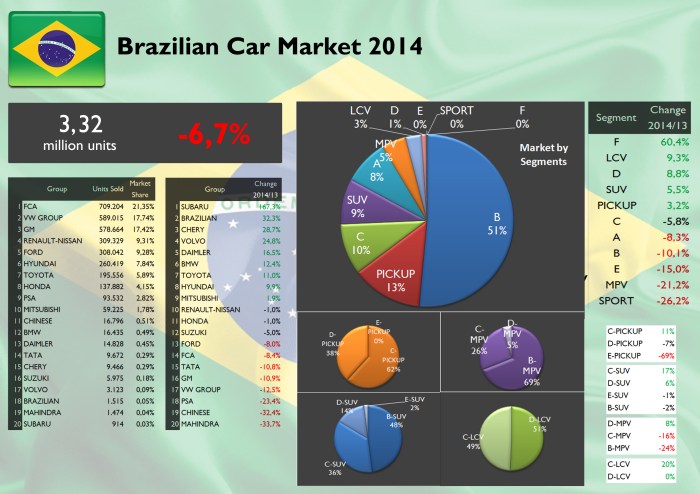

After some years of government incentives and economic growth, Brazilian car sales are back to negative change, down 7% to 3,3 million units. Due to some economical instability and higher prices, Brazilian car demand slowed down with almost all car makers narrowing their revenues. Once again, for the 13th year in a row, FCA was the country’s leader with more than 20% market share, some points ahead of VW and GM. Fiat was the major car maker to post the lowest plunge thanks to the Palio and Strada subcompact models, while VW and GM volume fell a massive 12%. Most of the market is dominated by subcompact cars (3 and 5 door hatchback and sedan) but the Pickups (where Fiat leads) and SUVs had the biggest jumps.

After some years of government incentives and economic growth, Brazilian car sales are back to negative change, down 7% to 3,3 million units. Due to some economical instability and higher prices, Brazilian car demand slowed down with almost all car makers narrowing their revenues. Once again, for the 13th year in a row, FCA was the country’s leader with more than 20% market share, some points ahead of VW and GM. Fiat was the major car maker to post the lowest plunge thanks to the Palio and Strada subcompact models, while VW and GM volume fell a massive 12%. Most of the market is dominated by subcompact cars (3 and 5 door hatchback and sedan) but the Pickups (where Fiat leads) and SUVs had the biggest jumps.

- Whereas the big 3 posted negative growth, Hyundai and Toyota managed to increase their registrations thanks to their HB20 and Etios subcompacts. In the opposite side there is PSA with demand plunging by 23%.

- Brazilians keep buying subcompact cars, counting for more than half of total market. Pickups (specially the small ones) and SUVs (specially the compact ones) were the segments with the best performance.

- Total market change outperformed FCA’s, but the Italians are still the best-selling car maker in Brazil. The group lost 0,4 basis points of market share due mostly to the increasing demand for the Hyundai HB20S and Toyota Etios.

- Brazil was the word’s largest market for Fiat brand. The only brand of the group to increase its deliveries was Dodge, thanks to the Journey.

- With the exception of the city-cars (Uno and 500), FCA sales composition by segments is pretty similar to overall market’s. Almost half of its sales come from the Palio family (Siena included).

- The Fiat Palio wasn’t only the group’s best-selling nameplate but the whole market’s as well. It managed to end up years of VW Gol’s domination.

- The Strada was the best performer, along with the new Fiorino. The Uno was Fiat’s main problem losing segment share due in part to its age and to the arrival of the new VW Up!.

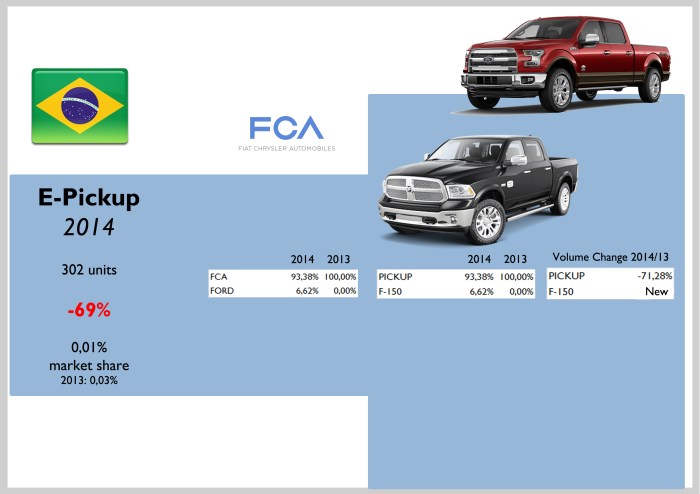

- The Ram Pickup reigned in its small segment with almost 94% of share. The Strada impresses increasing its share in the segment even if it is an old model (with some tiny restylings).

- FCA leads in the large MPV segment, small and large pickups, LCVs and A-Segment.

- Premium cars are still very rare in Brazil. As most of the offer is composed by imported cars, high level of taxes has a direct impact on the demand. BMW and VW Group lead this tiny market.

Brazilian Car Market by Segments

- Even if the Fiat Uno leads by far, it lost a big segment share due to the arrival of the VW Up!, which had a negative effect not only on the small Fiat but also on its brother, the VW Gol. The new Ford Ka started well. The old Chevrolet Celta falls massive 43%, and the Fiat 500 suffers the consequences of more taxes and currency fluctuations.

- Brazil’s largest car segment is dominated by Volkswagen but the Gol isn’t the country’s best-selling car anymore. The Fiat Palio outsold the VW by the first time in 23 years.

- This segment is quite competitive with a lot of players in the game.

- Renault-Nissan registered the largest growth thanks to the Renault Logan. The Fiat Siena is still the country’s best-selling small sedan.

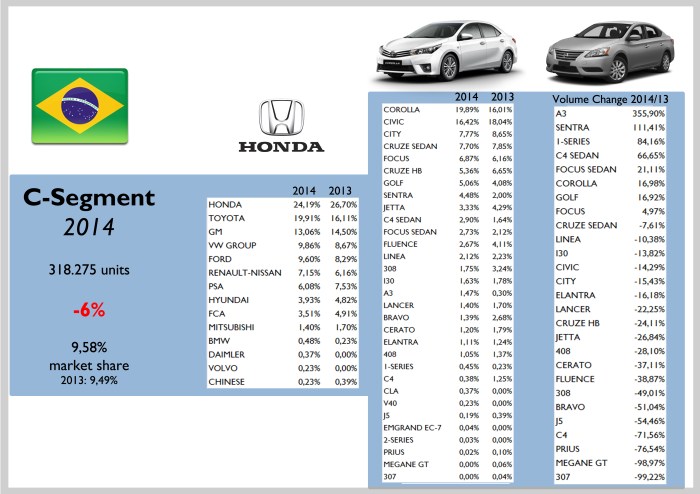

- Compact cars demand fell 6% it still counts for a big part of the market. Japanese brands lead the segment thanks to the Toyota Corolla which outstripped the Honda Civic for the first time.

- The Nissan Sentra was the rock star. Its demand rose buoyed by the new generation.

- Some premium products had big improvements.

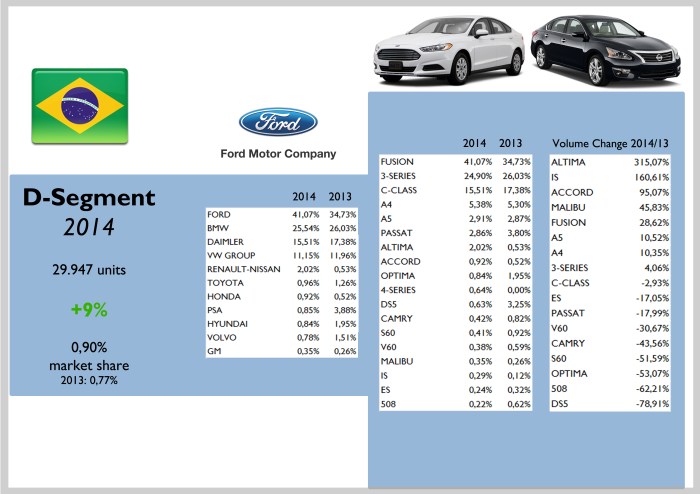

- The Ford Mondeo is the absolute leader of the segment. Thanks to the new generation (it is imported from Mexico), Ford was able to rise its share within the segment from 35% to 41% in only year. However in terms of growth, the Nissan Altima and Honda Accord posted the largest increase. The Germans didn’t have important changes.

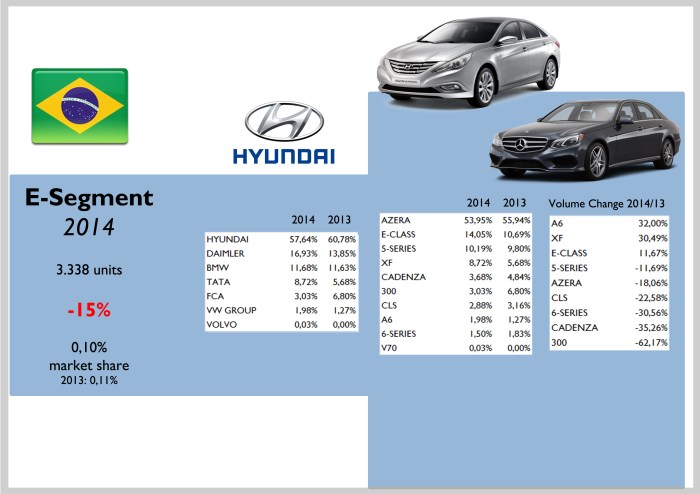

- Despite their big differences in terms of price, the Hyundai Azera was ahead of all German rivals. Its sales counted for more than half of the 3,3k units segment.

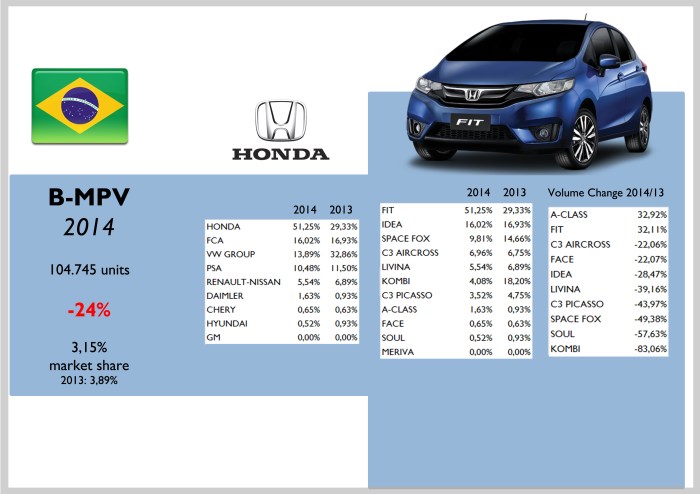

- The new Honda Fit is a complete success in the Brazilian market. It managed to get market share from all of its rivals. The Mercedes A-Class figures correspond to the previous generation.

- The C-MPV segment is mostly composed by the Chevrolet Spin. It is much cheaper than its French and German rivals but because of its dimensions it is considered a compact MPV.

- Large MPVs are mostly Fiat and Dodge. Brazil is one of the few markets that gets both nameplates.

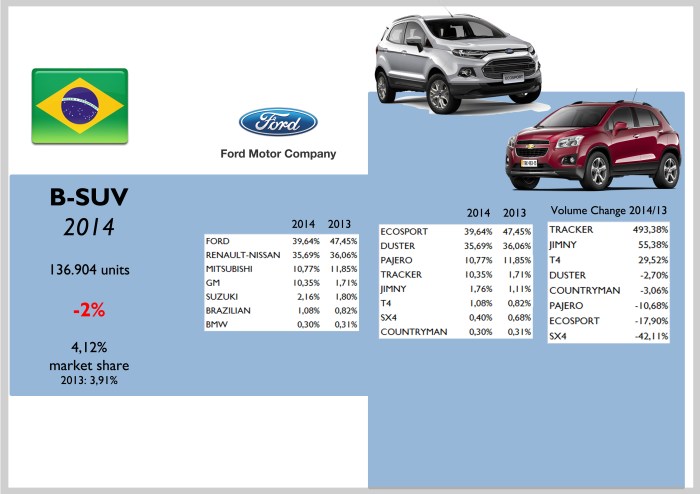

- Small SUVs demand fell only 2% allowing this kind of cars to gain some market share. The segment is still dominated by the Ford Ecosport (the pioneer). However its leadership isn’t as clear as before, as some of its demand moved to the Chevrolet Tracker. Meanwhile the Renault Duster sales remained stable.

- The Jeep Renegade will hit this segment in 2015 but due to its price it is expected to occupy the fifth place right after the Ford, the Renault, the Mitsubishi and the Chevrolet.

- The Mitsubishi Pajero figures include those of the mid-size and full-size versions.

- Contrary to the negative change on the demand for the small SUVs, the compact ones posted a positive change. The demand rose thanks to the Toyota Rav4 and to the Hyundai ix35.

- Almost 41.000 mid-size SUVs were sold in Brazil in 2014. It is not a bad number. Toyota leads with the SW4, while Mitsubishi outsold Hyundai and Chevrolet thanks to its Outlander.

- The German SUVs had big advances.

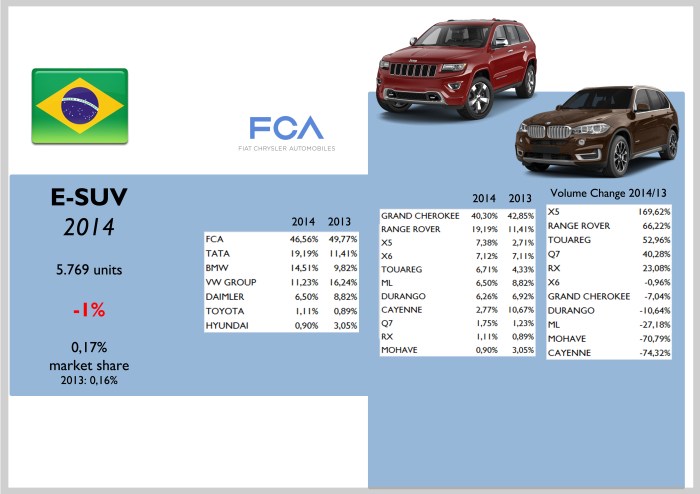

- FCA and the Grand Cherokee are the absolute leaders. Notice that these figures may include both, the Cherokee and Grand Cherokee nameplates. Anyway, it is quite ahead of Land Rover, BMW and VW Group. The Porsche Cayenne was the big loser.

- Once again the Fiat Strada is the favorite small truck in Brazil. The updated version, launched in the first semester of 2014, gave this Fiat even more power to increase its share in a segment whose sales are up 11%.