a Brazilian basic tax applied to industrial products produced in or outside Brazil. In the case of Brazilian products, the IPI is calculated based on the sales price, while in the case of imports, it is on sales price plus shipping costs and import duty. Dilma Roussef government places auto industry as one of the most important for future economic development. It is why they decided to reduce this tax as an incentive for the industry and when it all seemed the reduction was going to be cut at the end of August, the government decided to keep the reduction until December 31st. It allows Brazilians to buy cheaper cars, most of them locally produced as there is one ‘Super IPI’ with a higher tax that applies to imported cars. For example, a locally produced Gol with 1.0 liter will pay 0% of IPI until the end of this year, while an imported Picanto with the same engine has to pay 30% of IPI.

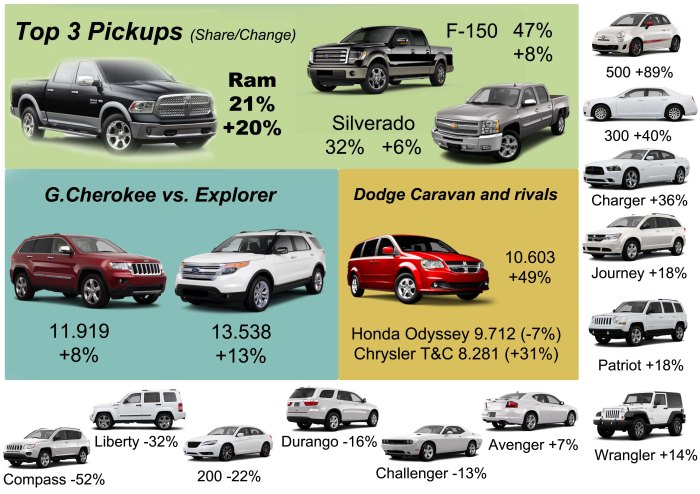

Sales figures for passenger cars. In October Fiat sales grew up two times more than industrywide. Thanks to the reduction of IPI tax, which is applied to final price of the car, most of Fiat models increased their registrations. Source: carsitaly.net, Auto Esporte

Fiat is making use of this tax reduction. The Palio had its best month in terms of share and the second best result in terms of units delivered. Compared to October/11 the ‘B-Segment’ car is up 113% which is an awesome result for mass product such as the Palio. More than 10.000 more Palios were sold last month, accounting for 49% of total rise. The introduction of the sunroof feature may had an impact on this result. The same happened to the ‘B-Sedan’ Siena, up 135%! during that month the Siena got the first place among small sedans. The rise of Palio and Siena counted for 17.195 more cars, 85% of the total. They were both the main stars of Fiat performance in October as the small Uno is up just 3%. The result of Palio and Uno should warn Fiat people as there may be a sort cannibalism between them, specially with the basic versions of the Palio. Down in the list the Strada continues to be Fiat’s most stable model as it keeps being the leader of the ‘C-Pickup’ segment and it is pretty old now. Other good performances: the Punto, boosted by the strong facelift and the small 500 which sold again more than 1 thousand units. Compared to competition, the Palio continues to be behind the Gol but it seems to resist, at least for now, the arrival of all-new Hyundai HB20 and Chevrolet Onix, both models to difficult Palio and Gol’s domination. In other segments, the Idea loses share against the new Spin from Chevrolet, which though it is not considered a small MPV (it is closer to a ‘C-MPV’) its features and prices affects directly the Fiat model. The 500 should be preparing for the arrival of Brazilian-made VW Up!. Anyway, Fiat continues to be Brazil’s leader but coming months will complicate its leadership as more competition will arrive and no new Fiats are expected to arrive shortly. All of that takes place in a market strongly healthy and not dependent on government incentives, well the IPI tax is just that, and when the government reduces it, the market reacts positively as it can buy cheaper cars. The opposite situation of toxic government helps that took place in Europe for years, which allowed many people to buy a car without taking into account the fact that they did not even need one.

Brazil, October 2012. The Uno keeps being Brazil’s best-selling city car but it seems a facelift is needed. The new Palio and Siena are doing great. Just the most expensive cars (500, Bravo and Linea) are doing bad. Source: bestsellincarsblog.net