Is the question I’ve had during the last weeks. While I continue to gather all the information for the analysis of 2012 results, a lot of doubts and questions come to me regarding the future of Fiat-Chrysler alliance. I’ve been a close follower of car industry and it has allowed me to have an idea of how interesting it can be, but at the same time how hard it is when it’s about competition. Cars are becoming just another appliance as it gets easier to buy them, to use them and to get rid of them. That’s why the industry moves faster now as more and more people around the world buy a car. No matter if there are specific crisis, the trend is that the demand grows in those developing countries while it evolves in those developed ones. But at the end all consumers make part of a global market that changes everyday with more and more challenges ahead. In this context all car makers need to work fast not only to expand their business but to survive as competition gets tougher and the possibilities to do wrong tend to disappear.

Is the question I’ve had during the last weeks. While I continue to gather all the information for the analysis of 2012 results, a lot of doubts and questions come to me regarding the future of Fiat-Chrysler alliance. I’ve been a close follower of car industry and it has allowed me to have an idea of how interesting it can be, but at the same time how hard it is when it’s about competition. Cars are becoming just another appliance as it gets easier to buy them, to use them and to get rid of them. That’s why the industry moves faster now as more and more people around the world buy a car. No matter if there are specific crisis, the trend is that the demand grows in those developing countries while it evolves in those developed ones. But at the end all consumers make part of a global market that changes everyday with more and more challenges ahead. In this context all car makers need to work fast not only to expand their business but to survive as competition gets tougher and the possibilities to do wrong tend to disappear.

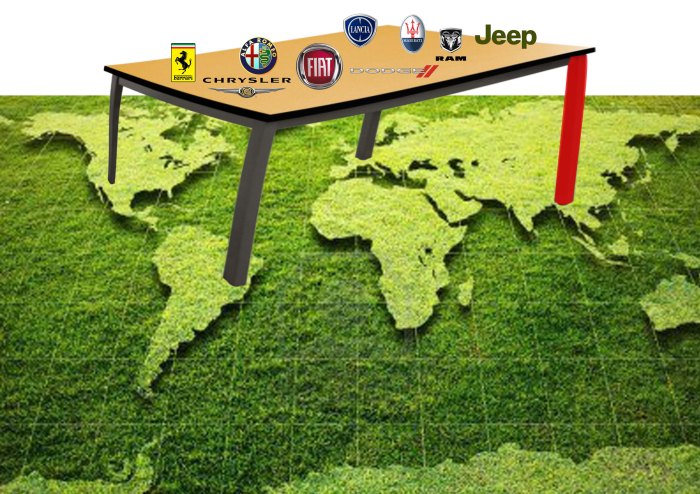

A 3-leg table won’t be enough in the next years if Fiat wants to survive as an independent car maker. The future of all brands of the group depends now in the ability of finding the right partner in Asia, where the group has a weak position.

Last year was not easy for Fiat. Its traditional market dropped dramatically and went back to the 70’s levels. Other European markets did also bad affecting not only Fiat but its direct rivals from France and Germany. But Fiat had even more problems: the continuous battle with its labor unions has become an endemic disease that affects its production levels and competitiveness. One more problem is the lack of new products as a consequence of investment cuts in Europe. The goal of this article is not discuss about current Fiat problems but to define whether or not Fiat is staying behind in this automotive race. It stopped from being European leader back in the 80’s to struggle to be part of European top 10 manufacturers last year. And it is not only a matter of Europe and car registrations. Fiat is one of the few car makers without a strong presence in Asia and even though it is working hard with its comeback to China, it still depends on a weak Italy and a more challenging Brazil. After the acquisition of the majority of Chrysler Fiat added one more leg to its two-leg table (Europe and Brazil) so it could breathe ‘calmly’ in 2010-2012. But the market goes that fast that now Chrysler is not enough to survive and once again Fiat faces really hard times.

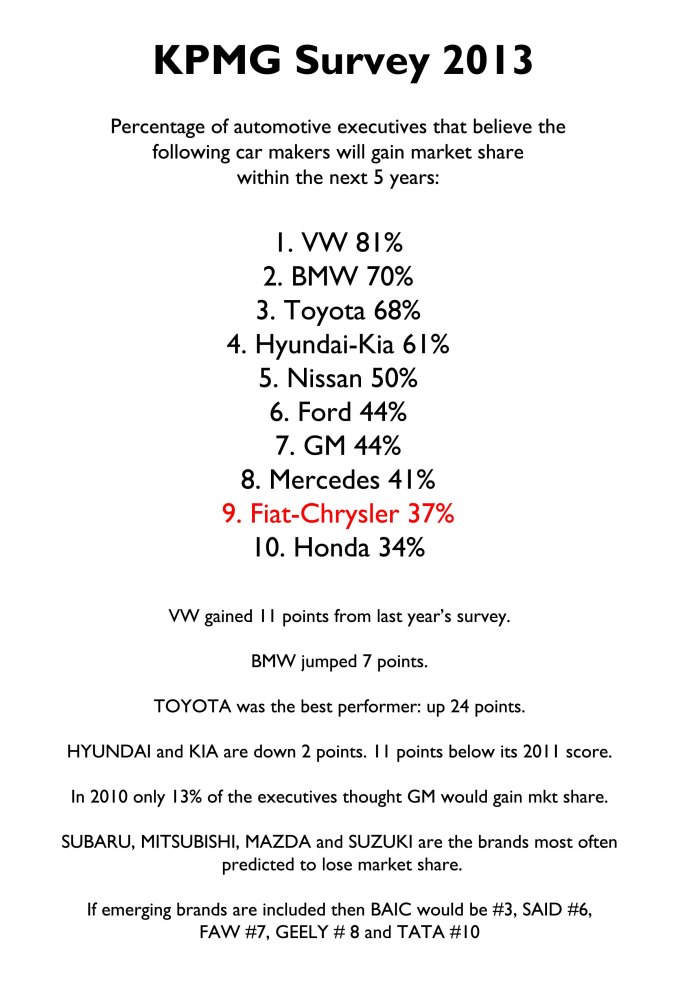

Most of all polled executives believe VW will gain market share in the next 5 years. If new emerging brands from China and India are included then Fiat-Chrysler would rank #14. Source: Automotive News Europe

Last week two news confirmed that future perspectives for Fiat are not good at all. First of all analysts expect Fiat and PSA to be the top losers in Europe 2013. Fiat’s registrations had already fallen 40% compared to 2007 figures. The reason for more bad months is explained by the fact of its strong dependence on Italy and the lack of new products. Then came the KPMG survey which indicated that only 37% of top automotive executives believe Fiat and Chrysler will gain market share in the next five years. On the other side there is VW which ranked first with 81%. The fact that analysts and executives of the industry predict even worse times for Fiat shows how difficult the situation will get for it if things don’t change for good. But it is not only a matter of what they believe. There are several examples that anyone can notice from what happens in the market. When getting to a new segment Fiat is late most of the times and therefore it is difficult for it to become the leader of a particular segment. The best example is what happens to the 500L and its future SUV version. Fiat took almost 5 years after the launch of the regular 500 to make use of the success of the small car and then it was late in the segment as French, Germans, Japanese and Koreans were already there. The same will happen to the 500X, which will be certainly an excellent product but by the time it will be introduced the Mokka from Opel, the new Renault Captur, the Ford EcoSport and the Peugeot 2008 will be ruling.

The fast growing small SUV segment is getting full of options coming from everywhere except from Fiat. How long will Fiat take to launch the 500X for Europe, USA and Brazil?

Someone could say it is a matter of money. But that’s not the case. Fiat is not as big as VW, Toyota or GM, but it has plenty of cash to develop new models and expand its business. But the problem is that Fiat and its brands are going to slow, so when Fiat steps forward, its rivals are far away from that point. In the last years Fiat, Lancia and Alfa Romeo stopped making sedans and station wagons and their presence in higher segments disappeared. The case of SW is particular hard to understand. This kind of cars are not the most popular but Italy is one of the few markets where the SW are still popular and sometimes even more than the sedan versions. Fiat is the absolute king in Italy but it is the only major car manufacturer not to offer any SW neither in the D, C nor B segment. The same happens to SUV segment, which accounted for about 12% of European sales and 16% of global sales*. Now it offers the Jeep brand but a buyer in Brazil or Europe, which is not used to hear about this SUV brand, can not count on Fiat, Alfa Romeo, Lancia or Maserati, if he or she wants to buy a SUV.

In terms of markets the situation is pretty similar. Besides the dramatic case of China and the fact that in 2012 Fiat would had sold around 20.000 cars when VW sold more than 2 million, Fiat’s position in other major markets is not good at all. There is no presence in fast growing markets such as Indonesia or Africa. In those areas where it is strong it is more because it depends on few countries: Italy in Europe and Brazil/Argentina in Latin America. But if one goes to Switzerland or Croatia, which are located close to Italy, then Fiat’s share drops. The same for Chile, Peru or Colombia in South America. Or why have they took so long to establish properly in Russia and India? Why does it take so long to relaunch Alfa Romeo? why not to launch something really innovative when the old concept did not work? if second generation Ypsilon was a product that only worked in Italy, why did they repeat the formula for the third generation launching a new car without any specific added value that would only work in Italy? or why not even one concept in the auto shows? too many questions and one reality: if Fiat does not work faster and finds an Asian partner to complete its table fourth-leg, then producing 4 million or even 5 million cars won’t be enough in the next couple of years. The group has an enormous potential with its mythical brands. It has the best automotive CEO and a glorious history. Therefore it deserves more and better work.

* FGW data basis