Illustration by Automobile Magazine

On friday Fiat SpA released the Group’s results for May 2012 in Italy and USA. Unsurprisingly sales figures confirmed the recent trend: America’s rise up and Italian deep crisis. Those are frequent results since last year when the new Fiat-Chrysler Group began to see a shift in car registration growth from its native Italy to its new native America. 3 years ago, when Marchionne signed the deal with Obama’s government, was Fiat saving Chrysler from bankruptcy. Now is not that Chrysler is saving Fiat from disaster, but because of several facts to be explained in this article, Chrysler Group is now leading the match to make of the Group one of ‘big six’ of the world, while Fiat Group deals with big problems in Europe and tries to maintain its success in Brazil. To try to explain the reasons of this situation with only one fact would be unsuitable. Behind the uprising of Chrysler and the crisis of Fiat, there is a connected net of things that can explain why Chrysler, without any all-new model is having continuos sales growth while Fiat, with some new models, is looking deseperate for solutions to not to sink.

First of all there is the Economic crisis reason. The financial problems that took place in USA in late 2008 affected first American economy and then European one. But while America is more or less getting over it Europe add the debt crisis of some of its EU members like Greece, Ireland, Portugal, Spain and Italy. Althouhg developed countries are all facing the new scenario in which emerging markets are catching investment flows, the situation of America is much better than Europe’s. The worst has already passed in the US, but not in Europe where is expected a full year 2012 and 2013 with lot of difficulties in terms of unemployment, demand and social destabilization. Italy is part of both, the problem and the solution. Its debt problems are making Italian authorities to rise taxes, and therefore restrict consumption. And with no good perspectives in the short term, here comes the second reason of the gap between F-C sales in USA and Italy. Italians are pesimistic about their future, about getting a job and go ahead. Americans are still having problems but their mood is different as they see the light at the end of the tunnel. And mood is a factor that explains perfectly the situation. When people don’t believe in better things to come they don’t care about the future and rather think of their present as a survival exercise. In the other hand, when some of main economic indicators show that the worst of the crisis has just passed, then people start to change their habits and be more positive about coming days. The mood certainly affects car industry, as a car is a product that costs, and is part of people’s main assets.

Actually the mood among citizens (or buyers) can be seen in other fields. If one watches any interview or statement of Sergio Marchionne, it will be evident the change of mood when he talks about Chrysler and America and when he mentions Fiat and Italy. His face changes. Yes, Fiat Italy is just giving him problems, but the good mood he projects when he is in Auburn Hills should be the same or better when he is in Mirafiori. People notice it and coming from him, has an impact on the organization, composed by powerful labor unions that every day communicate Italians their dissatisfaction with corporate decisions. It is not the intention to evaluate who is right in their demands, but this tense situation between board of directors and labor unions is generating a bad image of Fiat among Italian buyers. And that’s the other reason that can explain the gap between Chrysler’s sales in USA and Fiat’s in Italy. All car makers are having sales drops in Italy, but Fiat also worries because of the economic impact of its latest corporate decisions. Italians don’t like the idea of shifting production abroad (Poland, Serbia, USA, Mexico and now China), and they blame Fiat of being part of the unemployment problem there is now in Italy. If it is true or not, the reality is that ‘Fabbrica Italia’ plan has not been enough to project the idea that Fiat works for Italy. And that is probably the main problem now: Italians are tired of the status quo that has not brought the solution for their problems, and Fiat is part of the status quo.

Of course it is also a matter of offer. Although the new Panda was introduced in late 2011, and new Ypsilon or the rebadged Fiat Freemont are doing a good work since their launch in Geneva 2011, it has not been enough to change the trend. Fiat has decided to postpone the launch of new models waiting for better economic scenario arguing that most of European car makers are loosing money with their latest products. Fiat may not be loosing money but they are certainly loosing market share. The Punto, which was among Europe’s best selling cars, is now passing through its 7th year of lifecycle with remarkable sales drop Italy included, and there is no replacement model until 2014. Fiat Group’s model range in Italy is dramatically reducing: Fiat just offers 3 different small cars, Alfa has just 2 models at all, and Lancia survives thanks to its Ypsilon, that by the way is only successful in Italy. In this context, selling cars become a hard job. Fiat can not depend on economic cycles to develop its models. The models must be able to generate cash and support the production eventhough there is a big economic crisis, so a decision like the postponement of next Punto is going to increase the sales drop in a market that loves A and B-segment cars.

FIOM Labor Union protests. Photo by selvicenza.blogspot.it/

Finally, another fact that is playing against Italian Fiat’s sales is the role of government. Italian authorities continue to atack car industry through new taxes (super bollo, etc.) and making more expensive the price of gas. It has a direct impact on the demand in a moment in which people are struggling to keep their jobs and go on. The coming incentives for low emission and electric cars may be a good solution, but at the end an industry that depends on economic help is a none feasible industry. The role of government should be of generating good conditions for the whole industry and not creating new obstacles or distorting it with artificial and unsustainable incentives. Fiat made a good move with the gas promotion announced recently. All of these factor explain the increasing gap between the results in both sides of the Atlantic. What is next is to learn from what’s happening in America and anticipate it in Italy, but quickly, really quickly.

Italy’s figures include Fiat, Alfa and Lancia numbers only. Source: carsitaly.net, Chrysler Communications and Quattroruote.it

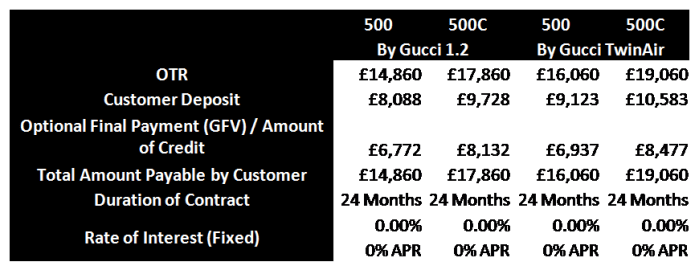

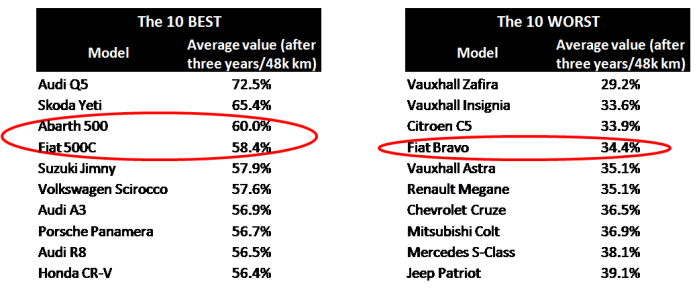

Once again, second month in a row, the successful Fiat 500 continues to hit British. In May 2012 it was again among 10 best selling cars in that important market. Last month 2.823 units were delivered to clients making of it the 10th best selling car and number 1 among small cars. The good sales performance is even more impressive if is taken into account that the UK is the land of Mini, the eternal archenemy of the small Italian (though they don’t belong to the same segment). Year to date results indicate the 500 has reached 14.113 units sold, compared to 25.607 units it sold for the whole 2011. The good results of it can be explained by several and continous promotions made by Fiat that include very interesting financial plans, and also by the good reputation the model has in the UK.

Once again, second month in a row, the successful Fiat 500 continues to hit British. In May 2012 it was again among 10 best selling cars in that important market. Last month 2.823 units were delivered to clients making of it the 10th best selling car and number 1 among small cars. The good sales performance is even more impressive if is taken into account that the UK is the land of Mini, the eternal archenemy of the small Italian (though they don’t belong to the same segment). Year to date results indicate the 500 has reached 14.113 units sold, compared to 25.607 units it sold for the whole 2011. The good results of it can be explained by several and continous promotions made by Fiat that include very interesting financial plans, and also by the good reputation the model has in the UK.