Europe’s debt crisis and its impact on car industry has become a regular topic among automotive analysts. On a daily basis, specialized press and automakers’ CEOs talk about it in several statements which sometimes can result in an alarm for coming months. And it’s true, the worst has not come yet and it is why VW CEO, Ferdinand Piëch, opened up the discussion about the future of European car makers. He said that current crisis will eliminate one of the big ones of the region as the market will continue to get smaller and production over capacity will be that big that at least one big car maker will disappear. This statement must be analyzed carefully as it comes from Europe’s largest car maker and one of the few that is not having problems at all. No matter whether it is true or not, what Piëch wants is to create even more chaos and uncertainty not only among other car makers having problems right now, but among car buyers who will choose those brands with a ‘brilliant’ future. VW is against Sergio Marchionne’s proposal of controlling over capacity by all car makers in the continent. They earn money thanks to great and boring products while they make use of overseas earnings (China) to compensate the possible losses they could have in Europe. Meanwhile the other ‘big’ are dealing with their own problems: Opel struggling with everybody to keep being protected by GM; Ford loosing more than 1.000 million euros; PSA dealing with French government to close one of its big factories; Renault looking at its operations in South America and Asia to endure the storm; and finally Fiat dealing with a big fall in its native market and fighting with labor unions to rise the productivity.

Europe’s debt crisis and its impact on car industry has become a regular topic among automotive analysts. On a daily basis, specialized press and automakers’ CEOs talk about it in several statements which sometimes can result in an alarm for coming months. And it’s true, the worst has not come yet and it is why VW CEO, Ferdinand Piëch, opened up the discussion about the future of European car makers. He said that current crisis will eliminate one of the big ones of the region as the market will continue to get smaller and production over capacity will be that big that at least one big car maker will disappear. This statement must be analyzed carefully as it comes from Europe’s largest car maker and one of the few that is not having problems at all. No matter whether it is true or not, what Piëch wants is to create even more chaos and uncertainty not only among other car makers having problems right now, but among car buyers who will choose those brands with a ‘brilliant’ future. VW is against Sergio Marchionne’s proposal of controlling over capacity by all car makers in the continent. They earn money thanks to great and boring products while they make use of overseas earnings (China) to compensate the possible losses they could have in Europe. Meanwhile the other ‘big’ are dealing with their own problems: Opel struggling with everybody to keep being protected by GM; Ford loosing more than 1.000 million euros; PSA dealing with French government to close one of its big factories; Renault looking at its operations in South America and Asia to endure the storm; and finally Fiat dealing with a big fall in its native market and fighting with labor unions to rise the productivity.

Ferdinand Piech from VW. Sergio Marchionne, Fiat. Carlos Ghosn, Renault-Nissan. Piech says one big European car maker will disappear by the end of the crisis. Marchionne wants to decrease European production levels, while Ghosn says nothing important will happen during the crisis. Photo by: Automovil Online, Jeff Kobalsky, El Comercio

Today, Renault-Nissan’s CEO, Carlos Ghosn, said nothing extreme will happen. But the thing is not to predict what will happen in the coming years. What all carmakers must do is to find quick solutions to current problem. Of course the first ‘remedy’ is to fire employees. PSA is planning to fire around 10.000 workers so they can reduce expenses and therefore the losses. Meanwhile Marchionne said today that Fiat will not close anymore plants in Italy but will send workers home for more days. All these decisions will solve the problem for some months but at the end the real problem will be the same: more production capacity than demand for the coming years (some say until 2020). After considering this terrible scenario it came to my mind how this 5 big carmakers could get out of the crisis. They have a lot in common and share the same threat, VW domination in Europe. All of them can be classified as mainstream car companies which produces all kind of vehicles, from small A-Segment cars up to big LCV. If they do not move VW will pass from current 23% market share to a bigger part of European market and from that moment trying to stop it will be almost impossible. So, if they are so similar and have the same problem, why not to join forces? it is not about an alliance as it is known so far. But it is about creating a special group composed by GM, Ford, PSA, Renault and Fiat, only for Europe in order to get out of the crisis and stop VW growth. But how could they join forces if they are competitors? how could they share any project if they have interests not only in Europe but outside?

VW is becoming a giant in Europe. If the other big ones don’t do anything they will have even more difficult times in the coming years.

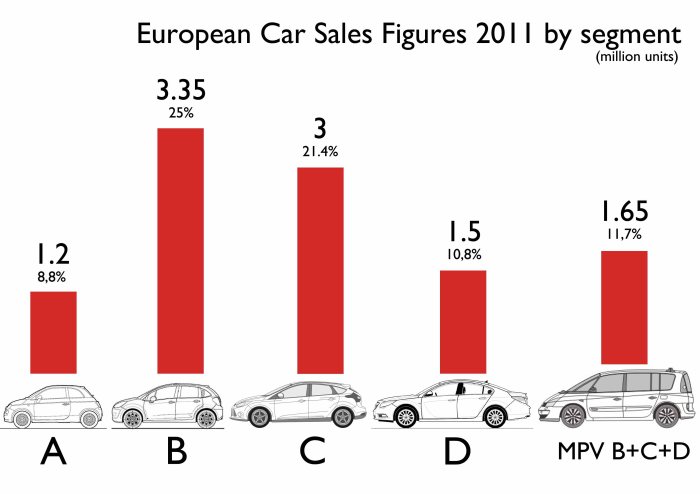

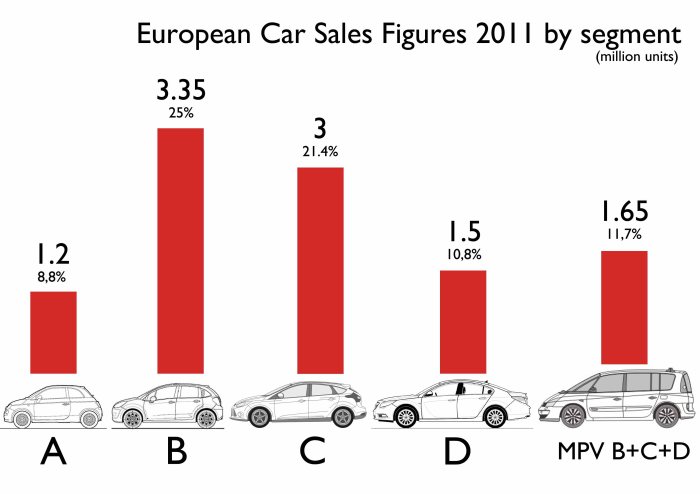

One of the possible solution for them could be to specialize each company on what it can do best only in European market. If they stop competing among them they could get better sales figures producing the cars they do the best. And if European market is divided into segments, well they could divide the market and their production according to the segment they dominate. In other words each car maker would be assigned one segment to produce a car to be sold under all brands. So, if they are 5 car makers they could select the top 5 European main segments by sales figures and then assign each one to a specific car maker. For example, Fiat is the absolute leader of A-Segment in Europe, so for the coming years and exclusively for Europe, Fiat would only produce small cars in its Italian factories to be sold not only under Fiat brand but also as Peugeot, Citroen, Renault, Opel and Ford. Following the example, PSA could produce in France the B-Segment car for all brands. Then Renault could do the same for C-Segment, and Opel could make the D-Segment offer in Germany, while Ford would be in charge of producing all MPVs of the European ‘alliance’. Doing so, the big 5 would benefit from cost savings as they would work together in the development of each car, while they could enhance their local production as more units would be required to fulfill the demand of not only one brand but five. In the example, Fiat would not produce 250.000 units of its 500 and Panda but would have to increase the production up to 600.000 or 700.000 units that means the A-Segment for the 5 makers (last year around 1.2 million units were sold in Europe and VW did not count for anything of them as they had not launched the Up/Mii/Citigo yet). Fiat would increase the production of small cars using its plants in Italy, where it now produces other segments such as the Punto or Bravo. The production of those segments would move to other factories of its allies. In the example, it means that the Punto would now be the result of a unique model developed by all 5 car makers but produced in PSA factories. Of course, for every segment, each car maker would apply a deep design work to differentiate each model from the other brands and keep the family feeling.

Source: Fiat Group’s World Data basis

There are several real examples of this kind of deals and Fiat is part of them. The 500 and Ford Ka produced in Poland, or the Fiat Doblo and Opel Combo produced in Turkey. Or the Suzuki SX4 and Fiat Sedici in Hungary. The difference now would be that not 2 but 5 car makers would be involved in the deal. Of course not all segments have the same size. In 2011, almost 1.2 million units were A-Segment, B-Segment counted for more than 3.3 million, not far from 2.9 million cars sold of C-Segment. Over 1.5 million cars were D-Segment and all MPV segments sold 1.6 million units*. Therefore in the example, Fiat would be in charge of a segment which is much smaller than the one assigned to PSA or Renault. How they could solve these differences? if for example, Fiat has to produce the A-Segment it would focus all its plants to build the small car but it could also produce some part of the B or C segment car, so PSA would not only produce the major part of B-Segment but some part of it would move to Italy to compensate for the smaller part Fiat got. In other words each manufacturer would do what it can do the best but would not have a dominant position in terms of production. Does it mean that a company like Fiat would have to stop building the Punto, Bravo or the Giulietta to give some space to more production of the Panda? yes. For the coming years Fiat would not have an authentic B, C, D or MPV offer but the result of a work together with Opel, Ford, PSA and Renault. Doing that Fiat would benefit from lower development expenses and from the increase of its production in Italy, while the competition would not be as hard as it is now, with not only VW in the field but several others trying to get more market share with a price war. It also means that at the end the 5 big would decrease a part of their production capacity but in a controlled way and all of them doing it, something that Marchionne has been saying from the beginning of the crisis.

As they are independent companies the idea must only work in Europe and the ideas and developments got by the team work can not be taken by anyone to develop car outside Europe. If the problem is in Europe the solution must be exclusively over there. Problems? a lot. First of all, none of the carmakers cited before will want to share independence especially with direct competitors. Second, some carmakers have developed their own models for next years: Fiat presented the Panda in 2011, Peugeot showed the 208 in 2012, while Renault has just shown the new Clio. It also means that all of them must reduce current production levels and maybe fire more people, but at the end they could do it carefully and after an agreement between them, while the big VW could be finally worrying about real tough competition. What would VW think about this idea?

*FGW data basis

Here there are the main highlights of Sergio Marchionne’s interview with Luca Ciferri, Editor-in-Chief of Automotive News Europe:

Here there are the main highlights of Sergio Marchionne’s interview with Luca Ciferri, Editor-in-Chief of Automotive News Europe: