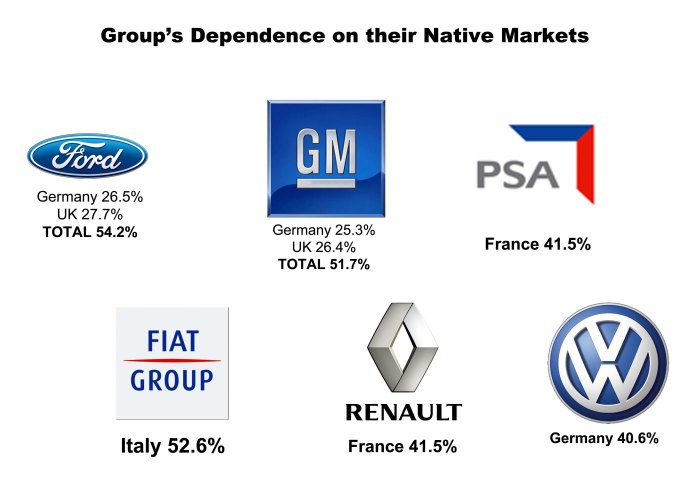

The results for Fiat Group plus Jeep in Europe last month are good and bad. Good because Fiat brand decreased its fall and did well in the UK and Spain. But bad because Alfa Romeo and Lancia shrink and German and French registrations continue to fall. European car market fell 4.6% in October 2012 and the whole group did it too but even more: 5.8%. Its market share falls from 6.6 one year ago to 6.5. Total fall could had been worse if Lancia and Alfa Romeo counted for more share inside the group. Their sales in EU + EFTA countries, declined 15% in the case of Lancia and 17.6% for Alfa Romeo. Jeep, which sold only 2.322 units, is up 6%. Once again the group loses market share but this time the fall slows down as Fiat brand managed to increase it. The brand sold 2.7% less than previous period allowing it to increase its share from 4.7% to 4.8%. In October 2012 the group sold 64.736 units (4.016 units less), and Italy counted for 52.6% of them vs. 55.3% of October 2011. It means the group sells fewer cars in Italy (but keeps stable its share over there) and the fall outside Italy is not that deep. The main problems come from the native Italy and France, which is Alfa Romeo’s second market. Compared to its rivals, Fiat Group did much better than Renault, GM and Ford, but is a step behind PSA. VW Group continues to impress increasing its sales volume and therefore its share to a massive 25.5%, almost 4 times Fiat Group’s. Fiat brand occupies place number 8 even after Audi and BMW that now sell more cars. If market conditions continue to aggravate next year Fiat brand could be surpassed by Skoda, which sold 8.557 less cars and is really close to Toyota brand (120 units behind).

The results for Fiat Group plus Jeep in Europe last month are good and bad. Good because Fiat brand decreased its fall and did well in the UK and Spain. But bad because Alfa Romeo and Lancia shrink and German and French registrations continue to fall. European car market fell 4.6% in October 2012 and the whole group did it too but even more: 5.8%. Its market share falls from 6.6 one year ago to 6.5. Total fall could had been worse if Lancia and Alfa Romeo counted for more share inside the group. Their sales in EU + EFTA countries, declined 15% in the case of Lancia and 17.6% for Alfa Romeo. Jeep, which sold only 2.322 units, is up 6%. Once again the group loses market share but this time the fall slows down as Fiat brand managed to increase it. The brand sold 2.7% less than previous period allowing it to increase its share from 4.7% to 4.8%. In October 2012 the group sold 64.736 units (4.016 units less), and Italy counted for 52.6% of them vs. 55.3% of October 2011. It means the group sells fewer cars in Italy (but keeps stable its share over there) and the fall outside Italy is not that deep. The main problems come from the native Italy and France, which is Alfa Romeo’s second market. Compared to its rivals, Fiat Group did much better than Renault, GM and Ford, but is a step behind PSA. VW Group continues to impress increasing its sales volume and therefore its share to a massive 25.5%, almost 4 times Fiat Group’s. Fiat brand occupies place number 8 even after Audi and BMW that now sell more cars. If market conditions continue to aggravate next year Fiat brand could be surpassed by Skoda, which sold 8.557 less cars and is really close to Toyota brand (120 units behind).

It is amazing the way VW manages to rise its market share. Audi and Mercedes stole market share from Renault, Ford and Opel, mainly. Fiat Group did not fall that much as Renault, GM and Ford. Hyundai keeps growing and in October the whole group (Hyundai + Kia) sold 61.810 cars, just 2.926 cars behind the whole Fiat Group. Source: ACEA

The reason for the tiny fall of Fiat brand is explained by the good results in the UK and Spain. Thanks to optimal registrations of the 500 model (in the top 10 best-selling cars in October), the brand is up a massive 39% in a market up 12%. Contrary to those good results, Alfa Romeo does not stop falling, this time 33%, which is too much compared to the good results of Chrysler, up 288%. Alfa Romeo sold 786 units in Oct/11. Last month Alfa Romeo and Chrysler combined sold 686 units. UK has become a kind of substitution market for French bad numbers but the group is still really small in terms of market share (3.4% for Oct/12 vs. 2.9% for Oct/11). Jeep did also good, up 178%, with 339 units delivered. Something similar occurs in Spain: the whole group’s share is up to 3.36% from 2.91% last year. It gained market share due to a lower fall compared to total’s market. Fiat Group plus Jeep fell 9.5% while Spanish car market declined 22%. Fiat brand is up 7.6%, Jeep is up 15%, but Alfa Romeo shrinks a massive 47% and Lancia sells 2 fewer cars. Once again, interesting results but not enough to help the troubled Italian and French figures.

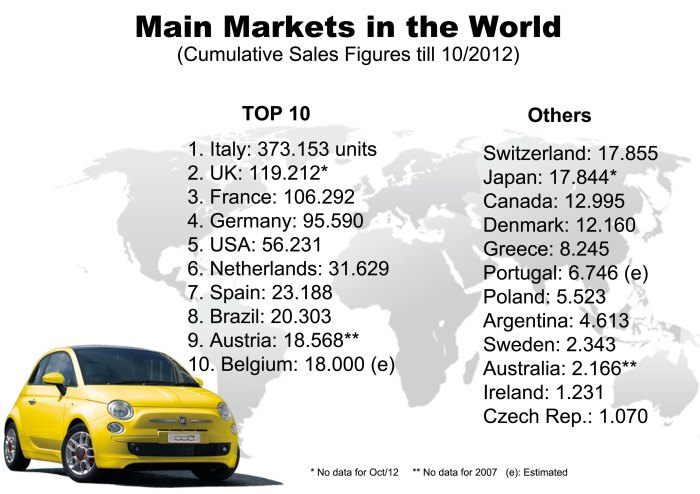

Fiat Group is not really suffering outside Italy. Germany is the largest market in terms of units sold but is the lowest in terms of market share. Good for the UK, Spain and Austria. France is some how stable while the Netherlands and Switzerland did very bad. Source: Autoblog Español, Automotive Austria, ACEA, Rai Netherlands, Auto-Suisse, Carsitaly.net

In France things are going bad but during October 2012 the fall slows down. The market is down 7.8%, much better than previous months results, and Fiat Group declined its registrations by 7.7% thanks to a lower fall of Fiat brand mainly. The brand fell 5.3%, while Lancia increased its registration 1.8% (or 8 more cars), but Alfa Romeo is down 23% (or 259 fewer cars). As it happened in the UK, the 500 model was the protagonist of the month. A record of 2.204 units were sold in October, counting for 54% of the brand’s sales. In Germany, which is Fiat Group’s second most important market after Italy, the group had mix results: Fiat brand is up 8.9% in a market that grew up only 0.5%. But Alfa Romeo declined 20% and Lancia sold only 153 cars, down 0.6%. All brands together (plus Jeep, Ferrari and Maserati) sold 7.244 units against 6.784 in October 2011 (+6.8%). Market share is extremely low at 2.79% against 2.62% for Oct/11. Once again the Fiat 500 is the star with a record sales of 2.310 units. Germany was the largest market for Jeep brand in that month. Too bad in the Netherlands (-38%) where the group sold 1.199 units, down 48%. In Austria (-9%) they all sold 1.497 cars, down 0.4%. In Switzerland all brands sold 1.354 cars compared to 1.637 of last year. In Poland, where Fiat’s share is historically higher than in any other European country, the Group sold 2.169 units (8.5% of the market), down 9%. Generally speaking, Fiat is still strongly dependent on Italian market, which affects its performance as Italy is doing really bad while the good results in other markets is not enough.

This Figure shows the percentage of homeland sales. Almost 53% of Fiat Group’s sales in Europe corresponded to Italy during October 2012. Ford and GM depend on two main markets, while Fiat Group is highly dependent on just one market, which is not good at all. Surprisingly VW Group’s big sales are not exclusively in Germany, which counts for 41% of them. Source: ACEA, Autoblog Español