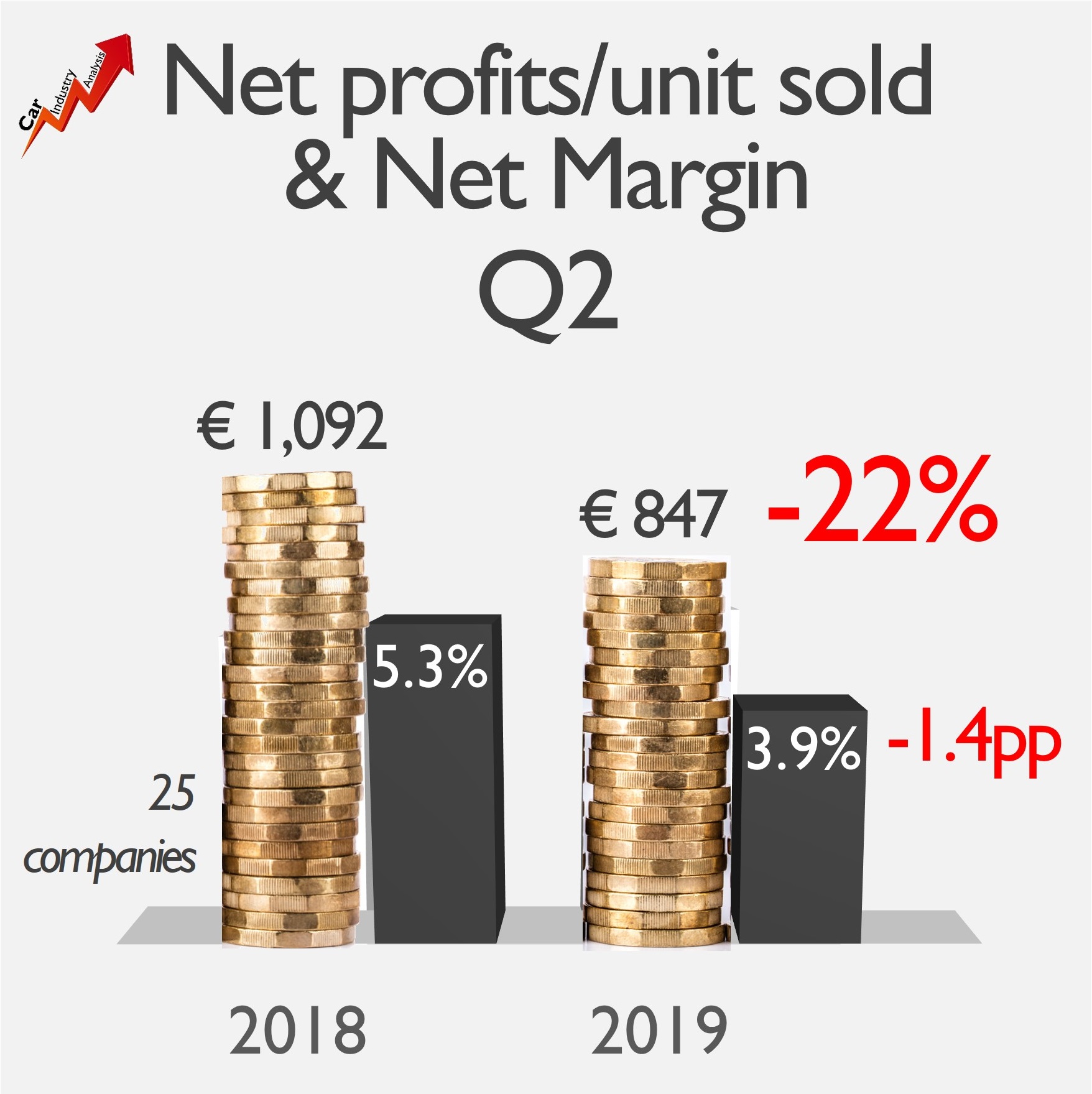

The Q2 2019 financial results of 25 auto makers are the best proof that the global economic growth is rapidly slowing down. According to the reports published by these companies, their net profit margin fell compared to Q2 2018, following lower sales volume and higher costs. The industry earned less money, but some companies, like FCA, were able to improve their positions.

Sales volume drop: Q2 slightly better than Q1

Despite the negative scenario, the drop on units sold in Q2 was slower than the one recorded in Q1 2019. The information for 30 different auto makers showed that total volume fell by 5.4% in Q1 2019 vs Q1 2018, and by 4.0% in Q2 2019 vs Q2 2018. This data excludes some key Chinese makers (they don’t specify the volume sold from JV and their own operations).

When including all the markets and players in H1, the situations is quite dramatic. A total of 44.75 million vehicles were sold in H1 2019, down 6.8% compared to the first half of 2018.

In terms of sales volume, FCA did not have a good second quarter. Its sales fell by 11% to 1.16 million units (1.30 million in Q2-18). In Q1, its volume fell by almost 14%. The company is in fact selling fewer cars due to the problems in Europe, its marginal role in Asia and the stagnation of the US market.

FCA was the world’s 7th largest in terms of revenue and profits

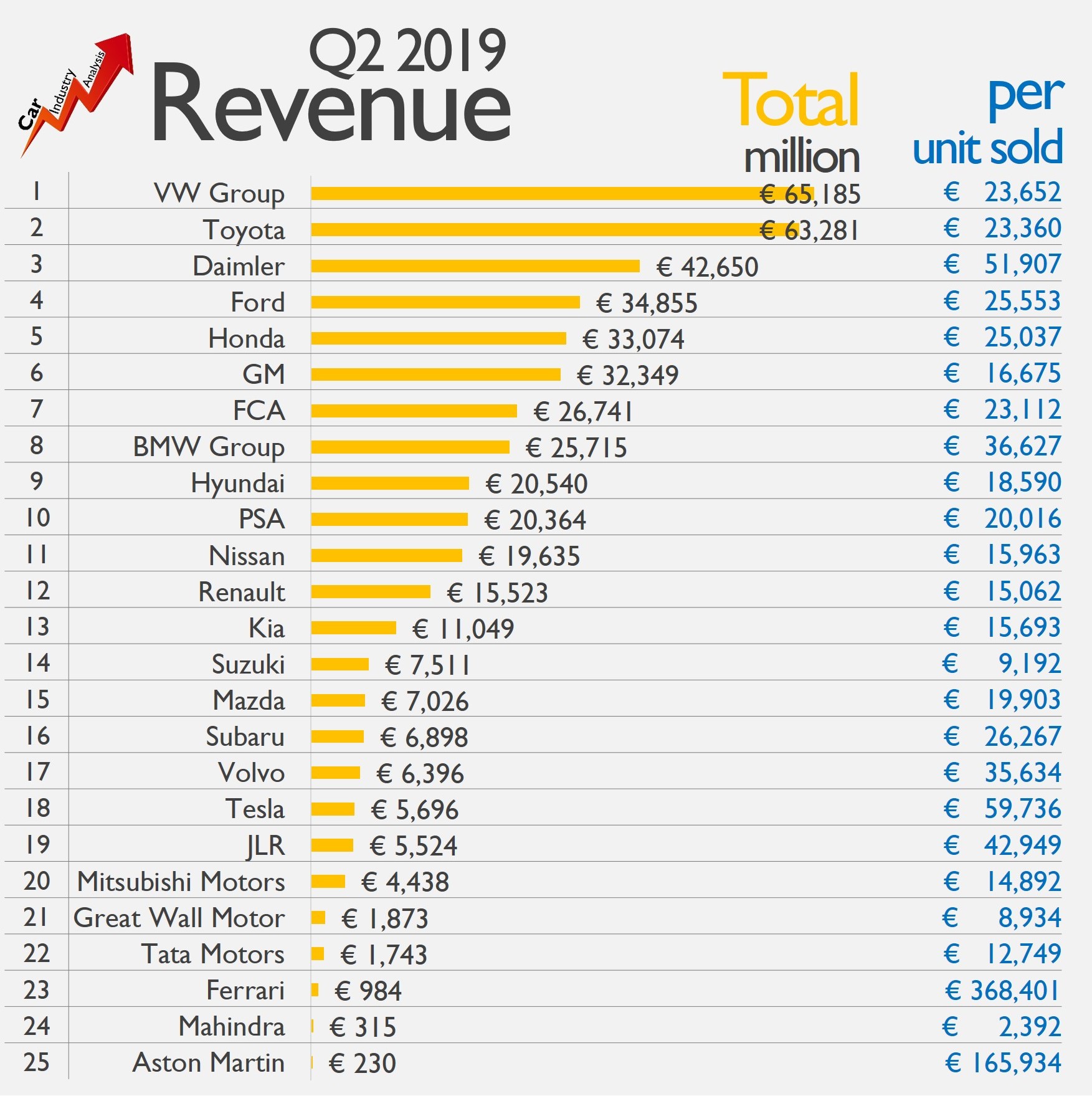

Revenue totaled 459.6 billion euros in Q2 (25 companies). Unlike the sales volume, the revenue was up by 1% during the quarter as some companies improved their mix and reduced incentives in key markets. FCA was the seventh largest company with 26.7 billion euros, down by 3% mostly because of the big drop on its sales volume.

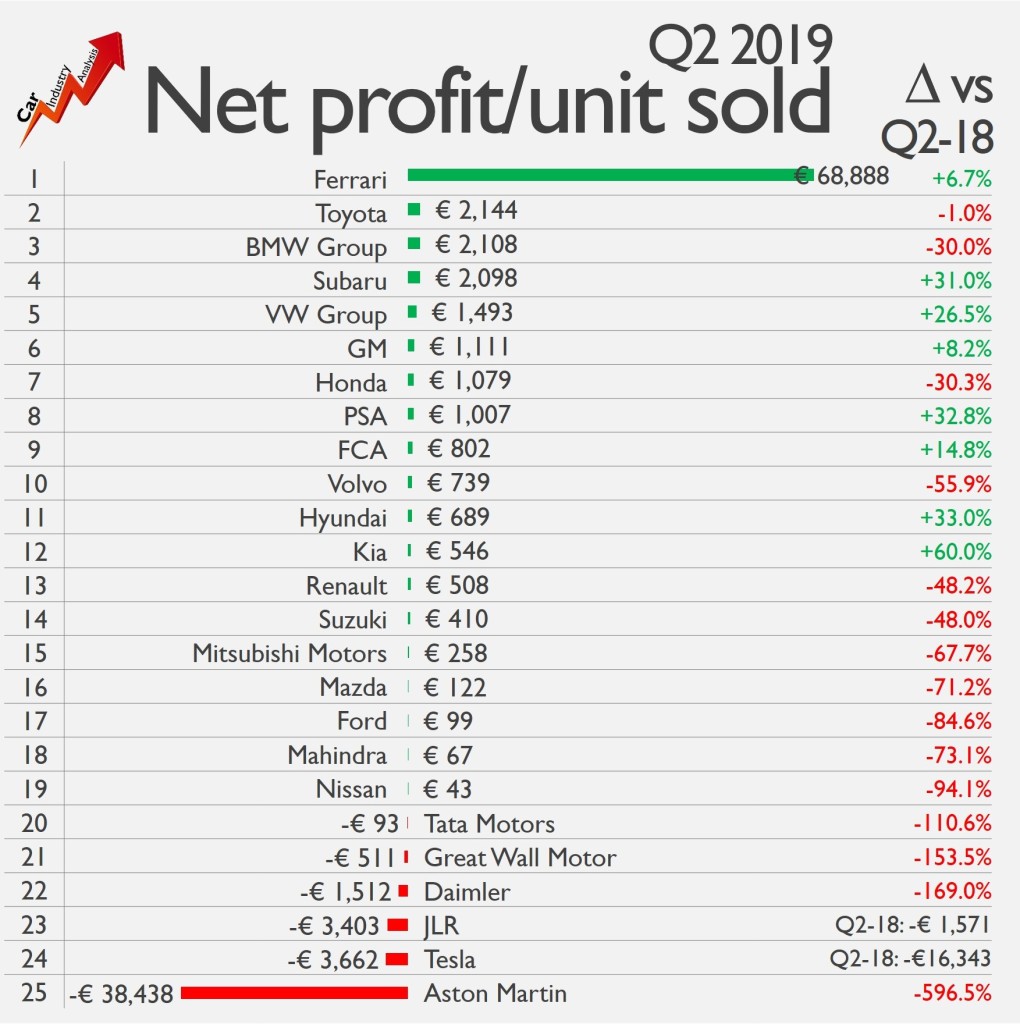

However, the big issue in the auto industry now is the profitability. While revenue increased by 1%, the net profit fell by 25% in Q2 2019 to 17.9 billion euros. It is mostly explained by the deteriorating situation of the Chinese market which has left many manufacturers with high operating costs that are no longer capable of resisting the lower demand. In other words, the installed capacity is becoming a big cost nowadays.

The most delicate thing about the profitability of these companies is that the worst is yet to come. The situation is getting bad right before they are all getting ready for the electrification of the industry, more complex regulations and trade war. All of these changes are going to consume a lot of resources. If the demand does not help, then profits are going to fall even more.

In this context, FCA was still the seventh largest with 928 million euros, up by 2%. It was outperformed by Toyota, Volkswagen Group, GM, BMW Group, Honda and PSA. Both BMW Group and PSA sold fewer cars during the quarter.

FCA’s net margin at 3.5%, the 12th largest

Things get a little bit worse for FCA when looking at the net margin. With 3.5% of net margin, the company was outperformed by other 11 rivals. They include not only the usual premium/supercars makers but also other mainstream like PSA, Suzuki or Hyundai and Kia. FCA’s margin was below the industry’s average of 3.9%. However, the company was able to increase its net margin by 0.2 points compared to Q2 2018.

Why FCA lags behind its rivals? because the improvements made in North America are being offset by the poor results in Europe and the loses in Asia. FCA is now more dependent on US-Canada than ever and this is a good thing as long as the North American market grows. This is not the case anymore, so the strategy to keep profitability in this region should focus on selling more profitable cars. Besides, the relaunch of Alfa Romeo and Maserati continues to burn money without any positive outlook yet.

I buy only FCA vehicles,and happy to see them doing fairly well,but I hope they get some new products to showrooms very soon.Thank God for the RAM and Jeep brands,and Fiat in Europe.

LikeLike

i drive two Alfa Romeo´s (Giulia 2016, Stelvio 2018) but i think there will come no future Alfa´s under Manley. Maybe Tonale arrives in late 2020 but what about new Giulietta, Giulia Coupe, Spider, Mito Successor? Below Tonale there should still be place for a B-SUV…

LikeLike

Pingback: El Porsche 911 es actualmente el coche más rentable de la industria, mientras Ferrari gana casi 70.000 euros por coche – On the Road Today

Pingback: El Porsche 911 es actualmente el coche más rentable de la industria, mientras Ferrari gana casi 70.000 euros por coche – Alvolante

Pingback: ¿Sabes cuántos coches se venden en el mundo? – El Negocio Digital