The European car registrations in H1 2019 show that FCA was able to increase its market share in only two segments. As the overall market deteriorates, the Italian-American automaker lost ground in most of the segments where it operates. Its market share fell in 12 of the 14 segments where FCA has a model.

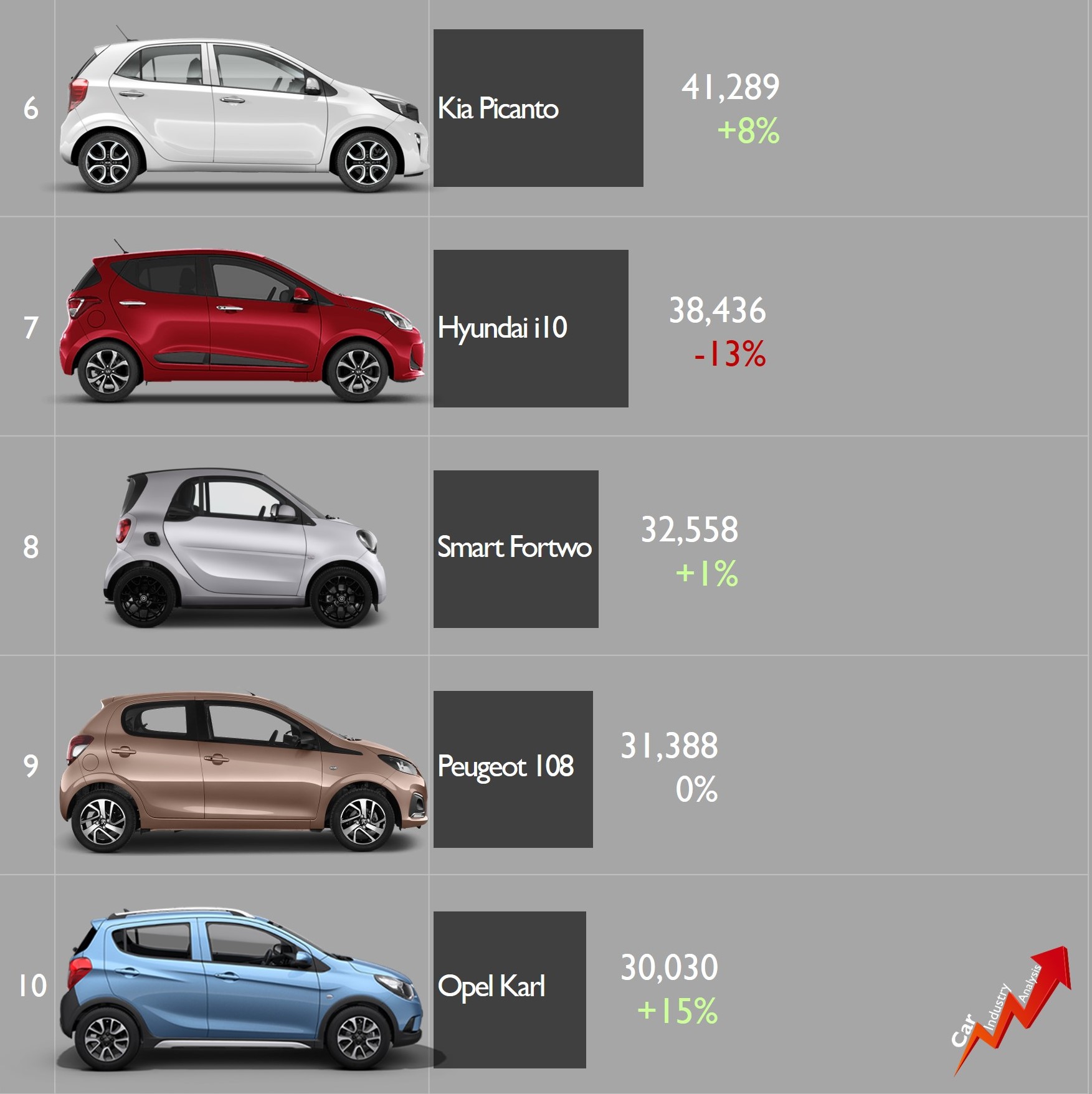

The absolute leader in the City-car segment

If there is a clear strength of FCA in Europe it is its strong position in the A-Segment. Despite their ages, the Fiat 500 and Fiat Panda continue to attract many consumers allowing the group to control almost one in three of the cars sold in the segment. FCA segment increased from 30.7% in H1 2018 to 31.4% in H1 2019.

The combined results of the second and third in the ranking (PSA and Hyundai-Kia) don’t even equal FCA’s share. This gives an idea of how popular these Fiats are and how the car maker can lead without any problem. With two models, Fiat was able to almost triple the volume sold by Volkswagen Group and its three models.

The success is explained by two reasons: the popularity of the Fiat 500 outside Italy, and the strong demand of the Panda in Italy. In the case of the 500, its sales outside Italy counted for 76% of its European total. The car is still the leader in the UK, Spain, Belgium, Portugal, Austria, Switzerland, Hungary, Croatia, Slovenia, Luxembourg and Lithuania. Even excluding the volume in Italy, the 500 is by far the top-selling city-car in Europe.

The case of the Fiat Panda is exactly the opposite. Three in four of the Pandas sold in H1 2019 remained in Italy. Without its homeland market, the Panda would be outsold by the Volkswagen Up (excluding its German sales volume). This Fiat has the highest local market penetration among the models with a homeland market in Europe. In other words, the Panda is only popular in Italy, which is by the way the biggest city-car market in Europe.

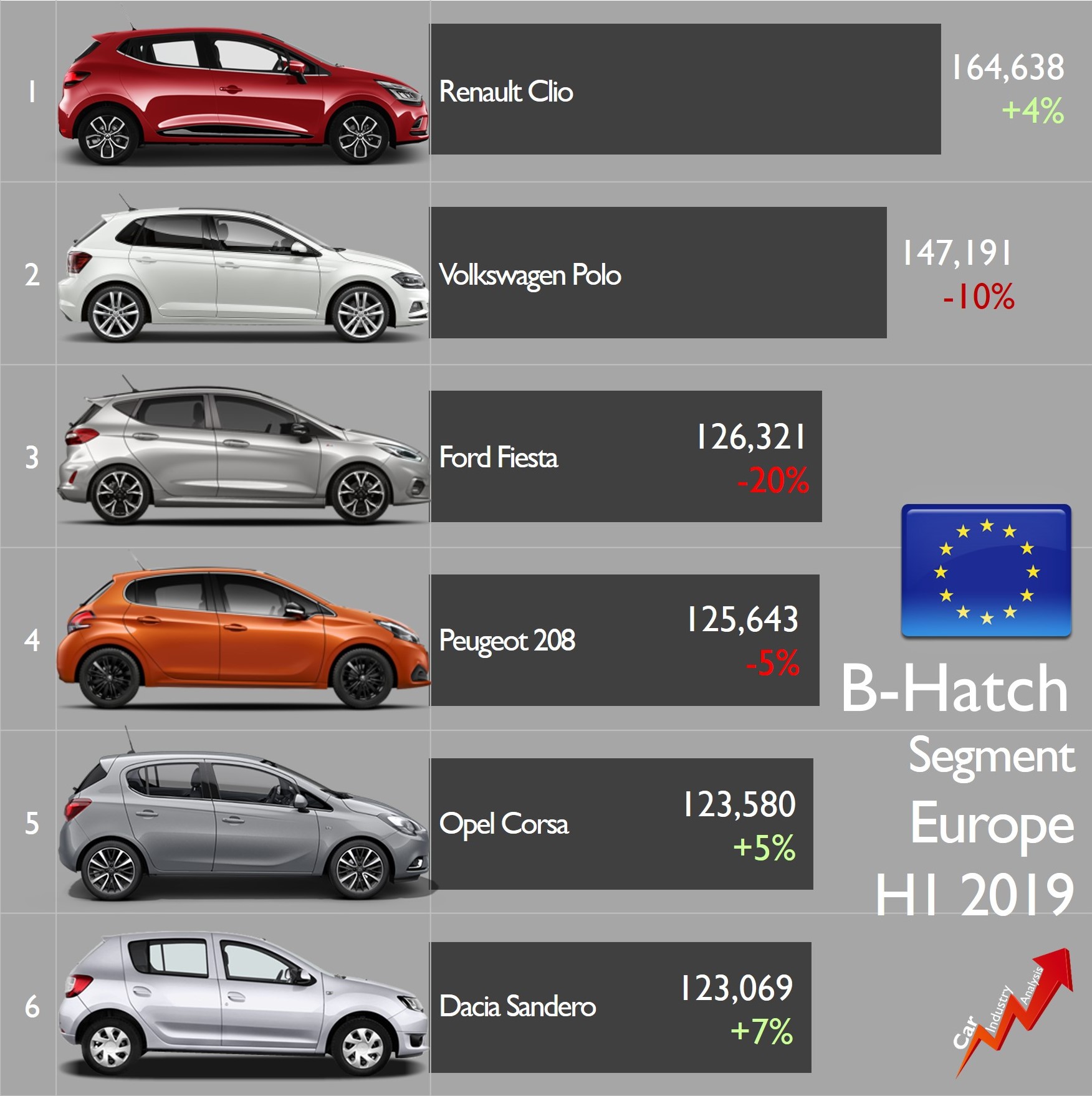

No Punto, no sales in the B-Segment

Back in the year 2000, Fiat and Lancia sold 722,300 subcompacts (B-Segment). It was the third largest group with 16.8% market share, only outsold by PSA (21.3%) and VW Group (19.9%). The Punto was Europe’s third best-selling car. Times have changed for FCA in this segment, and for bad, very bad.

During the first six months of this year, Fiat, Lancia and Alfa Romeo sold 35,700 subcompacts together, counting for 2.1% of the segment’s total. The full year forecast is 65,000 units, or more than 11 times less than the total seen in 2000. The main reason? the discontinuation of the Punto without any successor leaves FCA with only one model in the segment, the Ypsilon, which is only available in Italy. The Mito is slowly disappearing from the rankings.

Even if it is a segment that doesn’t grow anymore (volume fell by 6% in H1), it is still crucial in terms of volume. FCA plays a marginal role in a segment that sold 1.66 million units in the first half, accounting 19.8% of total market.

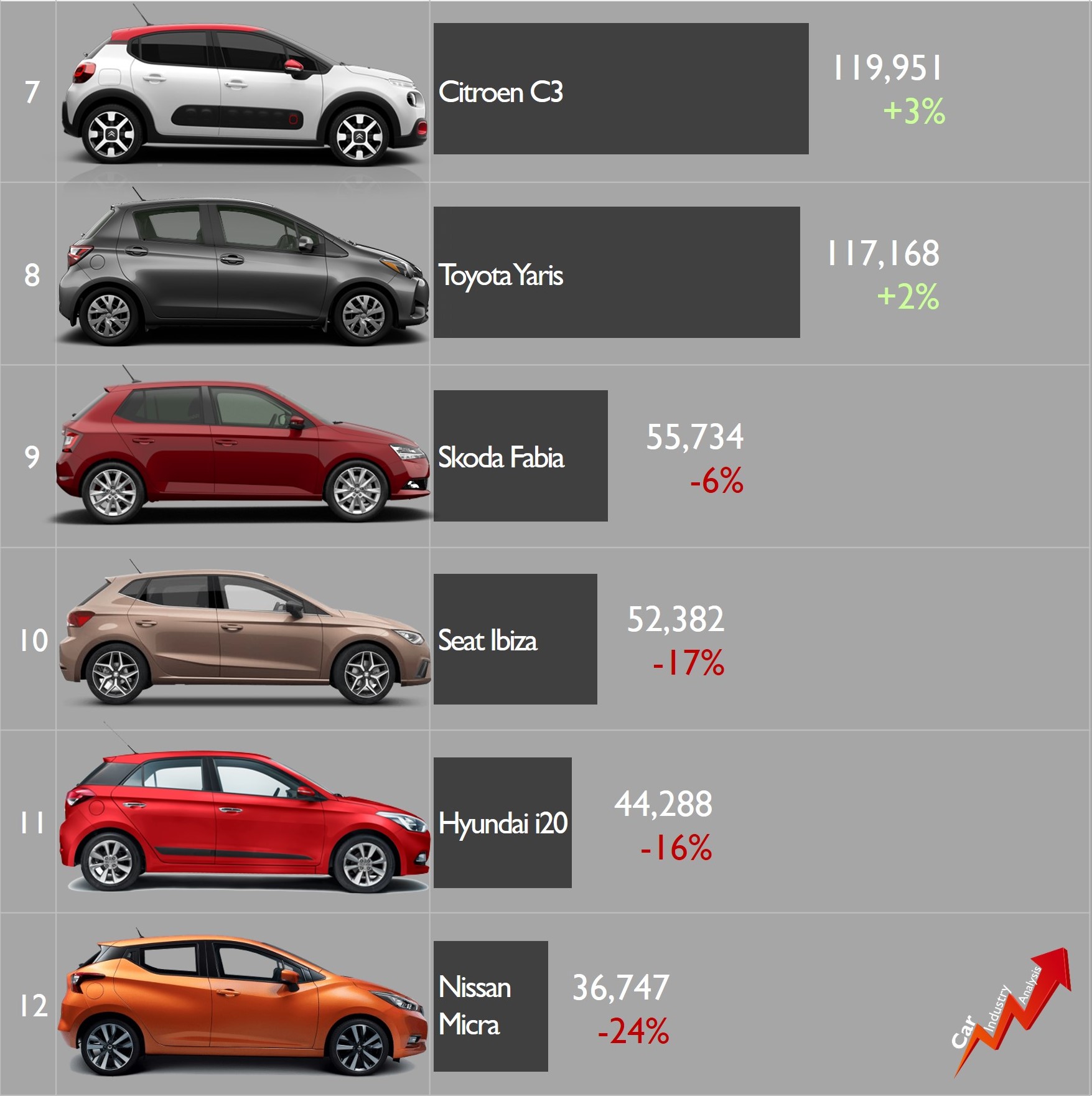

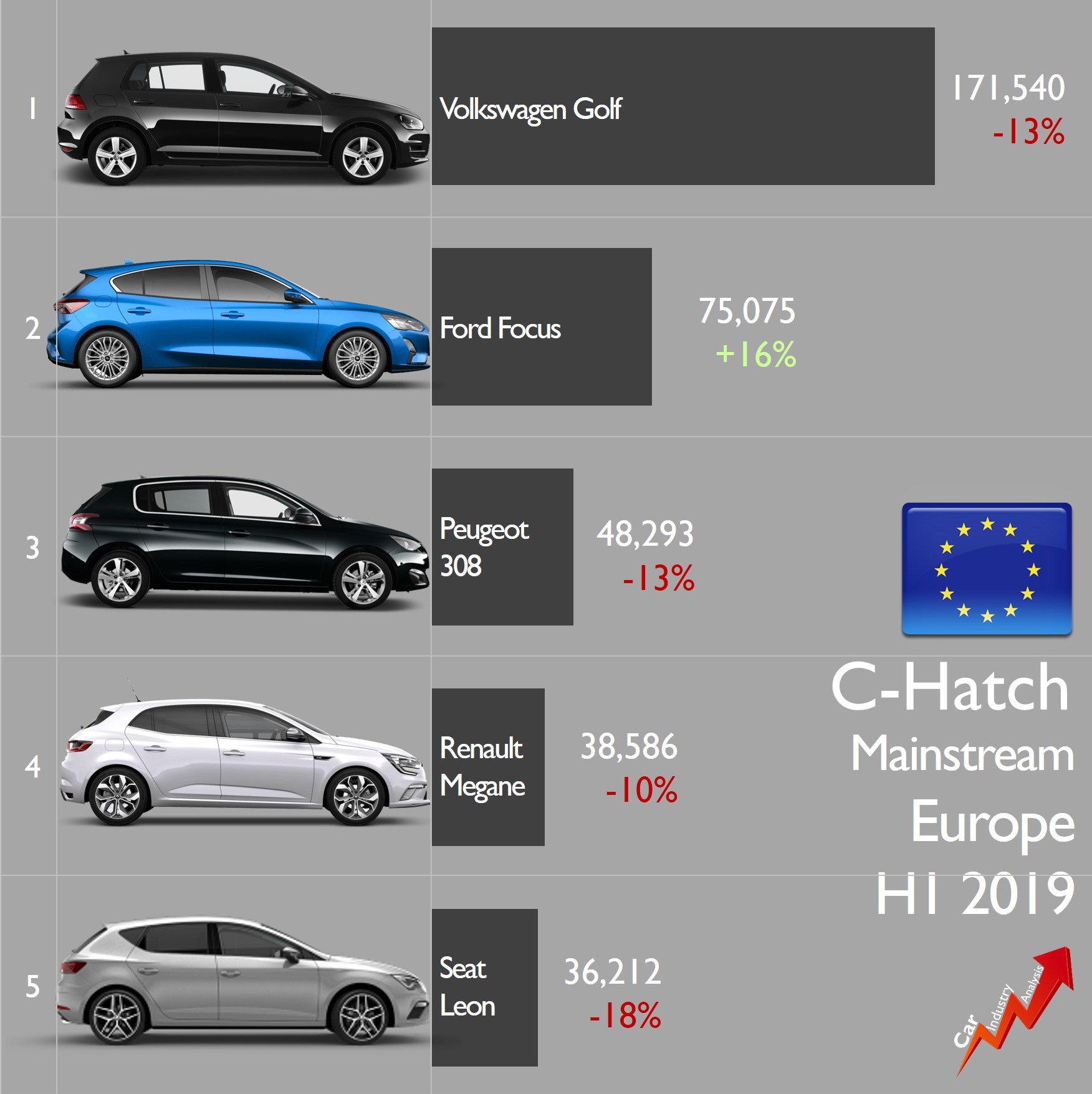

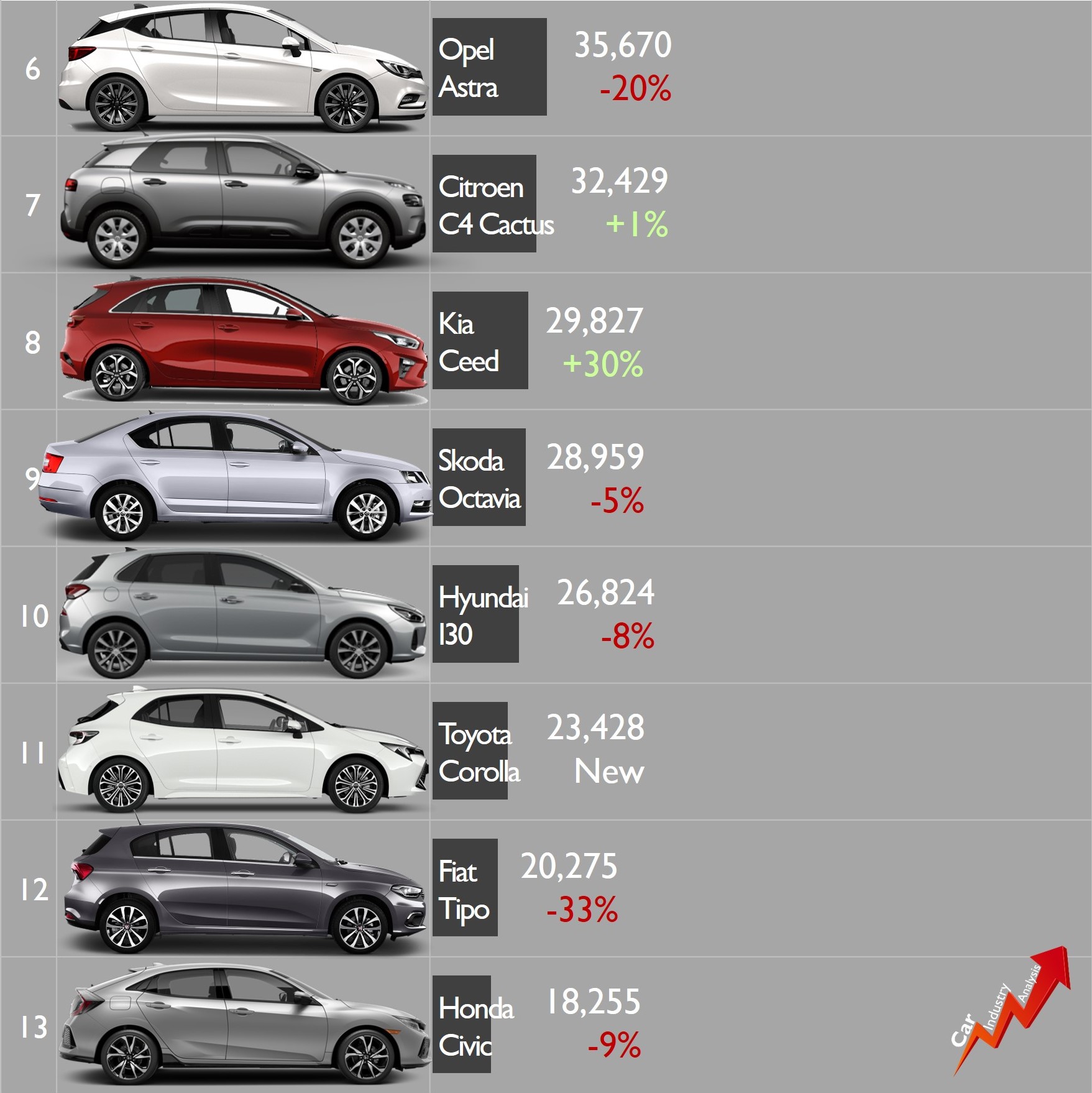

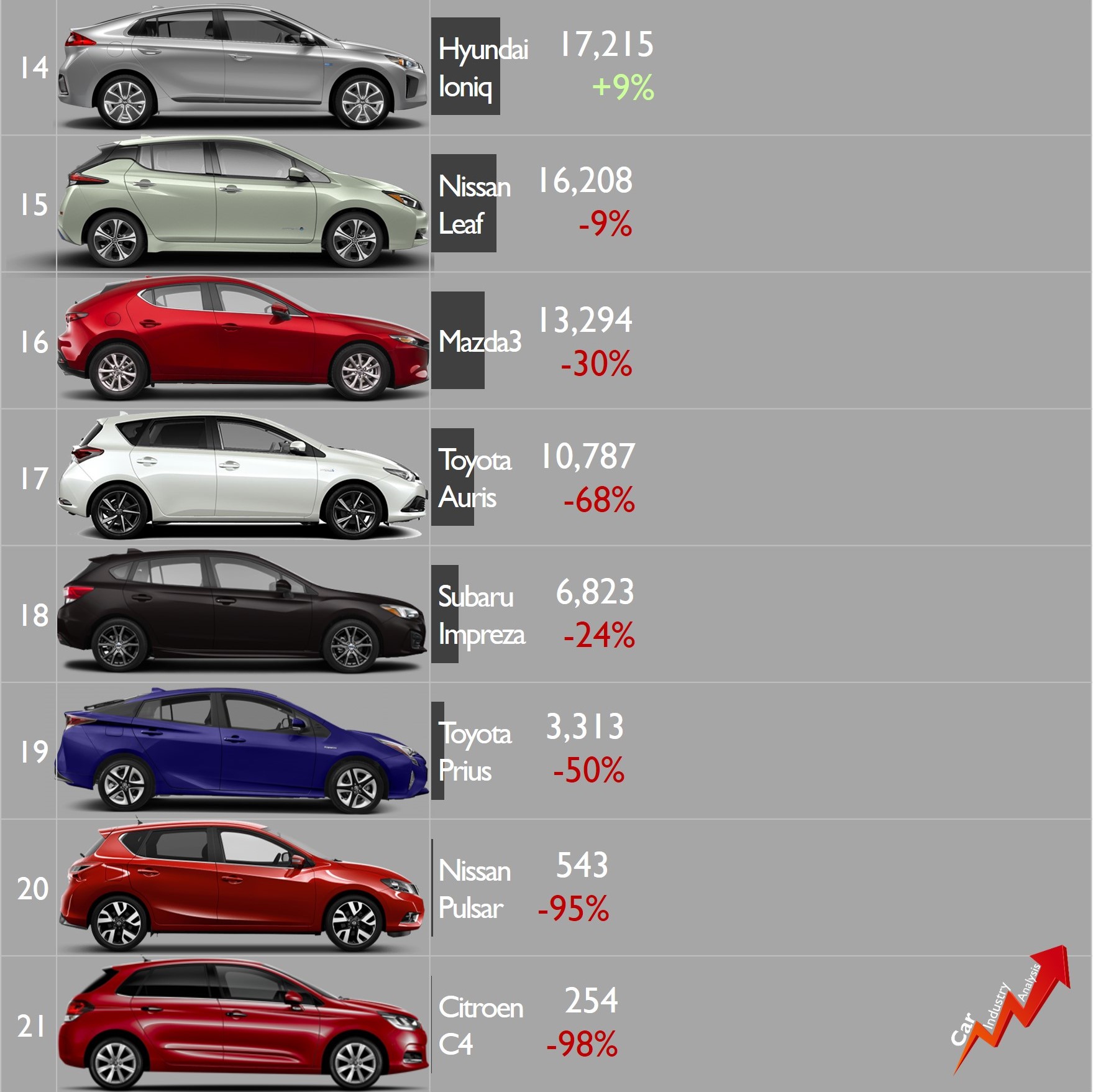

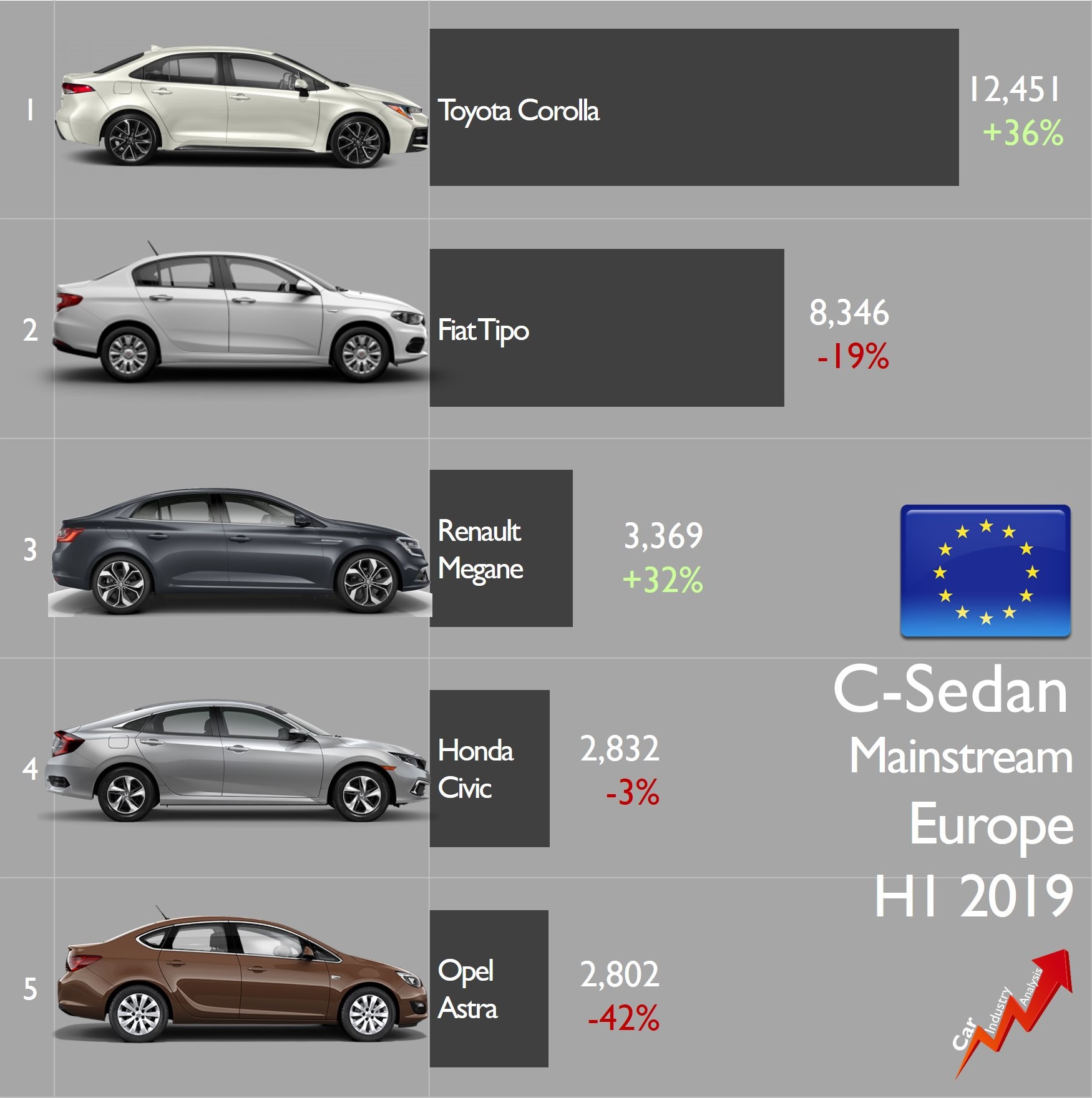

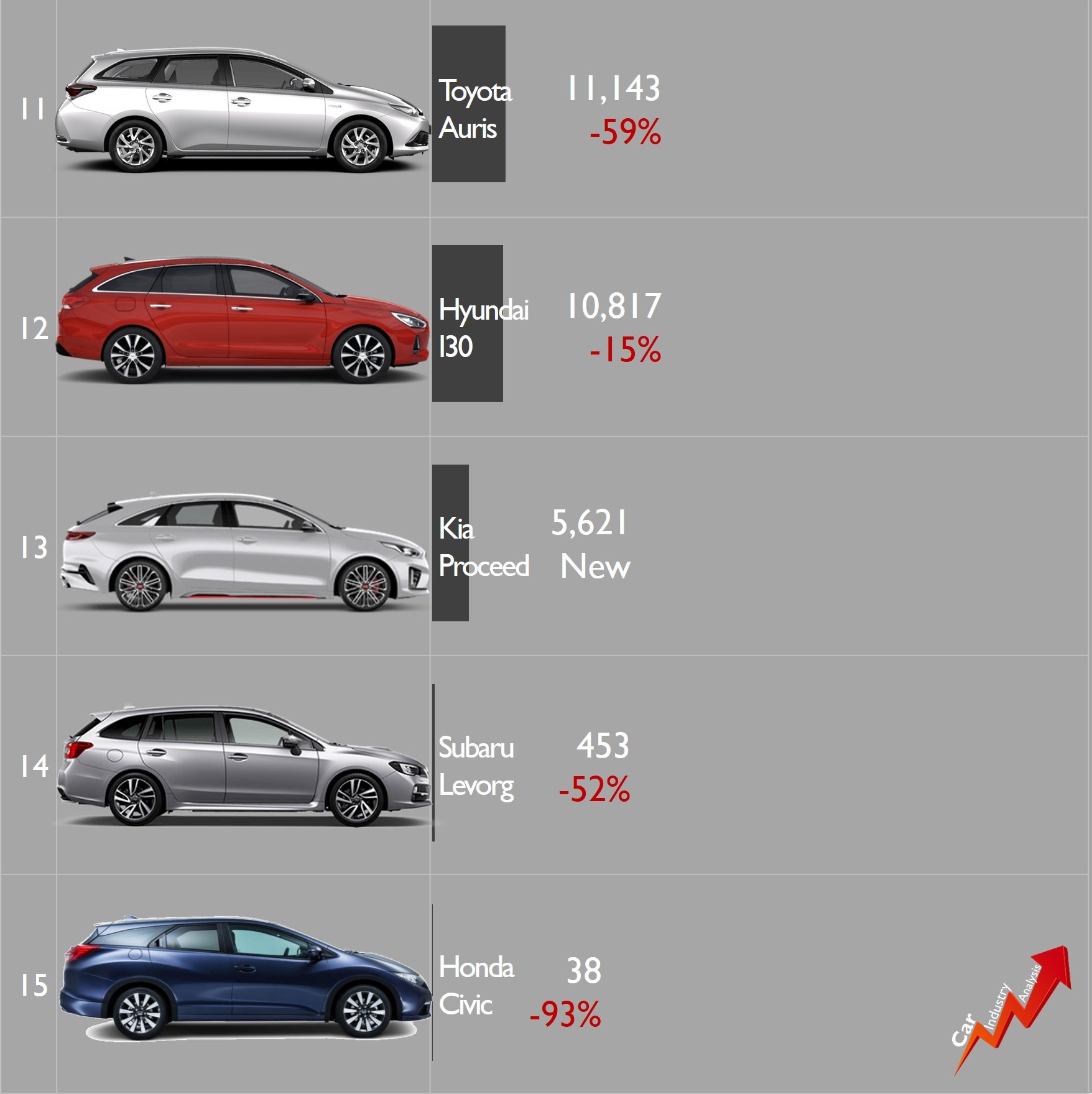

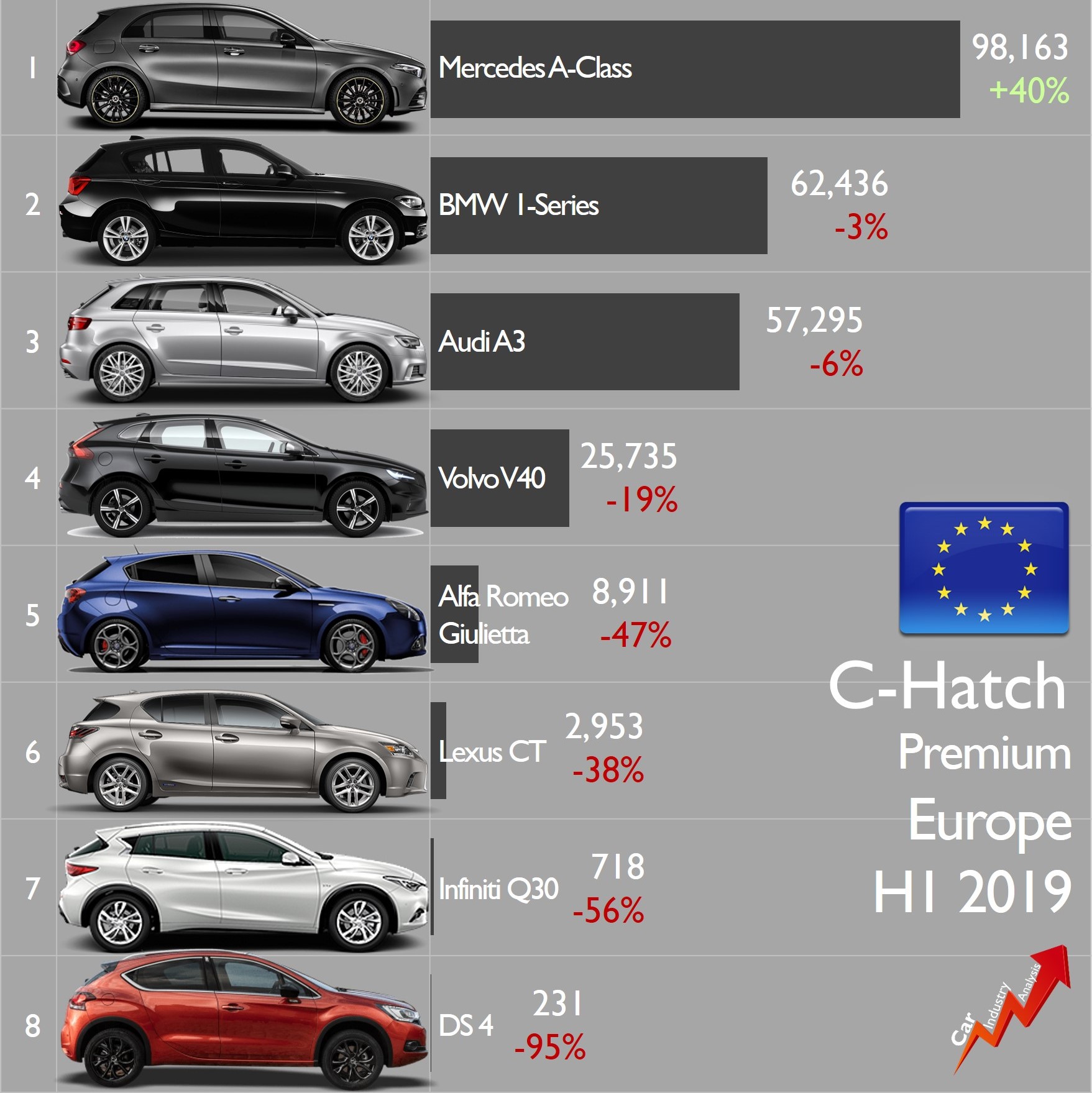

The Fiat Tipo doesn’t shine anymore in the C-Segment

The good start that had the Fiat Tipo after its introduction in 2015 was quickly followed by a big drop. It is the case of most of the FCA products. In H1 2019, the brand sold 47,300 units of the Tipo, down by 23%. All of its bodytypes recorded decreases, with the hatchback showing the biggest drop (-33%). It seems that the end of self-registrations in Italy hit its commercial performance. The Tipo is due to get a facelift in 2020.

Registrations of the Alfa Romeo Giulietta dropped to only 9,000 units, or 47% less than in H1 2018. This was the lowest results for H1 since its introduction in 2010. Without a new generation in the pipeline, the current Giulietta is likely to follow the same faith of the Punto in the coming years.

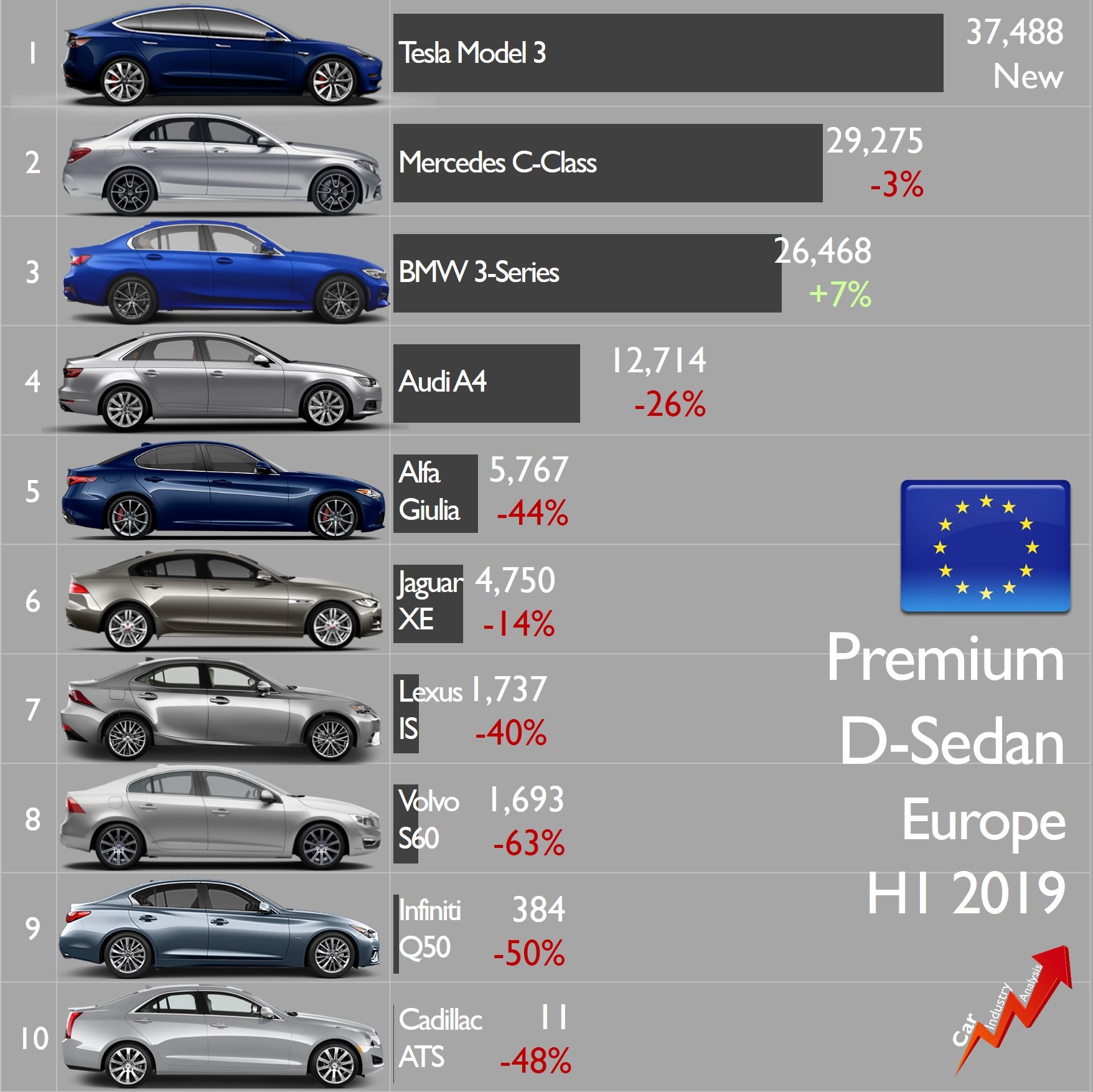

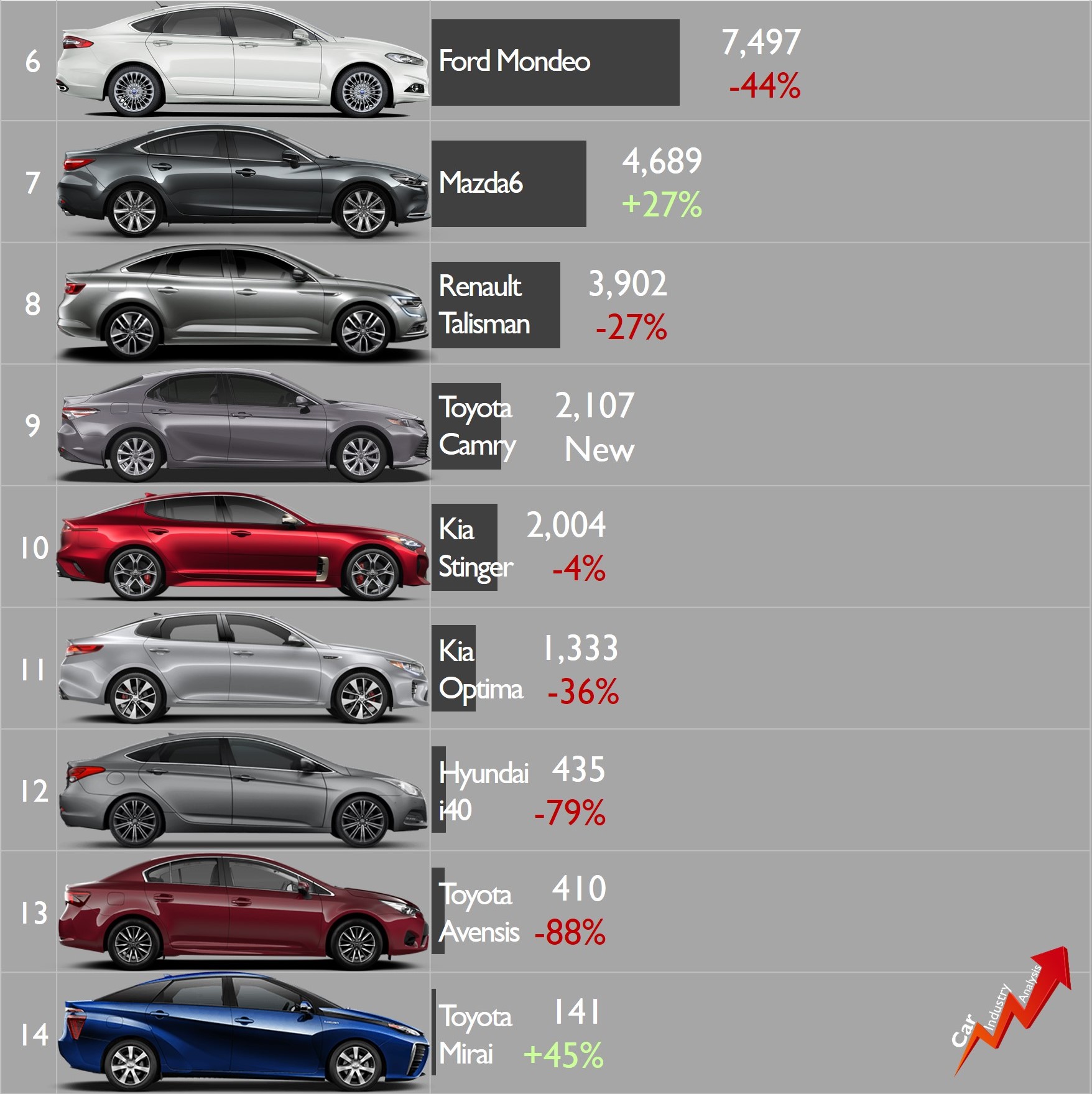

The Tesla Model 3 outsold the Alfa Romeo Giulia by 6.5 to 1

Shocking. In only 5 months, the Tesla Model 3 became Europe’s top-selling premium sedan outselling the popular Germans and the rest of the ranking. This includes the Alfa Romeo Giulia, whose big drop has not stopped since 2018. Tesla, a brand without heritage, is being able to catch the attention of many consumers thanks to a car that is less expensive and features a real break with the status quo.

These are very difficult times for the Giulia. It is only three years old but is already performing as an older car. The case of the Model 3 is a good example of how well received are the cars that innovate and feature a real solution to the current problems of consumers. In addition to this, we must remember that the midsize sedans are another victim of the SUV invasion.

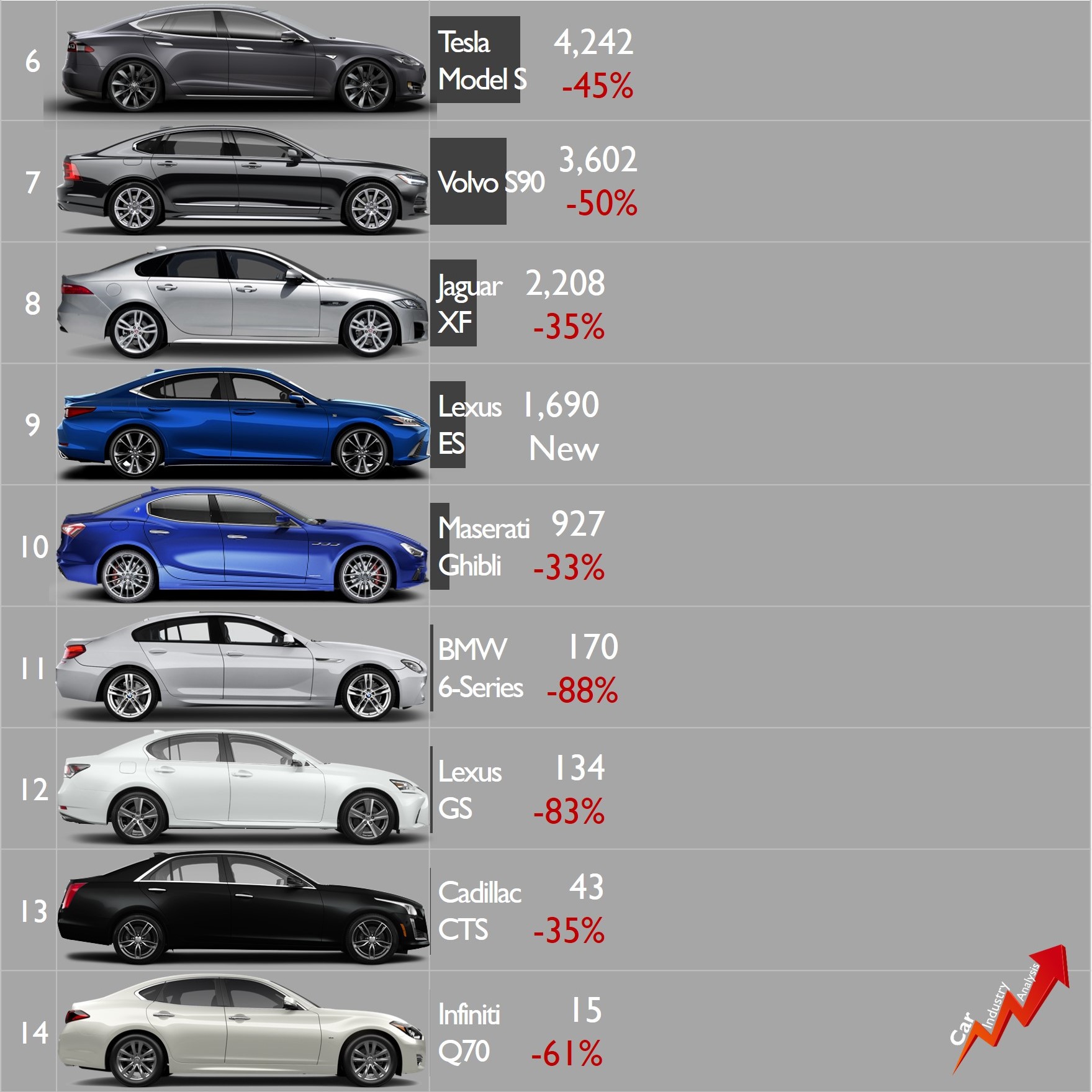

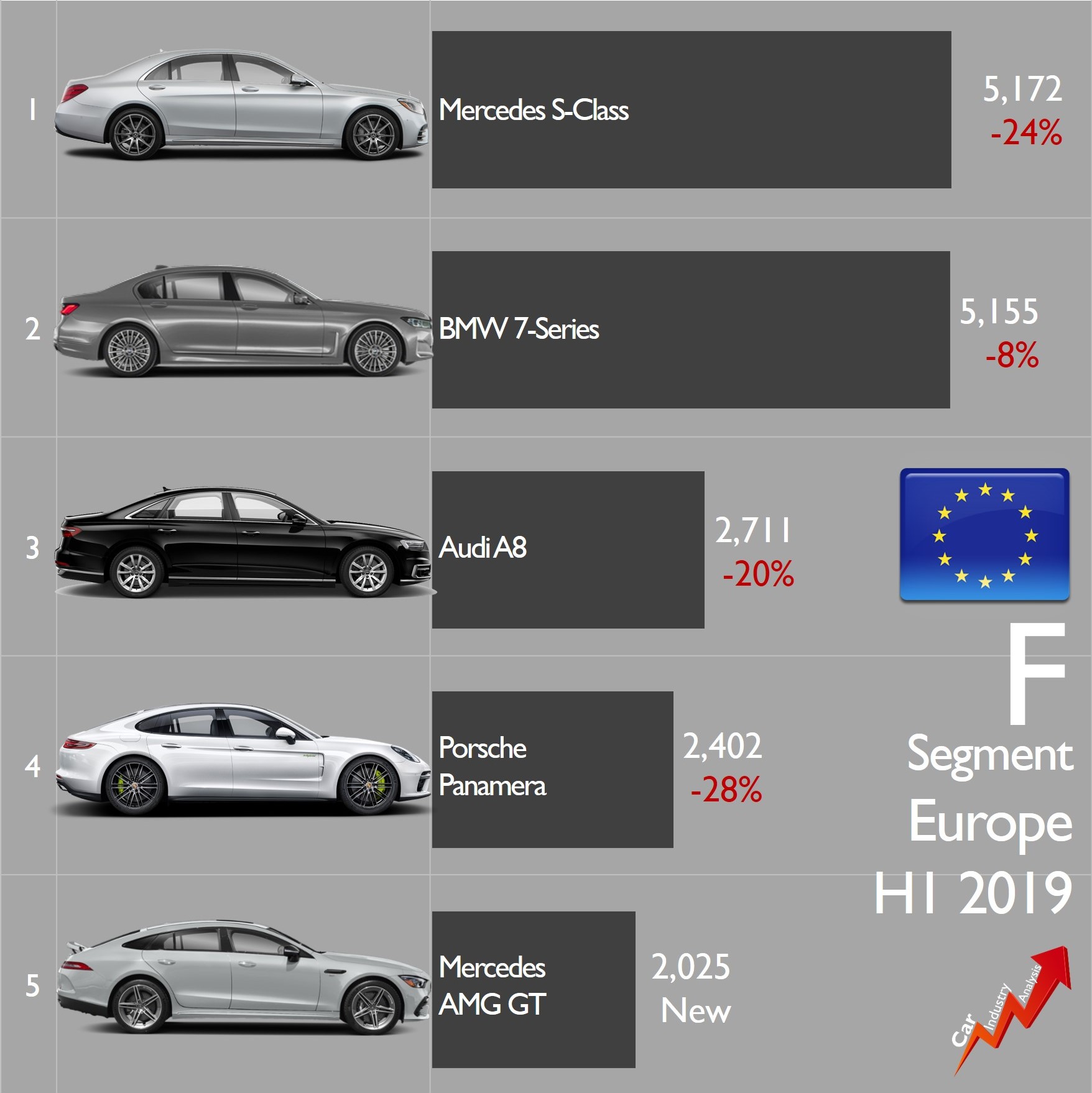

Maserati Ghibli and Quattroporte shrink as they wait for a new generation

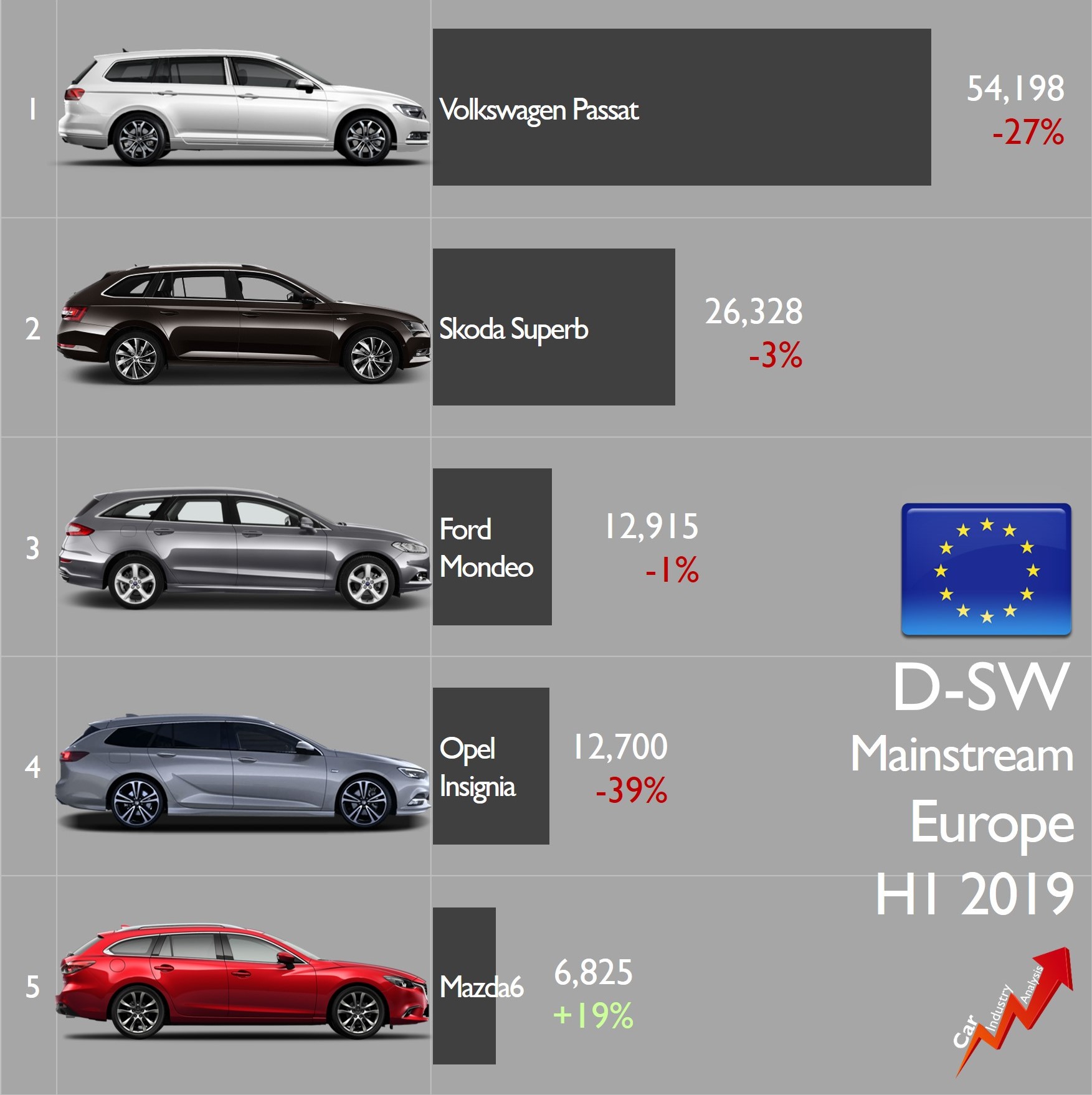

The big sedans of the group struggle to survive in a segment that does not grow anymore, and at the same time gets updated by the arrival of more modern rivals. The Maserati Ghibli was the 10th best-selling premium executive sedan in Europe with only 927 units, down by 33%. It was even outsold by the new Lexus ES.

The Maserati Quattroporte was the 8th best-selling luxury sedan, outselling only the ultra luxury models from Rolls-Royce and Bentley.

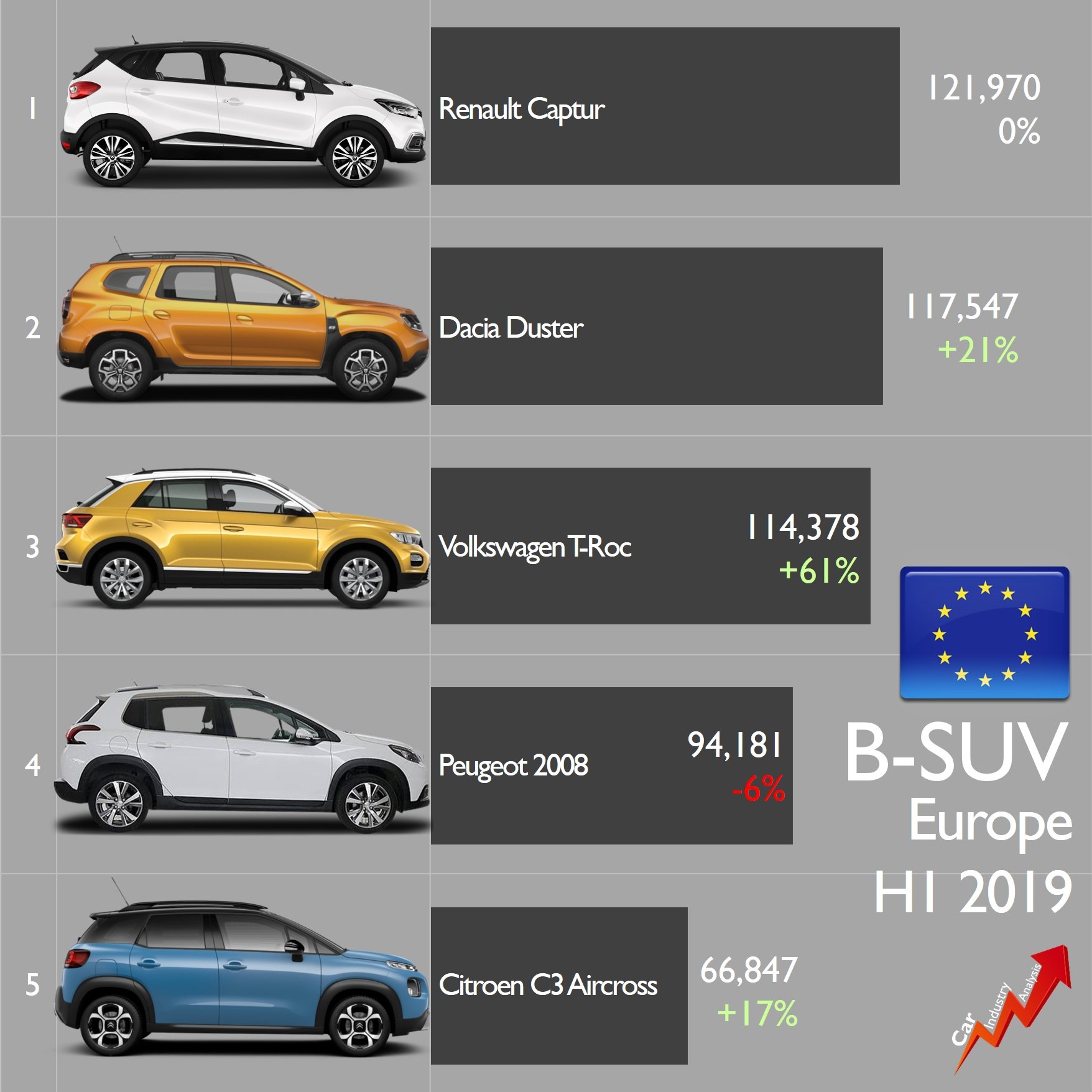

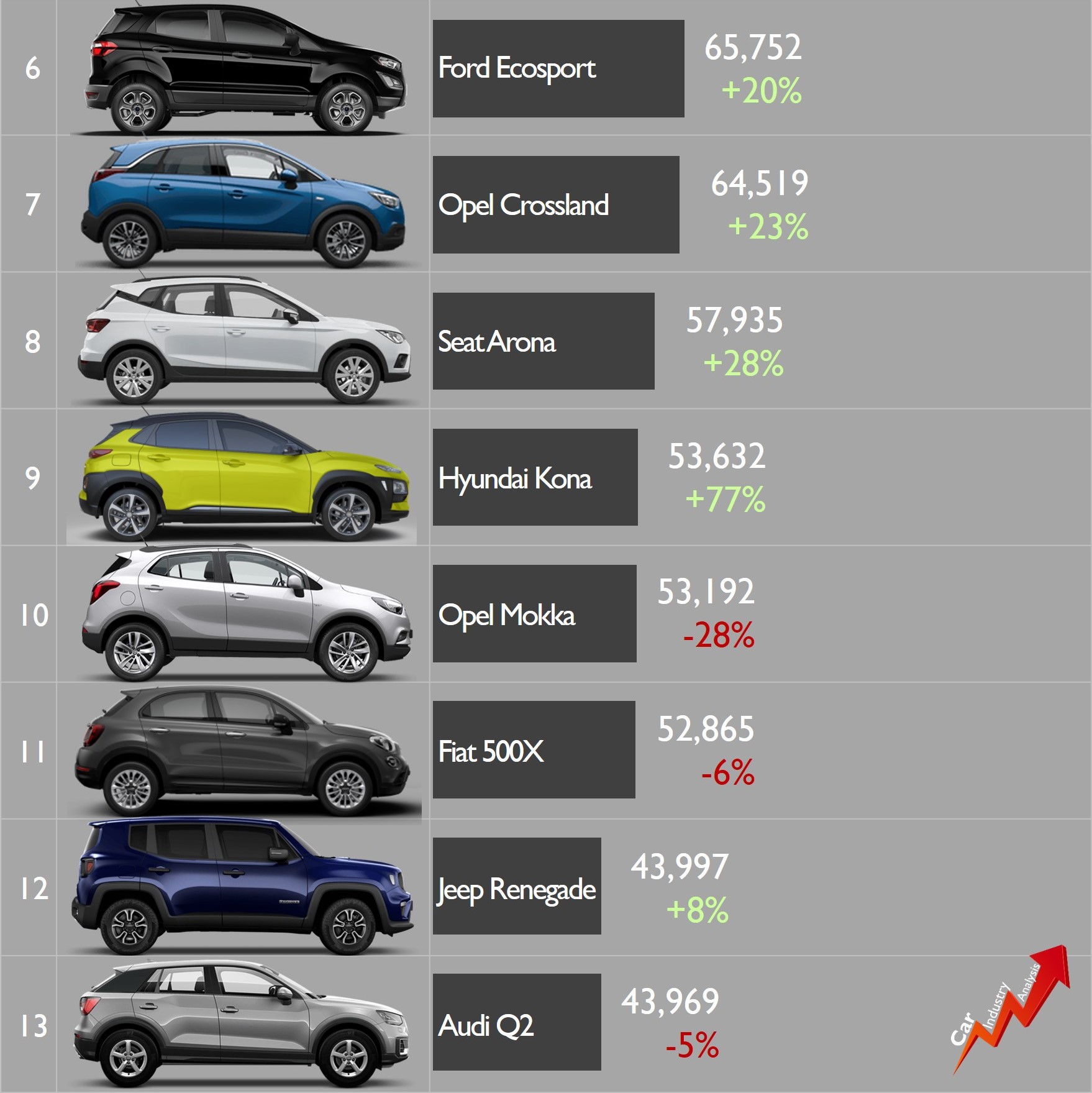

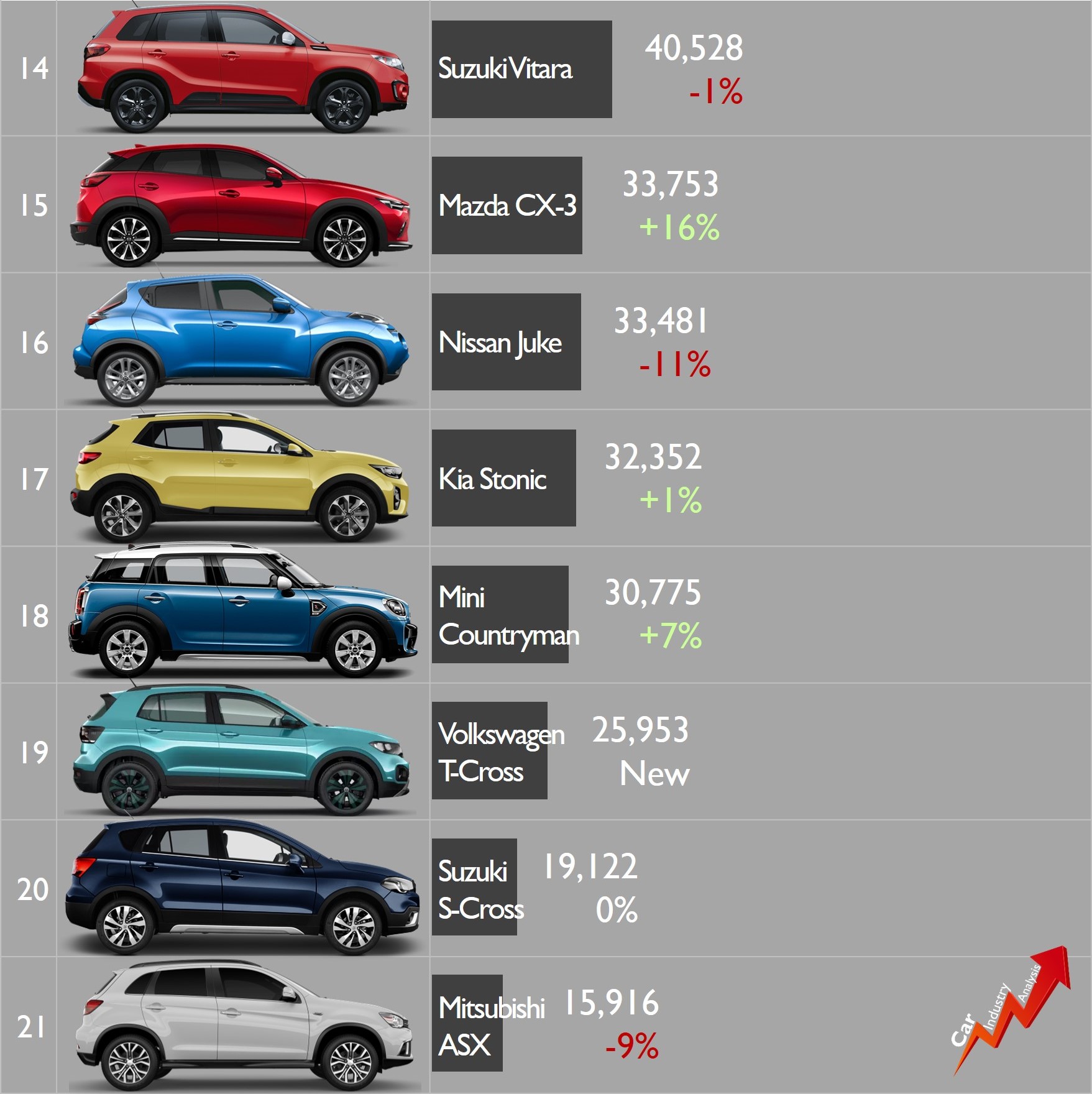

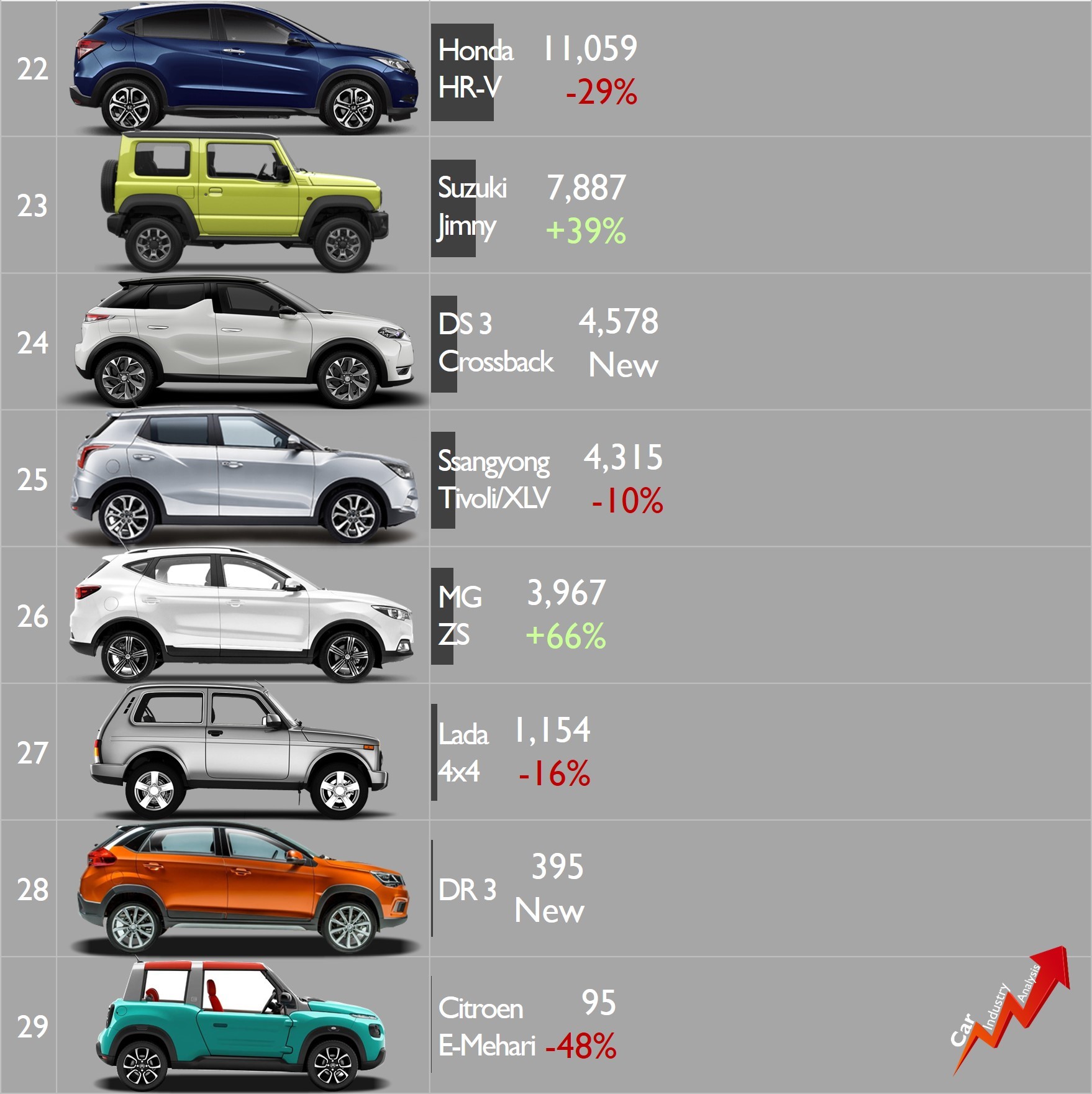

The Fiat 500X and Jeep Renegade face tougher competition in the B-SUV segment

The arrival of VW Group and Hyundai-Kia to the B-SUVs has severely shaken the segment. H1 figures show that it was the segment with the highest percentage increase in Europe mostly because of the good results of the latest small SUVs introduced by the German and Korean groups. FCA is feeling the consequences.

Due to the strong demand of the Hyundai Kona and Seat Arona, the Fiat 500X is no longer part of the top 10. Its volume fell by 6% to 52,900 units, with Italy counting for 46% of the total. In fact it was its homeland the main cause of the overall drop, as registrations fell by 21% in contrast to increases in France (+25%), Germany (+18%), Belgium (+15%) and the UK (+44%).

Registrations of Jeep Renegade were boosted by the recently introduced updated version. However, it is more dependent on Italy than its twin, the Fiat 500X. Homeland represented 55% of its European volume, but growth was driven by Spain, its second largest market, and France, up by 72% and 17% respectively. Both the 500X and Renegade have been aggressively affected from above and below by the Volkswagen T-Roc and T-Cross.

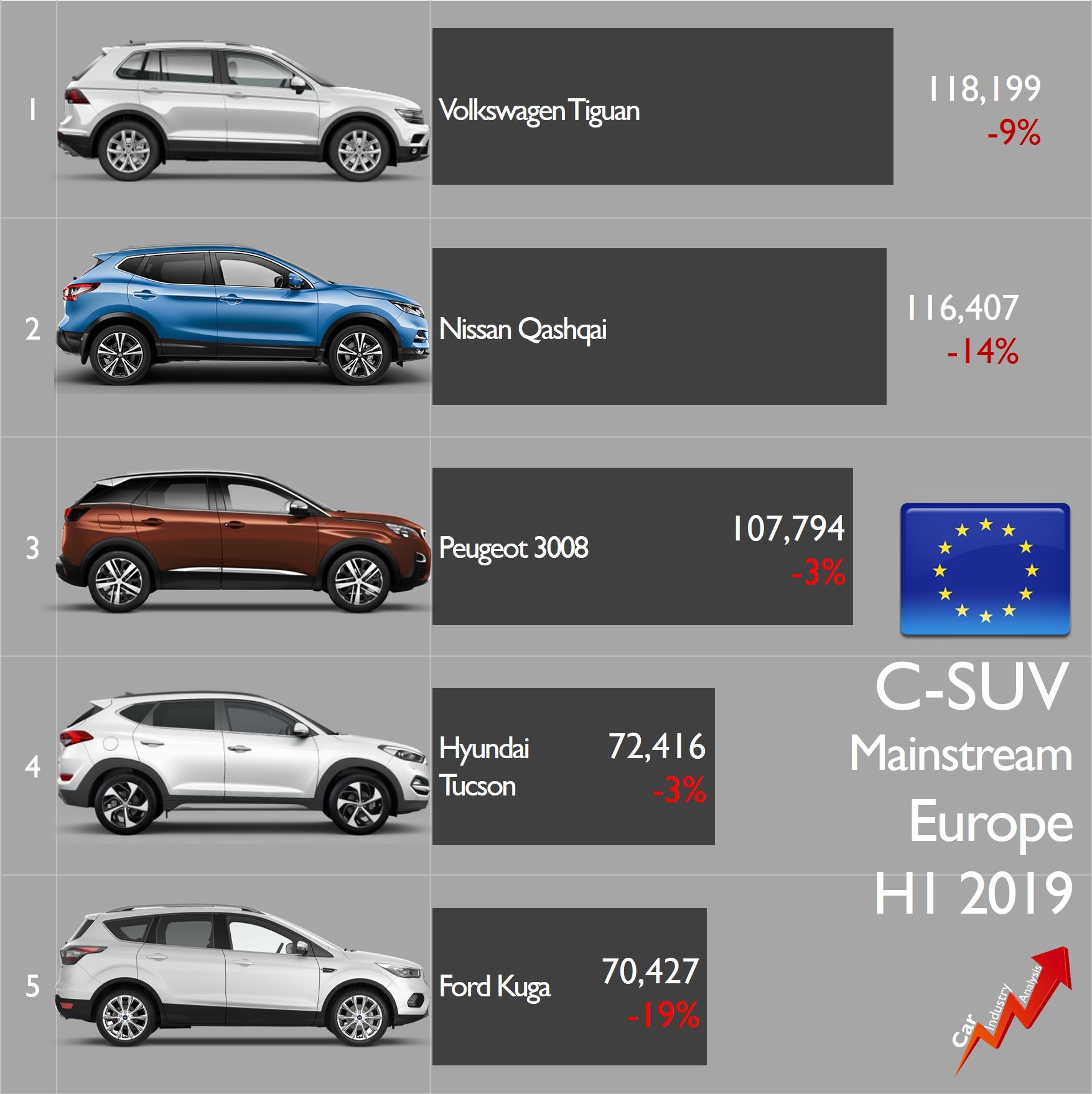

The Compass outperformed by other recently introduced C-SUVs

The Jeep Compass had a very good start in 2018. Unfortunately, the good times are over and it seems that the sales volume of the compact Jeep has already peaked last year. It is too early for this especially because the Compass is a global and very competitive product. Nevertheless, other players that were also launched recently are having better results.

It is the case of the Skoda Karoq, Opel Grandland, Seat Ateca, Toyota RAV4 and Citroen C5 Aircross. They are all more or less the same age of the Compass, but unlike the Jeep, they posted big increases during the first half. Even the C5 Aircross, which was not available last year, was only 800 units behind the Compass and is set to outsell it soon. Jeep should consider a big update and its localized production in Italy.

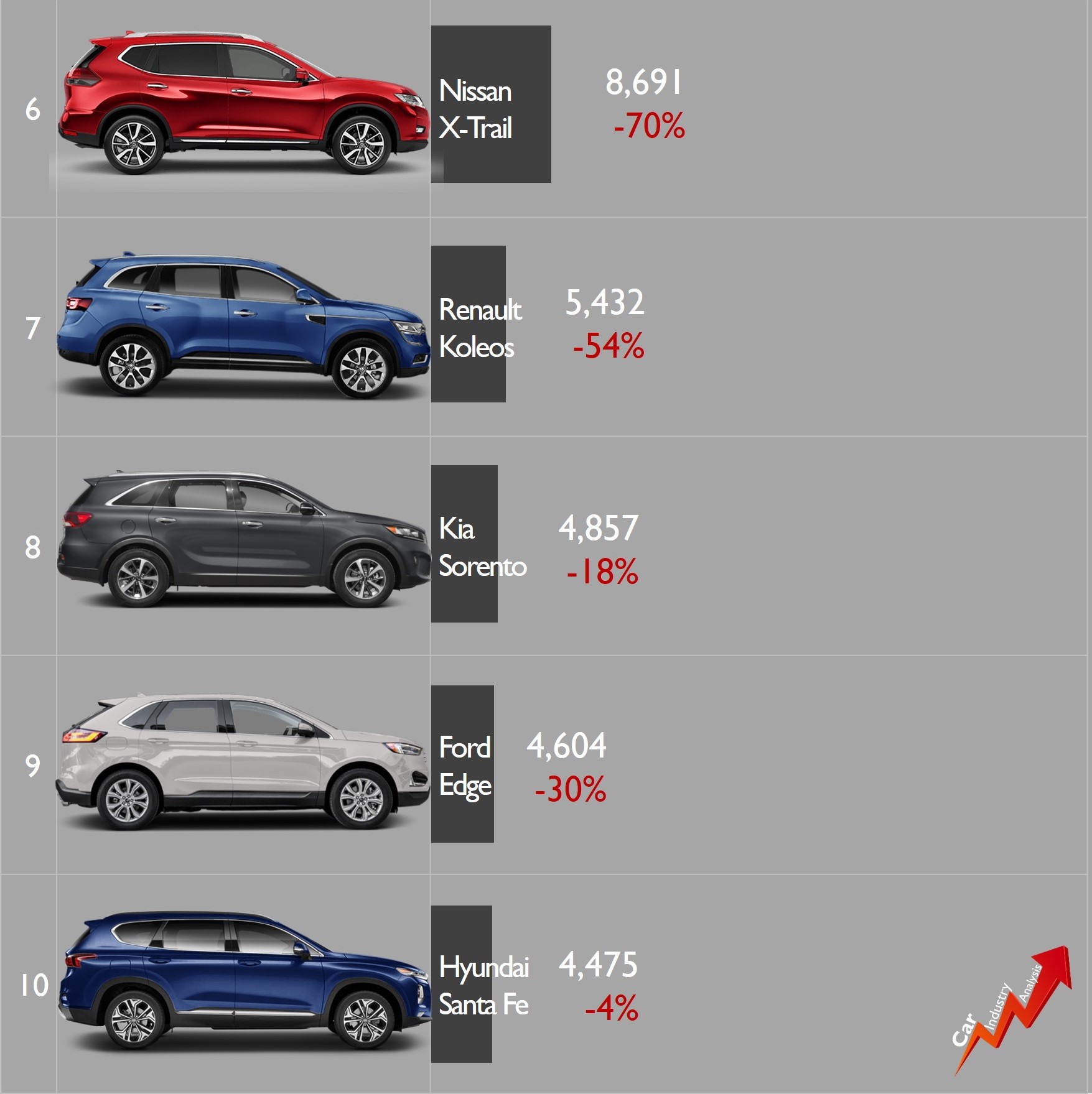

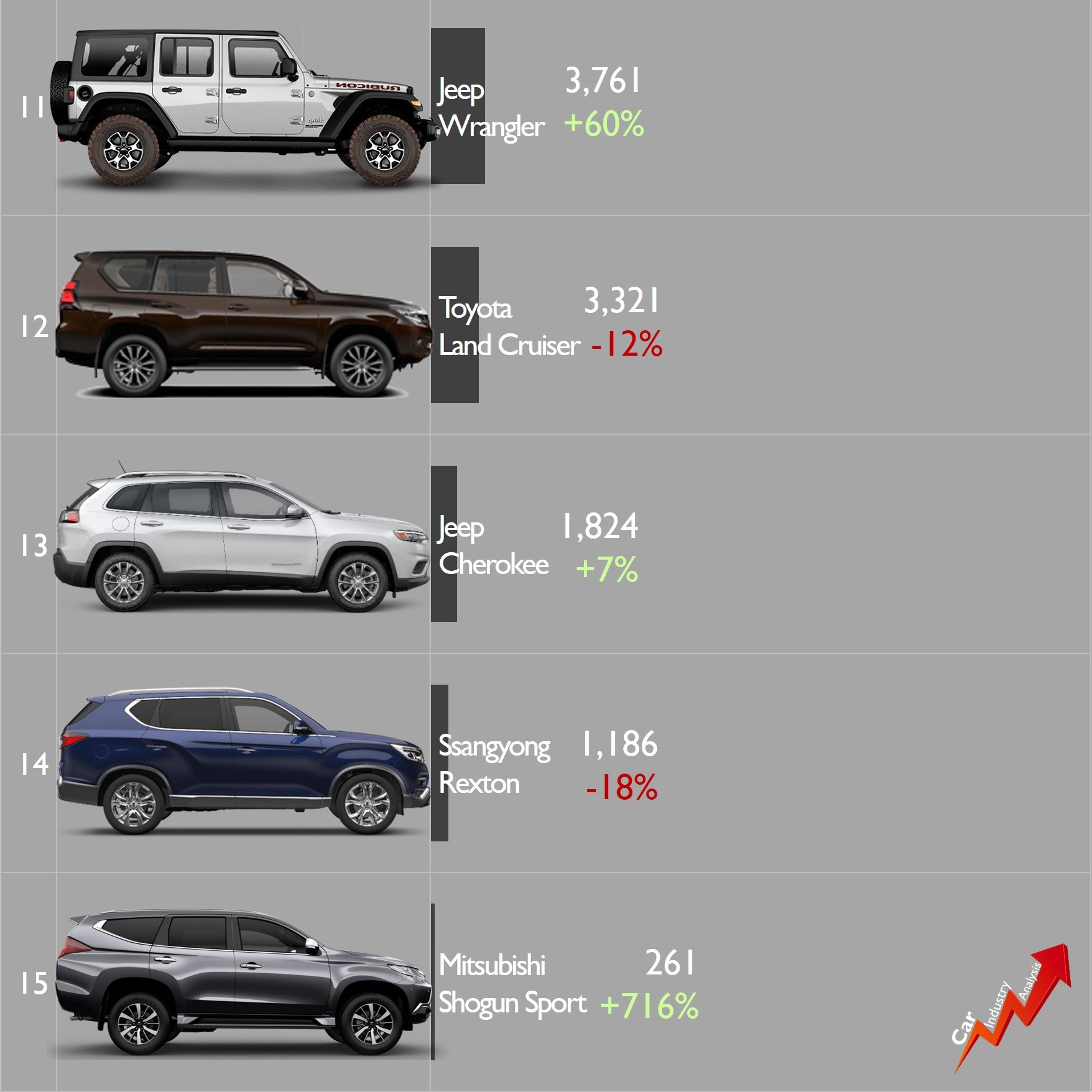

The Jeep Wrangler is the other bright spot of FCA in Europe

In addition to the market increase in the A-Segment, FCA was also able to improve its position in the mainstream D-SUV segment. The reason? the introduction of the new Jeep Wrangler. Thanks to this model FCA’s share jumped from 2.2% in H1 2018 to 3.2% in H1 2019, following a 60% increase in the demand of the iconic Jeep.

The updated Cherokee also contributed to the good result, but the increase was more moderated, at +7%. Both models defied the trend, as overall sales of the mainstream D-SUVs fell by 6% to 173,300 units. In any case, the volume posted by both models is still very low compared to more European styled models like the Kodiaq, 5008 or Tarraco.

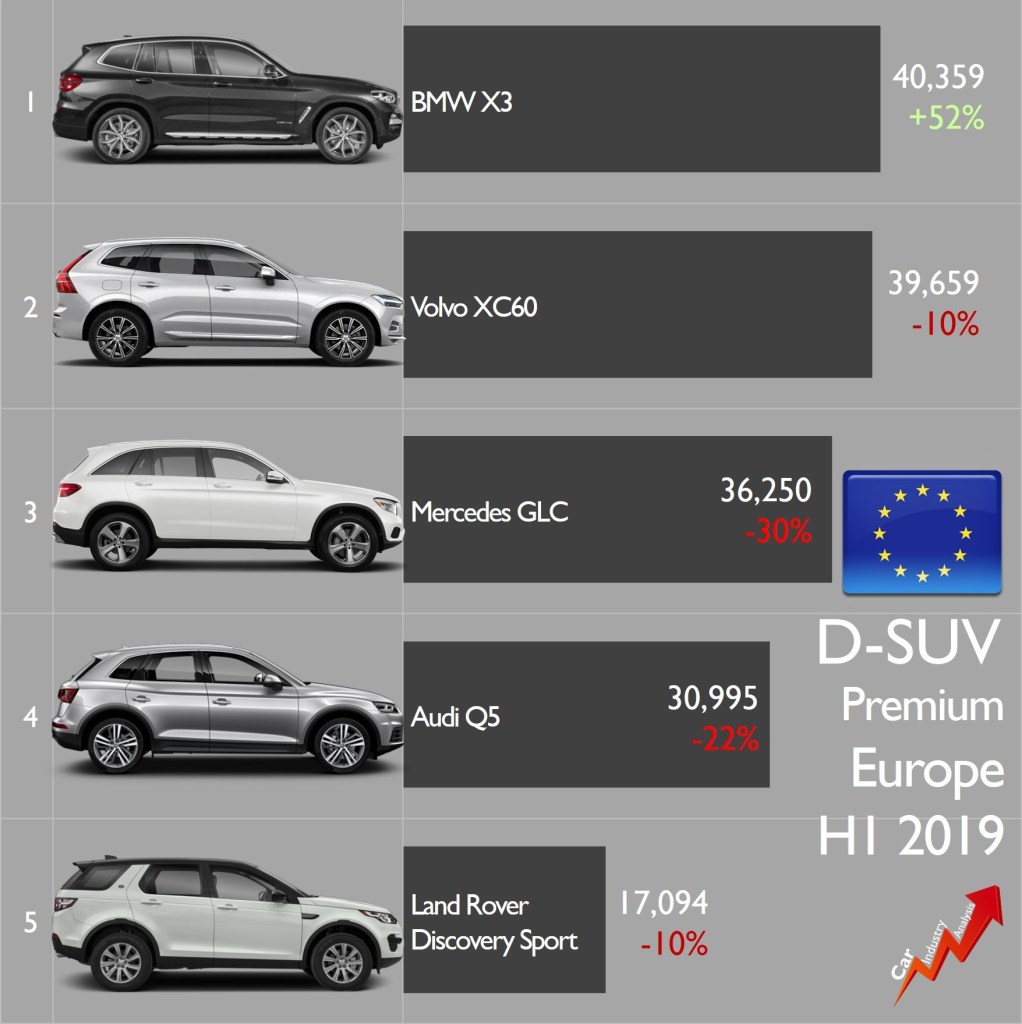

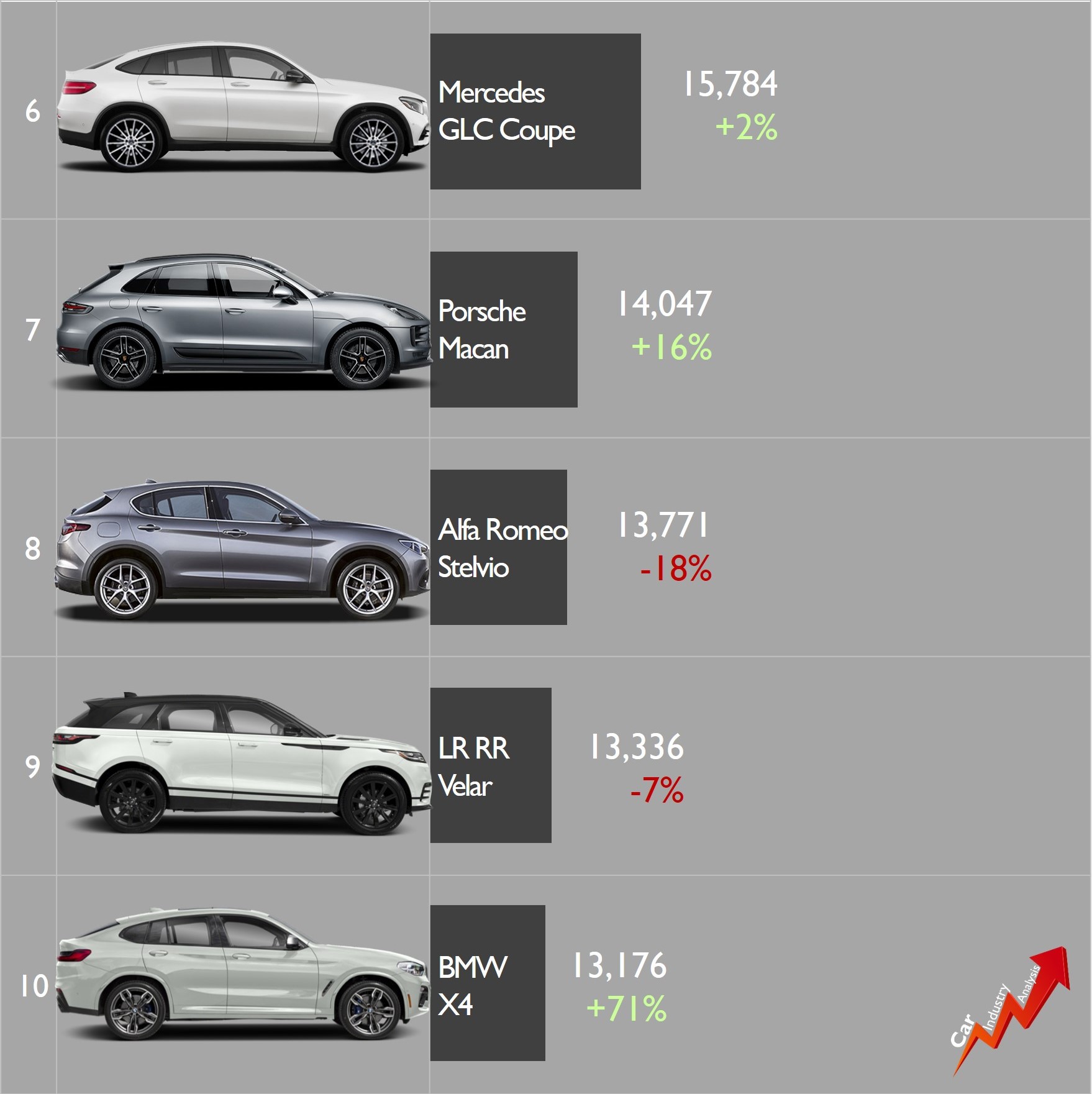

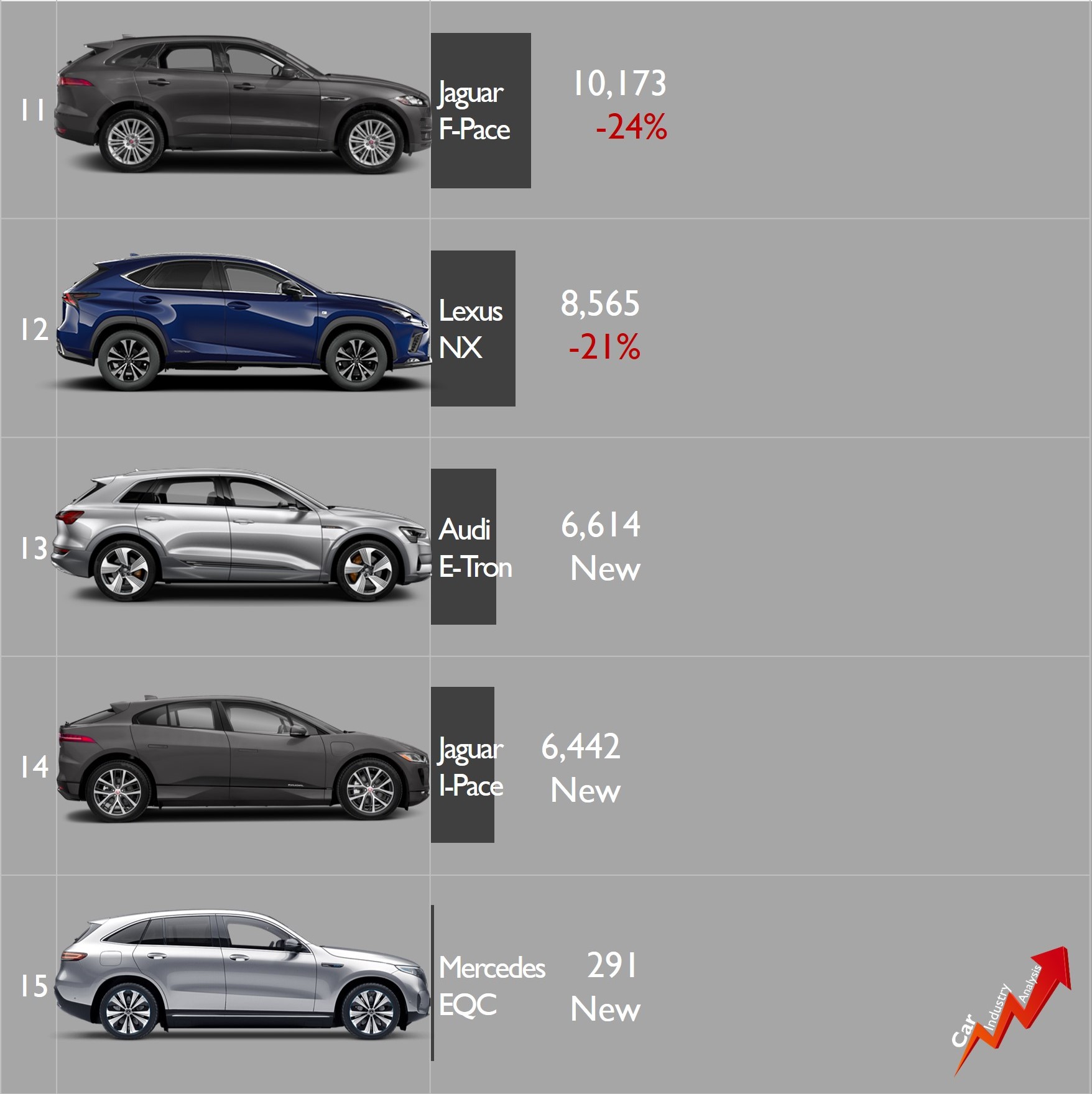

It is perhaps the worst news for FCA: the Stelvio loses ground

The early sales drop of the Alfa Romeo Stelvio is perhaps the most critical fact that FCA has to deal with right now. The Stelvio was introduced in Q1 2017, it had a good start and soon the interest from the public faded away. In H1 2019 its registrations in Europe fell by 18% to 13,800 units. The total places the Alfa Romeo between the new BMW X4 and the recently updated Porsche Macan. Both rivals climbed in the ranking.

The main problem here is that if the Stelvio continues to fall in the ranking, Alfa Romeo is going to be in a very difficult situation. Without the SUV boost (the Alfa Romeo Tonale is due to arrive in late 2020), the brand faces an uncertain future. Why is this happening? first, because its German rivals are getting updated; and second, because Alfa has nothing new to say.

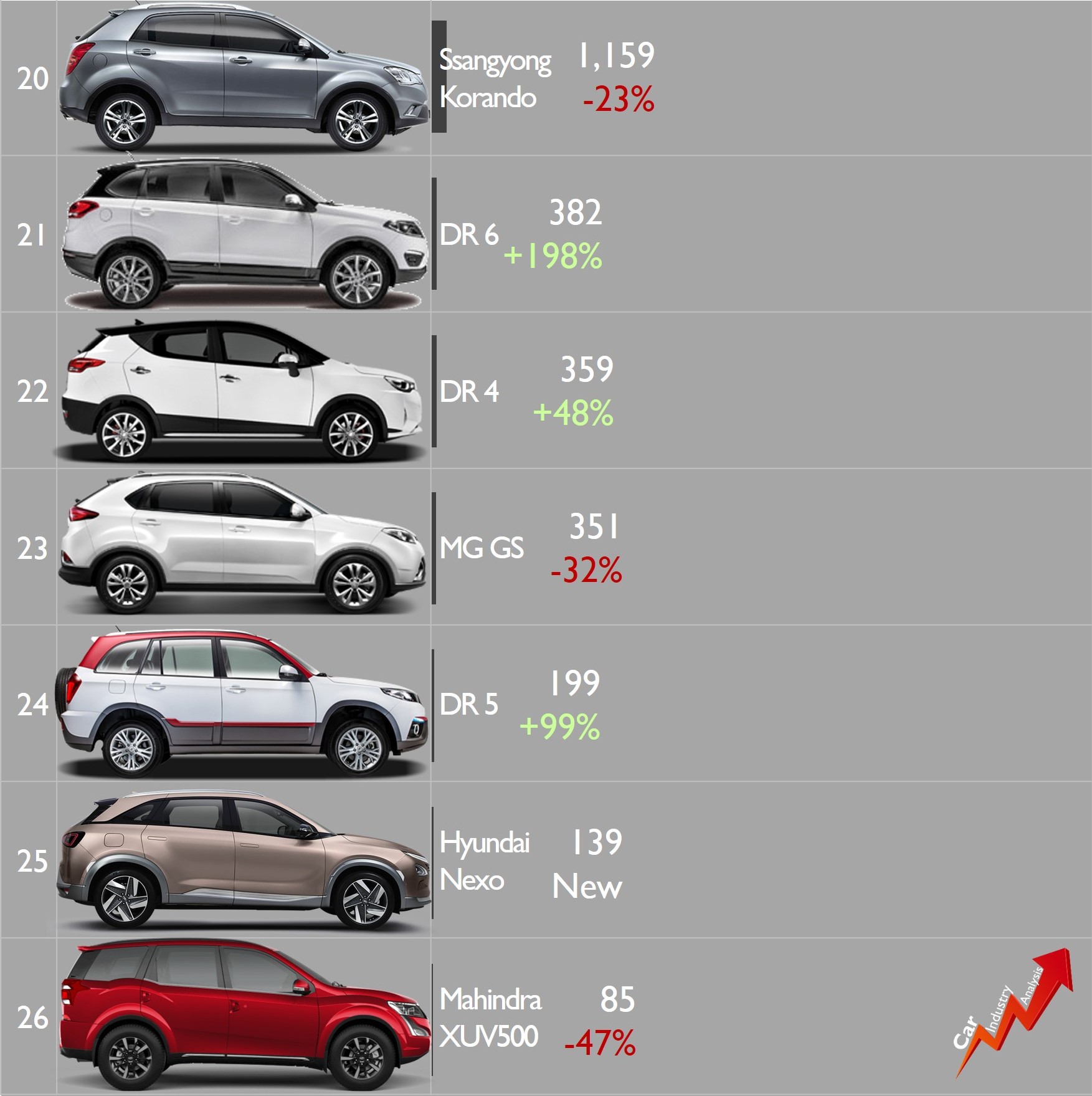

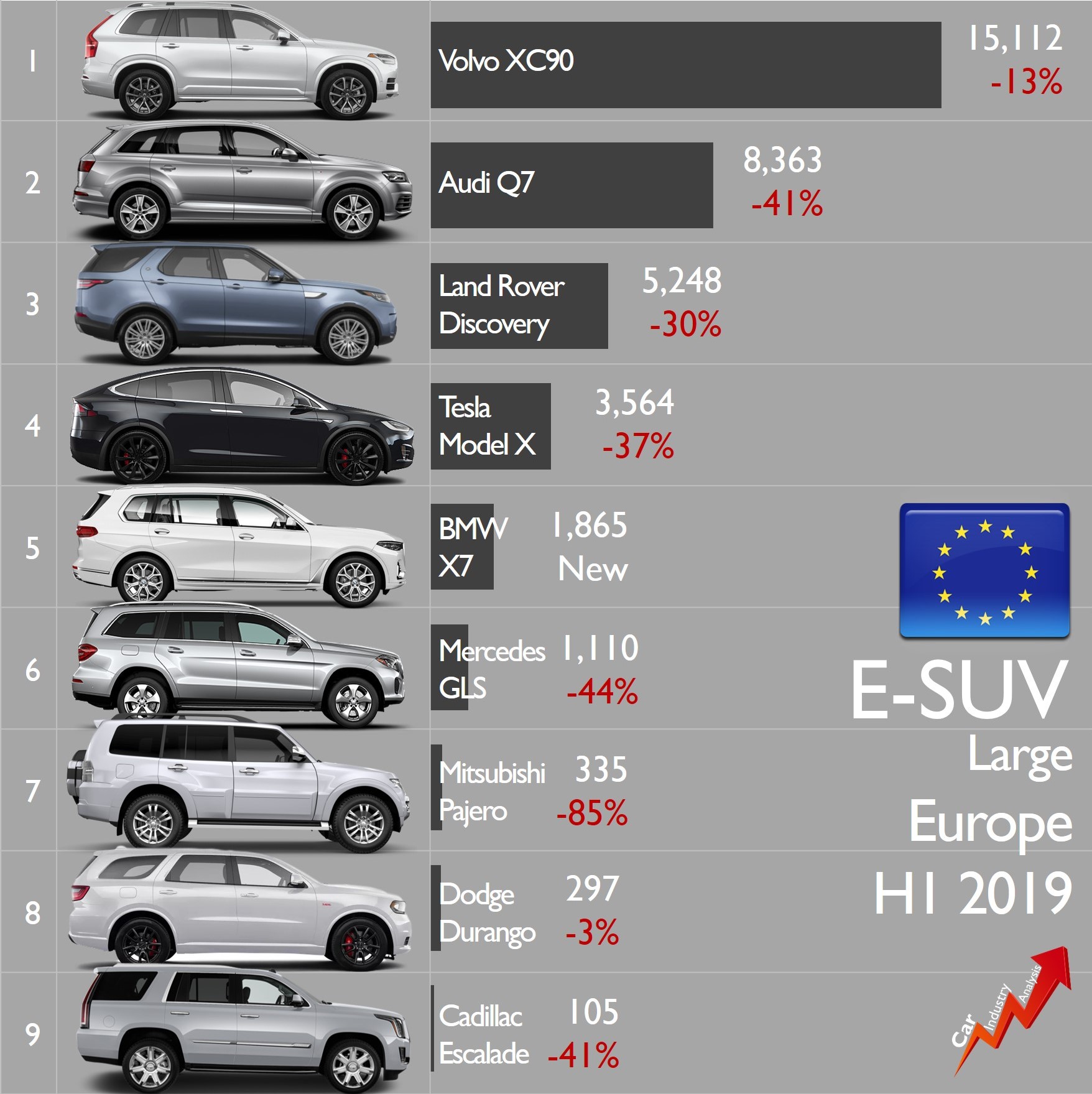

The Maserati Levante and Jeep Grand Cherokee need help in the E-SUV segment

The Stelvio is not the only SUV of the group to face difficult times. The group is also struggling to keep a decent market share in the E-SUV segment. Both the Jeep Grand Cherokee and Maserati Levante recorded double-digit falls during the first half, making the FCA’s market share to fall from 4.8% in H1 2018 to 4.2% in 2019.

While the current generation of Grand Cherokee is already living its final months, the Levante faces more challenging times. FCA is due to present the all-new Grand Cherokee in 2020. In the case of the Levante, it went on sale in Q2 2016, so it means that it will be in the market for at least three more years. The announced repositioning of the brand and better infotainment should help the Levante to resist the tough competition.

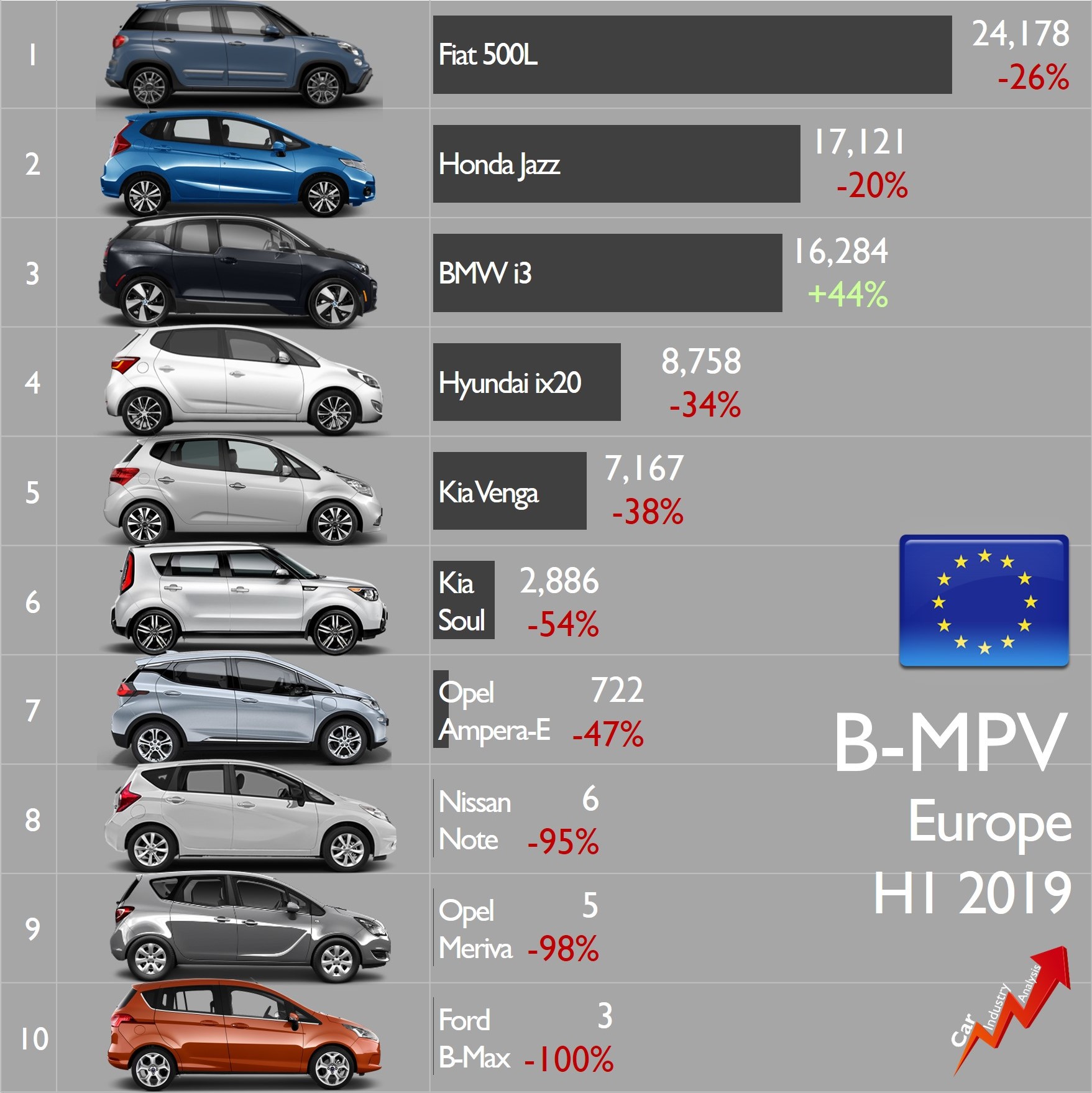

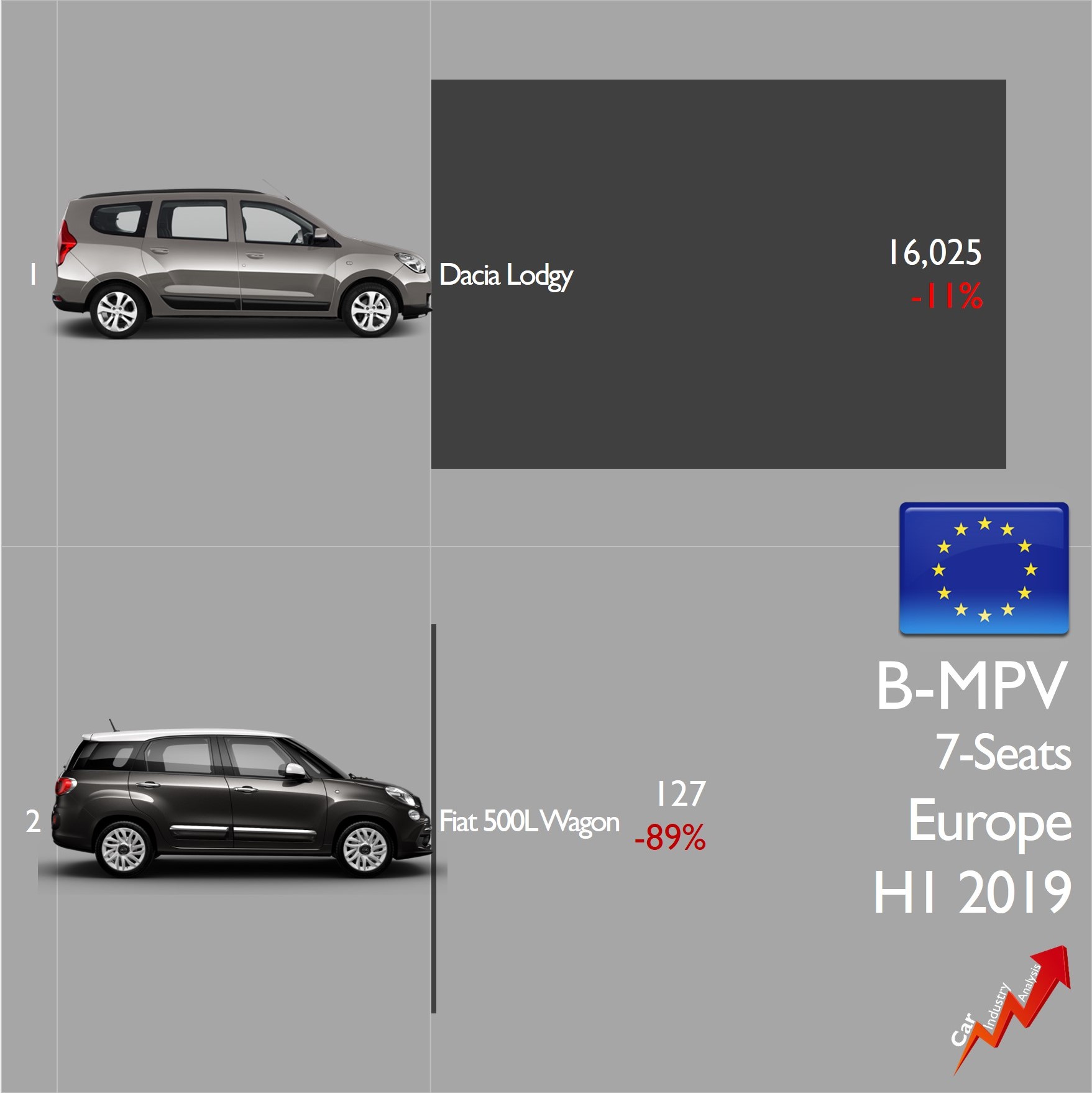

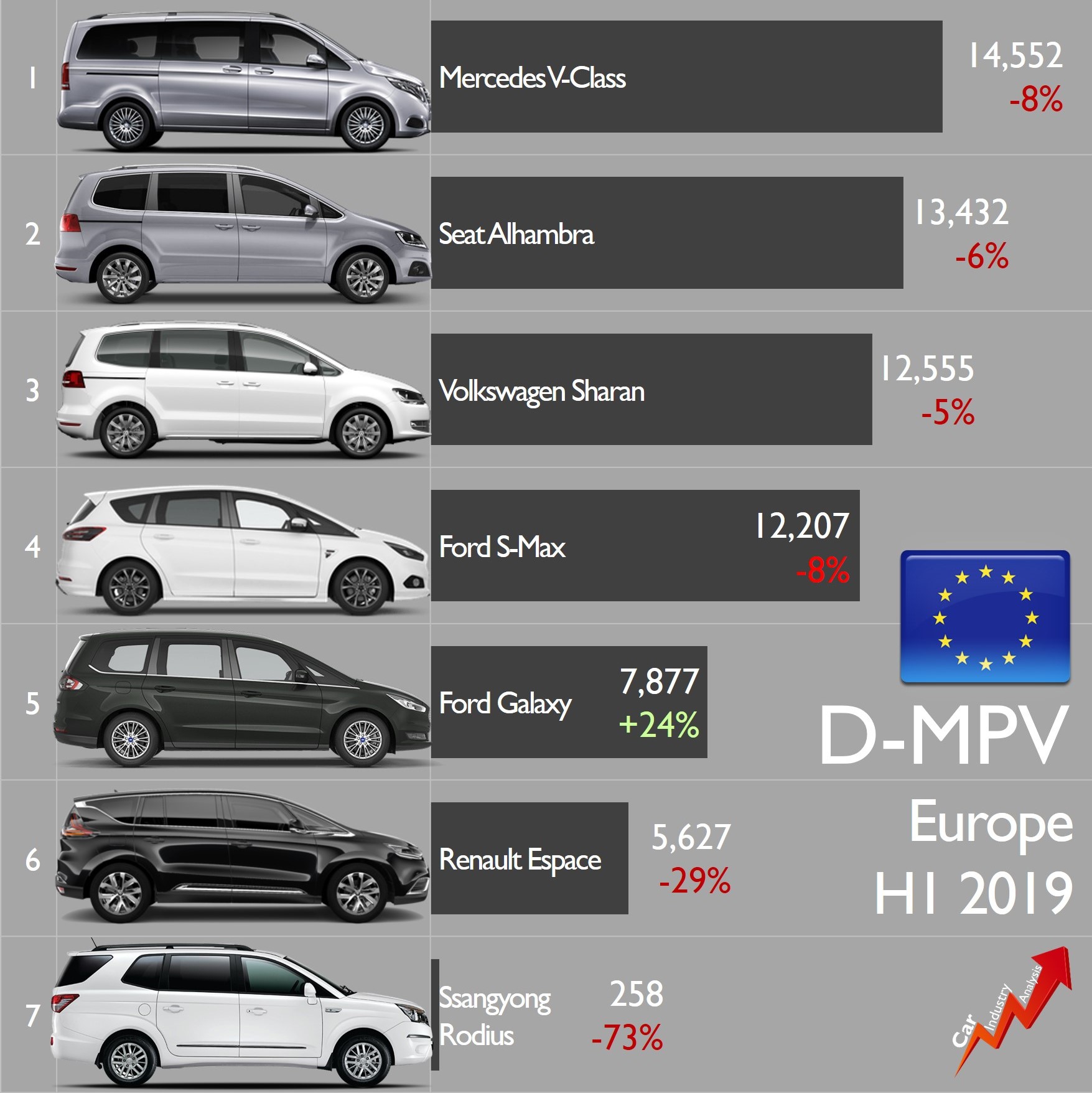

The Fiat 500L continues to lead in a segment that no one wants anymore

The B-MPV is the segment with the second highest market share for FCA after the city-cars. Thanks to the popularity of the Fiat 500L in Italy, the group was able to grab 26.1% market share in H1 2019. That was 1.9 points less than in H1 2018, as the small MPV posted a 28% drop in its registrations.

The B-MPV segment is one of the biggest victims of the SUV popularity. As they latter became cheaper and more comfortable, the former lost appeal. In fact, during the last two years, Citroen, Ford, Nissan and Skoda have abandoned the segment to better focus on SUVs. Will Fiat follow? or they will continue betting on this family car?

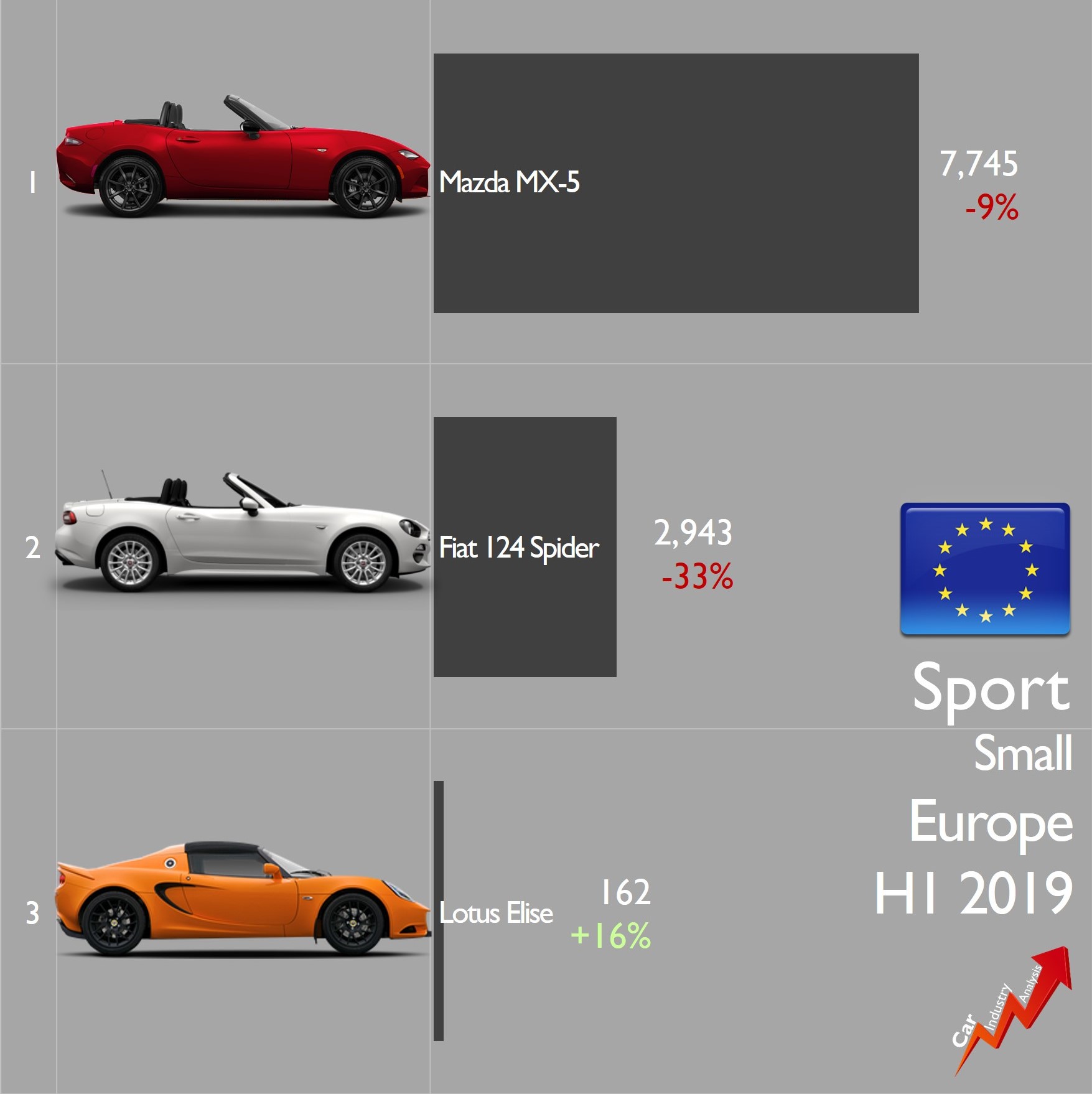

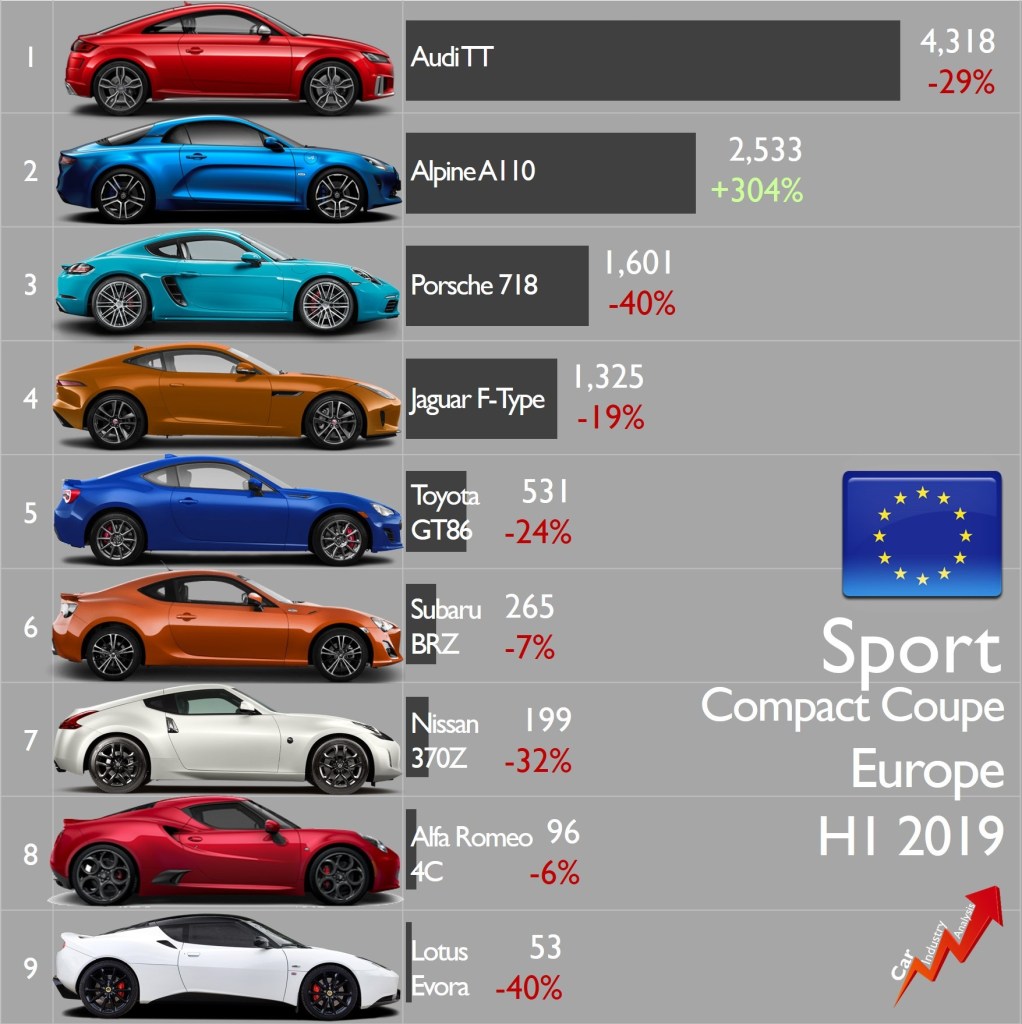

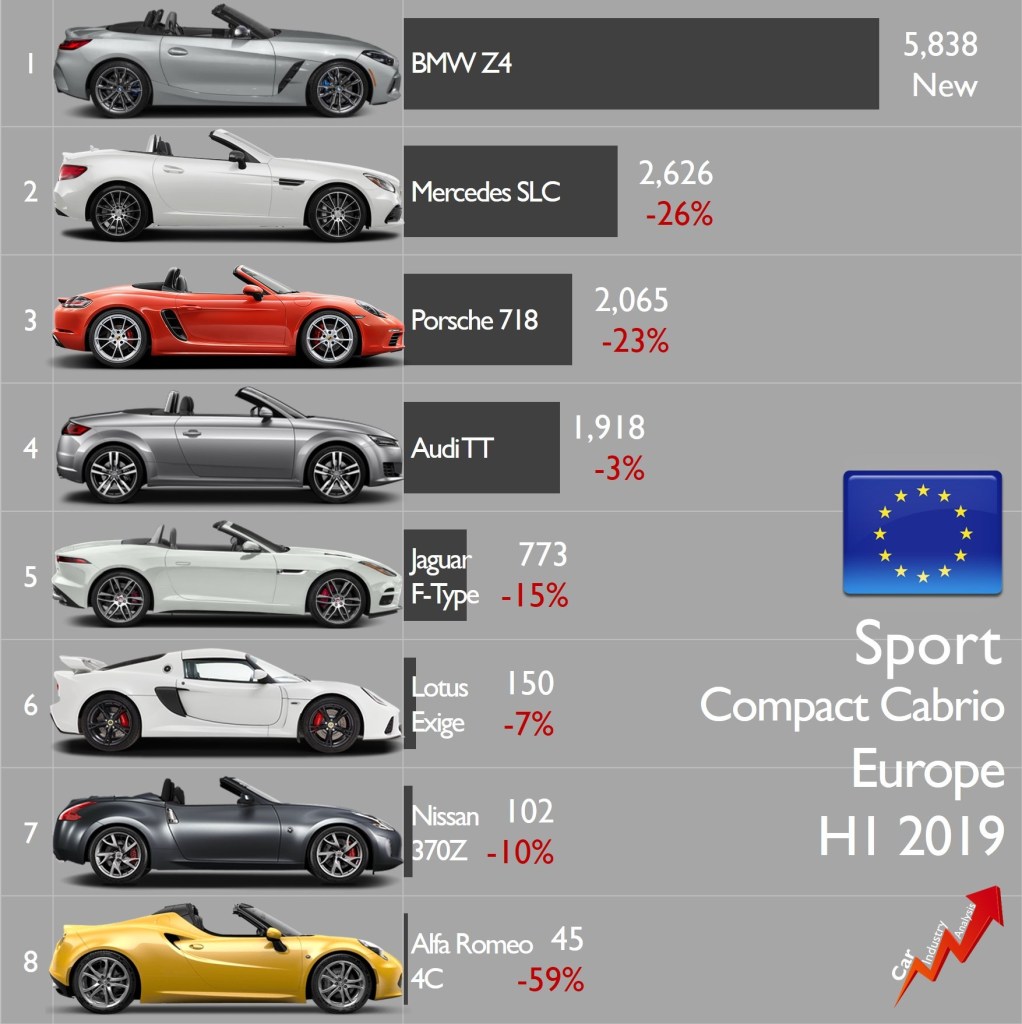

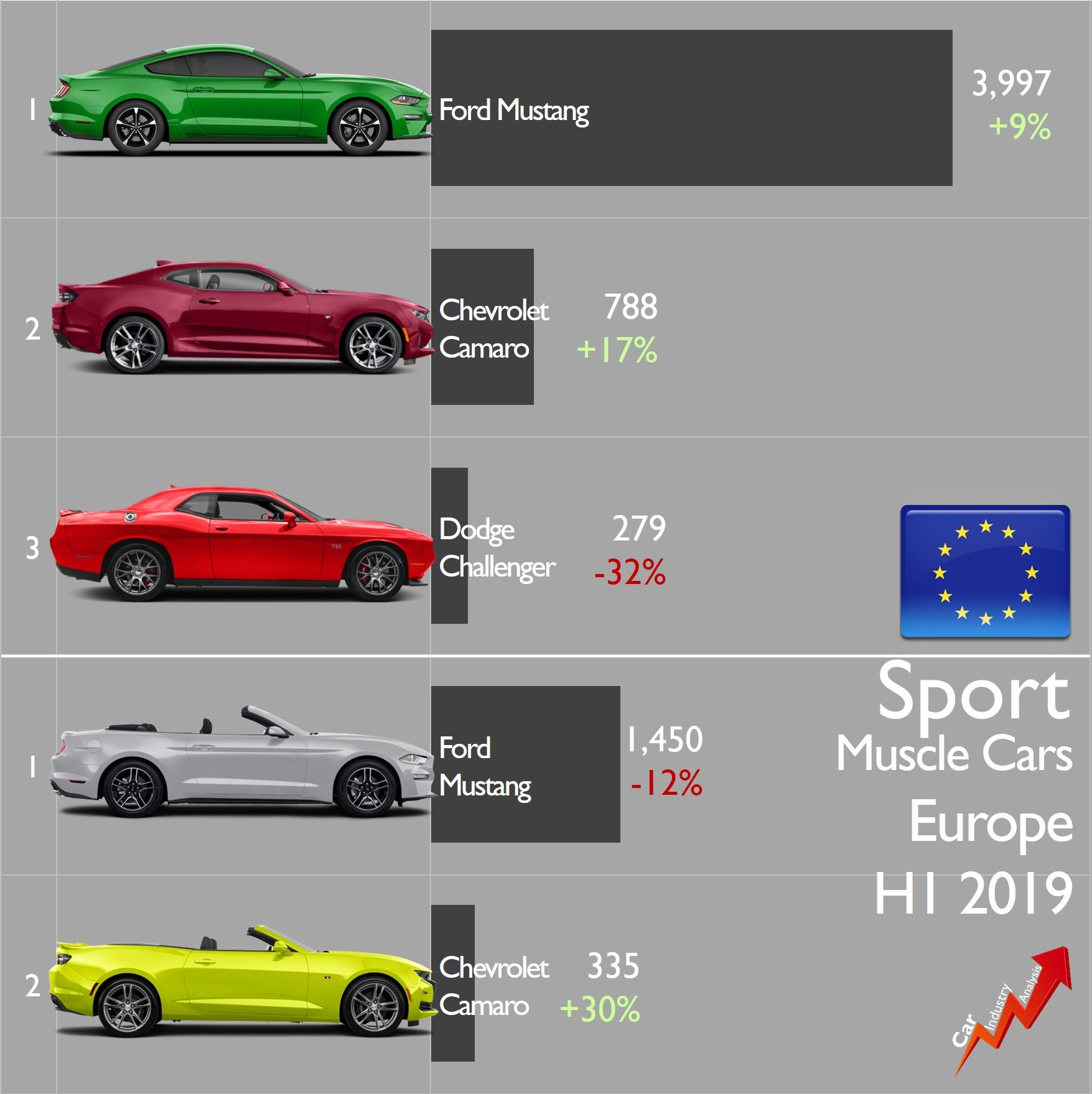

The biggest market share lose of the group: Sport cars

The sport cars are becoming a rare thing to see in the roads of Europe. The decreasing popularity is also making them more expensive to produce. This is the main reason of the FCA-Mazda agreement for the production of the Fiat 124 Spider and Mazda MX-5. Unfortunately, the formula has not proved to be successful, at least for FCA.

The Fiat 124 Spider, which is likely to die without a successor, posted a 33% decrease on its registrations in Europe during H1 2019. A total of 2,953 units were registered. Its twin the Mazda MX-5 sold 2.6 more times in a market that is considered closer to FCA than to Mazda.

The same happens to the Alfa Romeo 4C and Dodge Challenger. The 4C is getting old and the Challenger (available in very few markets) faces more modern rivals.

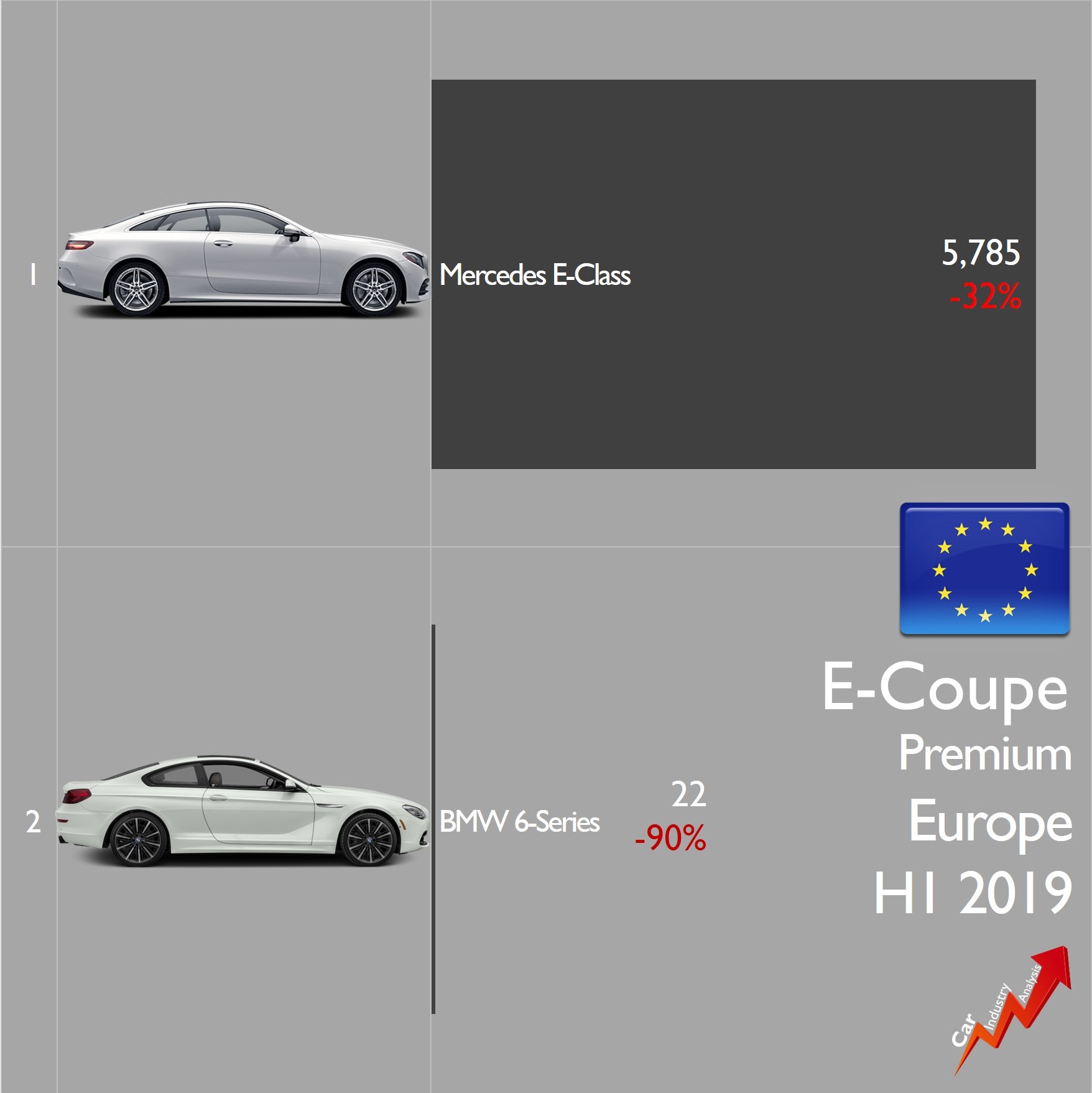

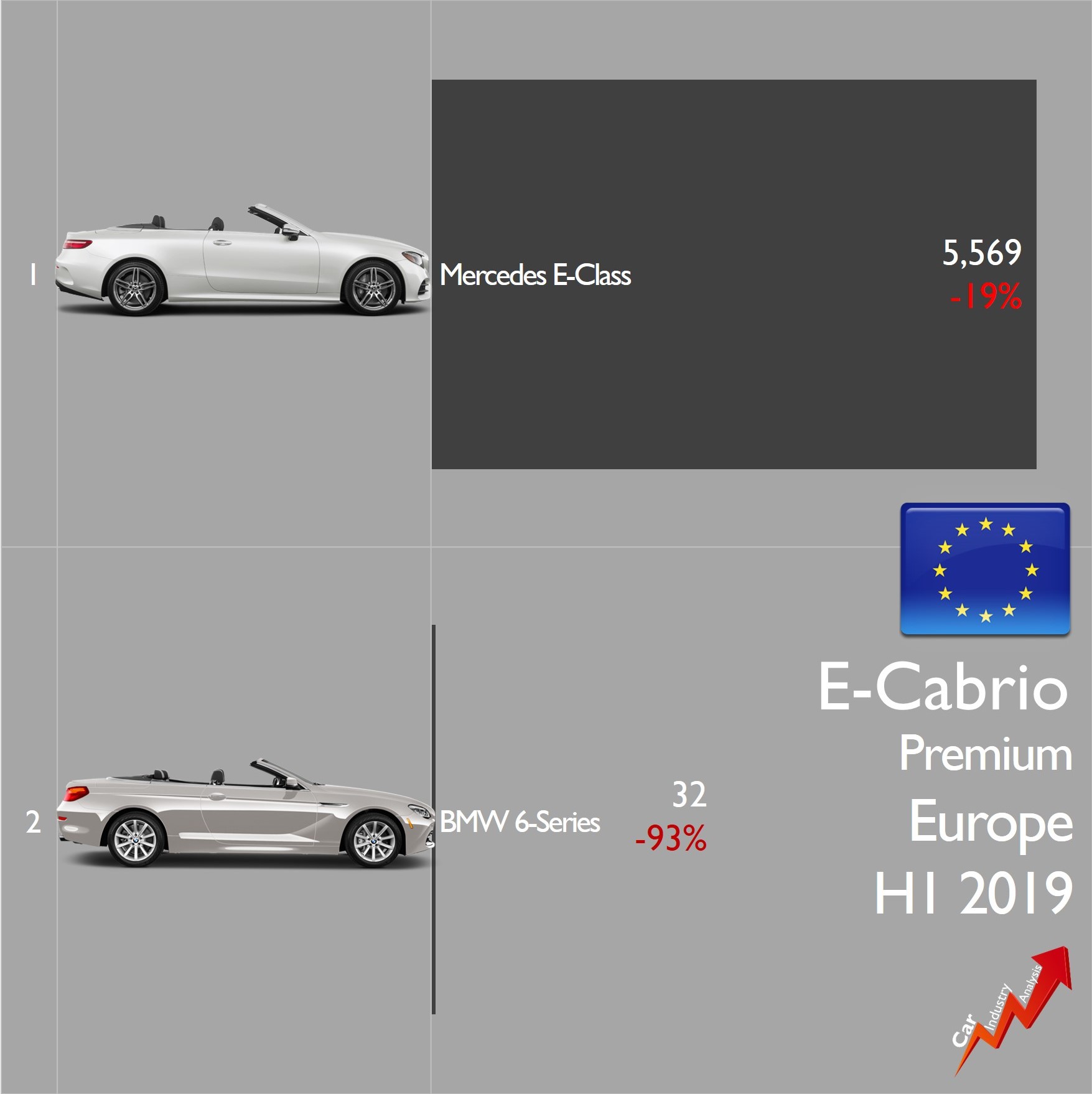

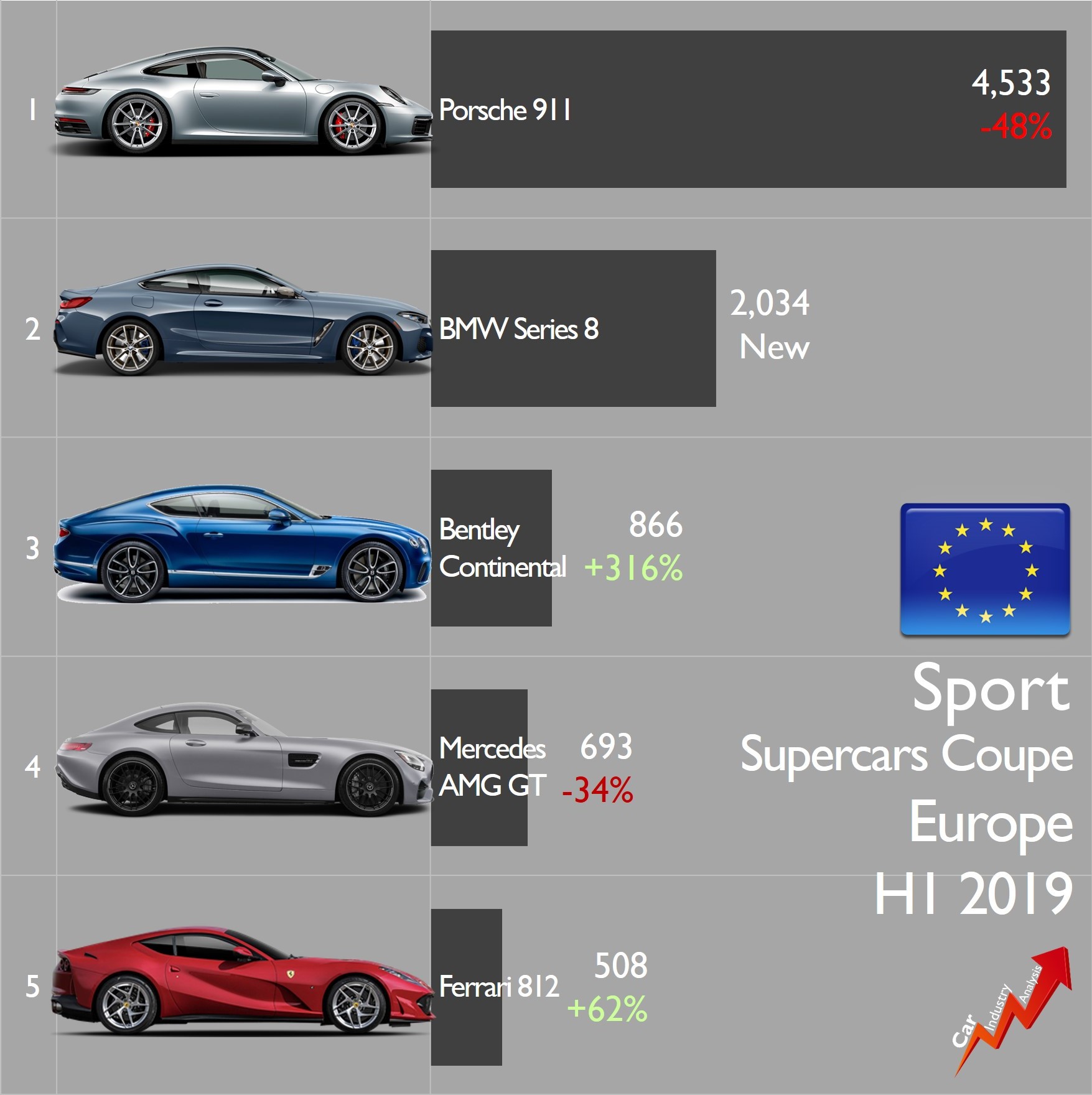

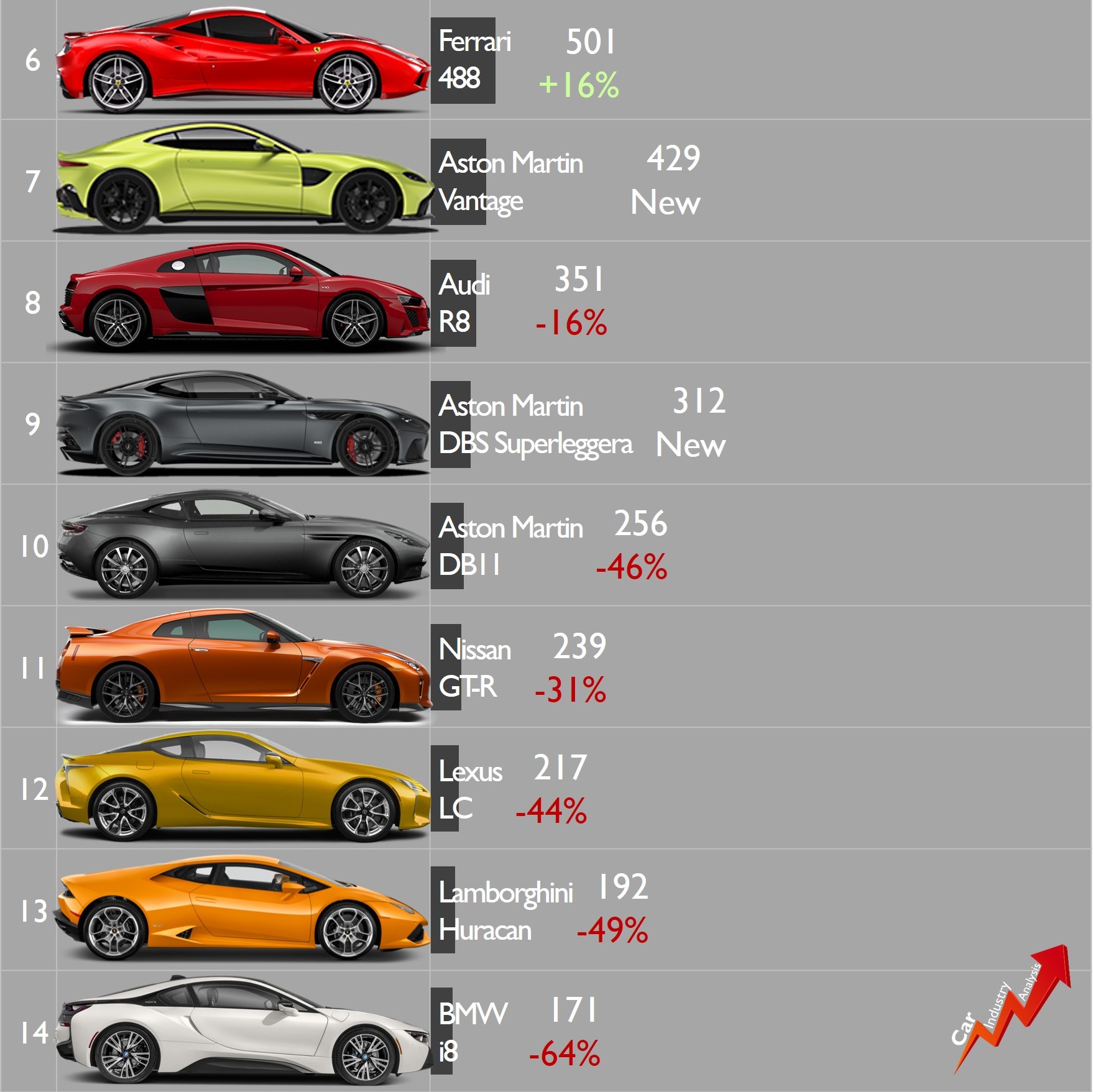

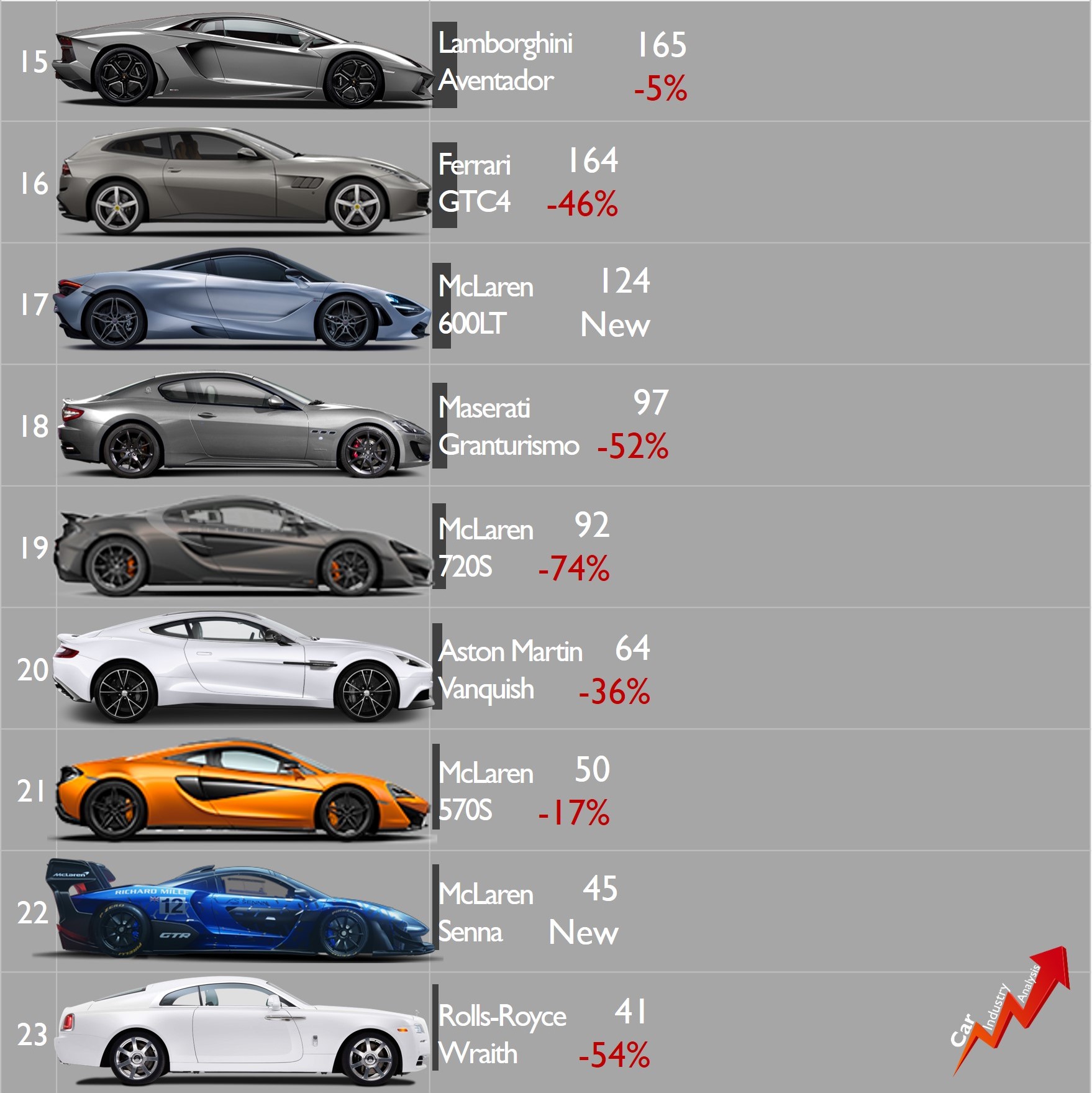

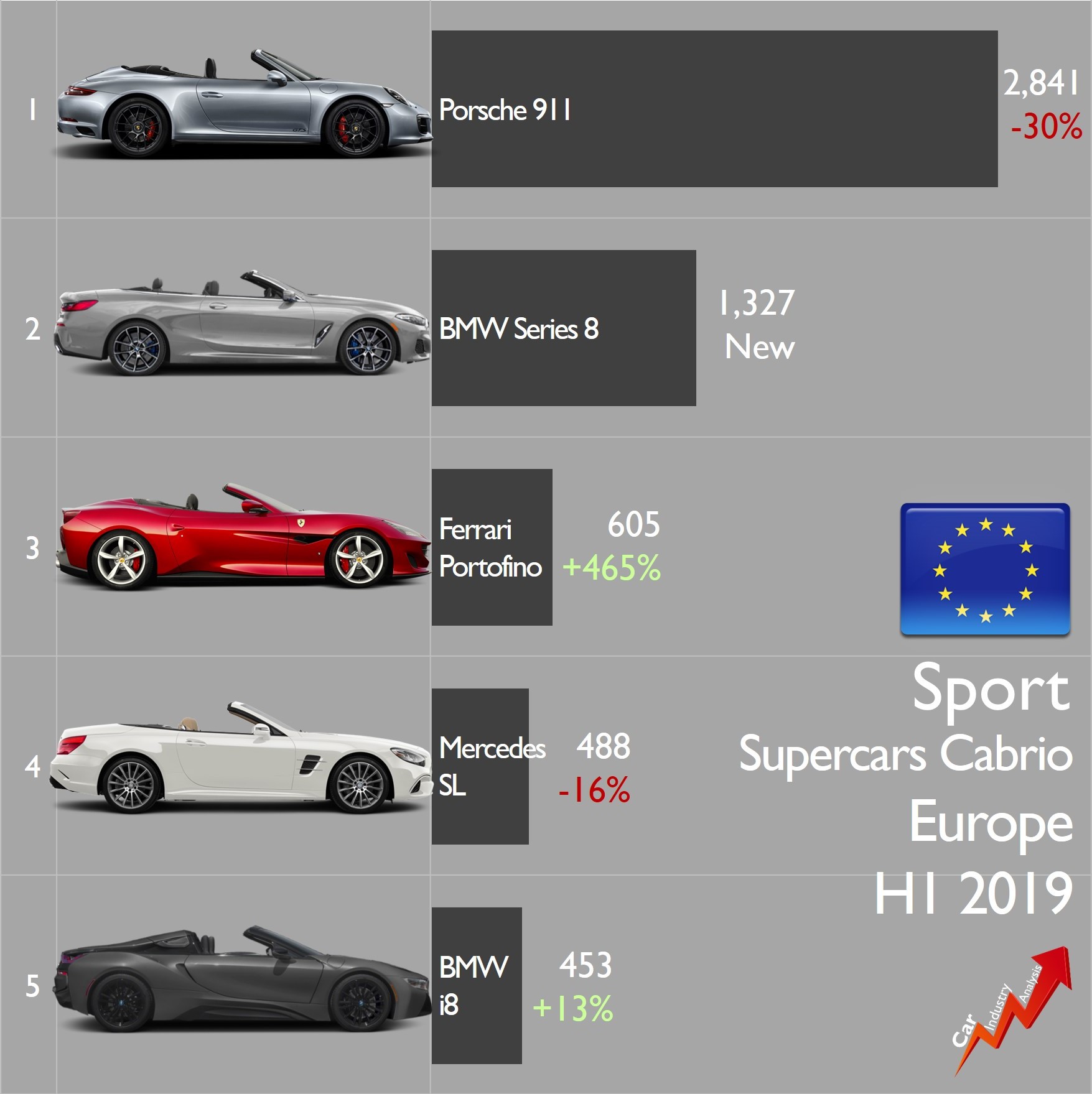

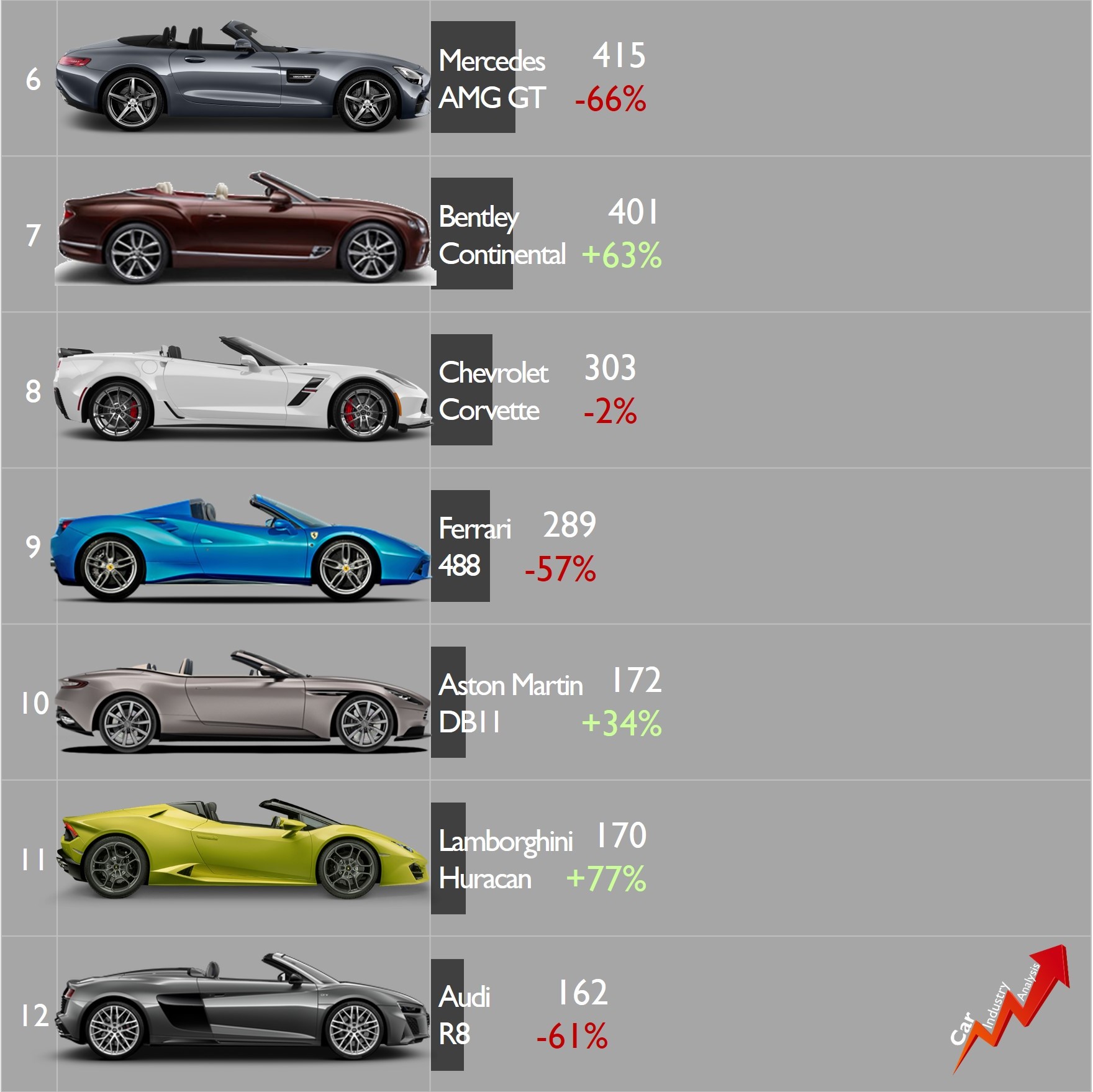

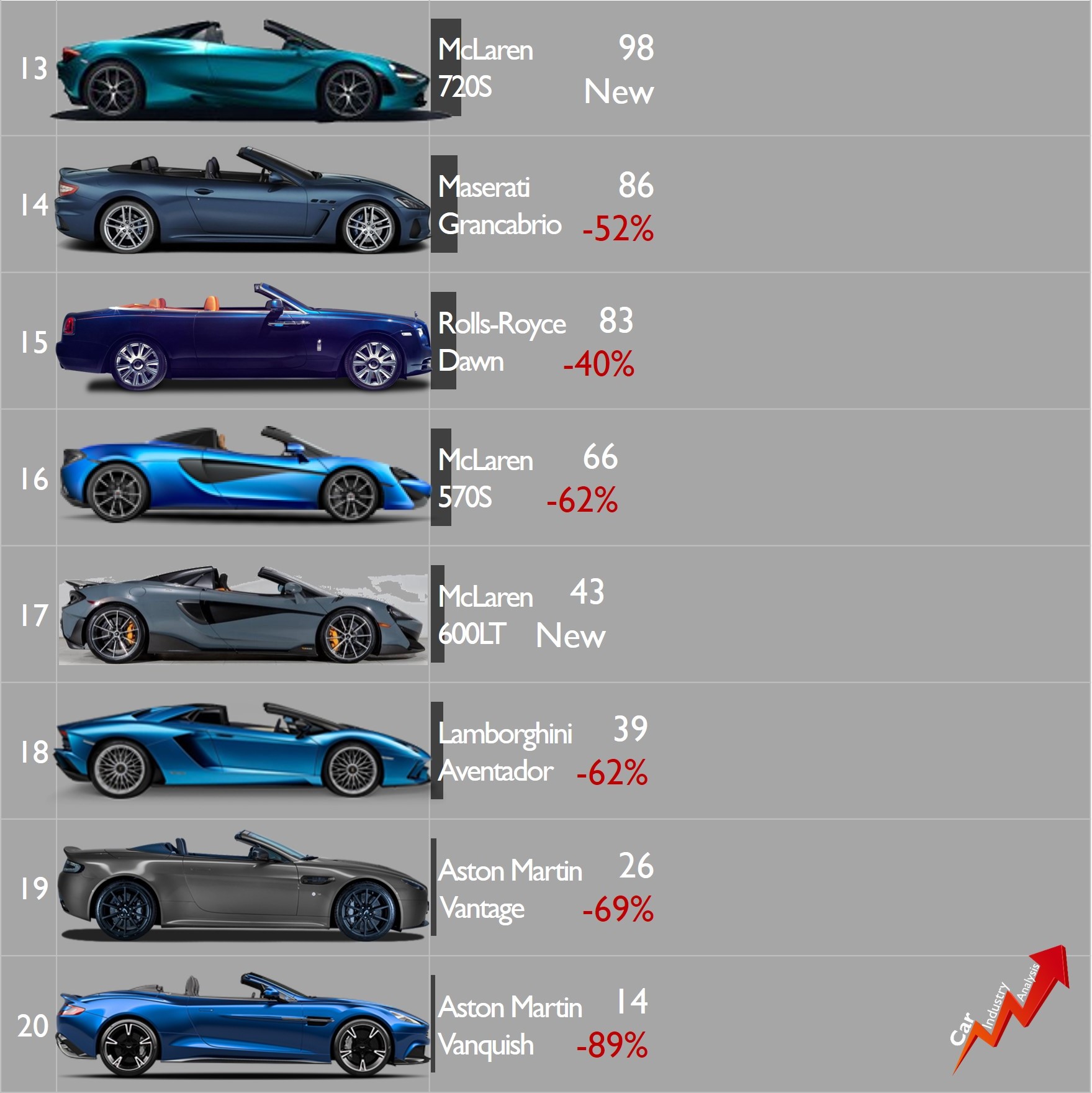

The aged and still beautiful Maserati Granturismo and Grancabrio show big declines as they wait to be replaced by a new generation within the next 24 months. Registrations of supercars totaled 20,900 units in Europe during the first half. That is 14% less than in H1 2018.

Source: FGW database, JATO, ACEA, CCFA, ANIACAM, KBA

Ehi there!

Thank you for the intresting articles… This one has ton of data, which is great, since carsitaly.net has been down for ages. I know you are not running that, but I don’t suppose you know if it will be back up at all?

Thank you.

LikeLike

Ciao Marco. I have no clue. I’m sure they are working on a refresh

LikeLike

Yes. Now we are seeing the effects of the lack of investment of FCA in Europe.

They froze the launch of the Alfa Romeo range besides the Giulia and Stelvio and froze investment on these two as well (no PHEV, no updates to the interior in new model years, no station wagon…).

The Tonale will only be launched in 2021 and there’s no news of any other model for Alfa Romeo still. If something else was coming why aren’t we seeing anything more about that?

They kind of forgot about the Tipo, with barely any updates, without replacing its extremely outdated petrol engines, and infotainment. Heck, launch a sporty version with a turbo engine to at least raise some awareness to it.

No Fiat compact-SUV, that was supposed to come and share the platform and components with the Compass.

No replacement for the Punto. Is it a surprise sales of the Ypsilon increased? Not really, it’s the last FCA B-segment model in Europe which is just beyond ridiculous for a group that dominated this segment in Europe.

Also, no “rational” B-SUV that competes via its price.

The management of the product range of FCA in Europe is nothing short of catastrophic. The departure of Altavilla left Europe completely abandoned since he was the guy that fought the most for investment in Europe.

Look at FCA’s performance in LATAM, where they actually invested and launched new models! That could be Europe.

LikeLike

I totally agree with you. Even if in Brazil the situation is not as good as you say because there are no Fiat SUVs yet

LikeLike

This is really strange policy of FCA. They were and still are pioneer of city car segment. But still they do not have anything new to offer. Panda is there since ages without any major updates, 500x is also same story. They are loosing Brazil to VW and GM. And they are not even trying to compete in Asian market. Sales of Jeep and RAM in North America can not save entire organization

LikeLike